Carbon Fiber Market Outlook:

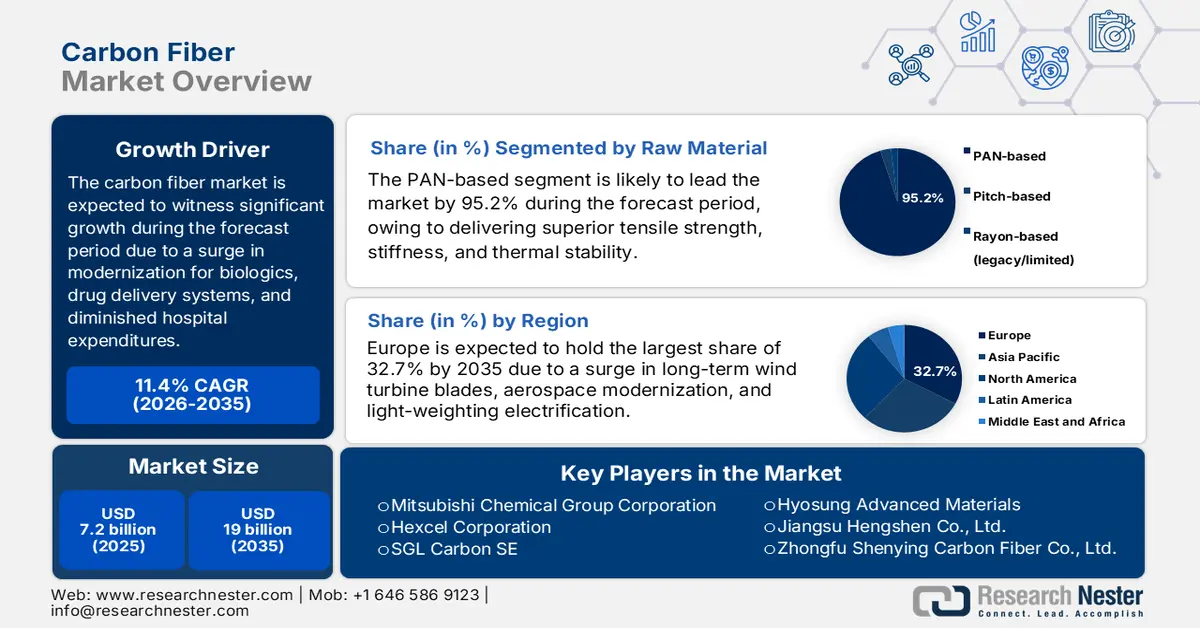

Carbon Fiber Market size was over USD 7.2 billion in 2025 and is estimated to reach USD 19 billion by the end of 2035, expanding at a CAGR of 11.4% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of carbon fiber is assessed at USD 8 billion.

The international carbon fiber market is considered a standard cornerstone for innovative materials, providing high strength-to-weight ratios, along with durability that makes it readily indispensable across industrial, wind energy, automotive, and aerospace applications. According to an article published by the U.S. Department of Energy in 2025, almost a 10% reduction in vehicle weight tends to result in a 6% to 8% fuel economy optimization, since it generally takes less energy to accelerate a light object. Thereby, by utilizing lightweight components, along with high-efficiency engines can enable innovative materials within a quarter, especially in the U.S., and successfully save over 5 billion gallons of fuel every year by the end of 2030. Besides, replacing heavy steel components with materials, including high-strength steel, glass fiber, and aluminum composites, can readily decrease component weight by 10% to 60%, thus denoting an optimistic approach for the carbon fiber market’s growth.

List of Light-Weight Materials Ensuring Mass Reduction (2025)

|

Material Type |

Mass Reduction (%) |

|

Magnesium |

30 to 70 |

|

Carbon Fiber Composites |

50 to 70 |

|

Aluminum and AI Matrix Composites |

30 to 60 |

|

Titanium |

40 to 55 |

|

Glass Fiber Composites |

25 to 35 |

|

Advanced High-Strength Steel |

15 to 25 |

|

High Strength Steel |

10 to 28 |

Source: U.S. Department of Energy

Furthermore, the recycled carbon fiber adoption, increased automation in manufacturing, integration into electric vehicle platforms, expansion in wind energy, diversification into new applications, and the aspect of regional leadership are other factors driving the carbon fiber market internationally. As per an article published by the WWEA Organization in April 2025, the overall wind capacity exceeded by 1,174 GW, with 121 GW readily added in 2024. In addition, China has significantly installed 87 GW, which accounts for 72% of the newest international capacity. Moreover, countries with the largest carbon fiber market volume for new wind turbines include 5.4 GW in Brazil, 4.2 GW in the U.S., 3.4 GW in India, 3.3 GW in Australia, 3.2 GW in Germany, and 2.2 GW in the UK, thereby driving the market’s demand across every nation.

Yearly Overall Cumulative Installed Wind Capacity (2016-2024)

|

Year |

Capacity (MW) |

|

2016 |

485,549 |

|

2017 |

537,732 |

|

2018 |

589,511 |

|

2019 |

650,951 |

|

2020 |

744,695 |

|

2021 |

844,740 |

|

2022 |

930,743 |

|

2023 |

1,051,335 |

|

2024 |

1,173,580 |

Source: WWEA Organization

Key Carbon Fiber Market Insights Summary:

Regional Highlights:

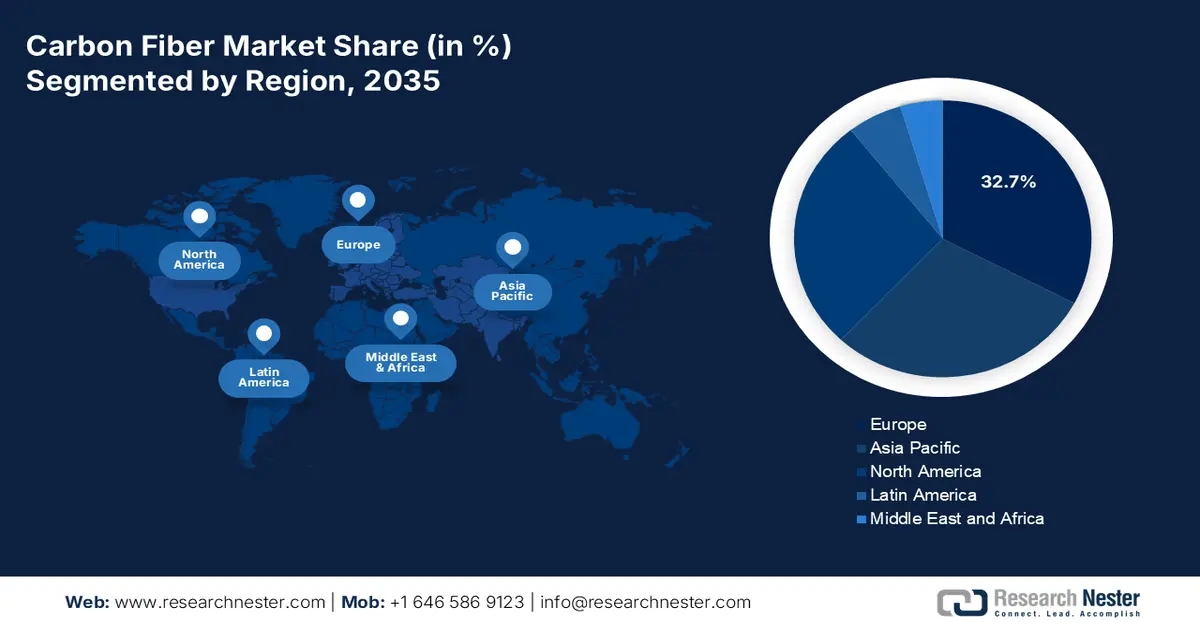

- Europe is forecast to secure a leading 32.7% share by 2035 in the carbon fiber market, supported by strong demand from wind turbine blade longevity, automotive electrification-focused lightweighting, and aerospace and defense modernization initiatives stimulating material adoption.

- North America is projected to register the fastest growth during the 2026–2035 period, advancing on the back of large-scale wind repowering programs, accelerating electric vehicle lightweighting requirements, and recurring aerospace airframe replacement cycles.

Segment Insights:

- PAN-based segment in the raw material category is projected to command a dominant 95.2% share by 2035 in the carbon fiber market, bolstered by its ability to deliver superior tensile strength, stiffness, and thermal stability essential for high-performance composite structures.

- Virgin carbon fiber segment is expected to capture the second-largest share over the 2026–2035 forecast horizon, strengthened by its indispensable role in high-performance aerospace, medical, and motorsports applications demanding exceptional strength-to-weight efficiency.

Key Growth Trends:

- Modernization in aerospace

- Electrification in automotive:

Major Challenges:

- Increased production expenses and raw material dependency

- Sustainability and recycling challenges:

Key Players: TORAY INDUSTRIES INC., Hexcel Corporation, Mitsubishi Chemical Corporation, TEIJIN LIMITED, SGL Carbon, Solvay SA, Formosa M Co., Ltd., ZOLTEK Corporation, Advanced Composites, Inc., HYOSUNG ADVANCED MATERIALS.

Global Carbon Fiber Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.2 billion

- 2026 Market Size: USD 8 billion

- Projected Market Size: USD 19 billion by 2035

- Growth Forecasts: 11.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe (32.7% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, Germany, Japan, China, France

- Emerging Countries: India, South Korea, Brazil, Spain, Italy

Last updated on : 16 December, 2025

Carbon Fiber Market - Growth Drivers and Challenges

Growth Drivers

- Modernization in aerospace: Manufacturers in the aircraft industry have readily prioritized light-weight composites to optimize fuel efficiency and diminish emissions, which is driving the carbon fiber market’s growth internationally. According to an article published by the Federal Register Government in December 2025, over the past 10 years, there has been an increase in satellite launches into orbit, especially by private organizations, witnessing over a 10-fold increase. Therefore, based on this increase, satellite service provides 100/20 Mbps speed, which is readily available to nearly 100% of the U.S.-based population. Besides, 295 space station applications have been received, along with 2,684 station applications as of 2024, thus readily proliferating the market’s demand globally.

- Electrification in automotive: The electric vehicle adoption is also driving the requirement for light-weight materials to expand the battery performance and life, which is creating an optimistic outlook for the overall carbon fiber market. As per a data report published by the IEA Organization in 2025, there has been a surge in electric car sales, accounting for 17 million globally as of 2024, denoting a rise of over 25%. In addition, 3.5 million cars have been significantly sold in the same year, in comparison to 2023. China is readily leading, with electric car sales exceeding 11 million. Moreover, there has been an upsurge in the electric car fleet by nearly 58 million, which is nearly 4% of the overall passenger car fleet and over triple the electric car fleet, thus positively impacting the market’s upliftment.

- Investments in renewable energy: The presence of wind energy projects globally depends on the carbon fiber market for turbine blade reinforcement, which deliberately contributes to the significant demand internationally. As per an article published by the United Nations Organization in 2025, USD 2 trillion went into clean energy, which is USD 800 billion more than fossil fuels, denoting a rise by nearly 70% within 10 years. In addition, clean energy industries readily drove 10% of the international gross domestic product growth as of 2023. Furthermore, nearly USD 7 trillion has been spent on fossil fuels in 2022, which comprises explicit subsidies, health and environmental damages, and tax breaks, thus denoting a huge growth opportunity for the carbon fiber market.

Challenges

- Increased production expenses and raw material dependency: The production process in the carbon fiber market is heavily dependent on polyacrylonitrile (PAN), which accounts for the majority of the international global output. The precursor material is expensive, and the conversion process requires energy-intensive stabilization and carbonization steps. This results in production costs that are higher than traditional steel or aluminum. Such cost barriers limit adoption in mass-market automotive and consumer goods, confining carbon fiber primarily to aerospace, defense, and premium applications. Additionally, volatility in acrylonitrile supply chains-linked to petrochemical markets, creates price instability, thereby causing a hindrance in the market’s growth and expansion.

- Sustainability and recycling challenges: While the carbon fiber market provides sustainability benefits through light-weighting and fuel efficiency, its end-of-life management is problematic. Unlike metals, carbon fiber composites are difficult to recycle due to thermoset resin matrices that resist reprocessing. Current recycling methods, such as pyrolysis, are costly, energy-intensive, and often degrade fiber quality, limiting reuse in high-performance applications. With global emphasis on the circular economy and ESG compliance, industries face mounting pressure to develop scalable recycling solutions. Regulatory bodies in Europe (ECHA, CEFIC) and the U.S. (EPA) are tightening waste management standards, forcing companies to invest in greener processes, thereby negatively impacting the carbon fiber market’s expansion.

Carbon Fiber Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

11.4% |

|

Base Year Market Size (2025) |

USD 7.2 billion |

|

Forecast Year Market Size (2035) |

USD 19 billion |

|

Regional Scope |

|

Carbon Fiber Market Segmentation:

Raw Material Segment Analysis

The PAN-based segment in the raw material category is anticipated to hold the largest share of 95.2% in the carbon fiber market by the end of 2035. The segment’s upliftment is highly propelled by its capability to deliver superior tensile strength, stiffness, and thermal stability compared to alternatives such as pitch or rayon. The production process involves stabilization, carbonization, and surface treatment, which yield fibers with exceptional mechanical properties suitable for aerospace, automotive, and wind energy applications. PAN-based fibers are the backbone of high-performance composites used in aircraft fuselages, EV chassis, and turbine blades. The reliance on PAN, however, creates cost challenges, as acrylonitrile—the precursor—is derived from petrochemicals and subject to price volatility.

Fiber Type Segment Analysis

Based on the fiber type, the virgin carbon fiber segment is expected to garner the second-largest share in the carbon fiber market during the forecast period. The segment’s growth is highly driven by the aspect of its importance in high-performance applications, such as medical, F1, and aerospace. This is essential because it provides unmatched strength, lightness, and stiffness for enabling fuel-efficient and lighter vehicles, along with advanced sports gear and faster aircraft. According to an article published by the Composites Part B: Engineering in February 2023, there has been a 37% decline in carbon fiber consumption in the aerospace field, yet the international demand for carbon fiber and carbon fiber reinforced polymer matrix composites (CFRPs) has been nearly 181 kt, which is more than double that of 2024, thereby proliferating the segment’s exposure.

Form Segment Analysis

By the end of the stipulated timeline, the continuous fiber sub-segment in the form segment is projected to cater to the third-largest share in the carbon fiber market. The sub-segment’s development is highly driven by the capability to produce long strands, offering superior load-bearing capacity and structural integrity compared to chopped or short fibers. This makes them indispensable in aerospace, automotive, and wind energy applications where high-performance composites are required. Continuous fibers are typically woven into fabrics, prepregs, or used in filament winding processes to create large structural components such as aircraft wings, EV chassis, and turbine blades. Their ability to deliver consistent mechanical properties across large-scale structures ensures reliability and safety, which is critical in regulated industries such as aerospace and defense.

Our in-depth analysis of the carbon fiber market includes the following segments:

|

Segment |

Subsegments |

|

Raw Material |

|

|

Fiber Type |

|

|

Form |

|

|

Manufacturing Process |

|

|

Application |

|

|

End use Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Carbon Fiber Market - Regional Analysis

Europe Market Insights

Europe in the carbon fiber market is anticipated to garner the highest share of 32.7% by the end of 2035. The market’s upliftment in the region is highly propelled by long-lasting wind turbine blades demanding high-stiffness-to-weight materials, automotive light-weighting electrification, and aerospace modernization. According to a report published by ASD in December 2025, the defense and aerospace industries in the region successfully reached a record growth as of 2024, along with a rise in turnover of 10.1% to EUR 325.7 billion, as well as employment effectively reaching 1.1 million employment opportunities across 4,000 organizations. Besides, the defense sector is continuously growing in the region by 13.8%, thereby reflecting the region’s escalated effort to strengthen its defense preparedness, thus suitable for boosting the market’s growth.

Germany in the carbon fiber market is growing significantly, owing to sustained wind capacity solutions, expanded Tier-1 composites ecosystem, and the dominating aerospace and automotive base. As per an article published by the CEFIC Organization in 2024, the pharmaceutical chemical sector constitutes a turnover amounting to €225.5 billion, along with €14 billion for research and development investment, and €9.4 billion in capital expenditure. Therefore, based on these, nearly 80% of domestic pharmaceutical and chemical organizations conduct research activities, and chemical forms gain almost 1% of their overall research and development spending through collaboration between academia and industry, along with governmental funding. Therefore, with advancement in both industries, there is a huge growth opportunity for the market in the overall country.

Poland in the carbon fiber market is also growing due to targeted investments in sustainable chemicals and advanced manufacturing, wind energy additions across the Baltic corridor, growth in automotive supply chains, and rapid industrial upgradation. As stated in an article published by PSEW in 2024, in terms of onshore wind capacity, there has been an increase in the dynamic to 24 GW by the end of 2040, creating almost 42,000 employment opportunities across the industry. Besides, in terms of the stagnation scenario, there has been a further increase in the capacity to only 10 GW as of 2025, along with restoration. Moreover, it has been estimated that with each additional 10 MW in onshore wind in the country, there will be the generation of 61 direct job at the construction and preparation stages. Therefore, with this increased focus on employment, the market is poised to grow in the country.

North America Market Insights

North America in the carbon fiber market is expected to emerge as the fastest-growing region during the forecast period. The market’s development in the region is highly fueled by the aspect of wind repowering across Canada and the U.S.-based prairies and plains, electric vehicle lightweight, and the presence of aerospace airframe replacement cycles. According to an article published by the Climate Program Organization in March 2024, the U.S. Department of Energy (DOE), which is part of President Biden’s Investing in America Agenda, notified almost USD 6 billion for 33 projects across over 20 states. The purpose is to readily decarbonize energy-intensive sectors, diminish industrial greenhouse gas emissions, support good-paying union employment opportunities, strengthen the overall region’s manufacturing competitiveness, and revitalize industrial communities.

The U.S. in the carbon fiber market is gaining increased traction due to the aspects of defense and aerospace, electric vehicle and automotive adoption, the presence of industrial decarbonization programs, chemical industry modernization, and federal budget allocation. As per an article published by the EIA Government in August 2024, there has been an increase in the combined sales of battery electric vehicles, plug-in hybrid electric vehicles, and hybrid vehicles from 17.8% of the overall light-duty vehicles as of 2024 to 18.7% in the country. Additionally, the slight upsurge in the hybrid and electric vehicle field has been primarily driven by hybrid electric vehicle sales, which increased by 30.7% year-over-year (YoY). Therefore, with this continuous growth in the adoption of electric vehicles, there is a huge growth opportunity for the market in the country.

Canada in the carbon fiber market is projected to develop, owing to industrial carbon and clean energy pricing, research and development in sustainable chemicals, expansion in renewable and wind energy, government programs, and policy support. As stated in an article published by the Government of Canada in March 2025, Environment and Climate Change Canada declared almost USD 150 million from the Output-Based Pricing System (OBPS) Proceeds Fund. This fund is being utilized to benefit 38 projects, which are part of the Decarbonization Incentive Program. These particular projects are effectively focused on developing clean technology and green energy to assist in reducing greenhouse gas emissions.

Decarbonization Incentive Program Projects in Canada (2025)

|

Province Type |

Recipient |

Total DIP Amount (USD) |

Project Description |

Projected 2030 GHG Reductions (tCO2e) |

|

Manitoba |

McCAIN Foods |

662,000 |

The project will retrofit the dryer used in the McCain Foods manufacturing line at the Carberry facility. Implementation of this project would offset natural gas usage, resulting in GHG emission reductions for the facility. |

2,600 |

|

Manitoba |

Koch Fertilizer Canada, ULC |

713,000 |

The project will replace the ammonia convertor on-site to improve energy efficiency and reduce associated methane emissions. This, in turn, will help the company remain competitive in global markets. |

12,600 |

|

Ontario |

Western University |

500,000 |

The project will complete deep energy retrofits that use innovative technology to optimize ventilation, electrify heating, and enable buildings to participate in the low temperature district energy loop on campus, helping drive down carbon pollution. |

1,500 |

|

Ontario |

Stelco Inc. |

500,000 |

Stelco’s Z-Line uses innovative technology to produce high quality, value-added galvanized steel sheet for the automotive and construction markets. This project will support installation of a state-of-the-art Level 2 furnace model for the Z-Line furnaces, thereby improving furnace efficiency and reducing natural gas consumption. |

800 |

|

Saskatchewan |

SaskEnergy Incorporated |

674,000 |

SaskEnergy installed Spartan Controls’ SlipStream vent gas conservation technology on 10 natural gas mobile compressors. The SlipStream system captures vent gas and routes it to the engine to be used as fuel. SaskEnergy also installed 100 kW of solar arrays at three of SaskEnergy’s transmission facilities, helping drive down carbon pollution. |

2,200 |

|

Saskatchewan |

SaskEnergy Incorporated |

1,015,000 |

SaskEnergy will install flare systems at three compressor stations to combust vented methane from regular operations. Converting from methane to carbon dioxide by flaring will result in lower GHG emissions. |

3,700 |

Source: Government of Canada

APAC Market Insights

The Asia Pacific in the carbon fiber market is projected to witness considerable growth by the end of the stipulated timeline. The market’s growth in the region is extremely driven by Southeast Asia’s industrial upgradation, India’s wind build-out and electric vehicles, Japan's or Korea’s aerospace-electronics depth, and China’s upscale. According to an article published by the ADB Organization in 2024, the 600-megawatt Monsoon Wind Power Project, comprising 133 wind turbines, is significantly under construction in the south provinces of Attapeu and Sekong. This particular project is expected to assist in unlocking Southeast Asia’s substantial and untapped wind resource potential. In addition, this is poised to diminish greenhouse gas emissions by almost 748,867 tons of carbon dioxide equivalent, thereby increasing the demand for the market in the overall region.

The carbon fiber market in China is gaining increased exposure due to the increased demand for broad industrial composites, aerospace supply chains, wind installations, and automotive electrification. As per a data report published by the Climate Energy Finance Organization in February 2025, the country has successfully hit the latest record of yearly net new capacity addition to the grid at 429 GW, denoting a 21% YoY surge. Out of this, solar and wind power readily accounted for 83% at 356.5 GW, thereby catering to the 4% proportion of nuclear and hydropower capacity. Besides, the country has significantly invested a huge RMB 608 billion (USD 84.7 billion) in grid transmission-based modernization projects and expansion. Additionally, this denotes more than 15% YoY, which is a key for grid capacity extension, along with facilitating the 429 GW connection to the grid, thereby suitable for enhancing the market’s exposure.

The carbon fiber market in India is also growing due to industrial modernization, hydrogen and pressure vessels, grid-scale and wind renewables, and rapid electric vehicle adoption. According to a data report published by the IBEF Organization in August 2025, the country has readily marked a commitment to meet net zero emissions by the end of 2070, as well as 50% of renewable electricity by the end of 2030, which is also regarded as a huge international climate milestone. Besides, the country has significantly generated 1,08,494 GWh of solar power, which has exceeded Japan’s 96,459 GWh. Furthermore, the installed renewable power generation capacity has surged over the past years, posting a 14.9% growth rate, and meanwhile comprising 184.6 GW of renewable energy capacity. In addition, 48.2% of the overall power installed capacity derives from non-fossil fuels, thereby driving the market’s demand.

Carbon Fiber Market Players:

- Toray Industries, Inc. (Japan)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Teijin Limited (Japan)

- Mitsubishi Chemical Group Corporation (Japan)

- Hexcel Corporation (U.S.)

- SGL Carbon SE (Germany)

- Solvay SA (Belgium)

- Zoltek Companies, Inc. (U.S.)

- Hyosung Advanced Materials (South Korea)

- Jiangsu Hengshen Co., Ltd. (China)

- Zhongfu Shenying Carbon Fiber Co., Ltd. (China)

- Weihai Guangwei Composites Co., Ltd. (China)

- Jilin Chemical Fiber Group Co., Ltd. (China)

- DowAksa Advanced Composites Holdings (Turkey)

- Aksa Akrilik Kimya Sanayi A.S. (Turkey)

- Nippon Graphite Fiber Co., Ltd. (Japan)

- Kureha Corporation (Japan)

- Formosa Plastics Corporation (Taiwan)

- Quickstep Holdings Limited (Australia)

- Reliance Industries Limited (India)

- Toray Plastics (Malaysia) Sdn. Berhad (Malaysia)

- Toray Industries, Inc. is one of the international leaders in carbon fiber production, holding the largest market share worldwide. Its dominance stems from strong aerospace partnerships and extensive PAN-based fiber capacity, positioning it as the benchmark supplier for high-performance composites.

- Teijin Limited is a major Japan-based producer with a strong presence in automotive and industrial applications. The company invests heavily in recycled carbon fiber technologies and sustainability initiatives, aligning with global ESG trends.

- Mitsubishi Chemical Group Corporation has leveraged and integrated chemical expertise to produce advanced carbon fiber materials. Its focus on aerospace and energy applications, combined with innovation in resin systems, strengthens its role in high-value composite markets.

- Hexcel Corporation is considered a leading U.S. supplier specializing in aerospace-grade carbon fiber and prepreg composites. With long-term contracts with Boeing and Airbus, Hexcel plays a critical role in the aerospace supply chain and advanced defense programs.

- SGL Carbon SE is Europe’s flagship carbon fiber producer, with strong ties to automotive OEMs and industrial sectors. The company emphasizes lightweighting solutions for EVs and renewable energy, while also expanding into hydrogen storage and battery enclosures.

Here is a list of key players operating in the global carbon fiber market:

The worldwide carbon fiber market is extremely consolidated at the top, with the U.S., Europe, and Japan-based leaders upscaling PAN-based capacity, securing long-lasting contracts with wind and automotive OEMs, and qualifying materials for aerospace. Besides, China-specific players are extending rapidly, deliberately narrowing expense gaps and localizing supply chains. Notable approaches, such as co-development with Tier-1, circularity and recycling programs, automated processing, and backward integration into precursors, with the intention of meeting performance targets and certification. Besides, in February 2025, SGL Carbon SE announced the approval from its Board to significantly restructure the loss-making Carbon Fibers business unit. This in turn, is poised to assist in reducing business activities of Carbon Fibers and readily focus on a profitable core, thus making it suitable for uplifting the carbon fiber market globally.

Corporate Landscape of the Carbon Fiber Market:

Recent Developments

- In December 2025, Toray Industries, Inc. declared its plan to raise prices for TORAYCA carbon fiber, along with TORAYCA prepreg, laminate, fabric, and other intermediates, and this increase ranges between 10% and 20%, which is applicable to shipments.

- In April 2024, UBE Coporation notified that it has successfully introduced the latest composite products, which are designed to assist in reducing greenhouse gas emissions as well as ensure environmental impact by leveraging technologies behind the company’s long-lasting track record.

- Report ID: 3429

- Published Date: Dec 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Carbon Fiber Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.