Carboxylated Nitrile Rubber Market Outlook:

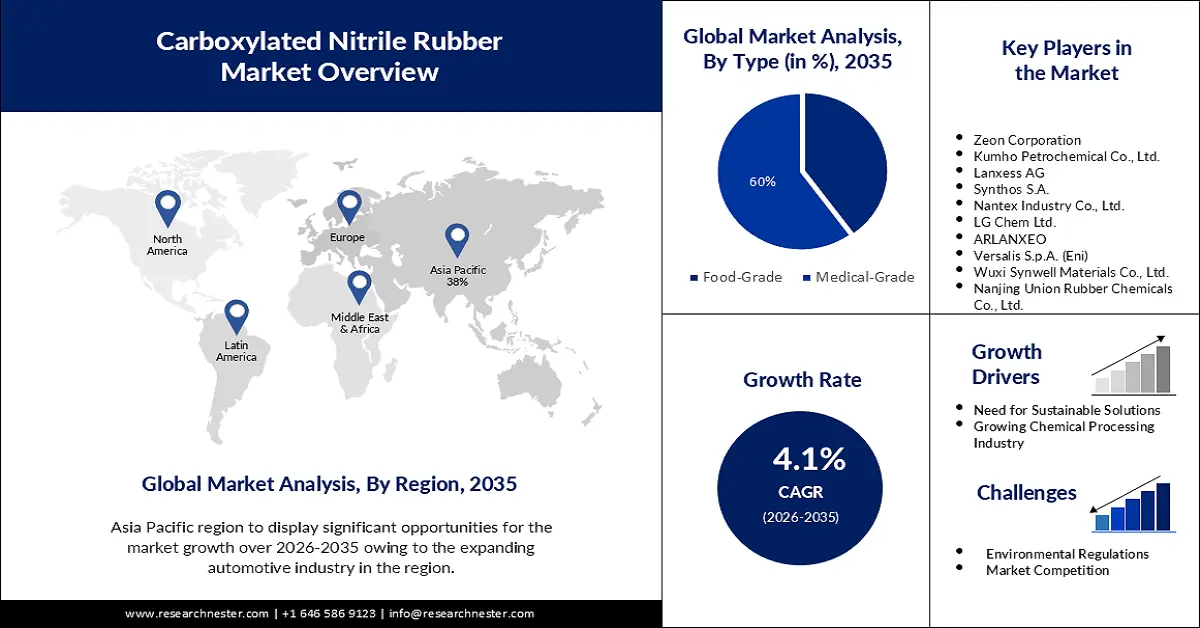

Carboxylated Nitrile Rubber Market size was over USD 4.32 billion in 2025 and is poised to exceed USD 6.46 billion by 2035, witnessing over 4.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of carboxylated nitrile rubber is estimated at USD 4.48 billion.

Carboxylated nitrile rubber is often used in automotive applications such as oil seals, gaskets, and hoses due to its excellent oil resistance. The demand for this rubber can be closely tied to the health of the automotive industry. Carboxylated nitrile rubber is also used in the oil and gas industry for seals and gaskets in equipment that comes into contact with petroleum-based fluids. The performance of this rubber in harsh environments can make it valuable in this sector.

Carboxylated Nitrile Rubber (XNBR) is a type of synthetic rubber that is created through the carboxylation of nitrile butadiene rubber (NBR). This modification introduces carboxyl groups into the polymer structure, enhancing its performance characteristics. Carboxylated Nitrile Rubber offers improved oil resistance, abrasion resistance, and heat resistance compared to standard NBR.

Key Carboxylated Nitrile Rubber Market Insights Summary:

Regional Highlights:

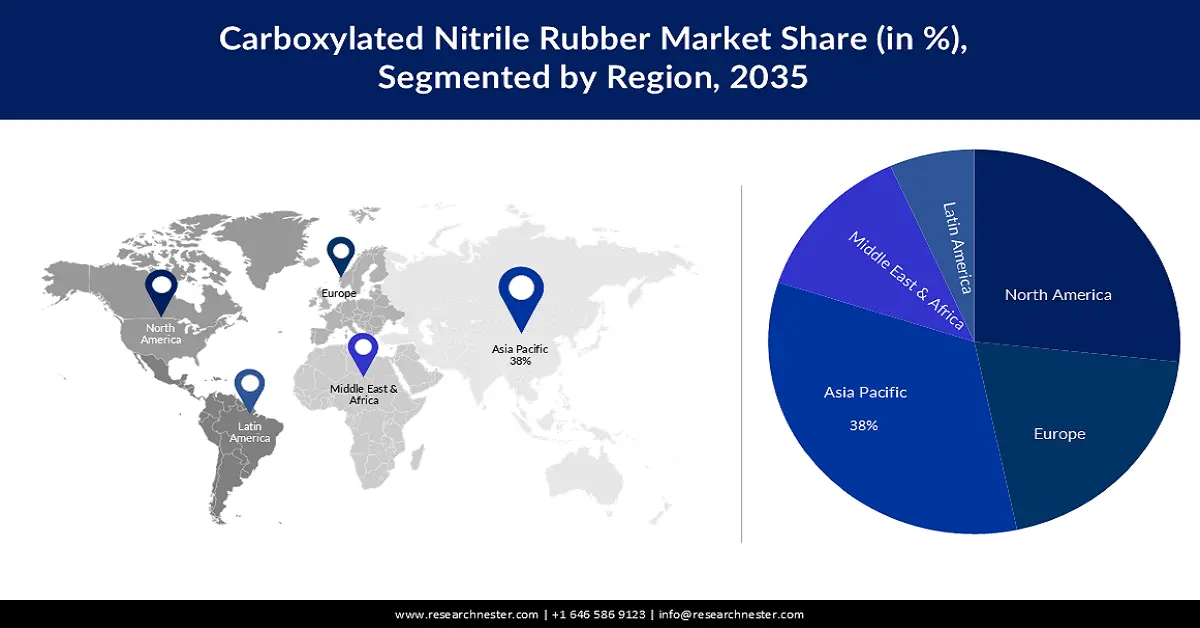

- The Asia Pacific carboxylated nitrile rubber market is expected to capture a 38% revenue share by 2035, attributed to strengthening sustainability regulations.

- The North America region is projected to hold the second-largest share by 2035, supported by the resurgence of the automotive industry.

Segment Insights:

- The medical-grade segment of the carboxylated nitrile rubber market is estimated to secure a 60% share by 2035, spurred by amplified demand for PPE.

- The automotive segment is poised to attain a notable share by 2035, bolstered by increasing automotive production.

Key Growth Trends:

- Increasing Demand in the Automotive Industry

- Emphasis on Sustainable Solutions

Major Challenges:

- Fluctuating Raw Material Prices

- Environmental Regulations

Key Players: Zeon Corporation, Kumho Petrochemical Co., Ltd., Lanxess AG, Synthos S.A., Nantex Industry Co., Ltd., LG Chem Ltd.

Global Carboxylated Nitrile Rubber Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.32 billion

- 2026 Market Size: USD 4.48 billion

- Projected Market Size: USD 6.46 billion by 2035

- Growth Forecasts: 4.1%

Key Regional Dynamics:

- Largest Region: Asia Pacific (38% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: India, Brazil, Indonesia, Mexico, Vietnam

Last updated on : 25 November, 2025

Carboxylated Nitrile Rubber Market - Growth Drivers and Challenges

Growth Drivers

- Increasing Demand in the Automotive Industry: The automotive industry remains one of the principal consumers of carboxylated nitrile rubber due to its exceptional oil resistance. As vehicles become more advanced and incorporate intricate systems, there is a growing need for high-performance rubber components, such as seals, gaskets, and hoses. Carboxylated nitrile rubber's ability to withstand exposure to various automotive fluids makes it indispensable in this sector. the global automotive rubber industry, which includes carboxylated nitrile rubber, is projected to grow by 5% by the year 2027.

- Emphasis on Sustainable Solutions: The carboxylated nitrile rubber sector is also adapting to evolving carboxylated nitrile rubber market trends, including a growing emphasis on sustainability and eco-friendly materials. Manufacturers are investing in research and development efforts to create more environmentally friendly versions of carboxylated nitrile rubber. This aligns with the global push towards reducing the environmental impact of industrial processes and materials.

- Chemical Processing Industry: In the chemical processing industry, where exposure to a wide range of corrosive chemicals is commonplace, carboxylated nitrile rubber is prized for its resistance. Moreover, the industry's responsiveness to emerging trends, such as sustainability, positions it for sustained growth and innovation in the coming years.

Challenges

- Fluctuating Raw Material Prices: The cost of raw materials used in the production of carboxylated nitrile rubber, such as butadiene and acrylonitrile, can be subject to fluctuations due to factors like supply disruptions, geopolitical events, and changes in demand. These fluctuations can affect production costs, pricing strategies, and profit margins for manufacturers in the sector.

- Environmental Regulations

- Market Competition

Carboxylated Nitrile Rubber Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.1% |

|

Base Year Market Size (2025) |

USD 4.32 billion |

|

Forecast Year Market Size (2035) |

USD 6.46 billion |

|

Regional Scope |

|

Carboxylated Nitrile Rubber Market Segmentation:

Type Segment Analysis

The medical-grade segment is estimated to hold 60% share of the global carboxylated nitrile rubber market in the year 2035. The COVID-19 pandemic has amplified the demand for PPE, including medical gloves, masks, and protective clothing. Medical-grade XNBR is utilized in the production of these critical protective materials, with its resistance to chemicals and pathogens making it a valuable choice in the fight against infectious diseases. The global PPE sales were valued at USD 52.7 billion in the year 2019.

End User Segment Analysis

Carboxylated nitrile rubber market from the automotive segment is expected to garner a significant share in the year 2035. One of the primary drivers for the automotive segment of XNBR is the sustained growth in global automotive production. As more vehicles are manufactured, the demand for high-quality rubber components, such as gaskets, seals, and hoses, increases. XNBR's exceptional oil resistance and durability make it a preferred choice for these critical automotive applications. Global automotive production reached approximately 75 million vehicles in 2020, with projections of continued growth in the coming years. The growth of the automotive segment of XNBR is driven by factors such as increasing automotive production, a focus on fuel efficiency and emissions reduction, the rise of electric vehicles, engine downsizing, durability requirements, and NVH reduction efforts.

Our in-depth analysis of the global carboxylated nitrile rubber market includes the following segments:

|

Type |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Carboxylated Nitrile Rubber Market - Regional Analysis

APAC Market Insights

The carboxylated nitrile rubber market in the Asia Pacific industry is expected to account for largest revenue share of 38% by 2035. Stringent environmental regulations and a growing emphasis on sustainability are driving the demand for eco-friendly rubber materials. XNBR manufacturers in the Asia-Pacific region are responding by developing formulations that are more environmentally friendly and meet regulatory standards, aligning with the region's commitment to reducing its environmental footprint. The Asia-Pacific region has been increasingly focusing on environmental regulations and sustainability. For example, China has set ambitious goals to reduce carbon emissions, aiming for carbon neutrality by 2060.

North American Market Insights

The carboxylated nitrile rubber market in the North America region is projected to hold the second largest share during the forecast period. One of the primary drivers of the XNBR market in North America is the resurgence of the automotive industry. XNBR's exceptional oil resistance and durability make it a preferred choice for automotive applications such as seals, gaskets, and hoses. As the automotive sector in North America continues to recover and adapt to evolving consumer demands, the demand for high-quality rubber components is on the rise. In 2020, the North American automotive market witnessed a rebound, with over 14.5 million vehicles sold, representing a recovery from the previous year's challenges. The demand for high-performance tires is increasing in North America, driven by consumer preferences for safety and improved driving experiences. XNBR is used in tire manufacturing to enhance properties such as abrasion resistance, heat resistance, and grip on the road.

Carboxylated Nitrile Rubber Market Players:

- Zeon Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Kumho Petrochemical Co., Ltd.

- Lanxess AG

- Synthos S.A.

- Nantex Industry Co., Ltd.

- LG Chem Ltd.

- ARLANXEO

- Versalis S.p.A. (Eni)

- Wuxi Synwell Materials Co., Ltd.

- Nanjing Union Rubber Chemicals Co., Ltd.

Recent Developments

- Kumho Petrochemical Co., Ltd. Completes Acquisition of LG Chem's Petrochemical Business on August 4, 2021.

- Kumho Petrochemical Co., Ltd. and SK Global Chemical Co., Ltd. Sign MOU to Explore Merger on October 14, 2022.

- Report ID: 5278

- Published Date: Nov 25, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Carboxylated Nitrile Rubber Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.