Caravans Market Outlook:

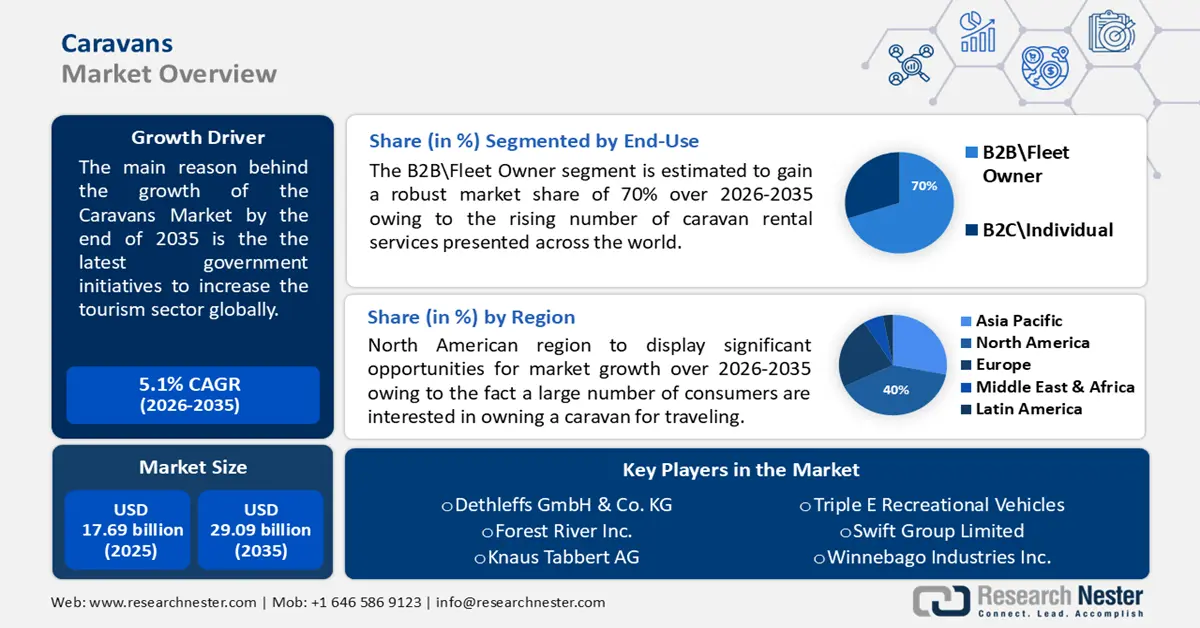

Caravans Market size was over USD 17.69 billion in 2025 and is anticipated to cross USD 29.09 billion by 2035, growing at more than 5.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of caravans is assessed at USD 18.5 billion.

The reason behind the growth is the latest government initiatives to increase the tourism sector globally. 2020 has expanded by 3% to 4%, according to the most recent International Tourism Organization Confidence Index, which indicates cautious optimism, whereas, 47% of participants think tourism will do better in 2019 and 43% think it will perform at the same level.

Key Caravans Market Insights Summary:

Regional Highlights:

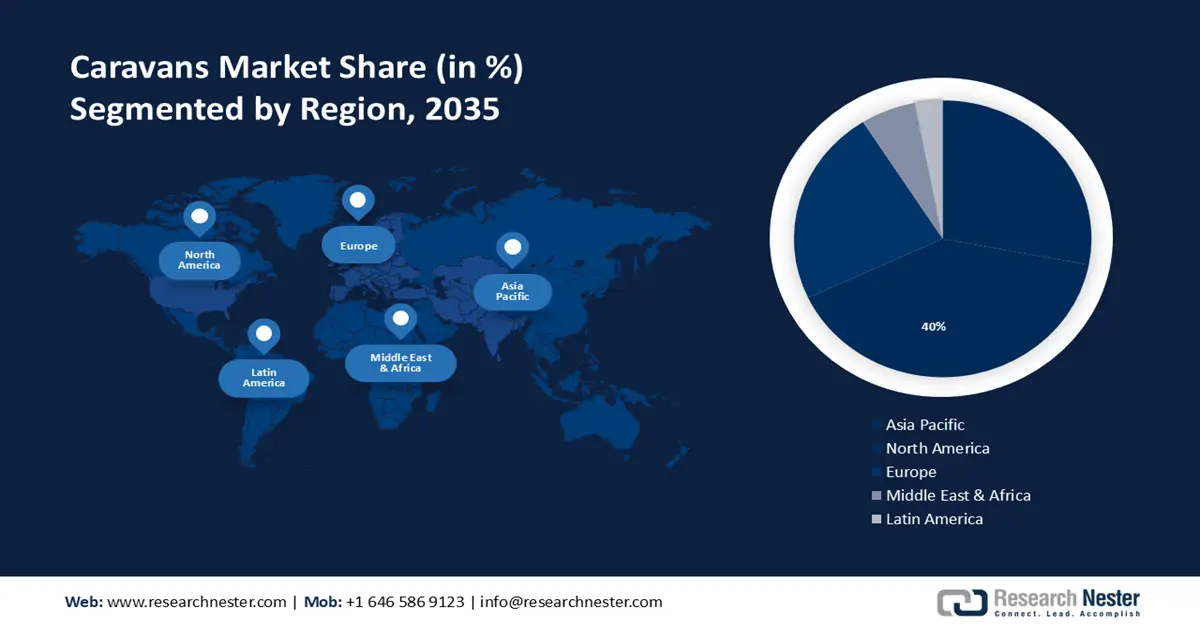

- North America caravans market will secure over 40% share by 2035, driven by increasing caravan ownership.

- Asia Pacific market will exhibit lucrative CAGR during 2026-2035, attributed to emerging markets like China and Korea with government initiatives boosting RV use.

Segment Insights:

- The standard segment in the caravans market is anticipated to achieve a 75% share by 2035, attributed to the huge expansion of the tourism sector globally.

- The b2b\fleet owner segment in the caravans market is anticipated to see significant growth till 2035, driven by the rising number of caravan rental services globally.

Key Growth Trends:

- Rising investment in leisure activities while traveling

- Increasing advancement of caravan associations to protect their rights

Major Challenges:

- High price of caravans and RVs

- Stringent government rules to encourage clean air initiatives

Key Players: Bürstner GmbH & Co. KG, Dethleffs GmbH & Co. KG, Forest River Inc., Knaus Tabbert AG, Triple E Recreational Vehicles, Swift Group Limited, Winnebago Industries Inc.

Global Caravans Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 17.69 billion

- 2026 Market Size: USD 18.5 billion

- Projected Market Size: USD 29.09 billion by 2035

- Growth Forecasts: 5.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: Germany, United States, United Kingdom, France, China

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 17 September, 2025

Caravans Market Growth Drivers and Challenges:

Growth Drivers

- Rising investment in leisure activities while traveling - Travel and leisure expenditures are predicted to continue to climb throughout the world due to factors including the fast expansion of the middle class in emerging nations, a tendency toward investing in experiences rather than material items, and easier access to booking channels and information due to new technology.

Almost 80% of all travel and tourism-related expenses are derived from leisure travel. With the start of the health crisis, spending on vacations dropped sharply, but the market is now steadily recovering from COVID-19's effects. As per the Research Nester’s investigation, the package vacations category, an integral part of leisure travel, is calculated to come up to pre-pandemic profit in 2023. - Increasing advancement of caravan associations to protect their rights - A lot of caravan associations are created to protect the prerogatives of distributors, manufacturers, and consumers’ interests. The Caravan Industry Association of Australia has published the production and import figures for the industry for 2022, registering close to 50,000 new registrations.

Furthermore, the ability of an RV to be silently adjusted is accelerating the development of creative RV layouts. One of the key factors influencing the client's selection is the smart home framework in RVs. As a kind of leisure, camping and traveling are becoming more and more popular among millennials -

Rising popularity of outdoor entertainment activities worldwide - All around the world, local and regional economies depend heavily on outdoor leisure as people are more conscious about fitness and fitness equipment. Both heavily populated metropolitan regions and rural locations fall under this category.

According to our research, in 2020, over 199 million people globally engaged in outdoor recreational activities, indicating that despite the problems caused by the worldwide pandemic, a substantial majority of the world's population participated in outdoor recreational activities during the year.

Challenges - High price of caravans and RVs - Luxurious features and amenities are becoming more and more frequent in RVs. These days, a lot of luxury RVs have lavish interiors, premium appliances, and state-of-the-art entertainment systems. From gourmet kitchens to top-of-the-line music systems and smart home technologies, these amenities may encompass everything.

It makes sense that RVs and caravans are getting more and more costly with such sophisticated features. The prices of these high-end recreational vehicles reflect the expense of adding these opulent features to RVs. - Stringent government rules to encourage clean air initiatives - A global assessment of initiatives and policies aimed at enhancing air quality reveals that more nations have enacted laws covering all significant polluting industries during the last five years. Therefore, people are becoming aware of the harmful pollution released from caravans.

Caravans Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.1% |

|

Base Year Market Size (2025) |

USD 17.69 billion |

|

Forecast Year Market Size (2035) |

USD 29.09 billion |

|

Regional Scope |

|

Caravans Market Segmentation:

Type Segment Analysis

Fifth wheelers segment is poised to capture over 40% caravans market share by 2035. The segment’s expansion will be propelled by the increasing use of fifth-wheeler recreational vehicles because they are easy to arrange for owners as they consist of auto-leveling and split-level planning which raise privacy. According to International Trade Association’s report with 374,246 units shipped, RV shipments increased by about 5% over the previous year.

Additionally, the fifth wheel connection is lightweight, which increases fuel economy. This is anticipated to drive increasing purchases of fifth-wheel couplings, along with the introduction of government regulations to limit vehicle emissions.

End-Use Segment Analysis

By 2035, B2B\Fleet owner segment is expected to hold more than 70% caravans market share. This segment will have significant growth due to the rising number of caravan rental services presented across the world. Different forms of accommodation, such as motorhomes, campervans, caravans, and trailers, are available to suit the needs and interests of different types of travelers.

The immense cost of recreational vehicles and caravans compels consumers to rent these caravans. For instance, Allstar Coaches LLC, a U.S.-based company recently launched its luxury caravans and offering them rental services.

Price (Standard, Luxury)

In caravans market, standard segment is predicted to account for around 75% revenue share by 2035 owing to the huge expansion of the tourism sector globally. Because of the expansion of the tourism sector, the sales of motorhomes, caravans, and campers will increase massively.

As per our survey, there is an anticipated 18% rise in tourist visits in 2024 compared to the previous year, 2023. About 1.55 billion foreign visitors are calculated a considerable increase over the previous year.

Our in-depth analysis of the global caravans market includes the following segments:

|

Type |

|

|

Price |

|

|

End-Use |

|

|

Application |

|

|

Traveler |

|

|

Caravan |

|

|

Traveler’s Age Group |

|

|

Fuel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Caravans Market Regional Analysis:

North American Market Insights

North America industry is anticipated to account for largest revenue share of 40% by 2035. The region's caravan sector is blooming since a large number of consumers are interested in owning a caravan for traveling. According to the International Trade Administration, more and more customers are growing old enough to wish to vacation and camp in recreational vehicles.

Although historically the largest group of buyers has been middle-class consumers between the ages of 55 and 64, customers between the ages of 35 and 54 now make up the majority of buyers. In the US, more than 9 million families own an RV.

The U.S. will account for a massive expansion of the caravans industry because of the country's economic growth due to the increasing export of caravans. RV exports from the US reached USD 1.2 billion in 2020. Travel trailers and other towable RV types made up the majority of exports (74%). Trailers accounted for 26% of exports.

The industry for caravans has grown in Canada massively during the forecast period because of the rising import of caravans. Moreover, the International Trade Administration (ITA) anticipates more than 90% of American RV exports go to Canada these days.

APAC Market Insights

Asia Pacific region in caravans market size is estimated to witness lucrative CAGR till 2035 because of the emerging markets of caravan in developing countries like China and Korea. Intending to expand exports to China, Korea, and Japan, ITA awarded RVIA a second consecutive three-year Market Development Cooperator Program (MDCP) contract in 2020. The market of recreational vehicles is expanding massively in this region.

The caravans market has expanded in China as a result of the country's government initiatives to boost travel and create laws specifically for RVs and campgrounds. Recent data from a Chinese travel website indicates that in the previous year, over 70% of reservations for picturesque locations came from surrounding areas, and over 80% of reservations for goods like hotels, tickets, and entertainment were made one to two days before the trip.

The Korean caravans development mainly lies in the several campsites that are currently in existence in Korea. In fact, due to the increasing number of campers who were drawn to outdoor activity during the COVID-19 epidemic, the total number of camping sites in South Korea reached a record high of around 3,600 in the third quarter of 2023.

The Japanese government's rising investment in tourism will help in increasing the caravans sector in this country. Furthermore, the federal government provides the Japan National Tourism Organization with an operational expenditures subsidy of JPY 6.5 billion (USD 4 Million) to carry out initiatives, which includes encouraging tourism to Japan.

Caravans Market Players:

- Bürstner GmbH & Co. KG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Dethleffs GmbH & Co. KG

- Forest River Inc.

- Knaus Tabbert AG

- Triple E Recreational Vehicles

- Swift Group Limited

- Winnebago Industries Inc.

- Freedom Caravans

- Laika Caravans SPA

To appeal to tech-savvy consumers, major companies in the caravans market business are constantly upgrading caravans and motorhomes by adding cutting-edge technologies, energy-efficient features, and smart home automation. Some of the key players in the industry are:

Recent Developments

- Nissan Motor announced a new van-type in its venerable Caravan series that is intended for long stays and road journeys by distant personnel. The inside of the Myroom was designed to include wood-grain surfaces and indirect lighting to provide the impression of a room. A bed and a moveable table will be helpful elements for telecommuters.

- Winnebago Industries Inc. unveiled their proposal for a "zero-emission, all-electric motorhome" in January 2022. This helps to improve user experience and preserve environmental sustainability.

- Report ID: 6045

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Caravans Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.