Cannabis Pharmaceuticals Market Outlook:

Cannabis Pharmaceuticals Market size was over USD 7.93 billion in 2025 and is anticipated to cross USD 744.87 billion by 2035, witnessing more than 57.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of cannabis pharmaceuticals is assessed at USD 12.03 billion.

Increasing demand for plant-derived clinical solutions is one of the major drivers in the market. A World Drug Report 2023 by the UN Office on Drugs and Crime (UNODC) revealed that more than 90,000 opioid-related overdose deaths were registered alone in North America in 2021. Thus, the growing incidences of serious adverse reactions from synthetic therapeutics are raising public awareness and shifting consumer preferences. According to an LVMH Research for Dior Science-funded study, published in February 2024, globally over 80.0% of habitats were using traditional herbal medicines to combat diseases. This has also dragged the focus of global health authorities, which is pushing them to cultivate more innovative and safer ways to curate effective treatment.

The global production and availability of these synthetic products have significantly risen through the past decade, which subsequently multiplied the abuse cases. Additionally, the cost-effectiveness of these medicines is contributing to this province. This is forcing government authorities and biopharma companies to introduce more effective and affordable options, increasing adoption in the market. A study, published in October 2021, concluded a threshold of USD 451,800 per QALY (quality-adjusted life-year) for cost savings in different settings, perspectives, types of medicinal cannabis, and indications. Further, they are putting efforts to standardize payers’ pricing for improved accessibility by implementing innovative extraction methods and assuring a consistent supply of raw materials.

Key Cannabis Pharmaceuticals Market Insights Summary:

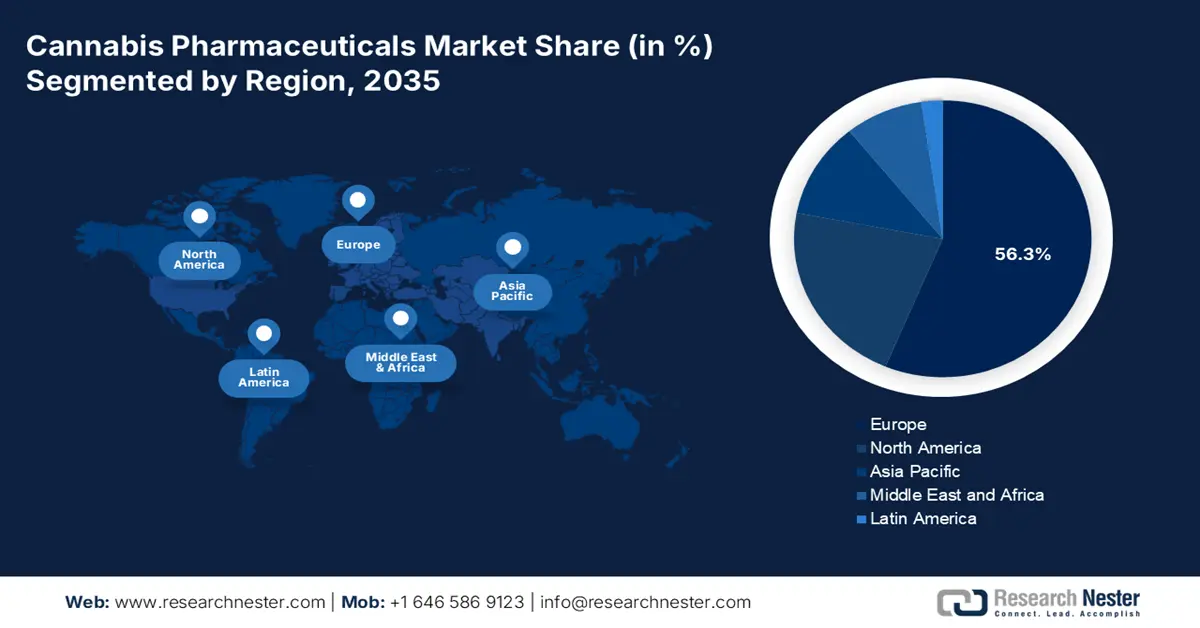

Regional Highlights:

- Europe leads the Cannabis Pharmaceuticals Market with a 56.3% share, propelled by pharmaceutical excellence and strong presence of medicine producers, ensuring robust growth through 2026–2035.

- Asia Pacific’s cannabis pharmaceuticals market is poised for rapid growth through 2026–2035, driven by uninterrupted raw material supply and strong pharma manufacturing hubs.

Segment Insights:

- The Epidiolex segment is anticipated to dominate with a 59.2% share by 2035, driven by increasing use of CBD for treating epilepsy with low side effects.

Key Growth Trends:

- Increased awareness and legalization

- Investments and collaborations for extensive R&D

Major Challenges:

- Stigma and stringent public perception

- Reimbursement challenges and economic hurdles

- Key Players: Jazz Pharmaceuticals, Inc., Aurora Cannabis Inc., Aequus Pharmaceuticals Inc., SOMAÍ Pharmaceuticals, Medical Marijuana, Inc..

Global Cannabis Pharmaceuticals Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.93 billion

- 2026 Market Size: USD 12.03 billion

- Projected Market Size: USD 744.87 billion by 2035

- Growth Forecasts: 57.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe (56.3% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, Canada, Germany, Netherlands, Israel

- Emerging Countries: Germany, France, UK, Canada, Australia

Last updated on : 13 August, 2025

Cannabis Pharmaceuticals Market Growth Drivers and Challenges:

Growth Drivers

- Increased awareness and legalization: The aim of globalizing the cannabis pharmaceuticals market is fed by supportive regulatory bodies across the globe. The proven efficacy of the medicinal plant is increasingly being utilized for medical and recreational use. The therapeutic benefits of cannabis over a wide range of conditions are encouraging countries, that are seeking sustainable alternatives, to invest in this sector. This cohort is further fed by the accelerated recognition of various clinical authorities such as the FDA, MHLW, PDMA, and the European Union. For instance, in July 2020, the FDA provided an allowance to the new indication of Epidiolex (cannabidiol), treating tuberous sclerosis complex (TSC)-associated seizures.

- Investments and collaborations for extensive R&D: Considering the rising acceptance of the market, many global pharma companies are showing interest in exploring more untouched potentials of these medications. As the opioid crisis is widespread, the adoption of plant-based APIs is amplifying. The leaders are forming beneficial relationships with each other to accelerate the development of more refined, consistent, and standardized products. For instance, in September 2024, Aurora Cannabis partnered with Vectura Fertin Pharma to launch Luo CBD lozengewhile adhering to stringent safety, quality, and regulatory standards. Such innovations are further expanding the existing portfolio.

Challenges

- Stigma and stringent public perception: Despite the exceptional growth rate, the cannabis pharmaceuticals market still lacks full-fledged adoption and exploration. The persistence of the negative image of this medicinal ingredient due to past and current utility records shrinks the scope of exposure. In addition, its close involvement with drug abuse is also a source of resistance in several regions. Thus, the risk of face-loss from these accumulative setbacks may create hesitance among both manufacturers and consumers, decreasing engagement.

- Reimbursement challenges and economic hurdles: The lack of sufficient standardization and limited clinical evidence often omits the coverage for the offerings from the cannabis pharmaceuticals market. Limited knowledge of the growing acceptance among insurance service providers makes it difficult for patients to afford these solutions. In addition, the bad reputation of this category of pharmacology may restrict these companies from incorporating related therapies, fostering an economic gap between consumers and producers.

Cannabis Pharmaceuticals Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

57.5% |

|

Base Year Market Size (2025) |

USD 7.93 billion |

|

Forecast Year Market Size (2035) |

USD 744.87 billion |

|

Regional Scope |

|

Cannabis Pharmaceuticals Market Segmentation:

Brand Type (Sativex, Epidiolex, Others)

The epidiolex segment is expected to capture cannabis pharmaceuticals market share of around 59.2% by the end of 2035. The heightening demand for these cannabinoids (CBD) is largely fed by their rapid legalization, bio-availability, and remarkably low side effects. The breakthrough application of this compound in curing epilepsy is also a major contributor to its proprietorship. For instance, in 2020, NLM proved the efficacy of CBD for treating refractory epilepsy syndrome in patients by conducting a study on 120 dravet syndrome (DS) residents. The randomized analysis showed a 50.0% reduction in convulsive seizure frequency among 42.5% of them. This is making this segment the prime target for global pioneers.

Our in-depth analysis of the global market includes the following segments:

|

Brand Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cannabis Pharmaceuticals Market Regional Analysis:

Europe Market Analysis

Europe cannabis pharmaceuticals market is likely to dominate revenue share of around 56.3% by the end of 2035. The region’s progress is led by its pharmaceutical excellence and the strong presence of giant medicine producers. As the oriented policies evolved in developed countries such as Germany, France, and Switzerland, the use of marijuana in medicinal applications increased. Thus, the established frameworks of these nations are fostering a lucrative landscape for this category. For instance, in March 2021, STADAPHARM GmbH unveiled a new form of its existing pain therapy pipeline by adding medical cannabis as a primary indication for the treatment of chronic pain patients. This is a suitable alternative to established opioids that have a multidisciplinary use in neurology and oncology.

Germany is augmenting the cannabis pharmaceuticals market with extensive prescription utility and R&D activities. The country is solidifying its position in the current international scenario by introducing innovative extraction technologies and well-diversified distribution channels. According to the OEC data, Germany became the top importer of hemp fibers including cannabis sativa in the world with a value of USD 12.0 million in 2023. This signifies a notable consumption of these legalized compounds, which are mostly used in developing medicines, making this country a center of attraction for leaders. For instance, in February 2025, Tilray Medical consolidated its leadership in Germany by extending its commodities with new cannabis extract products and formulations.

The UK market is propagating with clinical advancements and extensive R&D efforts. The country’s efforts to attain a sufficient supply of high-quality extracts for the domestic consumer base are leveraging its progress in this field. On this note, in November 2023, the team of IPS Pharma and Grow Group opted for AVD (Advanced Vapor Devices) to supply hardware for the commercial launch of the UK-formulated medical cannabis extracts brand, Vida Vapes. In addition, its strong emphasis on API production and discovery is fueling this sector’s growth, creating a new scope of business. For instance, in March 2024, Brains Bio launched a new cannabis-based active pharmaceutical ingredient (API), solid tetrahydrocannabinol (THC).

APAC Market Statistics

Asia Pacific is predicted to register one of the fastest growth rates in the cannabis pharmaceuticals market by the end of 2035. The region is filled with biodiversity and bioavailability, which ensures an uninterrupted supply of raw materials for therapeutic production. In addition, the pharmaceutical manufacturing powerhouses of this region such as China and India are significantly contributing to this cohort. Moreover, the acceptance from countries with well-established healthcare infrastructure such as Japan and Australia are encouraging others to participate by offering scope for greater revenues. For instance, MediPharm Labs, a precision-based cannabinoids producer, revealed its quarter results of 2024, highlighting a record GMP sales of USD 2.5 million from Australia.

India, with its ancient roots in plant-based medicine, Ayurveda, is presenting a lucrative opportunity for the market. The rising demand for medicinal plants and extracts in this country to curate nutraceuticals is boosting this sector. According to IBEF data, the medical plant industry is projected to attain USD 188.6 million by 2026 while exhibiting a CAGR of 38.5%. Such a readymade business environment in this country is also propelled by governmental support for extensive R&D, which magnifies the market reach. For instance, in July 2023, a medical research-based initiative, the Cannabis Research Project was commenced under the public-private partnership between CSIR-IIIM Jammu and a Canadian firm.

China is one of the largest suppliers and acquirers of raw materials for the producers in the market. The well-balanced inflow and outflow of resources in this country is fostering a healthy trading atmosphere for this field. According to the 2023 OEC database, China ranked as the 4th largest importer of hemp fibers (cannabis sativa) in the world with a value of USD 4.7 million. The country is also reported to become the fastest-growing exporter in this category, accounting for USD 1.3 million in the same year. Thus, many domestic and international biopharma pioneers are finding deep interest in cultivating this genre of pharmaceuticals in China.

Key Cannabis Pharmaceuticals Market Players:

- Jazz Pharmaceuticals, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- AbbVie, Inc.

- Insys Therapeutics, Inc.

- Bausch Health Companies, Inc.

- Maridose

- Pharma5

- Aurora Cannabis Inc.

- Maridose

- STADA Group

- Pharma5

- Aequus Pharmaceuticals Inc.

- CannRx

- iCAN

- SOMAÍ Pharmaceuticals

- Medical Marijuana, Inc.

- DSM-Firmenich

The global cannabis pharmaceuticals market is continuously evolving with ongoing clinical discoveries and investments in R&D. The current trend of establishing medicinal plants as a reliable source of APIs to produce more effective and affordable drugs to address the unmet needs of many neurological and oncological diseases is empowering the supply network of key players. They are also forming teams of expertise to serve the purpose. For instance, in December 2023, Maridose launched a cannabis-based contract research organization (CRO) to offer services that assist in the preclinical, clinical, and commercialization of drugs. The groundbreaking group is dedicated to serving the wide network of pharma and biotech researchers in the market. Such key players are:

Recent Developments

- In January 2025, SOMAÍ Pharmaceuticals launched a new pipeline for oral solutions and inhalation oils, Origins and Senses. The addition was aimed at amplifying the company’s global presence in the innovative and patient-centric cannabis-based medicines market, with a strong focus on flavor, aroma, and clinical effectiveness.

- In June 2024, DSM-Firmenich announced the commercial launch of an advanced formulated cannabidiol (CBD) drug product intermediate, CBtru. The IP-protected CBD is designed to exhibit oral solid delivery formats, enabling enhanced functionality and higher drug loading in cannabis-based medicines.

- Report ID: 7199

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cannabis Pharmaceuticals Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.