Captive Power Generation Market Outlook:

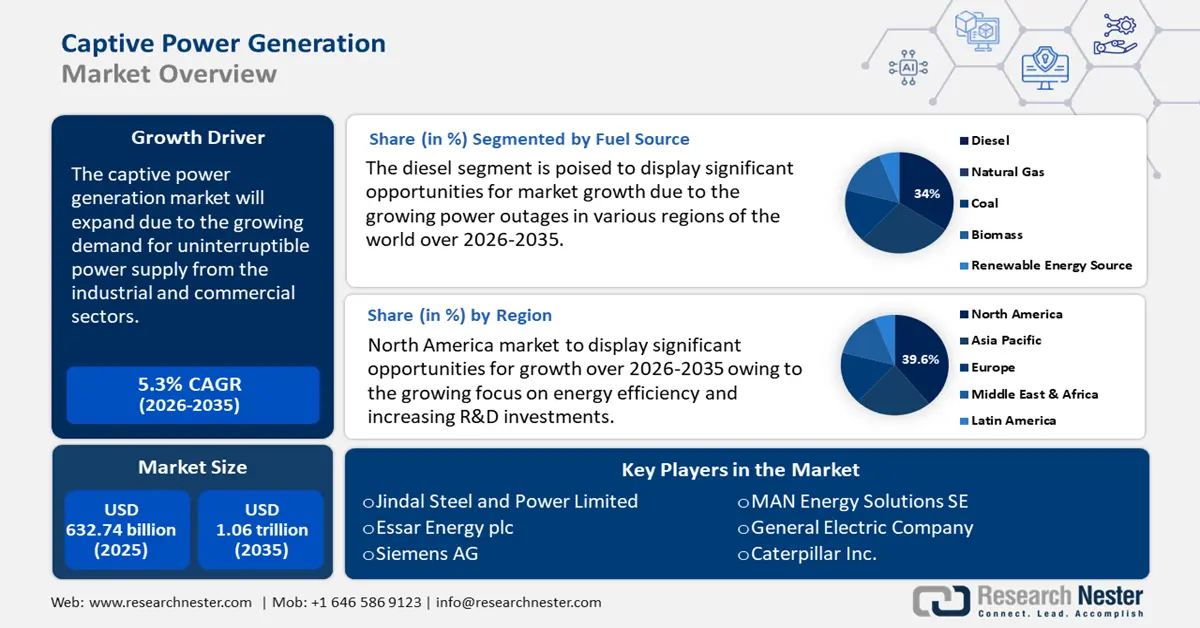

Captive Power Generation Market size was over USD 632.74 billion in 2025 and is anticipated to cross USD 1.06 trillion by 2035, witnessing more than 5.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of captive power generation is assessed at USD 662.92 billion.

The captive power generation market is expanding due to the growing demand for reliable and uninterrupted power supply from the industrial and commercial sectors. According to the International Energy Agency (IEA), the electricity demand is predicted to increase more quickly worldwide, averaging 3.4% per year until 2026. In many areas, data centers are major contributors to the rise in power demand. After using an anticipated 460 terawatt-hours (TWh) of electricity globally in 2022, data centers may use over 1,000 TWh of electricity in 2026.

As a localized power source, captive power plants are becoming essential to the infrastructure of data centers, big offices, and various sectors. It is crucial that they can run in island mode, which is separate from the local electrical system, or grid parallel mode, which permits surplus power to be exported to the local energy distribution network. This operational adaptability guarantees a steady and dependable power supply, essential for sectors where even a small interruption can have serious operational and financial consequences.

Key Captive Power Generation Market Insights Summary:

Regional Highlights:

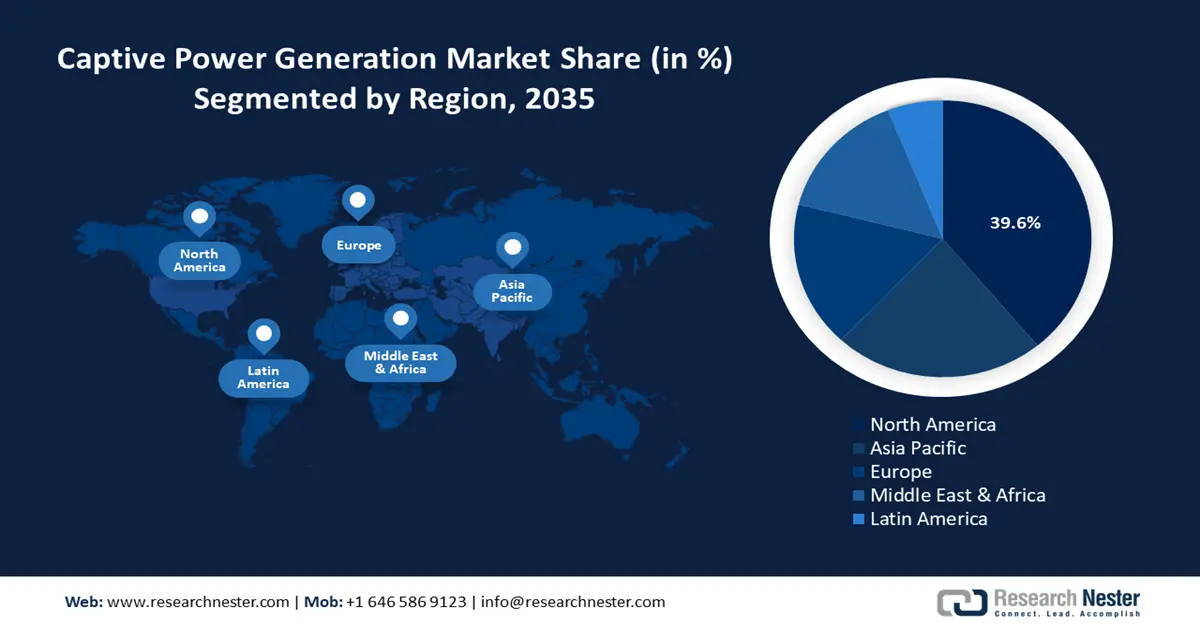

- North America commands a 39.6% share in the Captive Power Generation Market, fueled by rising demand for resilient and dependable energy sources, driving robust growth by 2035.

- Asia Pacific's captive power generation market is set for huge growth by 2035, driven by the growing base in steel, aluminum, and petrochemical refining industries.

Segment Insights:

- The Diesel segment of the Captive Power Generation Market is projected to hold around 34% share by 2035, driven by increasing demand amid rising energy needs and outages.

Key Growth Trends:

- Increasing need for energy efficiency and cost optimization

- Favorable government initiatives

Major Challenges:

- High initial capital investment

- Expansion of open access capacities

- Key Players: Jindal Steel and Power Limited, Essar Energy plc, Siemens AG, MAN Energy Solutions SE, General Electric Company, Caterpillar Inc., Doosan Group, Reliance Industries Limited, Enercon GmbH, Cummins Inc..

Global Captive Power Generation Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 632.74 billion

- 2026 Market Size: USD 662.92 billion

- Projected Market Size: USD 1.06 trillion by 2035

- Growth Forecasts: 5.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (39.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, India

- Emerging Countries: China, India, Japan, South Korea, Indonesia

Last updated on : 13 August, 2025

Captive Power Generation Market Growth Drivers and Challenges:

Growth Drivers

- Increasing need for energy efficiency and cost optimization: Businesses can avoid the transmission and distribution losses of electricity from the grid by producing power locally. Furthermore, captive power plants save energy waste and increase efficiency by enabling businesses to customize their power generation to meet their unique requirements. Captive power plants are an appealing alternative for budget-conscious companies due to their capacity to regulate energy costs and enhance operational profitability. These facilities achieve exceptional fuel efficiency when utilized in a combined heat and power (CHP) design. Since electricity and heat can be produced simultaneously with the CHP design, fuel may be used more efficiently and operating costs can be decreased. Due to the decreased fuel use and resulting pollutants, this efficiency reduces costs and improves environmental performance.

- Favorable government initiatives: Particularly in industries, captive power plants (CPPs') transition to renewable energy is gaining momentum. Government initiatives to reduce carbon emissions and promote sustainability are the driving forces behind this shift. According to the United Nations Organizations, 107 nations which account for over 82% of the world's greenhouse gas emissions have made net-zero commitments through legislation, policy documents like long-term strategies or national climate action plans, or statements made by high-ranking government representatives. More than 9,000 businesses, 1000 cities, 1000 educational institutions, and 600 financial institutions have joined the Race to Zero worldwide campaign, pledging to take strong, immediate action to reduce global emissions by half by 2030.

- Increasing technological advances: Growing technological developments such as IoT and smart grids are improving the operational efficiency of these plants. Moreover, battery storage systems and other energy storage options are becoming popular. These systems enhance the use of renewable energy sources and stabilize the power supply, particularly in places where wind and solar power generation is sporadic.

Also, industrial power generation is changing due to the incorporation of wind and solar technologies into Captive Power Plants (CPPs).

In addition to being plentiful and cost-free, these renewable resources emit no emissions, which makes them ideal for achieving global sustainability objectives. Major key players are integrating these advances in their power plants to supply continuous electricity. For instance, to support TP Solar's planned 4.3 GW solar cell and module manufacturing facilities in Tamil Nadu, Tata Power Renewable Energy will establish a 41 MW captive solar plant.

Challenges

- High initial capital investment: One major obstacle is the significant capital outlay needed to build captive plant infrastructure, particularly for smaller corporate entities with tighter budgets. Generators, fuel supply and storage facilities, distribution networks, and other auxiliary equipment are included in the expenses. Extended repayment durations serve as a disincentive. The high upfront costs prevent captive plants from being used more widely.

- Expansion of open access capacities: Instead of producing captive power, open access enables commercial and industrial clients to directly buy less expensive power from IPPs and renewable energy providers. Open access reduces investment risks, offers procurement flexibility, and lowers the cost of establishing and operating captive plants. New investments in captive generating are discouraged by the expansion of open access capacities. Industries are switching from captive power sources to open-access electricity due to the lower cost of power from the open captive power generation market.

Captive Power Generation Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.3% |

|

Base Year Market Size (2025) |

USD 632.74 billion |

|

Forecast Year Market Size (2035) |

USD 1.06 trillion |

|

Regional Scope |

|

Captive Power Generation Market Segmentation:

Fuel Source (Diesel, Natural Gas, Coal, Biomass, Renewable Energy Sources)

Diesel segment is projected to capture captive power generation market share of around 34% by the end of 2035. The segment growth can be attributed to its growing demand among manufacturers worldwide. The demand for diesel-based captive power plants is expected to grow significantly in the future due to rising energy demands and an increase in the frequency of power outages in many parts of the world. To increase productivity and dependability, manufacturers are incorporating digital monitoring systems and smart technology, driving the growth of the segment.

Application (Industrial, Commercial, Residential)

The industrial segment in captive power generation market will garner a notable share in the forecast period. CPG has emerged as a strategic asset as the industrial sector struggles with growing energy costs and the need for sustainability. It supports international initiatives to lower carbon footprints in addition to offering energy security. Moreover, the growing integration of CHP systems is another factor driving the captive power generation market growth. Systems that mix power and heat offer a significant improvement in operating efficiency. CHP systems can save up to 80% on primary energy costs when compared to conventional grid power by collecting and using waste heat from producing electricity for industrial processes or heating. This is a preferred option for energy-intensive sectors since it maximizes energy consumption and significantly reduces energy expenditures.

Our in-depth analysis of the global captive power generation market includes the following segments:

|

Fuel Source |

|

|

Application |

|

|

Capacity |

|

|

Technology |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Captive Power Generation Market Regional Analysis:

North America Market Statistics

North America captive power generation market is projected to account for revenue share of around 39.6% by 2035. Technological developments, shifting regulations, and changing energy demands are contributing to the captive power generation market in North America. The region is witnessing a rise in the usage of captive power plants, which are establishments devoted to producing electricity for a particular business or industrial user rather than for sale to a utility or the general public. Natural gas, coal, renewable energy sources such as solar and wind, and even hybrid systems that combine several technologies can all power these facilities.

In the U.S., the need for improved energy resilience and dependability is driving the expansion of the captive power generation market. A strong and dependable energy source is now essential as companies deal with more complex issues including climate change, extreme weather, and even disruptions to the traditional power infrastructure. The U.S. Energy Information Administration reported that in 2022, there were eighteen weather-related disasters in the United States, each with damages above USD 1 billion. For instance, Hurricane Ian in September 2022 knocked out power to more than 2.6 million consumers in Florida, some of whom were without power for more than two weeks.

With captive power generation, businesses can set up on-site power systems, guaranteeing continuous operations and lowering susceptibility to external grid breakdowns. Energy resilience is improved by the capacity to continue vital operations during grid disruptions, giving companies in industries like manufacturing, healthcare, and data centers where downtime is not an option a competitive advantage.

In Canada, they may operate independently or in tandem with the main grid, microgrids small, and local energy systems driven by renewable energy offer businesses flexibility and dependability, especially in remote places. By integrating solar, wind, and biomass, hybrid power systems assist in stabilizing energy output, increasing dependability, and lessening their negative effects on the environment. Furthermore, by modifying energy use in real time, AI and machine learning can optimize power system performance, lowering expenses and emissions. A viable substitute for fossil fuels, green hydrogen is created with renewable energy, giving businesses a means to further lower their carbon footprint and decarbonize their energy.

APAC Market Analysis

Asia Pacific captive power generation market will encounter huge growth during the forecast period. The market is booming due to the existence of a strong copper, steel, and aluminum production base in developing nations such as China and India. For instance, over the previous ten years, China's steel output has been steadily rising, reaching a peak of 1.065 billion tons in 2020. According to preliminary data, primary aluminum output in the non-ferrous metal industry increased by 1.2% from the same period the previous year to 10.43 lakh tons in FY 2024-25 (April-June) from 10.28 LT in 2023-24 (April-June). Furthermore, the petrochemical refining industry's explosive growth in the region contributes to the expansion of the regional captive power generation market. Furthermore, the existence of unstable and subpar power resources in nations such as India is also fueling the market growth.

Key Captive Power Generation Market Players:

- Jindal Steel and Power Limited

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Essar Energy plc

- Siemens AG

- MAN Energy Solutions SE

- General Electric Company

- Caterpillar Inc.

- Doosan Group

- Reliance Industries Limited

- Enercon GmbH

- Cummins Inc.

Leading companies in the captive power generation market are always creating cutting-edge technology to satisfy the changing needs of the sector. To increase their market share and improve their product offerings, major companies in the captive power generation market are concentrating on strategic alliances, acquisitions, and partnerships.

Recent Developments

- In October 2024, Suzlon Group is expected to help to the decarbonization of hard-to-abate industries by harnessing wind power with a large 400 MW order from JSP Green Wind 1 Pvt. Ltd. This milestone order is the industry's largest C&I win, bolstering Suzlon's market position and propelling India's sustainable energy transition.

- In November 2022, Indorama Eleme Petrochemicals Limited and GE Gas Power announced that they have successfully completed GE's 6B Performance Improvement Package (PIP) upgrade on the third 6B gas turbine at the petrochemical facility in Eleme, Rivers State, as part of their ongoing operations improvement and power plant modernization plan.

- Report ID: 6943

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Captive Power Generation Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.