Cancer Therapeutics Market Outlook:

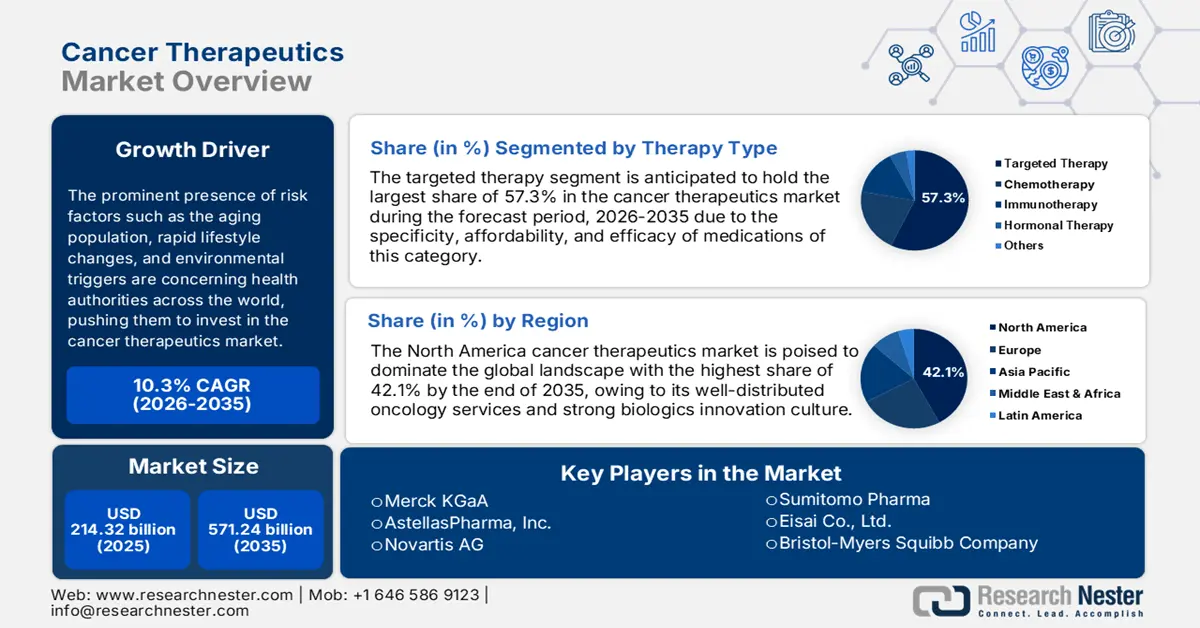

Cancer Therapeutics Market size was over USD 214.32 billion in 2025 and is poised to exceed USD 571.24 billion by 2035, witnessing over 10.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of cancer therapeutics is estimated at USD 234.19 billion.

The prominent presence of risk factors such as the aging population, rapid lifestyle changes, and environmental triggers are concerning health authorities across the world, pushing them to invest in the cancer therapeutics market. The growing demand for effective therapies due to the rising complexities and prevalence of cancer is captivating a major portion of attention and efforts from various public and private organizations. According to the 2022 GLOBOCON statistics, globally around 20.0 million and 9.7 million new and death cases of cancer were registered in 2022. The data further highlighted its projection till 2050, solely based on the growing global population, to reach 35.0 million. This is a prior indication of inflation in the number of patients worldwide, considering the impact of other factors.

2022 Global Statistics of Most Frequent Cancers:

|

Cancer Type |

Incidence |

Mortality |

|

Lung Cancer |

12.4% (2.5 million) |

18.7% (1.8 million) |

|

Breast Cancer |

11.5% (2.3 million) |

6.8% (66.6 thousand) |

|

Colorectum Cancer |

9.6% (2.0 million) |

9.3% (90.4 thousand) |

|

Stomach Cancer |

4.9% (96.8 thousand) |

6.8% (66.0 thousand) |

|

Liver Cancer |

4.3% (86.6 thousand) |

7.8% (75.8 thousand) |

|

Prostate Cancer |

7.3% (1.5 million) |

4.1% (39.7 thousand) |

Source: GLOBOCON 2022

Key Cancer Therapeutics Market Insights Summary:

Regional Highlights:

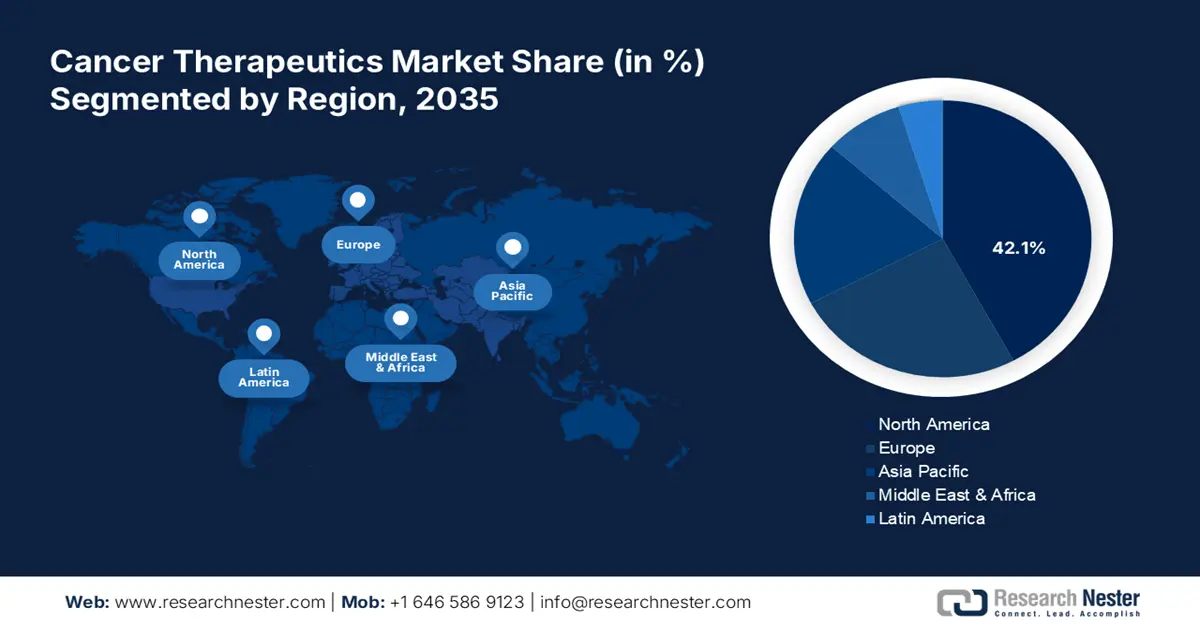

- North America holds a 42.1% share in the Cancer Therapeutics Market, with strong biologics innovation driving its dominance and supporting growth through 2035.

- Asia Pacific's cancer therapeutics market is experiencing the fastest growth by 2035, attributed to personalized medicine emphasis, government cancer control programs, and domestic pharmaceutical advancements.

Segment Insights:

- The Targeted Therapy segment is anticipated to achieve a 57.30% market share by 2035, driven by the specificity and fewer side effects of targeted therapies.

- The Lung Cancer segment is poised for substantial growth in the Cancer Therapeutics Market from 2026-2035, fueled by rising lung cancer cases and the need for advanced treatments.

Key Growth Trends:

- Innovation and progress in evaluation processes

- Global expansion and diversity of offerings

Major Challenges:

- Economic and efficacy constraints

- Heightening concerns about side effects

- Key Players: AstellasPharma, Inc., Pfizer, Inc., Merck KGaA, Novartis AG, Johnson & Johnson, Bristol-Myers Squibb Company.

Global Cancer Therapeutics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 214.32 billion

- 2026 Market Size: USD 234.19 billion

- Projected Market Size: USD 571.24 billion by 2035

- Growth Forecasts: 10.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, India, Brazil, Russia, Mexico

Last updated on : 13 August, 2025

Cancer Therapeutics Market Growth Drivers and Challenges:

Growth Drivers

-

Innovation and progress in evaluation processes: Besides the increasing awareness and advancements for early diagnosis, the process of approvals has also evolved. This has accelerated drug developments in the cancer therapeutics market by enabling faster approvals from strict regulatory frameworks. For instance, in January 2025, Kazia Therapeutics launched its new FDA-approved clinical trial, ABC-Pax (Advanced Breast Cancer – Paxalisib) for evaluating the efficiency of the paxalisib and immunotherapy amalgamation in advanced breast cancer. In addition, the contribution of biotechnology firms in availing services for conducting hassle-free clinical and pre-clinical studies has leveraged the speed of progress.

- Global expansion and diversity of offerings: As leaders from the cancer therapeutics market outstretch their territory overseas, the accessibility to various treatment options increases through a wide range of drugs. This allows healthcare professionals to prescribe tailored therapies for better outcomes. The proven and positive results from this personalized approach further encourage more investors to involve their resources. For instance, in March 2023, Pfizer signed a merger agreement to acquire Seagen, in a transaction of USD 43.0 billion, as per the total enterprise value. This investment was intended to strengthen its oncology portfolio and earn an estimated risk-adjusted revenue of USD 10.0 billion by 2030.

Challenges

-

Economic and efficacy constraints: The prior setback in the cancer therapeutics market is the high cost of oncology treatment and medicines. The limited affordable options often become a challenge for companies to attain optimum sales. Additionally, the uncertain results of new therapies may make patients and service providers cautious before investing. Further, the unavoidable financial barrier among consumers, particularly those from budget-constrained backgrounds may affect robust consumption, shrinking the market reach.

- Heightening concerns about side effects: The resistant behavior toward accepting the consecutive reactions of products from the cancer therapeutics market is also a notable issue in expansion. The adverse of strong regimens such as combined radiation therapies come with prominent physical changes such as hair fall and body weakness, which often hinder the social life of a patient. This has been a critical problem for these individuals, raising questions about the validation of enrollment and post-process life changes. It may dilute their interest in adopting such advanced solutions.

Cancer Therapeutics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.3% |

|

Base Year Market Size (2025) |

USD 214.32 billion |

|

Forecast Year Market Size (2035) |

USD 571.24 billion |

|

Regional Scope |

|

Cancer Therapeutics Market Segmentation:

Therapy Type (Chemotherapy, Targeted Therapy, Immunotherapy, Hormonal Therapy)

As per therapy type, the targeted therapy segment is projected to hold cancer therapeutics market share of more than 57.3% by 2035. The inclusion of monoclonal antibodies, small molecule inhibitors, gene therapy, and immunoconjugates has elevated the demand for this segment due to their specificity and efficacy. In addition, fewer side effects and the personalized approach of this sub-type have made it more attractive for both patients and drug developers. For instance, in November 2024, Eisai announced the commercial launch of a tyrosine kinase inhibitor, TASFYGO Tablets 35mg for biliary tract cancer with FGFR2 gene fusion or rearrangements.

Application (Blood Cancer, Lung Cancer, Colorectal Cancer, Prostate Cancer, Breast Cancer, Cervical Cancer, Head & Neck Cancer, Glioblastoma, Malignant Meningioma, Mesothelioma, Melanoma)

In terms of applications, the lung cancer segment is predicted to attain a significant portion of the revenue from the cancer therapeutics market by the end of 2035. Comparatively higher incidence and mortality rates have increased the frequency of utilization in this segment. A study from JMIR Publications on lung cancer (LC) occurrence in 40 countries revealed that new incidences of LC are estimated to rise by 65.3% in 2035, accounting for 2.1 million. Thus, the urge for associated treatment is poised to keep heightening, ensuring a non-stop flow of business in this segment.

Our in-depth analysis of the global cancer therapeutics market includes the following segments:

|

Therapy Type |

|

|

Application |

|

|

Drugs |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cancer Therapeutics Market Regional Analysis:

North America Market Analysis

North America cancer therapeutics market is projected to capture revenue share of around 42.1% by the end of 2035. The well-established distribution network and strong biologics innovation culture are conjugately garnering the most suitable marketplace for global leaders, inflating engagement in this sector. In addition, the supportive healthcare infrastructure is feeding this growth by offering lucrative trading opportunities to foreign forces. For instance, in December 2024, the Texas Medical Center partnered with Mitsui Fudosan Co., Ltd. and the National Cancer Center, which originated from Japan, to cultivate a new pathway for the U.S. market extension. The alliance built TMC Japan BioBridge and JACT to advance in oncological innovations.

The leading biological producers in the U.S. cancer therapeutics market are significantly contributing to the country’s proprietorship. They are strategically forming and strengthening new international partnerships to escalate the level of their expertise in associated R&D practices. For instance, in January 2024, the team of Glenmark and Ichnos Sciences unveiled a distinguished joint venture, Ichnos Glenmark Innovation to accelerate their cancer medicine development. Since its formation in October 2019, the alliance has meticulously worked on novel biologics entities (NBE) research by sharing each other’s capabilities in designing cutting-edge therapy solutions for hematological malignancies and solid tumors.

Canada is fueling the cancer therapeutics market with governmental funding and regulatory subsidies. The enacted policies and grants act as a financial cushion for all in-house pharma companies and R&D institutions, encouraging them to extend their exploration with different approaches. For instance, in January 2025, AstraZeneca shared its plans to invest USD 570.0 million in Canada to make it the company’s hub of global clinical studies. The fund aimed to create 700 new scientific and high-skilled jobs in the Greater Toronto Area, exhibiting over 210 clinical deliveries. Additionally, their efforts to reduce the economic burden, especially for long-term sessions, have inflated adoption in this sector.

APAC Market Statistics

Asia Pacific is predicted to experience the fastest growth in the cancer therapeutics market throughout the timeline between 2026 and 2035. Its strong emphasis on personalized medications, dedicated to revamping individuals from malignancies has pushed its position forward in this field. According to the Research Nester report, APAC is expected to hold the largest revenue share from the precision oncology industry. Furthermore, the governing bodies of developing countries are taking a proactive part in the cancer therapeutics market boost. For instance, in October 2024, the Ministry of Health of Indonesia released the new National Cancer Control Plan, consisting of radiotherapy and nuclear medicine services in 34 provinces across the country.

Considering the severity of the situation, where the rising incidences of malignancies in India if affecting the quality of life, the signs of magnification of the cancer therapeutics market have become more prominent. The country is showcasing its capabilities in domestic production with continuous inventions. For instance, in April 2024, the President of India launched its first solely curated CAR-T cell therapy at IIT Bombay to fight cancer while being affordable and accessible. The new line of action against the disease is a suitable option for the general patient demography of this country.

Being the 2nd leading cause of death in China, the oncological creations have captured a significant part of its pharmaceutical capacity. With a strong supply channel across the domestic territory, the accessibility and adaptivity of the cancer therapeutics market have multiplied. According to an NLM article, an annual improvement was noticed in the availability of 33 nationally negotiated anticancer medicines in China between 2020 and 2022. It further stated that a total of 221 were included in the National Reimbursement Drug List (NRDL) for coverage by December 2020.

Key Cancer Therapeutics Market Players:

- Boston Biomedical

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- GLG Pharma

- GlobeImmune

- Ionis Pharmaceuticals

- Onconova Therapeutics

- Circio Holding

- F. Hoffmann-La Roche AG

- Bristol-Myers Squibb Company

- AbbVie, Inc.

- Johnson & Johnson

- Celgene Corporation

- AstellasPharma, Inc.

- Pfizer, Inc.

- Novartis AG

- Merck KGaA

- Eli Lilly and Company

The ongoing creation of new regimens has become the plan of action for the key players in the cancer therapeutics market. They are taking inspiration from fastened regulatory approvals to levitate their medication discovery cohort. For instance, in August 2024, Adaptimmune Therapeutics gained FDA-allowance for its independently developed cellular therapy, afamitresgene autoleucel, or afami-cel (Tecelra) for metastatic synovial sarcomas. The T-cell receptor (TCR) therapy is effective for disease progression after chemotherapy and MAGE-A4 & certain types of HLA protein-positive tumors. This is evidence of the extending strings of this sector toward the unmet needs of complicated cancer cases, diversifying the range. Such key players are:

Recent Developments

- In September 2024, Novartis received approval from the FDA for marketing Kisqali to reduce the risk of recurrence in people with HR+/HER2, early breast cancer. The oncology adjuvant is instructed to be used in combination with aromatase inhibitor, which can also offer prevention from node-negative (N0) disease.

- In April 2024, the team of Pfizer and Genmab gained FDA acceptance for a supplemental Biologics License Application (sBLA) on TIVDAK (tisotumab vedotin-tftv), treating recurrent or metastatic cervical cancer. The therapy is capable of offering effective improvement in cases of disease progression on or after chemotherapy.

- Report ID: 7126

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cancer Therapeutics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.