Cardiopulmonary Resuscitation Market Outlook:

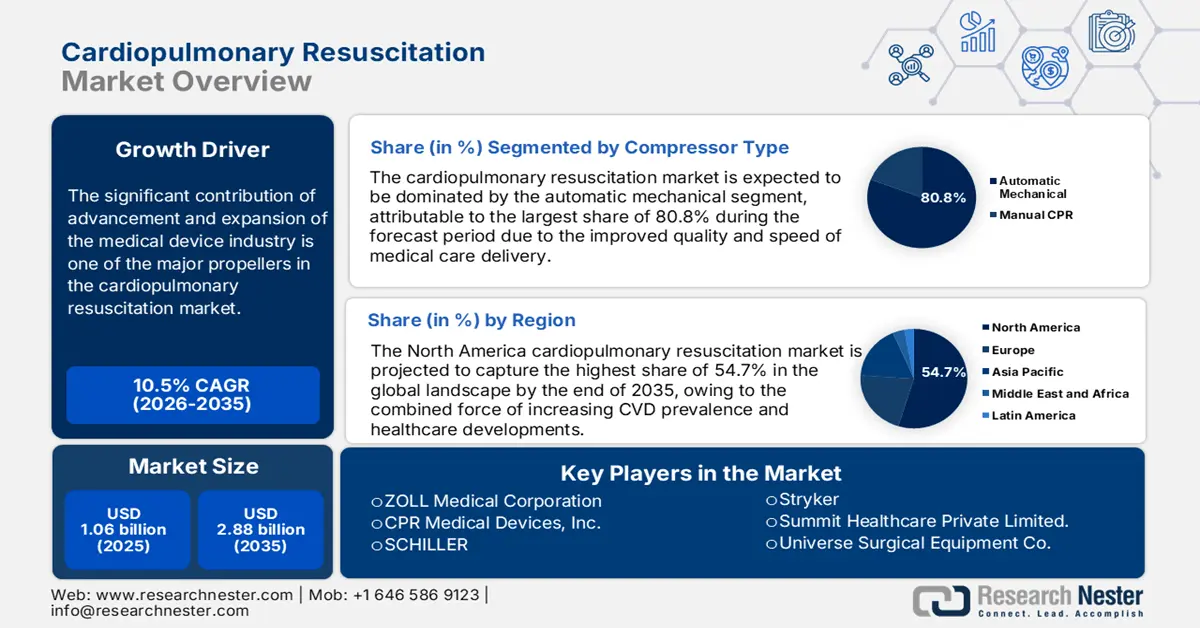

Cardiopulmonary Resuscitation Market size was over USD 1.06 billion in 2025 and is anticipated to cross USD 2.88 billion by 2035, witnessing more than 10.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of cardiopulmonary resuscitation is assessed at USD 1.16 billion.

The significant contribution of advancement and expansion of the medical device industry is one of the major propellers in the cardiopulmonary resuscitation market. According to 2022 OEC data, the global trade value of medical instruments including electro-cardio apparatus reached USD 157 billion. The value increased by 4.2% from 2021, when the top exporters were the U.S., Germany, Mexico, China, and the Netherlands. This growth is fueling the ongoing innovations in this sector and is influencing global leaders to introduce new technologies such as AEDs, and CPR monitoring mobile apps. This is further diversifying the product range, attracting more consumers to invest.

Improvement in healthcare infrastructure has also created scope for the leaders in the cardiopulmonary resuscitation market. The private investors are now embodying the regulatory initiatives and policies to standardize their offerings, securing consumer trust. In addition, they are participating in promotional activities such as training programs and campaigns, which bring a wider audience to this sector. For instance, in July 2023, Medtronic Pvt. Ltd. teamed with the Department of Cardiology at Sher-i-Kashmir Institute of Medical Sciences (SKIMS) to launch a CPR skill lab. The strategic partnership helped the company increase the popularity of its innovations by enhancing emergency cardiac care.

Key Cardiopulmonary Resuscitation Market Insights Summary:

Regional Highlights:

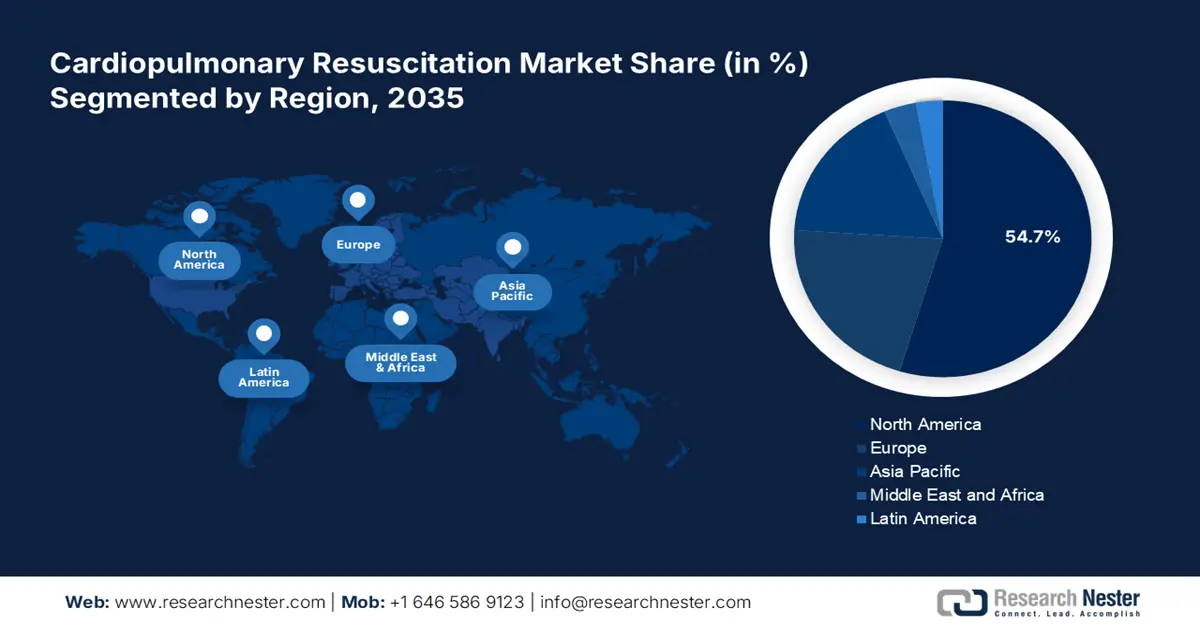

- North America holds a commanding 54.7% share in the Cardiopulmonary Resuscitation Market, driven by increasing CVD prevalence, healthcare advancements, and regulatory support for CPR training and devices, fostering growth through 2035.

- Asia Pacific's Cardiopulmonary Resuscitation Market is experiencing notable growth through 2026–2035, propelled by economic growth, government initiatives, and integration of automation in healthcare enhancing CPR device adoption.

Segment Insights:

- The Automatic Mechanical segment is projected to capture an 80.8% market share by 2035, driven by the improved quality and speed of medical care delivery.

- The Emergency Departments Segment is projected to achieve a significant share by 2035, driven by the proven efficacy of faster CPR in improving survival rates.

Key Growth Trends:

- Rising prevalence of cardiac arrest (CA)

- Supportive government initiatives

Major Challenges:

- Lack of knowledge about CPR utilities

- Limitation in integral settings

- Key Players: ZOLL Medical Corporation, CPR Medical Devices, Inc., Medtronic, SCHILLER, Stryker.

Global Cardiopulmonary Resuscitation Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.06 billion

- 2026 Market Size: USD 1.16 billion

- Projected Market Size: USD 2.88 billion by 2035

- Growth Forecasts: 10.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (54.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 13 August, 2025

Cardiopulmonary Resuscitation Market Growth Drivers and Challenges:

Growth Drivers

- Rising prevalence of cardiac arrest (CA): The impact of the increasing cases of cardiovascular diseases is inflating demand in the cardiopulmonary resuscitation market. Conditions such as sudden heart attacks and arrhythmias have become more frequent than ever. According to a 2022 NLM article, 20% of death cases were registered due to cardiac issues, majorly CA in Western society. This is further boosting demand for CPR training and cardiac equipment.

- Supportive government initiatives: The concerning volume of CA patients across the globe is pushing governing bodies to take action, securing capital investments in the cardiopulmonary resuscitation market. They are issuing favorable policies for device manufacturers and commencing promotional campaigns to educate patients. National associations are also taking an active part in serving the purpose of encouraging more consumers to adopt. For instance, in February 2024, the Union of European Football Associations (UEFA) started a CPR campaign named, 'Get Trained, Save Lives'. They launched an interactive training module, get-trained.com to captivate the large football fanbase.

Challenges

- Lack of knowledge about CPR utilities: Despite the increasing efforts to educate people about CPR operations, a majority of people from rural areas are still unaware of these techniques. This may limit optimum adoption in the cardiopulmonary resuscitation market. In addition, delayed life-saving interventions can result in the non-effectiveness of CPR due to the absence of proper training. Moreover, affording enrollment in such programs and certification courses often becomes difficult for the population in lower-income regions, restricting the widespread of this sector.

- Limitation in integral settings: Technological barriers between the healthcare facilities and offerings from the cardiopulmonary resuscitation market may become a hurdle for adoption. Volatility in the universal availability and pricing also can be a challenge for legacy infrastructures to incorporate these systems. Non-professional settings are more prone to lagging in delivering advanced services due to the absence of trained professionals with up-to-date knowledge. Further, these obstacles may hinder progress in this sector.

Cardiopulmonary Resuscitation Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.5% |

|

Base Year Market Size (2025) |

USD 1.06 billion |

|

Forecast Year Market Size (2035) |

USD 2.88 billion |

|

Regional Scope |

|

Cardiopulmonary Resuscitation Market Segmentation:

Compressor Type (Automatic Mechanical, Manual CPR)

By 2035, automatic mechanical segment is estimated to capture cardiopulmonary resuscitation market share of over 80.8%. The improved quality and speed of medical care delivery are propelling growth in this segment. The automated functions of these devices are meticulously designed to perform precise and faster CPR in time of need. Moreover, better patient outcomes are creating a surge in this segment, encouraging manufacturers to introduce more advanced systems. For instance, in April 2023, Defibtech launched a revolutionizing automated CPR device, ARM XR to assist paramedics in reviving patients of cardiac arrest.

Application (EMT Rescue Units, Coronary & Intensive Care Units, Emergency Departments, Organ Transplants Facilities, Air Medevac Units)

In terms of applications, the emergency departments segment is predicted to lead the cardiopulmonary resuscitation market with a significant share by 2035. The proven efficacy of faster CPR performances in improving CA survival rates is multiplying the demand for these devices each year. According to a study, published in February 2024, the reduction of death cases of CA dropped from 22% when CPR is performed within 1 minute to 1% when performed after 39 minutes. It is evidence of the need for CPR in an emergency to obtain complete effectiveness, propagating this segment. In addition, increased accessibility of emergency medical services is also expanding the consumer base of CPR devices and training programs.

Our in-depth analysis of the global cardiopulmonary resuscitation market includes the following segments:

|

Compressor Type |

|

|

Product Type |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cardiopulmonary Resuscitation Market Regional Analysis:

North America Market Analysis

In cardiopulmonary resuscitation market, North America region is predicted to capture over 54.7% revenue share by 2035. The combined force of increasing CVD prevalence and healthcare developments is pushing the region to augment in this sector. The availability of a diverse product pipeline concluding AEDs and training kits is garnering new possibilities for this sector, inspiring more companies to participate. In addition, the regulatory support and guidelines issued by governing bodies. For instance, in October 2020, the American Heart Association launched guidelines for CPR and emergency CVD care, standardizing the clinical practices of resuscitation science in North America.

The U.S. has placed itself at the forefront of the regional cardiopulmonary resuscitation market, backed by the deliberate efforts from several institutions to establish the foundation of CPR training initiatives. For instance, in November 2023, the University of Iowa Hospitals & Clinics launched an extracorporeal cardiopulmonary resuscitation (eCPR) program to save lives in sudden cardiac arrest events. They aimed at broadening the marketplace by introducing advanced techniques and methods such as extracorporeal membrane oxygenation (ECMO).

Canada is playing a pivotal role in fueling regional growth in the cardiopulmonary resuscitation market by accumulating government funding. The country is concentrating on strengthening its healthcare infrastructure by allowing advanced medical devices from foreign manufacturers, creating scope for international leaders in this sector. According to the 2022 OEC report, Canada secured a remarkable trade value in the medical instruments industry through larger imports, accounting for USD 2.4 billion.

APAC Market Statistics

Asia Pacific is estimated to exhibit a notable CAGR, presenting the fastest growth in the cardiopulmonary resuscitation market during the forecast timeline, 2025-2035. The region’s economic growth is constructing emerging marketplaces for both domestic and global leaders. Government initiatives to establish improved health and public safety are the key aspects behind the regional progress in this sector. In addition, the integration of automation in the healthcare industry has enhanced patient outcomes by producing smart CPR devices such as AEDs.

Propagation of the cardiopulmonary resuscitation market in India is utilizing the government’s interest and contribution. By prioritizing patient education, the country is fostering better prompt administration and emergency response systems to prevent cardiac fatalities. For instance, in December 2023, the Union Minister for Health and Family Welfare in India launched a nationwide CPR training program. This awareness campaign witnessed participation from around 2 million citizens. Thus, training CPR devices and management accessories are in high demand.

China feedstocks the cardiopulmonary resuscitation market with its exceptional manufacturing capacity. Heightening mortality and prevalence rates of CA due to CVD are dragging the country’s focus on expanding both domestic and international trading of medical devices including CPR systems. According to the 2022 NLM article, the number of CA cases in patients with cardiovascular disease accounts for 55,000 annually. The report further states that the population of CVD patients in China reached 230 million in the same year. Thus, it is developing great opportunities by enlarging domestic production and foreign access.

Key Cardiopulmonary Resuscitation Market Players:

- ZOLL Medical Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- CPR Medical Devices, Inc

- Medkm Healthcare

- Medtronic

- HMP

- Zeal Medical Private Limited

- Premier Medical Systems & Devices Private Limited

- Health Care Needs

- Summit Healthcare Private Limited.

- Universe Surgical Equipment Co.

- Technocare Medisystems.

- Phoenix Medical Systems Pvt. Ltd

- Michigan Instruments.

- SunLife Sciences.

- Jolife AB

- SCHILLER

- MEDinCN

- Stryker

- Dynarex Corporation

The recent allowance for automation and AI integration in healthcare has positively stimulated the dynamics of the global market. Global leaders are leveraging their production and R&D capabilities to captivate leadership in this sector. For instance, in 2023, ZOLL unveiled an advanced mechanical CPR technology, Autopulse NXT to evaluate its positioning in this landscape. The innovative device offers continuous circumferential compressions on a wide range of patient sizes without hindering the visibility of the coronary arteries. These innovations further influenced other competitors to introduce more effective and responsive systems to solidify their position. Such key players include:

Recent Developments

- In April 2024, Dynarex expanded its portfolio of portable respiratory systems by introducing Dynarex Resp-O2. The new line consists of a range of transportable solutions for oxygen delivery, suction care, nebulization therapy, and more, enhancing the flexibility of caregivers in every situation.

- In March 2024, Stryker launched LIFEPAK CR2 AED and Evacuation Chair while participating in the Criticare National Conference (2024), held at the ITC Royal Bengal, Kolkata. The revolutionary defibrillator consists of QUIK-STEP electrodes, allowing faster placement on the patient’s chest during CPR.

- Report ID: 6977

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.