CA 125 Test Market Outlook:

CA 125 Test Market size was valued at USD 908.98 million in 2025 and is expected to reach USD 1.57 billion by 2035, expanding at around 5.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of CA 125 test is evaluated at USD 954.79 million.

The rising prevalence of ovarian cancer across the world is the major growth factor in the CA 125 test market. According to the 2022 estimation of the Globocan, the annual OC fatalities are expected to reach 350956, increasing by 70% from 2022. The projection further states, that the number of diagnosed OC patients worldwide is estimated to be 503,448 with a 55% increment. The reliance and accuracy of CA-125 serum as a tumor marker are significantly preferred and adopted for observing the treatment progress and introducing new therapeutic discoveries. This test is also utilized by researchers for new drug developments due to its high precision and specificity.

The growing number of new and death cases is further concerning regional authorities and is forcing them to regulate policies and take initiatives to control the outrage. They are continuously promoting the importance of regular check-ups and preventive healthcare measures for early detection. Thus, women with the potential threat of having cancer are opting for routine screenings, cultivating investments in the CA 125 test market. Further studies are being conducted to advance the performance of these tests by combining different biomarkers with this antigen. For instance, in April 2024, a research paper was published by ACS Publications, introducing a more bio-based, fast, and affordable solution, organohydrogels (ONOHs) for CA-125 serum testing.

Key CA 125 Test Market Insights Summary:

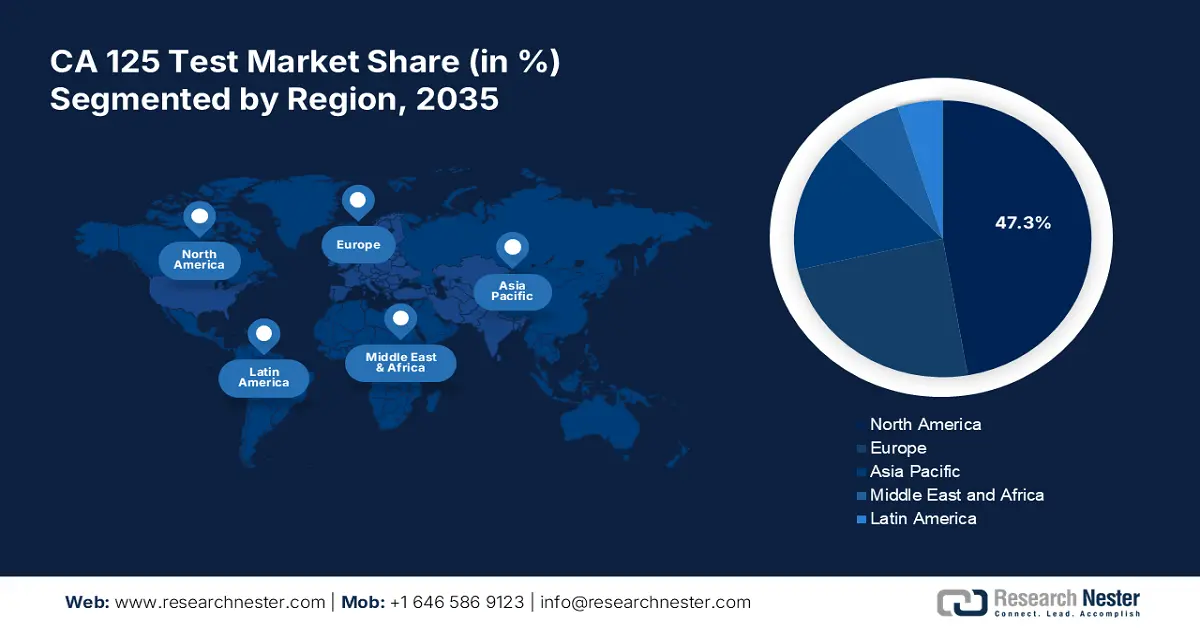

Regional Highlights:

- North America CA 125 test market will account for 47.30% share by 2035, driven by healthcare advancements and the need for more accurate and faster testing results for ovarian cancer detection.

Segment Insights:

- The diagnostic segment segment in the ca 125 test market is expected to hold a 68.40% share by 2035, driven by a wide network of diagnostic expertise and adequate laboratories.

- The cancer (indication) segment in the ca 125 test market is forecasted to witness significant growth till 2035, influenced by the growing prevalence of cancers with high mortality rates demanding monitoring tests.

Key Growth Trends:

- Growing awareness about early detection

- Advancement in diagnostic components

Major Challenges:

- Competition with alternative methods

- Limitations in affordability and accessibility

Key Players: Allergan plc., Amgen Inc., Bayer, BD, Eli Lilly Company, Merck & Co., Inc., Pfizer Inc., Teva Pharmaceuticals Private Limited, AMAG Pharmaceuticals, Johnson & Johnson, Sanofi, Novartis, AbbVie Inc., GlaxoSmithKline plc..

Global CA 125 Test Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 908.98 million

- 2026 Market Size: USD 954.79 million

- Projected Market Size: USD 1.57 billion by 2035

- Growth Forecasts: 5.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (47.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Brazil, South Korea, Mexico

Last updated on : 18 September, 2025

CA 125 Test Market Growth Drivers and Challenges:

Growth Drivers

- Growing awareness about early detection: With the improvement in healthcare access, the growing trend of early detection and preventive care ignited the CA 125 test market. People with risk factors such as family history are taking extra care to detect these diseases at an earlier stage. This has dragged the focus of many public health institutions on accelerating innovations to establish a proactive clinical setting to enhance survival rates. For instance, in May 2023, a USD 2 million project was inducted to enroll patients with OC symptoms in the West Midlands through ROMA to diagnose early-stage ovarian cancer. Under the NHS Cancer Programme, the advanced blood test was aimed at recognizing severe patients and referring them for a CA-125 test.

- Advancement in diagnostic components: Integration of technologically upgraded diagnostic tools such as spectrometers and biomarkers plays a pivotal role in ensuring optimum adoption in the CA 125 test market. The enhanced OC management and prevention is further encouraging suppliers to develop more innovative solutions, fostering progress in this field. For instance, in December 2024, Roche received CE mark approval for its cobas Mass Spec solution to make spectrometry a routine technology in clinical labs. The launch contained Cobas i 601 analyser and Ionify reagent pack of four assays for complete automation and standardization of mass spectrometry testing.

Challenges

- Competition with alternative methods: Even though it is widespread across the oncology field, the CA 125 test market may face a shift in consumer behavior due to the presence of new diagnostic solutions. The lack of perfection in advanced OC cases and camouflage symptoms often leads to altered sensitivity and false positives. This can create a risk for this sector to be replaced with other advanced diagnostic practices available for precise cancer detection.

- Limitations in affordability and accessibility: Lack of knowledge about the effectiveness of early detection in low-income regions may limit investments in the CA 125 test market. In addition, patient reluctance can impact the optimum adoption due to the fear of the financial burden of expensive associated follow-up procedures. In addition, the growing need for conjunction of CA 125 with other tests to ensure accuracy often discourages patients from investing.

CA 125 Test Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.6% |

|

Base Year Market Size (2025) |

USD 908.98 million |

|

Forecast Year Market Size (2035) |

USD 1.57 billion |

|

Regional Scope |

|

CA 125 Test Market Segmentation:

End user Segment Analysis

In terms of end user, CA 125 test market diagnostic segment is poised to capture over 68.4% revenue share by 2035. This group of healthcare providers is generating remarkable revenue from this sector due to their wide network of diagnostic expertise and adequate laboratories. According to a report published in March 2023, the global diagnostic testing industry was valued at USD 166 billion in 2021. It was further expected to reach USD 349 billion by 2030. They are fully equipped with essential tools for specific tests such as CA 125, making them a preferable option for undergoing patients. Their direct interaction with consumers also helps them to offer tailored and budget-friendly diagnostic services, influencing patients to invest more.

Indication Segment Analysis

Based on indication, the CA 125 test market is projected to witness significant growth in the cancer segment by the end of 2035. The growing prevalence of cancers related to the ovary, endometrial, fallopian tube, breast, and other feedstocks in this sector. In addition, cancers with greater mortality rates are specifically increasing the demand for such monitoring tests. According to a study report, published in May 2024, ovarian cancer has the highest fatality rate with a survival rate of merely 50.8% in 5-year tenure. It further states, that the survival rate of early-stage OC patients has been studied to be around 92% when the same is less than 29% for patients with advanced stages. This exclaims the need for early diagnosis, surging demand in this sector.

Our in-depth analysis of the global CA 125 test market includes the following segments:

|

End user |

|

|

Indication |

|

|

Device & Accessory |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

CA 125 Test Market Regional Analysis:

North America Market Insights

North America in CA 125 test market is set to capture over 47.3% revenue share by 2035. Well-developed economies such as the U.S. and Canada are known for their highly equipped and efficient medical facilities and services. In addition, the regional R&D efforts to regulate more accurate and faster testing results are further accumulating growth in this sector. For instance, in September 2024, a study report was published by researchers at Johns Hopkins Kimmel Cancer Center, unveiling the possibilities of integrating AI into blood tests. The study used an AI-powered analysis of DNA and protein biomarkers for the early detection of OC, making tests more accessible and affordable with high detection capabilities.

Healthcare advancements are one of the major driving factors in the U.S. when the incidence rate of related cancers such as OC is increasing. According to data released by the Centers for Disease Control and Prevention, in June 2024, the country registered 20,032 new cases of ovarian cancer in 2021. The report further revealed that around 10 new cases of OC were encountered for every 100,000 women in this country. This escalates the implementation of effective and precise tests, increasing demand in the CA 125 test market.

Canada is following in the footsteps of its regional assessments and initiatives to make progress in the CA 125 test market. The country is closely working with many R&D organizations to leverage the speed of treatment discoveries and precise diagnosis. For instance, in 2019, the government of Canada funded USD 10 million to Ovarian Cancer Canada to empower its 5-year timeline of OC research initiatives. These investments work as a financial cushion for the developers in this field to introduce innovative solutions, improving test outcomes.

APAC Market Insights

The Asia Pacific landscape is evolving with the financial and regulatory progress of developing economies such as Japan, China, and India. The trend of investing in R&D for medical discoveries notably encourages pharma companies to innovate new molecular hybrids to enhance test accuracy. They are also exploring ways to engage this biomarker to detect a wide range of cancers. For instance, in January 2023, a team of researchers from some of the regional institutes conducted a study regarding the diagnostic capabilities of CA-125 in metastatic colorectal cancer. The results identified this antigen’s potential as a predictive and prognostic factor in later-line treatment of patients with mCRC.

India is utilizing its strong emphasis on the pharma industry to gain traction in the CA 125 test market. Besides, the wide spreading network of diagnostic centers across the country is garnering great business opportunities for the service providers and participants. According to a NABL report published in February 2024, the number of accredited medical laboratories in India reached 2150 in the same year, among which 24 were ISO-certified cancer labs. This is evidence of the scope of new developments and investments in this sector.

China is fostering resources and supply channels to reduce its growing burden of ovarian cancer. According to the NLM article, released in February 2023, the country reported to have 196,000 incident, 45,000 new, and 29,000 death cases for OC in 2019. The report further exclaimed the increment of 105.98%, 79.19%, 58.93%, 47.88%, 91.78%, and 46.81% in the ASPR, ASIR, ASMR, ASDR, and the ASRs of YLDs and YLLs of OC. The technology-driven country is now heavily contributing to the growth of its domestic CA 125 test market to control cancer outrage.

CA 125 Test Market Players:

- Allergan plc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Amgen Inc.

- Bayer

- BD

- Eli Lilly Company

- Merck & Co., Inc.

- Pfizer Inc.

- Teva Pharmaceuticals Private Limited

- AMAG Pharmaceuticals

- Johnson & Johnson

- Sanofi

- Novartis

- AbbVie Inc.

- GlaxoSmithKline plc.

- GENinCode Plc

- Hytest

The dynamics of the CA 125 test market are shifting towards creating hybrid biomarkers by combining the designated antigen with new bio-based solutions for more precise analysis. Global leaders are focusing on investing in more R&D projects to leverage their product lines to captivate the top positions in this field. For instance, in June 2022, Roche Diagnostics launched an advanced tissue staining platform, ULTRA PLUS to enable quick and accurate test results for cancer. The new system is capable of offering testing efficiency and environmentally sustainable features to empower pathologists by providing high-quality, time-critical results to doctors and patients. Such key players include:

Recent Developments

- In December 2024, GENinCode Plc partnered with Genesupport SA to spread its ovarian cancer detection test, ROCA across Switzerland. The partnership intends to utilize Genesupport’s network of laboratories nationwide to avail the revolutionary technology of calculating risk factors including age and CA 125.

- In June 2024, Hytest launched a new Anti-CA-125 antibody, RX16 to enhance the performance and accuracy of ovarian cancer diagnostics. The recombinant product is designed to support healthcare service providers and researchers for early detection, monitoring, and treatment, elevating patient outcomes.

- Report ID: 6953

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

CA 125 Test Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.