Carborundum Market Outlook:

Carborundum Market size was valued at USD 4.65 billion in 2025 and is likely to cross USD 16.5 billion by 2035, expanding at more than 13.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of carborundum is assessed at USD 5.21 billion.

The carborundum market is expanding due to increasing demand for various electronics applications such as kiln furniture, process components, and electrical field grading. The synthetic abrasive known as silicon carbide (SiC) or carborundum is produced by fusing finely powdered carbon (petroleum coke) with premium silica sand at high temperatures (1600–2500°C) in an electric furnace. Due to its superior features, carborundum is rapidly being regarded as a replacement for traditional silicon semiconductors in various applications such as electric vehicles, power electronics, and semiconductor devices.

Moreover, key leaders are extensively investing in silicon carbide or carborundum to expand their production capacity and strengthen their carborundum market position. For instance, The U.S. Department of Commerce and Wolfspeed Inc., an American manufacturer of wide-bandgap semiconductors, signed a non-binding preliminary memorandum of understanding (PMT) for up to USD 750 million under the CHIPS and Science Act. Additionally, a consortium of investment groups, including Apollo, The Baupost Group, Fidelity Management & Research Company, and Capital Group, pledged an extra USD 750 million in financing for Wolfspeed. These investments strengthen domestic silicon carbide production and support Wolfspeed's long-term expansion objectives.

Also, ON Semiconductor Corporation (Onsemi) extended its cutting-edge, world-class silicon carbide fabrication plant in Bucheon, South Korea. This fab will produce over 1 million 200 mm SiC wafers at full capacity each year. Moreover, STMicroelectronics, a global semiconductor leader serving customers in a wide range of electronics applications, constructed a new high-volume 200mm silicon carbide manufacturing facility in Catania, Italy, for power devices and modules, as well as test and packaging. Production is expected to start in 2026, reaching full capacity by 2033 with a target of up to 15,000 wafers per week. The total investment for the facility is around USD 5 billion, with approximately USD 2 billion in support from the State of Italy under the EU Chips Act.

Global Leading Silicon Carbide Manufacturers

|

Company |

Market Share |

|

STMicroelectronics N.V. |

36.5% |

|

Infineon Technologies AG |

17.9% |

|

Wolfspeed, Inc. |

16.3% |

|

ON Semiconductor Corporation (Onsemi) |

11.6% |

|

Rohm Co., Ltd. |

8.1% |

|

Others |

9.6% |

Key Carborundum Market Insights Summary:

Regional Highlights:

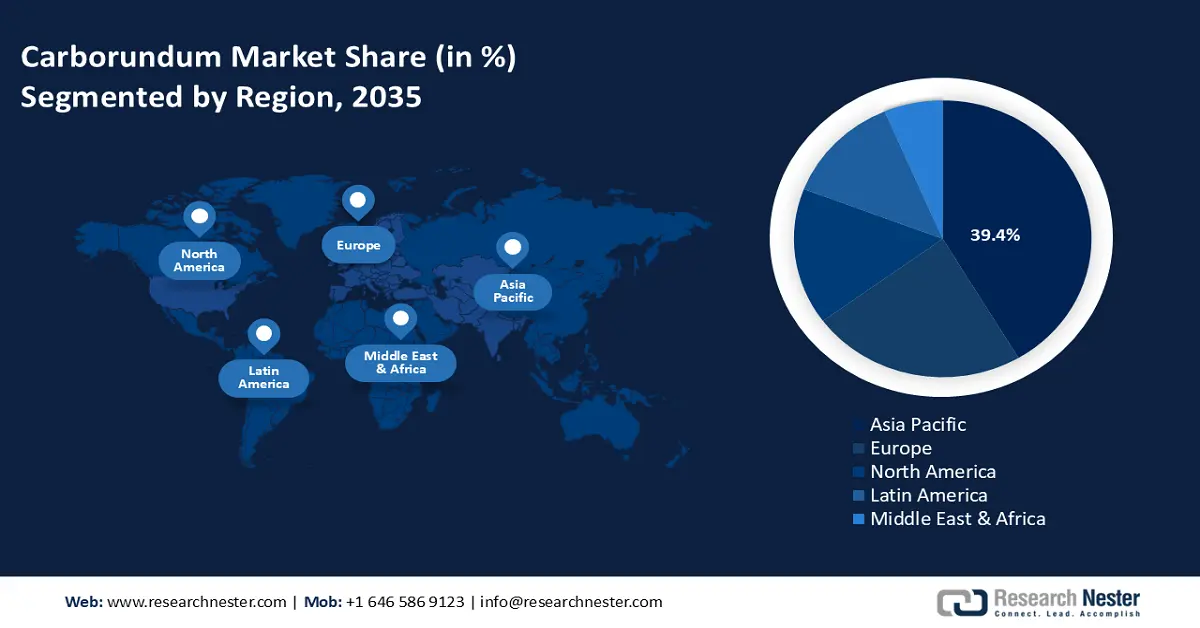

- Asia Pacific dominates the carborundum market with a 39.4% share, fueled by steel production bases, foreign investment, and rising interest in renewable energy, positioning it for significant growth through 2035.

- Europe’s carborundum market is growing steadily through 2035, driven by climate initiatives, EV adoption, and programs like the European Green Deal.

Segment Insights:

- The Electrical & Electronics segment is anticipated to achieve a notable market share by 2035, driven by carborundum’s high-frequency functioning and chemical stability.

- The Black SiC segment of the Carborundum Market is forecasted to achieve over 54.5% share by 2035, propelled by growing application in electric arc furnaces and increased steel production.

Key Growth Trends:

- Emerging trends in carborundum applications

- Increasing global trade activities

Major Challenges:

- High cost of carborundum devices

- Faults in materials, design, and packaging processes in SiC devices

- Key Players: STMicroelectronics N.V., Infineon Technologies AG, Semiconductor Components Industries, LLC, Wolfspeed, Inc., AGSCO Corporation, Carborundum Universal Limited, Washington Mills, CoorsTek, Inc., Entegris, Inc., Compagnie de Saint-Gobain S.A..

Global Carborundum Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.65 billion

- 2026 Market Size: USD 5.21 billion

- Projected Market Size: USD 16.5 billion by 2035

- Growth Forecasts: 13.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (39.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 13 August, 2025

Carborundum Market Growth Drivers and Challenges:

Growth Drivers

- Emerging trends in carborundum applications: Nanoscale silicon carbide is currently gaining attention as a possible way to improve power density and energy storage. Its distinct physical and chemical characteristics such as superior mechanical strength, high-temperature resistance, and exceptional chemical stability as compared to conventional carbon-based materials led to various research interests. The benefits of carborundum are especially noticeable in the field of supercapacitors. Moreover, carborundum is becoming the next-generation material platform for quantum technologies, recent research demonstrated its potential for spin qubits, due to its excellent spin coherent properties and compatibility with standard semiconductor fabrication techniques.

Furthermore, the improvement of SiC power devices' electrical performance and thermal management has been greatly aided by advancements in packaging technology. The overall dependability and endurance of SiC power modules under severe operating conditions have been improved by the effective heat dissipation and decreased thermal resistance made possible by advanced packaging techniques such as integrated substrate technologies and direct liquid cooling. Additionally, carborundum is gaining momentum for high-frequency switches operating at high speeds in 5G base stations and military electronics as it efficiently performs in high-temperature and high-frequency environments. - Increasing global trade activities: As the demand increases across diverse industries such as automotive, electronics, and renewable energy, the efficient and widespread distribution of silicon carbide is playing a critical role in meeting production needs. According to the Observatory of Economic Complexity (OEC), with a total trade of USD 1.38 billion, silicon carbide was the 1853rd most traded product in the world in 2022. Silicon carbide exports increased by 33.8% from USD 1.03 billion to USD 1.38 billion between 2021 and 2022, accounting for 0.0058% of global commerce. The increasing trade is fostering market expansion by ensuring a steady supply chain, enhancing global accessibility, and promoting technological advancements in key industries.

|

Country |

Silicon Carbide Export Value (USD million) |

Country |

Silicon Carbide Import Value (USD million) |

|

China |

6060 |

U.S. |

2520 |

|

Norway |

1460 |

Germany |

1770 |

|

Germany |

6950 |

Japan |

1610 |

|

Netherlands |

6310 |

South Korea |

7800 |

|

Brazil |

6290 |

India |

6760 |

Source: OEC

Challenges

- High cost of carborundum devices: Carborundum or silicon carbide is produced by a sublimation method requiring significant energy to reach high temperatures. This procedure results in final boules that are no longer than 25 mm and have lengthy growth durations. Compared to silicon wafers, this results in an increase in cost. Additionally, gadget fabrication and epitaxy are additional cost considerations that involve expensive consumables and high temperatures. The ultimate cost driver is the yield at each stage, including the number of wafers from boules that are not useful as well as the post-epitaxy and manufacturing write-offs. As a result, the high price of carborundum devices prevents the carborundum market from expanding.

- Faults in materials, design, and packaging processes in SiC devices: Micro-sized gaps called micropipes are found throughout the crystals of SiC materials. SiC devices are vulnerable to several flaws during the production of bigger wafers, including stacking faults, dislocations, and prototype inclusions. These defects result from localized variations in pressure or an unbalanced ratio of silicon and carbon precursors' temperature. As a result, these flaws reduce the device's electrical qualities and hinder its effectiveness.

Carborundum Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

13.5% |

|

Base Year Market Size (2025) |

USD 4.65 billion |

|

Forecast Year Market Size (2035) |

USD 16.5 billion |

|

Regional Scope |

|

Carborundum Market Segmentation:

Product Type (Black SiC, Green SiC)

Black SiC segment is likely to account for more than 54.5% carborundum market share by the end of 2035. The segment is expanding owing to the growing application of electric arc furnaces to encourage the use of less natural raw materials. This product category is offered in block, grain, and powder forms. The product is commonly used in grain form, particularly in electric arc furnaces to produce steel and iron. The South East Asia Iron and Steel Institute (SEAISI) estimated that from 1.89 billion tons (bnt) in 2023 to 1.97 billion bnt in 2030, the world's crude steel production is predicted to increase by almost 4%. Additionally, global EAF-based steel production will increase from about 550 million tons in 2023 to 790 million tons by 2030.

Application (Steel, Automotive, Aerospace, Military & Defense, Electrical & Electronics, Healthcare)

The electrical & electronics segment in carborundum market will garner a notable share in the forecast period. The product's growing importance in creating effective electronic chips will continue to be a major factor in the segment's expansion. Carborundum’s remarkable qualities, such as its increased bandgap, high-frequency functioning, chemical stability, and resistivity at high temperatures, will gain traction in the electrical and electronic sectors.

Also, various power devices in the power electronics sector are in charge of changing alternating current into direct current or vice versa within systems designed to reduce energy loss and increase system efficiency. SiC power semiconductors have higher resilience to high operating temperatures, higher voltage and current tolerances, and better power conversion efficiency than conventional silicon-based devices.

Our in-depth analysis of the global carborundum market includes the following segments:

|

Product Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Carborundum Market Regional Analysis:

APAC Market Statistics

Asia Pacific carborundum market is predicted to dominate revenue share of over 39.4% by 2035. Countries that produce steel, including China, India, Japan, and South Korea, are part of the regional market. Due to the substantial steel production bases in these nations, numerous foreign suppliers have established businesses in Asia Pacific. Also, the region's economic development has significantly changed due to its manufacturing capabilities, which has encouraged the construction of downstream industries and advanced the region's SiC penetration. Furthermore, the increased interest in renewable energy sources is escalating the carborundum market growth in the region.

In India, the growing demand for lighter and more compact power supplies in future combat systems has surged the use of carborundum/SiC technology for communications, intelligence, reconnaissance, and unmanned systems for military and commercial sectors, including electric vehicles and renewable energy. The governmental support for increasing the adoption rate of electric vehicles and renewable energy will expand the carborundum market in the country. According to the India Brand Equity Foundation (IBEF), the strategy for the expansion of electric mobility in India was established by NITI Aayog in July 2023, aligned with the government's goal of reaching net zero emissions by 2070. Additionally, India had a remarkable eleven-fold increase in the number of electric vehicle registrations, which rose from 1.3 million in 2018 to 15.29 million by 2023.

Additionally, in China, the need for SiC power devices and conventional application areas such as refractories and abrasives will drive the growth of the carborundum market. Also, foreign automotive semiconductor vendors are seeking long-term partnerships with SiC wafer suppliers. In May 2023, to obtain more competitive silicon carbide (SiC) sources and broaden its base of SiC material suppliers, Infineon Technologies AG entered into an arrangement with SICC, a Chinese supplier. Under the deal, SICC will provide the German semiconductor manufacturer with high-quality and competitive 150-millimeter boules and wafers for producing SiC semiconductors, accounting for a double-digit portion of the long-term projected demand.

Europe Market Analysis

Europe carborundum market is expected to grow significantly during the assessed period. The market growth is influenced by the region's strong dedication to energy-efficient technology, electric vehicles (EVs), and renewable energy. The growing use of carborundum devices in various industries is largely due to the European Union's strict regulations to lower carbon emissions and its vigorous support of green technologies. The shift to renewable energy sources like wind and solar power is accelerated by Europe's ambitious climate targets and programs, such as the European Green Deal.

Furthermore, the need for key power electrical devices and systems is expected to rise as the UK shifts to electric vehicle production over the next ten to fifteen years, with certain manufacturers and brands pledging to become entirely electric as early as 2025. The nation's carborundum market will grow as a result of this need. The government is introducing several programs to boost domestic SiC production. One of these, the USD 20.63 million ESCAPE (End-to-end Supply Chain development for Automotive Power Electronics) program, is funded by Innovate UK and the Advanced Propulsion Centre and aims to support a domestic SiC supply chain from epitaxial deposition to power converter manufacturing.

Key Carborundum Market Players:

- STMicroelectronics N.V.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Infineon Technologies AG

- Semiconductor Components Industries, LLC

- Wolfspeed, Inc.

- AGSCO Corporation

- Carborundum Universal Limited

- Washington Mills

- CoorsTek, Inc.

- Entegris, Inc.

Numerous vendors are present at different stages of the value chain, contributing to the carborundum market's significant fragmentation. While a few well-established vendors are attempting to integrate with developing value-added goods for the electronics sector, the main vendors are concentrated on developing SiC-based abrasives. With significant carborundum market developments including new product releases, contracts, higher investments, and cooperation with other players, companies are also implementing a variety of measures to expand their global presence.

Recent Developments

- In September 2024, STMicroelectronics, a worldwide semiconductor pioneer serving clients across various electronics applications, introduced its fourth generation STPOWER silicon carbide (SiC) MOSFET technology. Generation 4 technology sets new goals for power efficiency, density, and robustness.

- In March 2024, Infineon Technologies AG announced the latest generation of silicon carbide (SiC) MOSFET trench technology. The new Infineon CoolSiC MOSFET 650 V and 1200 V Generation 2 improves key MOSFET performance figures such as stored energies and charges by up to 20% compared to the previous generation without compromising quality and reliability levels, leading to higher overall energy efficiency and contributing to decarbonization.

- Report ID: 6999

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Carborundum Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.