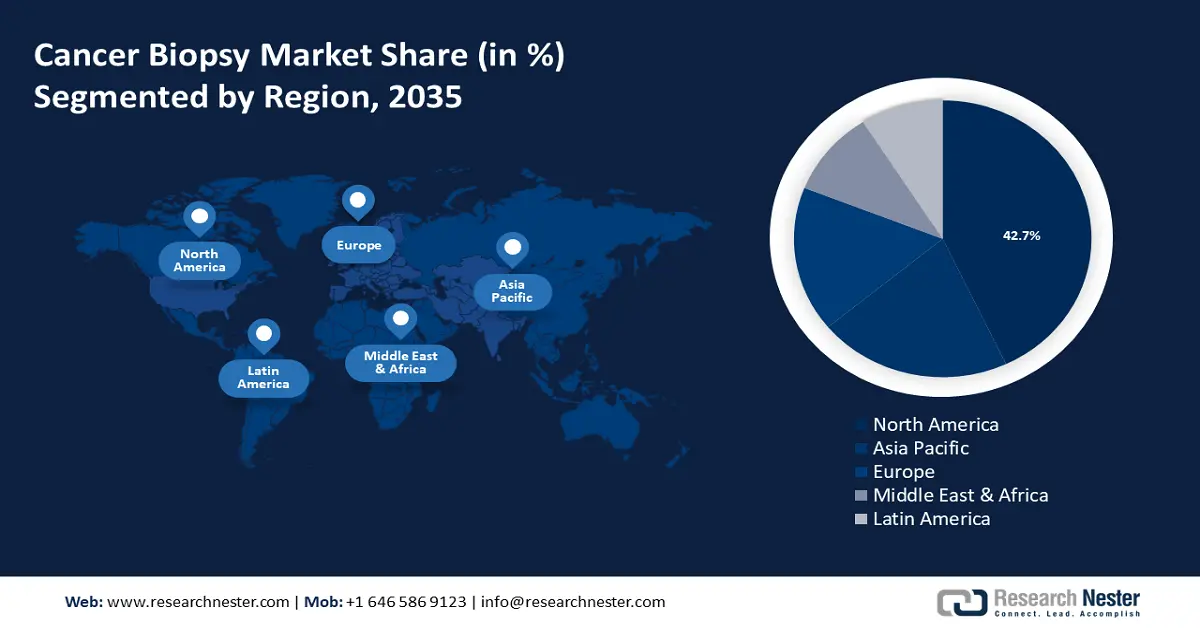

Cancer Biopsy Market Regional Analysis:

APAC Market Statistics

North America industry is anticipated to hold largest revenue share of 42.7% by 2035. Cervical cancer remains to be one of the most commonly diagnosed cancers worldwide even though it is highly preventable. It is referred to as a disease of inequity with a very low screening coverage of 4% in the Western Pacific and 18% in Southeast Asia, which is far below the WHO recommendation of 70% screening coverage of eligible women. These factors are projected to boost the Asia Pacific cancer biopsy market growth during the forecast period.

Increasing government cancer screening initiatives, growth of private healthcare facilities with advanced diagnostic technologies, and rising medical tourism are some of the driving factors for the India cancer biopsy market. In February 2024, Continental Hospitals announced the launch of the Early Detection Liquid Biopsy Test. The test provides capabilities of early detection, personalized care recommendations, and hands-on health management strategies based on a person’s genetic profile.

China cancer biopsy market is expanding significantly driven by the rising prevalence of multiple cancer types and a growing emphasis on early detection. As per the National Library of Medicine article published in March 2022, there were over 4 million cancer cases in China in 2022. These rising cases are expected to boost the cancer biopsy market in China during the forecast period. Additionally, China’s burgeoning biotech sector is accelerating the development of innovative biopsy techniques, catering to the demand for personalized cancer therapies.

North America Market Analysis

North America cancer biopsy market is boosted by the presence of prominent players in the region. These players engage in several competitive strategies to meet the rising demand for advanced therapies. In June 2023, Quest Diagnostics announced the completion of the Haystack Oncology acquisition. Quest aims to incorporate Haystack’s MRD technology into the development of new blood-based clinical lab services for solid tumor cancers. Market activities such as these are projected to further drive the industry’s growth significantly in the region.

As per an article by the National Cancer Institute, an estimated of over 2 million new cases of cancer will be diagnosed in the United States, causing nearly 611,720 deaths from the disease, in U.S. Companies headquartered in the country are also participating in several acquisitions and collaborations, to maintain competition in the market. For instance, Agilent Technologies, Inc. announced the acquisition of Resolution Bioscience, aiming to expand Agilant’s capabilities in NGS-based cancer diagnostics and serve the fast-growing precision medicine market requirements.

According to an article by the Canadian Cancer Society, cancer-related deaths are expected to rise from 86,700 in 2023 to 88,100 in 2024 in Canada. The rising cancer cases, growing demand for personalized medicines, and advanced healthcare system are boosting the cancer biopsy market growth in the country. Furthermore, significant investments in R&D activities in the country are also promoting various developments in terms of advanced treatment therapies. Strong governmental support is another factor boosting the industry’s growth.