Cancer Supportive Care Drugs Market Outlook:

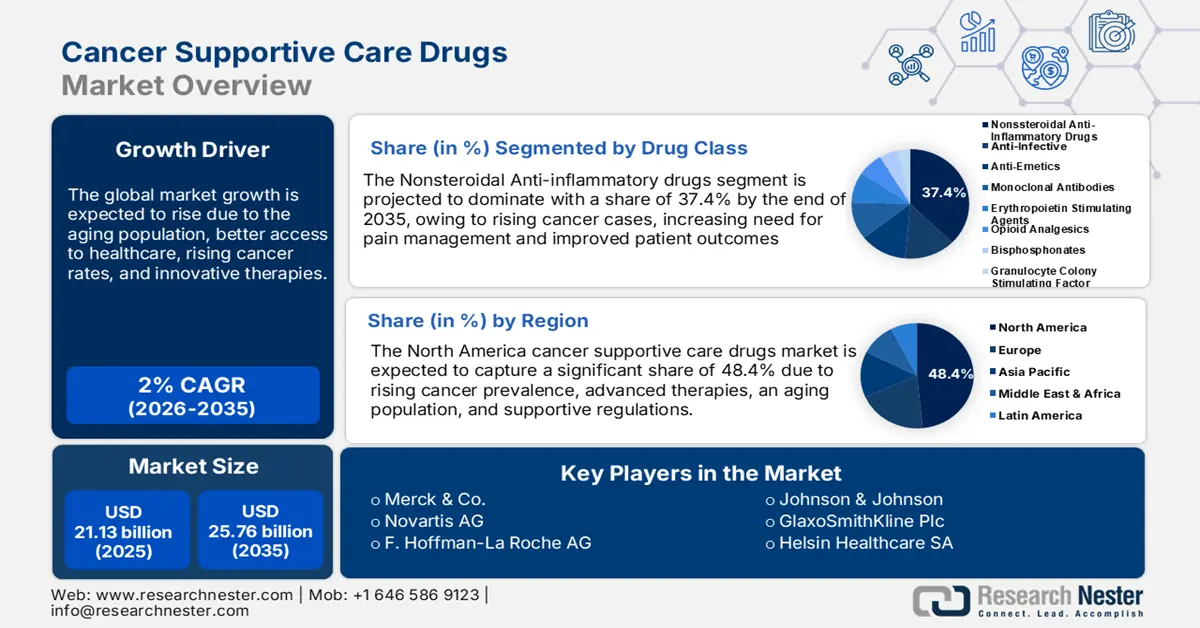

Cancer Supportive Care Drugs Market size was over USD 21.13 billion in 2025 and is poised to exceed USD 25.76 billion by 2035, witnessing over 2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of cancer supportive care drugs is estimated at USD 21.51 billion.

According to the World Health Organization, over 35 million new cancer cases are predicted to register by 2050, marking a 77% increase from the estimated 20 million cases in 2022. As malignancy continues to rise globally, driven by factors such as an aging population, lifestyle changes, and environmental influences, the demand for beneficial remedies grow significantly. These medications are essential for managing the complications of tumor medications such as chemotherapy, radiation, and immunotherapy. They help individuals cope with complications such as pain, fatigue, nausea, and anemia.

Additionally, recent innovations in neoplasm therapy, including immunotherapy, targeted therapy, and personalized medicine, have significantly improved survival rates and expanded remedy options for care recipients. However, these advanced therapies often come with severe impacts such as immune-related adverse events (irAes). Patients require sustaining medications to manage associated complications such as inflammation, fatigue, and organ toxicity. As immunotherapy adoption rises, the need for effective solutions grows, fueling market expansion and improving overall escalation for cancer supportive care drugs market.

Key Cancer Supportive Care Drugs Market Insights Summary:

Regional Highlights:

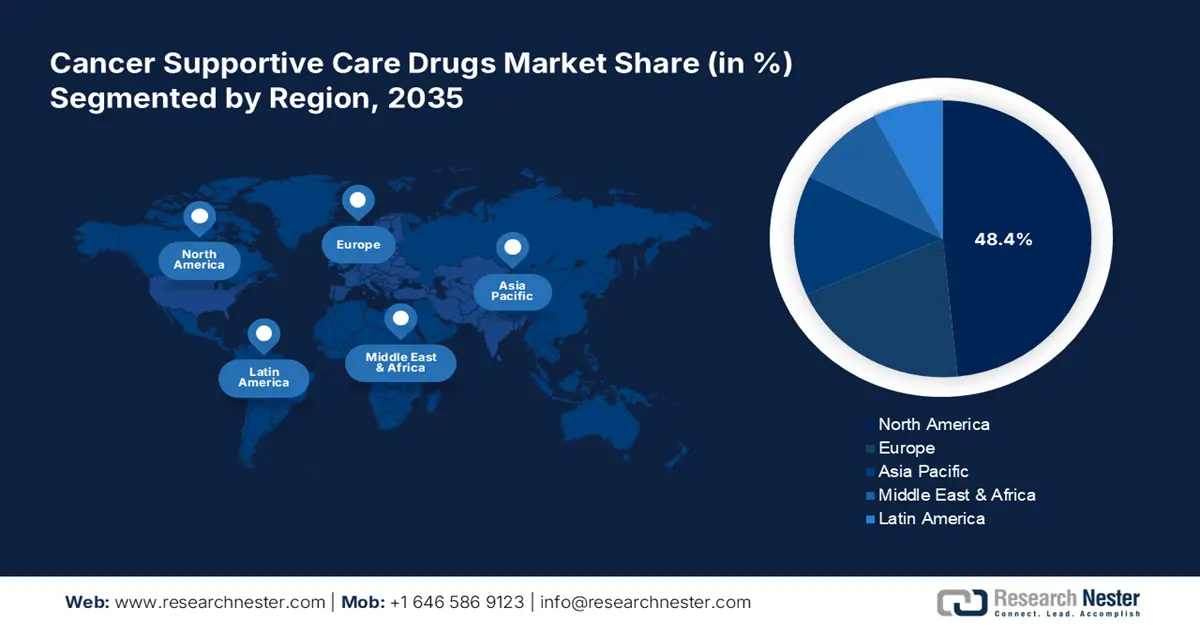

- North America commands a 48.4% share in the Cancer Supportive Care Drugs Market, driven by aging population, lifestyle-related risk factors, and government investments, fostering growth through 2026–2035.

- The cancer supportive care drugs market in Asia Pacific is set for the fastest CAGR by 2035, fueled by evolving healthcare systems and increasing funding for oncology.

Segment Insights:

- The Nonsteroidal Anti-Inflammatory Drugs segment is projected to hold a 37.4% share by 2035, attributed to its effectiveness in pain management and improved NSAID formulations.

Key Growth Trends:

- Drug delivery system augmentation

- Rising patient awareness

Major Challenges:

- Complex drug interaction

- Regulatory and ethical concerns with opioid-based pain management

- Key Players: Johnson & Johnson Services, Inc., Heron Therapeutics, Inc., Novartis AG.

Global Cancer Supportive Care Drugs Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 21.13 billion

- 2026 Market Size: USD 21.51 billion

- Projected Market Size: USD 25.76 billion by 2035

- Growth Forecasts: 2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (48.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 13 August, 2025

Cancer Supportive Care Drugs Market Growth Drivers and Challenges:

Growth Drivers

- Drug delivery system augmentation: Technical innovations in drug delivery systems, such as injectable formulation and extended-release options, are transforming the cancer supportive care drugs market. For instance, Bristol Myers Squibb’s FDA-approved KRAZATI, combined with cetuximab, offers targeted therapy for advanced colorectal carcinoma, improving efficacy and recipient outcomes. These advancements ensure precise dosing, reduce hospital visits, and minimize undesired effects, enhancing case subjects’ convenience and rehabilitative care adherence. As a result, the need for advanced assisting care medications is rising, significantly contributing to the cancer supportive care drugs market’s expansion.

- Rising patient awareness: Healthcare consumers and healthcare providers are well informed about the importance of managing procedure consequences. This heightened awareness drives requirement for aiding care substances, as users actively seek solutions to alleviate symptoms such as nausea, fatigue, and pain. Improved education, recipient advocacy, and promotional programs empower individuals to make informed healthcare decisions. As more recipients focus on symptom handling, the cancer supportive care drugs market is experiencing significant upsurge. This expansion ensures enhanced quality of life for users, with improved administration strategies expected to continue to the coming years.

Challenges

-

Complex drug interaction: Malignant individuals often take multiple therapies simultaneously, increasing the risk of drug interactions that can impact procedure outcomes. Some aiding care products may interfere with chemotherapy, targeted therapies, or immunotherapy, potentially reducing their effectiveness or causing additional offshoots. This requires careful monitoring, dosage adjustments, and coordination between oncologists and pharmacists to ensure a safe and effective remedy. Managing these interactions is crucial to optimizing healthcare consumers care and minimizing complications, highlighting the need for personalized care strategies in sarcoma administration.

- Regulatory and ethical concerns with opioid-based pain management: Opioid-based sustaining care remedies are vital for managing severe cancer-related pain, significantly improving individuals ‘comfort and quality of life. However, these medicines are subject to strict regulatory scrutiny due to the potential risks of addiction, misuse, and dependency. Stricter prescription regulation, while aimed at preventing abuse, can create barriers for malignant patients who genuinely need effective pain relief. This regulatory challenge results in a gap in pain handling options, requiring balanced policies to ensure both safety and admissibility.

Cancer Supportive Care Drugs Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

2% |

|

Base Year Market Size (2025) |

USD 21.13 billion |

|

Forecast Year Market Size (2035) |

USD 25.76 billion |

|

Regional Scope |

|

Cancer Supportive Care Drugs Market Segmentation:

Drug Class (Nonsteroidal Anti – Inflammatory Drugs, Anti-Infective, Anti-Emetics, Monoclonal Antibodies, Erythropoietin Stimulating Agents, Opioid Analgesics, Bisphosphonates, Granulocyte Colony Stimulating Factor)

By drug class, the nonsteroidal anti-inflammatory drugs segment is likely to account for around 37.4% cancer supportive care drugs market share by 2035. The segment’s progress is attributed to its effectiveness in managing cancer-related pain, inflammation, and medicinal side effects. As malignant cases rise, need for safer, non-opioid pain handling options increases. Advancements in NSAID formulations with improved safety profiles further drive adoption. For instance, Dana-Farber Cancer Institute, Inc. in June 2024, reported a clinical trial that found that celecoxib significantly improved survival and disease-free outcomes for stage 3 colon carcinoma patients with PIK3CA mutations, driving escalation in the market.

Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Compounding Pharmacies)

Based on the distribution channel, the hospital pharmacies segment is set to garner substantial cancer supportive care drugs market share over the forecast period. The segment is growing due to increasing neoplasm prevalence, leading to higher requisition for pain regulation, antiemetics, and immunosuppressants. Hospitals serve as primary intervention centers, ensuring timely approach to uplifting care medications. Additionally, advancements in oncology therapies require specialized pharmacy services for drug administration and care recipient monitoring. Government initiatives promoting hospital-based care, along with improved healthcare infrastructure, further drive the expansion of hospital pharmacies in the cancer supportive care drugs market.

Our in-depth analysis of the global market includes the following segments:

|

Drug Class |

|

|

Indication |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cancer Supportive Care Drugs Market Regional Analysis:

North America Market Statistics

North America in cancer supportive care drugs market is likely to account for more than 48.4% revenue share by the end of 2035. With an aging population and lifestyle-related risk factors, malignant cases are rising across North America, increasing need for aiding care products to manage pain, nausea, and fatigue from procedures such as chemotherapy and radiation. Additionally, governments and healthcare organizations are investing in neoplasm care programs, early detection, and patient assistance initiatives. Policies supporting oncology drug development and reimbursement for sustaining care medicines further drive cancer supportive care drugs market upsurge, ensuring better accessibility and improved user outcomes in tumor management.

The U.S. government is investing in metastatic tumor research, early detection programs, and patient assistance initiatives, while policies and reimbursement schemes support oncology care, including nurturing care drugs, improving market approach and affordability. In this regard, the FY25 budget proposal prioritizes neoplastic research, prevention, and service funding, including USD 2.9 billion for the Cancer Moonshot. The National Breast and Cervical Cancer Early Detection Program is expected to receive an additional USD 45.0 million as part of the proposed USD 90.0 million increase for CDC Cancer Programs over FY23. All these investments are boosting neoplasm care and supporting progress in the cancer supportive care drugs market.

The healthcare system in Canada is shifting towards specialized neoplasmic care centers, driving requirement for pharmaceuticals to aid in comprehensive procedures and symptom management. Moreover, the increasing availability of biosimilars and generic coorperative care substances is improving reach to affordable options. Over the decade, sales of biologic medicines in Canada tripled in 2020, reaching USD 10.0 billion. These lower-cost alternatives help ensure that users receive effective care without financial strain, further fueling market surge in Canada.

Asia Pacific Market Analysis

The APAC cancer supportive care drugs market is estimated to garner the fastest CAGR over the forecast period. Healthcare systems across Asia Pacific are evolving with significant investments in carcinoma care infrastructure, including specialized oncopathology centers, hospitals, and clinics, improving admission to comprehensive therapeutics. This rise propels the demand for sustaining care medications to manage tumor-related symptoms and enhance individual quality of life. Additionally, governments are increasing funding for myeloma research, early detection, and healthcare availability. Promoting policies and better reimbursement for oncology and aiding care agents are making the formulations more available to a broader population.

The growing collaboration with international pharmaceutical companies and research institutions in China is accelerating the development of advanced oncology-uplifting formulations, bringing global innovations to the local cancer supportive care drugs market. According to NLM, 577 trials on 335 new cancer medications were registered in China in 2020, making up 22.6% of all clinical drug trials as of August 2021. At the same time, increasing sarcoma rates due to lifestyle changes, an aging population, and environmental factors are driving a higher appeals for these substances. As more people are diagnosed with malignant tumors, the need for nurturing medications to manage side effects such as pain, nausea, and fatigue is rising, fueling cancer supportive care drugs market proliferation.

India is heavily investing in its healthcare system, expanding myeloma care centers and management facilities, which increases access to oncological interventions and drives need for such therapeutics. As per the Ministry of Health and Family Welfare in November 2024, the FY 2024-25 Union Budget boosted neoplastic care in India with an additional USD 480.0 million for the National Health Mission. Additionally, the growing middle class in India now has better access to healthcare, including carcinoma therapies and medicines, driving demand and fueling the expansion of the cancer supportive care drugs market.

Key Cancer Supportive Care Drugs Market Players:

- Merck & Co., Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Johnson & Johnson Services, Inc.

- Heron Therapeutics, Inc.

- Novartis AG

- Hetero Healthcare Ltd

- GSK plc

- Natera Inc

- F. Hoffmann-La Roche Ltd.

- Helsinn Healthcare SA

- Pfizer Inc.

Key companies in the cancer supportive care drugs market is driving innovation through the development of new formulations and delivery methods that improve patient compliance and effectiveness. They are also focusing on creating personalized therapy plans that cater to individual needs, addressing side effects from newer neoplasmic therapies such as immunotherapy and targeted therapies. For instance, in April 2024, researchers at the NIH created an AI technology that can match individuals with tumor medications more accurately. Additionally, companies are exploring biosimilars and generics to make these substances more affordable, ensuring broader user access to essential health maintenance remedies. Such key players include:

Recent Developments

- In January 2025, Natera Inc. presented new data from the Phase III CALGB/SWOG 80702 study at ASCO GI 2025, advancing cell-free DNA testing for improved cancer supportive care and personalized treatment

- In July 2024, Hetero Healthcare’s launch of Hetran (Vonoprazan) contributed to cancer-supportive care by offering a novel remedy for gastric ulcers, Helicobacter pylori eradication, and NSAID-related gastric issues in cancer patients.

- Report ID: 7167

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cancer Supportive Care Drugs Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.