Cadmium Telluride Market Outlook:

Cadmium Telluride Market size was over USD 2.18 billion in 2025 and is projected to reach USD 6.3 billion by 2035, witnessing around 11.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of cadmium telluride is evaluated at USD 2.4 billion.

The market is driven by its application in thin-film photovoltaic technology and the proliferation of Cadmium Telluride-based (CdTe) solar cells as an alternative to silicon-based PV systems. CdTe-based solar cells offer lower production costs which benefits the manufacturers of solar panels, detectors, and electronic components. The market’s expansion is underscored by substantial investments in manufacturing facilities, particularly in the U.S., where companies such as First Solar have expanded operations to meet increasing demand. First Solar reported a gross cash balance of USD 2.6 billion in 2022, with an increase in gross and net cash of USD 800 million in comparison to the previous year.

The table below highlights the global solar PV manufacturing capacity and an expansion in solar PV manufacturing is poised to bolster the demand for cadmium telluride.

|

Particulars |

Details |

|

Country with the highest Solar PV manufacturing capacity |

China has emerged as the leader with over USD 50 billion invested in new PV supply capacity in 2021. |

|

Solar PV export details |

In 2021, China’s solar PV exports were over USD 30 billion, accounting for almost 7% of the country’s trade surplus over the last five years. |

|

Emerging exporters of Solar PV |

Malaysia and Vietnam have emerged as significant exporters of PV products. |

Source: IEA

Furthermore, the International Energy Agency reported that the total value of worldwide PV-related trade exceeded USD 40 billion in 2021, representing a massive 70% increase from 2020. The supply chain for cadmium telluride involves the extraction and refinement of raw materials such as cadmium and tellurium. Opportunities are rife in the upstream value chains for the purification and CdTe synthesis, while the midstream value chain presents possibilities for bolstering the CdTe thin-film production. Companies such as 5N Plus have established themselves in the value chain by supplying high-purity CdTe to module manufacturers. In 2023, the annual report of 5N Plus indicated revenue worth USD 242.4 billion, reflecting the opportunities for investment within the cadmium telluride market.

Key Cadmium Telluride Market Insights Summary:

Regional Highlights:

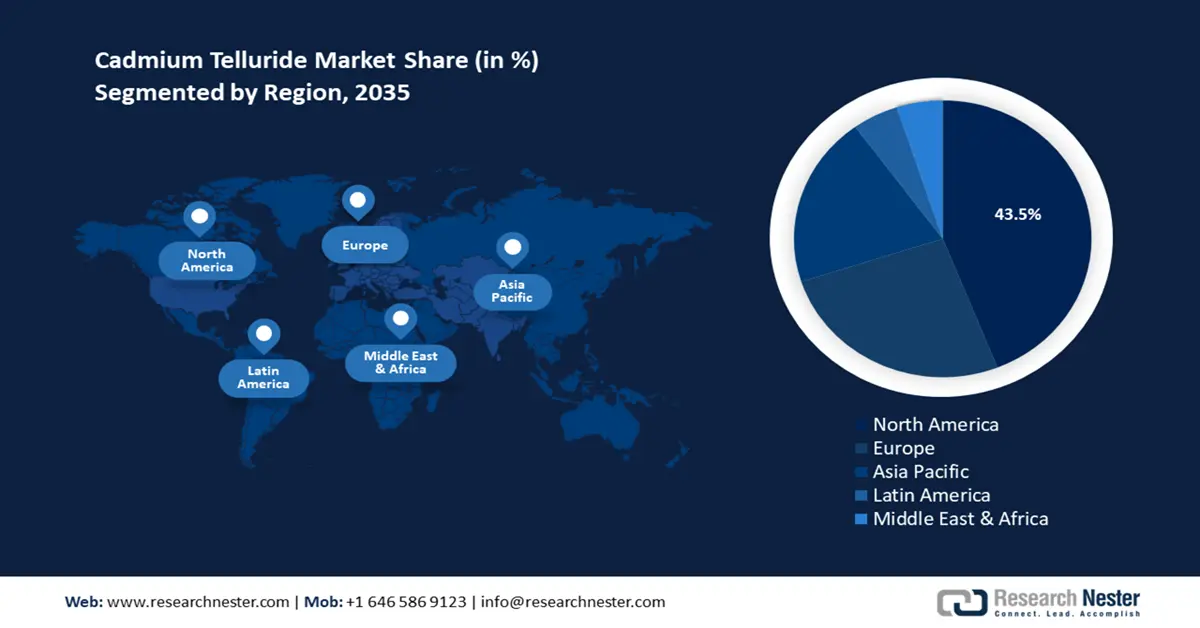

- North America holds a 43.5% share in the Cadmium Telluride Market, driven by investments to expand renewable energy applications and supportive policies, ensuring robust growth through 2035.

- Europe’s Cadmium Telluride Market is projected to hold the second-largest share by 2035, driven by investments in CdTe-based photovoltaic systems to meet sustainability targets and reduce fossil fuel reliance.

Segment Insights:

- The Solar PV segment is projected to experience over 40% CAGR growth by 2035, driven by surging investment and government incentives for renewable energy.

- The Tellurium segment is expected to achieve a 64.4% share by 2035, driven by rising production of thin-film solar cells and improved supply chains.

Key Growth Trends:

- Government incentives for renewable energy

- Surging demand for advanced radiation detection technologies

Major Challenges:

- Concerns of toxicity limiting end use

- Dependency on copper refining affecting supply chains

- Key Players: First Solar, Rio Tinto, 5N Plus, Calyxo, Advanced Solar Power, Lucintech, CTF Solar, Antec Solar.

Global Cadmium Telluride Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.18 billion

- 2026 Market Size: USD 2.4 billion

- Projected Market Size: USD 6.3 billion by 2035

- Growth Forecasts: 11.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (43.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Malaysia

Last updated on : 12 August, 2025

Cadmium Telluride Market Growth Drivers and Challenges:

Growth Drivers

- Government incentives for renewable energy: The government incentives offered to increase the production and integration of renewable energy benefit the growth of the cadmium telluride market. For instance, in October 2023, the U.S. Department of Treasury announced an extension of the Renewable Energy Production Tax Credit to provide credit of up to 2.75 cents per kilowatt-hour of electricity generated from renewable energy sources. The legislative support improves the competitiveness of CdTe technology in the solar energy market. Major market movements include Boviet Solar’s announcement to invest USD 294 million in its first solar panel manufacturing facility in North America. The heightened solar panel manufacturing offers opportunities to supply cadmium telluride in thin-film coatings, ingots, and processed semiconductor layers.

- Surging demand for advanced radiation detection technologies: CdTe-based x-ray and gamma-ray detectors are increasingly used in medical imaging. The material’s ability to operate at room temperature while delivering high-resolution imaging has resulted in its surging demand. Two recent developments highlight the use case of cadmium telluride for medical imaging in the healthcare sectors across the world. One in January 2025, Siemens Healthineers announced a licensing agreement with Kromek Group Plc to increase the in-house production of cadmium zinc telluride material for gamma-ray detectors. Another, in November 2024, where Canon Inc. collaborated with Penn Medicine for the application of photon counting CT. Canon’s PCCT utilizes cadmium zinc telluride, highlighting the scope of application companies operating in the upstream value chain of the market.

Challenges

- Concerns of toxicity limiting end use: Cadmium is classified as a toxic heavy metal, while CdTe is a stable compound. The toxicity of cadmium can affect environmental and workplace safety regulations. Companies in the sector deal with strict disposal and recycling requirements, which can increase compliance costs. Moreover, market expansion in Europe can be difficult, owing to the stringent regulations related to disposal.

- Dependency on copper refining affecting supply chains: Since tellurium is extracted as a byproduct of copper refining, the supply chain becomes dependent on copper production trends rather than CdTe market demand. The market can be negatively impacted if the global copper refining output declines or yields less tellurium. For instance, in 2023, copper production in U.S. refineries reportedly declined by around 7% in comparison to 2022. Although to offset the decline, global copper production showed an increase in 2024.

Cadmium Telluride Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

11.2% |

|

Base Year Market Size (2025) |

USD 2.18 billion |

|

Forecast Year Market Size (2035) |

USD 6.3 billion |

|

Regional Scope |

|

Cadmium Telluride Market Segmentation:

Source (Tellurium, Cadmium)

Tellurium segment is predicted to account for cadmium telluride market share of around 64.4% by 2035, due to the rising production of thin-film solar cells. Additionally, opportunities are rife to expand partnerships between solar manufacturers and mining firms to improve supply chains. For instance, in January 2025, First Solar established an Endowed Professorship in Critical Energy Materials to bolster critical supply chains for tellurium. The U.S. Department of Energy reported that 640 metric tons of tellurium produced globally in 2022 and predicted tellurium availability to increase with the introduction of new Te recovery capabilities deployed.

Application (Solar PV, Optical Lenses and Windows, Electro-Optic Modulator, Nuclear Spectroscopy, Infrared Optical Material)

The solar PV segment in cadmium telluride (CdTe) market is projected to register robust growth throughout the forecast period. The surging investment in utility-scale installations is estimated to drive applications of CdTe. The lower manufacturing costs have led to widespread adoption in solar farms and large commercial projects. Moreover, government incentives and policies promoting renewable energy have amplified the demand for CdTe solar PV applications. In May 2024, the U.S. DOE announced an investment of USD 71 million in the thin-film solar manufacturing process to boost the value chain. Such investments from federal agencies are projected to bolster the production and application of CdTe.

Our in-depth analysis of the global market includes the following segments:

|

Source |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cadmium Telluride Market Regional Analysis:

North America Market Forecast

North America cadmium telluride market is predicted to capture revenue share of around 43.5% by the end of 2035, attributed to growing investments to expand renewable energy applications. Moreover, the CdTe technology application is predicted to be positively impacted by its cost-effectiveness. The U.S. Department of Energy has been instrumental in funding research and development projects aimed at improving CdTe supply chains. The supportive regulatory ecosystem has positioned North America as a pivotal region for business opportunities in the market.

The U.S. cadmium telluride market is anticipated to register a considerable share in North America. The U.S. has historically been a lucrative market for specialty materials. Furthermore, recent trends of investment to increase domestic solar manufacturing bodes well for the application of cadmium telluride. For instance, in April 2023, the U.S. Department of Energy reported USD 82 million in investment to strengthen the clean energy grid in America by bolstering domestic production of solar energy. Moreover, positive progress in tellurium recovery is predicted to boost the market’s supply chain. For instance, in June 2022, Rio Tinto began processing tellurium at the Bingham Canyon Copper Mine in Utah, with Kennecott becoming one of the two U.S. producers of tellurium. The USD 2.9 million recovery circuit was estimated to produce around 20 tons of tellurium annually, which is 4% of global annual production.

The Canada market is forecasted to expand during the forecast period. The CdTe market in Canada is gaining momentum supported by the favorable regulatory ecosystem to improve the sustainable energy framework across the country. Furthermore, Canada benefits from the proximity to the U.S. which is steadily increasing tellurium processing capability, ensuring a steady supply of CdTe for solar PV manufacturing in the country. The recent expansion of businesses from the renewable energy sector in Canada to other markets highlights opportunities for key players in the market to invest in expanding production capabilities. For instance, in October 2023, Canadian Solar Inc., announced the establishment of a 5 GW solar PV facility at Indiana, U.S with production slated to begin from the end of 2025.

Europe Market Forecast

The Europe cadmium telluride market is poised to register the second-largest revenue share throughout the estimated timeframe of the sector’s analysis. Countries across Europe are investing in CdTe-based photovoltaic systems to meet ambitious sustainability targets and reduce reliance on fossil fuels. Since, Europe has been at the forefront of decarbonization calls, the opportunities for the expansion of renewable solar energy in the region are heightened. The European Union reported that in 2022, Sweden was the top producer of tellurium in Europe.

The Germany market is anticipated to register a considerable share in Europe. The Renewable Energy Sources Act of Germany prioritizes niche solar technologies, creating opportunities for the penetration of CdTe gaining traction. Furthermore, ongoing research efforts are targeting improvements in perovskite-CdTe tandem cell efficiencies. The lower production costs of CdTe solar cells align with Germany’s goals of affordable and reliable renewable energy.

The France market is forecasted to exhibit robust growth throughout the forecast period. A key factor of the market’s growth in France is the push to diversify the energy mix. The favorable government policies including feed-in tariffs for solar energy projects have spurred adoption rates of CdTe-based solar panels. Additionally, potentials of expansion arise in collaborations with North Africa nations, such as the Mediterranean Solar Plan, to bolster supply chains.

Key Cadmium Telluride Market Players:

- First Solar

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Rio Tinto

- 5N Plus

- Calyxo

- Advanced Solar Power

- Lucintech

- CTF Solar

- Antec Solar

The cadmium telluride market is anticipated to register robust growth during the forecast period. A key approach by the major players operating in the sector is to scale up production capacities by establishing new refining facilities or expanding the existing ones. The scaling up will allow companies to meet the surging demand from the solar PV sector. Additionally, strategic partnerships to leverage government-backed tax cuts and subsidies, along with bolstering R & D efforts are positioned to assist companies in maintaining a competitive edge in the market.

Here are some key players in the market:

Recent Developments

- In September 2024, First Solar inaugurated a USD 1.1 billion fully vertical integrated thin-film solar manufacturing facility in the U.S. The facility will add 3.5 gigawatts (GW) of integrated solar manufacturing capacity in the U.S.

- In January 2023, the EU-funded CIRCUSOL project expanded to include CdTe recycling pilots. The project aims to recover high-purity tellurium from end-of-life thin-film panels.

- Report ID: 7311

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cadmium Telluride Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.