Carbon Dioxide Utilization Market Outlook:

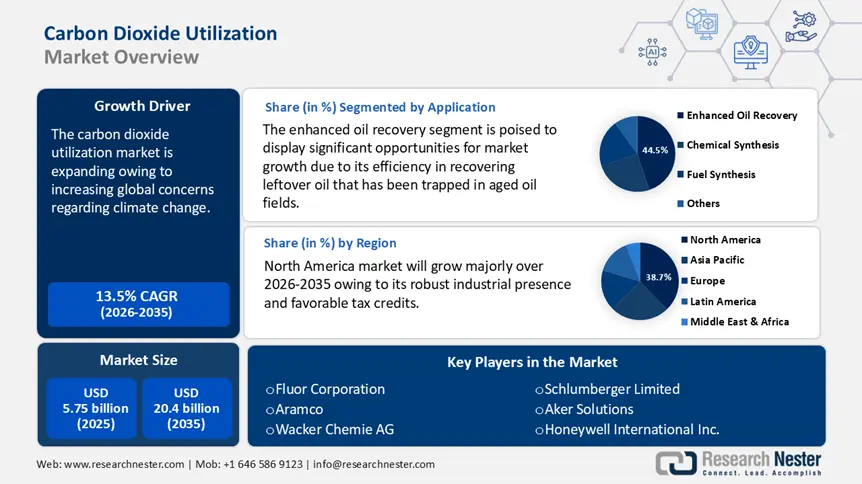

Carbon Dioxide Utilization Market size was over USD 5.75 billion in 2025 and is poised to exceed USD 20.4 billion by 2035, witnessing over 13.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of carbon dioxide utilization is estimated at USD 6.45 billion.

The global carbon dioxide utilization market is projected to experience significant growth due to the increasing global concerns regarding climate change. Stakeholders are actively seeking alternative solutions to mitigate the rising levels of carbon dioxide in the atmosphere. The Global Carbon Budget revealed that CO2 emissions are expected to increase from 40.6 billion tons in 2021 to 41.6 billion tons in 2024. This contains 37.4 billion in fossil CO2 emissions, with the remaining amount coming from land-use change (deforestation).Utilizing CO2 as a carbon feedstock or raw material in various industrial processes and everyday products is gaining traction globally. The International Energy Agency (IEA) reported that currently, the fertilizer sector uses around 230 million tons (Mt) of CO2 annually, mostly for enhanced oil recovery (80 Mt) and urea manufacture (130 Mt) through direct use pathways.

Among the main applications for carbon dioxide use are the manufacture of fuels such as methanol, synthetic gas, building supplies including concrete and cement, the production of plastic and polymers, and the food and beverage industry. Replacing fossil fuels in these sectors can greatly aid in the decarbonization of numerous industries, as carbon dioxide can serve as an affordable carbon supply.The expanding quantity of public and private financing directed towards businesses in this sector reflects the growing interest in CO2 conversion technologies. CO2 use for sustainable aviation fuels and building materials is increasing as a result of corporate goals and requirements for low-emission fuels and materials.

The IEA revealed that nearly USD 500 million was invested globally in utilization startups in 2023, accounting for nearly half of all venture capital (VC) investments in CCUS. With over 80% of the total investment throughout the 2015–2023 timeframe, North American businesses lead the market. Despite the fact that the primary use of large-scale capture plants is for the generation of fuel, investment is evenly split across the other use routes, with fuels accounting for about one-third of the total, chemicals for 40%, and construction materials for 25%.

Key Carbon Dioxide Utilization Market Insights Summary:

Regional Highlights:

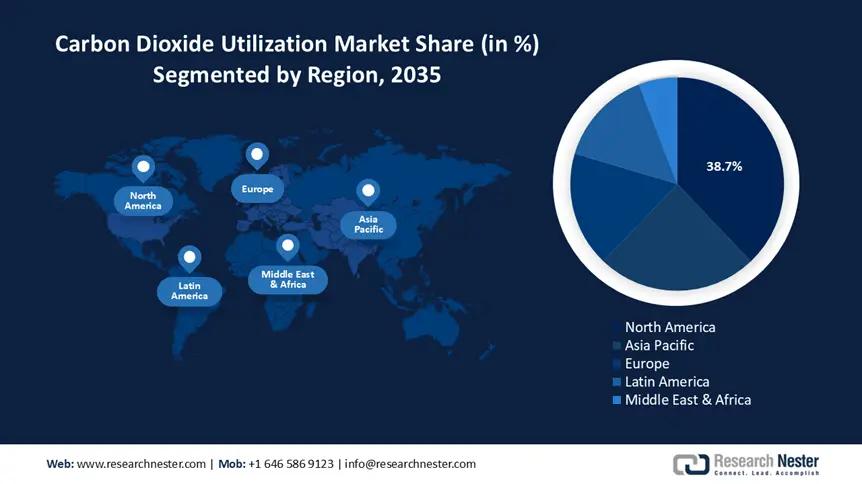

- North America leads the Carbon Dioxide Utilization Market with a 38.7% share, fueled by robust industrial presence and favorable regulations supporting carbon capture, sustaining growth through 2026–2035.

- The Asia Pacific region is expected to witness significant growth in the Carbon Dioxide Utilization Market from 2026 to 2035, driven by increasing government focus on environmental sustainability.

Segment Insights:

- The Oil & Gas segment is forecasted to achieve a significant market share by 2035, fueled by carbon dioxide utilization in enhanced oil recovery and its role in carbon management services for new income from sequestration infrastructure.

- The EOR segment is forecasted to secure a 44.5% share by 2035, propelled by the efficiency of carbon dioxide in enhancing oil recovery from aged fields, increasing recovery rates by up to 15%.

Key Growth Trends:

- Increasing popularity across diverse industries

- Favorable government taxes and funding

Major Challenges:

- Higher investment

- Stringent frameworks and technological maturity

- Key Players: Fluor Corporation, Aramco, Wacker Chemie AG, Schlumberger Limited, Aker Solutions, Honeywell International Inc., Equinor ASA, TotalEnergies SE, ExxonMobil Corporation, Royal Dutch Shell Plc.

Global Carbon Dioxide Utilization Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.75 billion

- 2026 Market Size: USD 6.45 billion

- Projected Market Size: USD 20.4 billion by 2035

- Growth Forecasts: 13.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 12 August, 2025

Carbon Dioxide Utilization Market Growth Drivers and Challenges:

Growth Drivers

- Increasing popularity across diverse industries: Carbon dioxide is becoming increasingly necessary for the gas and oil industries as well as for increased oil recovery operations. Carbon dioxide emissions are rising as a result of the world's rapid industrialization. The United Nations Industrial Development Organization indicated that a post-pandemic recovery was indicated by the 2.3% growth in industrial sectors worldwide, which include manufacturing, mining, power, water supply, waste management, and other utilities. The majority of this dynamism was driven by the manufacturing sector, which increased by 3.2%, while the mining and utilities sector, which makes up the greatest portion of the economy in low-income nations, declined by 0.9%.

Furthermore, hydrogen can be transformed into a fuel that is simpler to handle and use, like aviation fuel, due to the carbon in CO2. As a raw ingredient for chemicals and polymers, CO2 can also take the role of fossil fuels. Reacting CO2 with minerals or waste streams, like iron slag, to create carbonates for construction materials is one less energy-intensive method. - Favorable government taxes and funding: Tax incentives such as carbon credits and deductions for carbon capture investments reduce financial burdens for companies adopting these technologies. For instance, the 45Q tax credit for CCUS, which encourages CO2 use by offering tax credits now valued at USD 60 per tonne of CO2 used, was significantly increased as part of the U.S. 2022 Inflation Reduction Act. In a similar vein, the European Union approved the ReFuelEU Aviation proposal in April 2023, which imposes blending mandates on synthetic fuels for aviation. These mandates will increase from 0.7% in 2030 to 28% in 2050. Additionally, the EU Innovation Fund's 2022 large-scale call selected five large-scale CCU projects that target synthetic fuel.

Additionally, government funding in the form of grants, subsidies, and research support helps de-risk innovation and scale-up efforts in carbon capture, utilization, and storage (CCUS). For instance, the Energy Technology Development and Demonstration Program in Denmark awarded roughly USD 3 million to two projects in June and December. Similarly, one Mission Innovation nation, South Korea, has set the goal of becoming carbon neutral by 2050. The government declared in April that it would invest up to USD 1.2 billion to develop CCUS technologies and evaluate CO2 storage resources.

Challenges

- Higher investment: Large upfront expenditures are needed to set up infrastructure for carbon dioxide use. This covers the initial costs of purchasing the equipment required for carbon capture from point sources, pipeline transit, and eventual transformation into a range of downstream goods. For innovations that are still in the early phases of development and commercialization, the capital intensity is considerably greater. To reduce production costs and facilitate the expansion of new CO2 use pathways, including conversion into fuels, chemicals, cement, and carbonated beverages, large expenditures in research and development are required.

- Stringent frameworks and technological maturity: The absence of strong legislative and policy frameworks facilitating the use of CCU technology is a major obstacle. To encourage investment in CCU technologies, effective policies are required, such as tax incentives, grants, or carbon credits. Furthermore, many CCU technologies have not yet been validated at scale and are still in the pilot or development stages. There are many logistical and technological obstacles when expanding from lab or pilot initiatives to industrial-scale operations.

Carbon Dioxide Utilization Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

13.5% |

|

Base Year Market Size (2025) |

USD 5.75 billion |

|

Forecast Year Market Size (2035) |

USD 20.4 billion |

|

Regional Scope |

|

Carbon Dioxide Utilization Market Segmentation:

Application (Enhanced Oil Recovery, Chemical Synthesis, Fuel Synthesis, Others)

Enhanced oil recovery (EOR) segment is poised to account for more than 44.5% carbon dioxide utilization market share by the end of 2035. The method's efficiency in recovering leftover oil that has been trapped in aged oil fields is driving the segment's growth. Supercritical carbon dioxide is very effective in lowering oil viscosity and raising reservoir pressure when injected into reservoirs that are approaching the end of primary depletion. This enables the pumping of larger quantities to the surface.

Carbon dioxide-driven EOR has been shown in numerous field tests to increase recovery rates from mature asset bases by 10% to 15% of the initial oil in place. As a result of this, it is a desirable choice for operators that want to postpone field abandonment and increase the productive lifespan of current infrastructure. Carbon dioxide EOR is expected to see increasing use globally as the oil and gas sector places a higher priority on optimizing asset value during an energy transition.

End user (Oil & Gas, Power Generation, Iron & Steel, Chemical & Petrochemical, Others)

The oil & gas segment in carbon dioxide utilization market is anticipated to garner a significant share during the assessed period. Opportunities in various value chain segments can be attributed to the segment growth. The industry's activities generate significant amounts of carbon dioxide that can be used, such as in enhanced oil recovery applications, while being the world's greatest single industrial producer of emissions. Additionally, oil and gas companies see business opportunities in offering carbon management services to other heavy sectors. Businesses intend to provide integrated carbon capture and storage hubs to utility, manufacturing, and agricultural clients by utilizing key expertise in carbon transportation and sequestration infrastructure created for EOR. Obtaining long-term agreements for the offtake of carbon dioxide is a new source of income. The industry's active involvement in sustainable solutions may be made possible by the overall carbon use.

Our in-depth analysis of the global carbon dioxide utilization market includes the following segments:

|

Application |

|

|

Technology |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Carbon Dioxide Utilization Market Regional Analysis:

North America Market Statistics

North America in carbon dioxide utilization market is poised to capture over 38.7% revenue share by 2035. As a result of its robust industrial presence and advantageous government regulations that support carbon capture, use, and storage technologies in the region, North America leads the world for carbon dioxide utilization market. Since 2010, the United States, a leader in CO2-EOR projects, has added the majority of CCUS capacity. Companies in energy-intensive sectors, including power, cement, and oil and gas, have been forced to implement CCUS in order to lower their carbon footprint due to strict environmental laws. North America is a desirable carbon dioxide utilization market owing to the abundance of natural reservoirs for CO sequestration.

Furthermore, the U.S. government’s implementation of policies, such as the Inflation Reduction Act, has introduced substantial tax credits and funding to promote carbon capture and utilization technologies. The chemical sector also contributed to the market expansion by utilizing CO2 in various synthesis processes, including the production of plastics and other materials. Additionally, the innovation in carbon capture projects, such as direct air capture facilities, reflects a broader commitment to reducing atmospheric CO2 levels.

Similarly, IEA indicated that in Canada, new building projects must report their emissions and use concrete that is 10% less emissions-intensive than the regional norm, according to the Standard on Embodied Carbon in Building, which went into effect in December 2022. Additionally, nation’s commitment to achieving net-zero emissions by 2050 has spurred investments in carbon capture and utilization technologies, further propelling carbon dioxide utilization market expansion.

APAC Market Analysis

Asia Pacific carbon dioxide utilization market is expected to grow at a significant rate during the projected period. Asia Pacific is currently the world's top carbon emitter due to rapid industrialization and lax emissions regulations. As a result, regional governments are now paying closer attention to environmental sustainability. As manufacturers look to strike a compromise between their pledges to combat climate change and their objectives for economic growth, nations like China and India present a strong value offering.

In China, large-scale industrial sectors, such as cement, steel, and chemicals, are increasingly adopting CO2 utilization methods to meet tightening emission regulations and benefit from the national carbon trading market, Moreover, China is investing heavily in research and development to turn CO2 into valuable production including synthetic fuels, chemicals, and building materials, making the market not only an environmental priority but also an economic opportunity.

Key Carbon Dioxide Utilization Market Players:

- Fluor Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Aramco

- Wacker Chemie AG

- Schlumberger Limited

- Aker Solutions

- Honeywell International Inc.

- Equinor ASA

- TotalEnergies SE

- ExxonMobil Corporation

The carbon dioxide utilization market is defined by the existence of well-established competitors who compete based on technological breakthroughs, product quality, and innovation. Key market players frequently use strategic moves like mergers, acquisitions, and expansions to increase carbon dioxide utilization market presence and effectively fulfill the growing demand.

Recent Developments

- In March 2025, Aramco, one of the world's top integrated energy and chemicals corporations, launched the Kingdom's first CO2 Direct Air Capture (DAC) test unit, which can remove 12 tons of CO2 from the environment each year. The pilot plant, constructed in conjunction with Siemens Energy, is an important milestone in the company's attempts to expand its DAC capabilities.

- In September 2024, WACKER successfully recovered carbon dioxide (CO2) generated during silicon manufacturing. The project, which was made possible by the technology and expertise of the SLB and Aker Carbon Capture Joint Venture (SLB-ACC JV), included a pilot test of the capture process at WACKER's production site in Holla, Norway, where quartz and carbon are combined to produce silicon for use in silicone products.

- Report ID: 7501

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Carbon Dioxide Utilization Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.