Global Market Size, Forecast, and Trend Highlights Over 2025-2037

Carbon-neutral Fuel Market size was USD 87.8 billion in 2024 and is estimated to reach USD 230.1 billion by the end of 2037, expanding at a CAGR of 7.7% during the forecast period, i.e., 2025-2037. In 2025, the industry size of carbon-neutral fuel is assessed at USD 94.5 billion.

The net zero-emission goals adopted by a majority of countries across the world are fueling the sales of carbon-neutral fuel. The transition from fossil fuel to renewable energy sources is backing the trade of carbon-neutral fuel. These fuels are gaining importance in decarbonisation-focused industries such as maritime transport and industrial heat. The European Commission report states that by limiting global warming to 1.5o C the world's emission is expected to fall by 85.0% by 2050 and renewable energy production to capture 75.0% of the total energy supply share. Furthermore, the same source highlights that the Paris Agreement is supporting the global low-carbon fuel trade.

The International Energy Agency (IEA) report states that the move towards discontinuation of all unabated coal and oil power facilities by 2040 and mitigating the trade of internal combustion engine vehicles by 2035 are expected to rapidly hinder the consumption of fossil fuels. The same report also states that the rise in the electricity system’s flexibility such as hydrogen-based fuels, batteries, and hydropower is anticipated to support the mitigation the fossil fuel energy generation by 2040. Also, the large number of cars running on roads are estimated to rely on electricity or fuel cells, and planes on bio or synthetic fuels in the coming years. This highlights that the transformation of the global energy system is set to propel the sales of carbon-neutral fuel by the end of the forecast period.

Carbon-neutral Fuel Market: Growth Drivers and Challenges

Growth Drivers

- Electro fuel (e-fuel) gaining traction: The continuous advancements in electrolysis and renewable energy sources are leading to the development of advanced e-fuels. These solutions are gaining traction as carbon neutral alternatives to fossil fuels. For instance, the IEA study estimates that by 2030, e-fuels are set to scale up rapidly. The carbon neutral e-fuels are offering decarbonisation options for transport. Investments in clean energy are witnessing high growth compared to fossil fuels. The same study reveals that clean energy investments are expected to expand from USD 1.13 trillion in 2017 to USD 1.74 trillion by 2030. Furthermore, fossil fuel investments decreased from USD 1.11 trillion to USD 1.05 trillion during the same period. The second and third-generation biofuels particularly derived from algae, waste materials, and crops such as sugarcane, soybean, and corn are also witnessing increasing investments as they offer high energy and low emissions. For instance, the U.S. Energy Information Administration (EIA) states that biofuels are carbon neutral alternatives to fossil fuels.

- Rise in sustainable vehicle adoption: The surging sales of electric and hybrid vehicles are set to augment the demand for carbon-neutral fuel in the coming years. For instance, in September 2023, the California Air Resources Board estimated that a 94.0% reduction in liquid petroleum by 2045 is expected to aid in achieving carbon neutrality. The same source also states that the phase-out of most fuel-powered trucks by 2035 is expected to lead the road to zero emissions. The low carbon fuel standard (LCFS) program aimed at crop-based biofuel production and waste- and residue-based feedstock incentivization accounts for large land use change emissions. The majority of biomass-based diesel is produced from waste feedstocks. Thus, the new fuel type innovations coupled with sustainable vehicle adoption are set to drive carbon-neutral fuel market growth in the coming years.

|

Carbon Intensities Relative to Fossil Fuels |

|

|

Average Carbon Intensities for Transportation Fuels Reported to LCFS In 2022 |

|

|

Fuel Type |

Carbon Intensity (G CO2E/MJ) |

|

Fossil Gasoline |

99 |

|

Fossil Diesel |

100 |

|

Ethanol |

59 |

|

Biodiesel |

28 |

|

Renewable Diesel |

37 |

|

Electricity |

30 |

|

Alternative Jet Fuel |

38 |

|

Hydrogen |

33 |

|

Bio-CNG |

-99 |

|

Bio-LNG |

54 |

Source: California Air Resources Board

Challenges

- High cost a major barrier: The high initial investments in the production of carbon-neutral fuel are prime challenging factors for smaller companies or start-ups eager to enter the carbon-neutral fuel market. This sustainable fuel production requires the integration of advanced technologies, which uplifts the overall production costs. Another aspect associated with this is that the majority of end users hesitate to invest in carbon-neutral fuel owing to their high costs compared to fossil fuels. Thus, cost is a major restraining factor for the growth of the carbon-neutral fuel market.

- Uncertain regulations: Regulatory changes or uncertainty often create hesitancy among investors and hampers the overall trade to some extent. Governments’ changing policies and evolving regulations on carbon emissions have the potential to disrupt the revenue growth of the companies. The high competition from fossil fuel producers owing to their established infrastructure and lower prices are barriers to carbon neutral fuel companies' growth, both in terms of revenues and market dominance.

Carbon-neutral Fuel Market: Key Insights

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2037 |

|

CAGR |

7.7% |

|

Base Year Market Size (2024) |

USD 87.8 billion |

|

Forecast Year Market Size (2037) |

USD 230.1 billion |

|

Regional Scope |

|

Carbon-neutral Fuel Segmentation

Type (Hydrogen Cell, Biodiesel, Bioethanol, Others)

The bioethanol segment is set to capture over 37.5% carbon-neutral fuel market share by 2037. Bioethanol is exhibiting high demand from developing economies such as Brazil, Indonesia, and India owing to robust carbon neutrality policies and adequate feedstock production. The IEA report estimates that the demand for biofuels is expected to increase by 38 billion liters between 2023 and 2028, a hike of 30% over the last 5 years. The strengthening of existing policies and expanding biofuel needs are expected to triple the bioethanol demand growth in the accelerated case compared to the main case. Between 2023 and 2028, the bioethanol demand in Brazil is anticipated to be 15.7 billion liters per year, Indonesia (4.1 billion liters per year), India (2.6 billion liters per year), and other emerging economies (4.7 billion liters per year). This highlights bioethanol has a wider scope globally compared to other carbon-neutral fuel.

|

Global Biofuel Demand (in Billion Liters Per Year) Main Case |

||||

|

Year |

Ethanol |

Biodiesel |

Renewable Diesel |

Biojet Fuel |

|

2023 |

108.2 |

48.2 |

18.6 |

0.6 |

|

2024 |

110.9 |

50.2 |

18.9 |

1.8 |

|

2025 |

112.3 |

52.0 |

21.7 |

2.7 |

|

2026 |

114.1 |

52.3 |

23.2 |

3.5 |

|

2027 |

115.5 |

52.5 |

25.1 |

4.4 |

|

2028 |

117.5 |

52.9 |

26.4 |

5.2 |

Source: IEA

|

Global Biofuel Demand (in Billion Liters Per Year) Accelerated Case |

||||

|

Year |

Ethanol |

Biodiesel |

Renewable Diesel |

Biojet Fuel |

|

2023 |

108.2 |

48.2 |

18.6 |

0.6 |

|

2024 |

121.2 |

55.8 |

23.3 |

3.4 |

|

2025 |

130.8 |

60.6 |

30.2 |

5.4 |

|

2026 |

137.8 |

64.1 |

33.5 |

7.7 |

|

2027 |

141.8 |

66.1 |

37.0 |

11.1 |

|

2028 |

145.1 |

68.1 |

39.0 |

14.9 |

Source: IEA

Application (Automobiles, Ships, Aircraft, Others)

By 2037, automobile segment is expected to capture over 47.8% carbon-neutral fuel market share. Road transportation activities are major contributors to greenhouse gas emissions and automobiles are prime representative of them. The strict regulations on carbon emissions and increasing adoption of sustainable vehicles are generating profitable opportunities for carbon neutral fuel producers. The electrification trend and phasing out of internal combustion engine vehicles is anticipated to boost the sales of carbon-neutral fuel in the coming years. The IEA report reveals that around 14 million EVs were registered globally which means 1 in 5 cars sold globally were of electric engine, in 2023. Furthermore, the automakers increasing investments in R&D activities on innovative fuel options such as hydrogen fuel cells and renewable energy storage solutions, and supportive government policies are set to promote the consumption of carbon-neutral fuel in the coming years.

Our in-depth analysis of the global carbon-neutral fuel market includes the following segments:

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

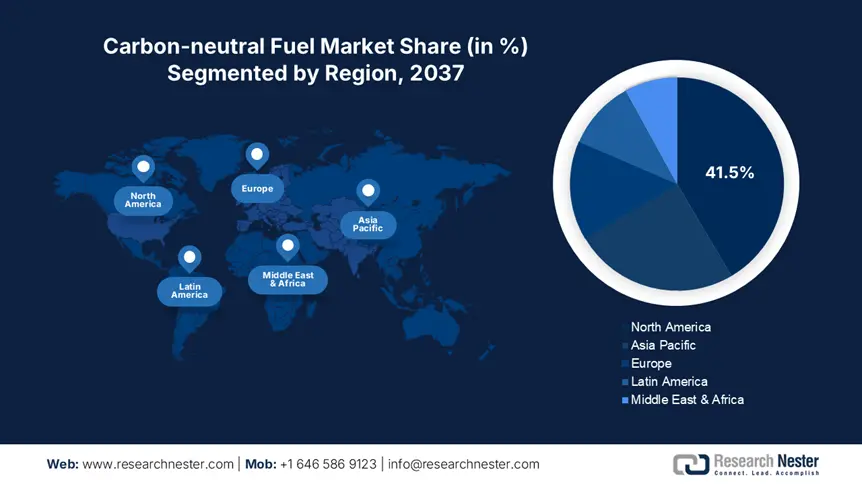

Carbon-neutral Fuel Industry - Regional Scope

North America Market Forecast

North America carbon-neutral fuel market is anticipated to capture revenue share of over 41.5% by 2037. The supportive government policies, technological advancements, corporative sustainability commitments, and growing investments in green energy projects are driving the sales of carbon-neutral fuel in North America. The rising awareness about GHG emissions and increasing adoption of carbon neutral vehicle adoption are further propelling the overall carbon-neutral fuel market growth in the U.S. and Canada.

In the U.S. the increasing government focus on reducing greenhouse gas emissions and growing investments in clean energy adoption are anticipated to contribute to the carbon-neutral fuel market growth. Innovations in biofuel, hydrogen, and synthetic fuel production are also aiding the country to gain dominance in the global landscape. For instance, the Growth Energy report states that the U.S. is the leading producer of bioethanol globally. The country purchases around 500 million bushels of corn each year for 15.0 billion gallons of bioethanol production. The 10% of total production is exported worldwide, annually. Apart from this, the country exports 11 million metric tons of dried distillers’ grains (DDGS) as an animal feed worth USD 4.0 billion. DDGS is a nutrient-rich residue developed during bioethanol production. Overall, it can be understood that carbon neutral fuel production is a win-win industry for the country’s GDP growth.

Canada is a lucrative marketplace for carbon neutral fuel producers owing high adoption of electric and hybrid vehicle production and adoption. The government’s supportive investments in EV companies are directly fueling the consumption of carbon-neutral fuel. The country’s increasing efforts to position it as the global producer and consumer of clean energy are set to propel the sales of carbon-neutral fuel. Considering these efforts many companies are focusing on the production and commercialization of biofuels, hydrogen fuel cells, and other carbon-neutral fuel. For instance, the Canadian Centre for Energy Information study reveals that the country is the 3rd largest hydroelectricity producer globally. The study also estimates that nearly 82.0% of the energy comes from non-GHG emitting systems such as hydro, solar, wind, and nuclear.

Asia Pacific Market Statistics

The Asia Pacific carbon-neutral fuel market is set to expand at the fastest pace during the assessed period. The increasing investments in biofuel production, growing implementation of strict carbon emission regulations, expanding energy needs, and strong existence of chemical and petrochemical companies are foreseen to uplift the position of Asia Pacific in the global landscape. High infrastructure development and manufacturing activities are also expected to promote the sales of carbon-neutral fuel in Asia Pacific countries such as China, India, Australia, Japan, and South Korea.

China’s carbon neutrality goal and strong emphasis on clean energy solutions are anticipated to propel the consumption of carbon-neutral fuel in the years ahead. The government's supportive polices in terms of schemes, tax benefits, and incentives to those who invest in renewable energy sources and technologies are also driving the carbon-neutral fuel market growth. High investments in green infrastructure and swift production and commercialization of electric and hybrid vehicles are pushing the sales of carbon-neutral fuel. For instance, the Research Nester’s study estimates that China’s EV market is estimated to attain a valuation of USD 377.9 billion in 2025 and the EV sales are projected to reach 9.57 million units by 2029.

In India, the strong presence of chemical and petrochemical manufacturing facilities, local and international, is set to significantly drive the sales of carbon-neutral fuel in the foreseeable period. Technological advancements in biofuel production and growing energy demand owing to rapid industrialization and urbanization are set to propel the demand for carbon-neutral fuel in the coming years. The strict carbon emission regulations and energy transition trend are expected to push the use of bioethanol and sustainable aviation fuel in transportation and aviation activities. For instance, in December 2024, the India Brand Equity Foundation (IBEF) revealed that the amended Pradhan Mantri Jaiv Indhan - Vatavaran Anukool Fasal Awashesh Nivaran (PM JI-VAN) Yojana offers financial support for enhanced bioethanol projects. More than USD 106.7 million are allotted to 2G bioethanol projects in Haryana.

Companies Dominating the Carbon-neutral Fuel Market

- Axpo Holding AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Carbon Engineering Ltd

- Umcor

- Nanoshell LLC

- American Element

- Pometon Powder

- POET, LLC

- Shell Plc

- Archer Daniels Midland Company

- Raízen S.A.

- Wilmar International Limited

- Renewable Energy Group

- Jivoule Biofuels

- Enerkem

- Pacific Ethanol Inc.

- TotalEnergies S.E.

- ExxonMobil Corporation

- Chevron Corporation

Carbon neutral fuel production and commercialization is highly an opportunistic market owing to the zero-emission goals of the majority of countries. The leading companies in the carbon-neutral fuel market are adopting several organic and inorganic strategies to earn high profits such as technological innovations, new product launches, strategic collaborations & partnerships, mergers & collaborations, and global expansions. Developing and untapped markets are anticipated to offer high-earning opportunities for carbon neutral fuel producers. Supportive government policies in the form of tax benefits, incentives, and schemes are driving the attention of new companies to invest in the production of carbon-neutral fuel such as hydrogen cells, bioethanol, and bio-diesel.

Some of the key players in carbon-neutral fuel market:

Recent Developments

- In December 2024, Axpo Holding AG initiated the purchase of additional biomethane projects in Italy. The facilities are anticipated to generate around 45 GWh of renewable energy annually and are set to start their operations by the second half of 2026.

- In April 2024, the European Renewable Ethanol Association (ePURE) revealed that the Superethanol-E85 is a new 100% renewable solution to reduce carbon dioxide emissions from transport. This carbon neutral fuel is as beneficial as all-electric energy solutions

- Report ID: 7062

- Published Date: Jan 28, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Carbon Neutral Fuels Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert