BYOD Security Market Outlook:

BYOD Security Market size was over USD 50.53 billion in 2025 and is anticipated to cross USD 292.63 billion by 2035, growing at more than 19.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of BYOD security is assessed at USD 59.26 billion.

Bring Your Own Device (BYOD) security solutions are emerging as game changers in the corporate world. These solutions are aiding companies to secure their data even if accessed on employee's personal devices. The majority of companies are employing BYOD policies leading to high sales of security solutions. For instance, according to a survey by JumpCloud, a leading device management solution provider estimated that over 80% of companies worldwide are employing BYOD strategies. Around 68% of companies observed enhanced productivity in employees through BYOD policies. Also, the survey determined that 42% of IT leaders believe smartphones accelerate the speed of innovations.

In December 2022, the National Institute of Standards and Technology revealed that over 95% of companies allow the use of personal devices for work, globally. Also, 86% of IT heads anticipate that mobile attacks are increasing frequently. These statistics underscore that the increasing use of self-owned devices for work and the risk of cyber threats are collectively fueling the adoption rates of BYOD security solutions. Thus, the consistency in the adoption of BYOD policies is set to double the BYOD security market revenue shares of key players in the coming years.

Key BYOD Security Market Insights Summary:

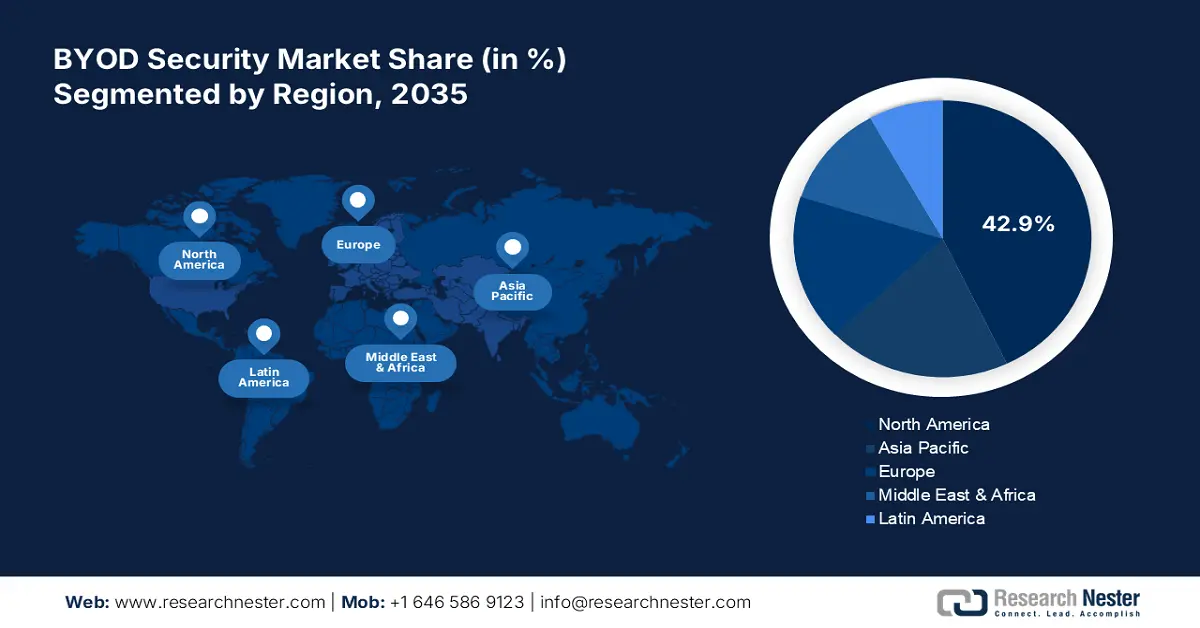

Regional Highlights:

- North America's 42.9% share in the BYOD Security Market is led by the presence of international end-use companies and supportive BYOD policies, enhancing its dominance through widespread adoption in 2026–2035.

- The Asia Pacific BYOD security market is expected to grow swiftly through 2035, driven by the expansion of multinational firms and supportive BYOD adoption.

Segment Insights:

- The Large Enterprises segment is anticipated to achieve a 66.40% market share by 2035, driven by widespread BYOD adoption and the need for advanced security due to remote and hybrid work.

- The Mobile Device Security segment is expected to hold a 70.6% share by 2035, driven by the vulnerability of mobile devices to malware and demand for robust security solutions.

Key Growth Trends:

- Remote and hybrid work models

- Integration of digital technologies

Major Challenges:

- Employee’s resistance to BYOD security integration

- Data leakage and cyberattack threats

- Key Players: Logitech International S.A., GoTo, Microsoft Corporation, and Zscaler, Inc.

Global BYOD Security Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 50.53 billion

- 2026 Market Size: USD 59.26 billion

- Projected Market Size: USD 292.63 billion by 2035

- Growth Forecasts: 19.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 13 August, 2025

BYOD Security Market Growth Drivers and Challenges:

Growth Drivers

- Remote and hybrid work models: The steady adoption of remote and hybrid work models is positively influencing the sales of BYOD security solutions. Security concerns related to employees accessing corporate data from personal devices are driving companies to invest in BYOD security technologies. Another aspect that augmenting BYOD security solution demand is that the personal devices used by employees are often with outdated operating systems, inconsistent security patches, and unstable device protection solutions such as antivirus software and encryption, which increases the risk of cyberattack.

Manufacturers are constantly focused on the WFH trend and investing heavily in R&D to develop advanced BYOD security solutions as per customers’ demands. For instance, in August 2023, 1840 & Company announced the launch of the bring your own device (BYOD) management addon to lead the way in remote work solutions. This addon offers businesses top-tier data compliance & protection, and seamless user experience. The software-driven approach and advanced security protocol of 1840 & Company’s BYOD addon are augmenting its adoption in remote work environments. - Integration of digital technologies: The integration of artificial intelligence (AI) and machine learning (ML) is significantly enhancing the capabilities of BYOD security market. The AI and ML-powered BYOD security systems effectively analyze massive volumes of data in real-time and identify anomalies and potential threats. The ability of AL and ML algorithms to continuously enhance their detection capabilities by analyzing past incidents is aiding in boosting the reliability of advanced BYOD technologies. Businesses’ continuous demand for advanced and reliable BYOD security solutions is driving key players to employ innovative product launch strategies.

For instance, in May 2024, Zscaler, Inc. one of the top developers of cloud security solutions announced multiple advancements in its AI data protection platform. The latest innovations in the solution include GenAI app security, in-line email protection, and data security posture management (DSPM). The company estimates that the newly integrated features in the solution are making it effective and reliable in protecting data across various channels such as BYOD, email, Web, private applications, and SaaS in both public cloud and data centers.

Challenges

- Employee’s resistance to BYOD security integration: Most of the employees are reluctant to adopt security measures that interfere with the usability or performance of their personal devices. Intrusive software installations, constant monitoring, and limitations on personal device usage are major factors limiting the use of BYOD security solutions. Thus, balancing security with personal devices is a major challenge for enterprises, hampering the BYOD security market growth to some extent.

- Data leakage and cyberattack threats: Despite top security measures, personal devices are more susceptible to data leakage and cyber threats compared to corporate devices. The risk of data leakage, whether intentional or accidental is high when employees use personal devices to access sensitive corporate data, creating a major security challenge. Thus, poor standardization of security measures is challenging the adoption of BYOD security solutions.

BYOD Security Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

19.2% |

|

Base Year Market Size (2025) |

USD 50.53 billion |

|

Forecast Year Market Size (2035) |

USD 292.63 billion |

|

Regional Scope |

|

BYOD Security Market Segmentation:

End user (Large Enterprises, Small & Medium Enterprises)

In BYOD security market, large enterprises segment is poised to capture over 66.4% revenue share by 2035. In large enterprises, employees have high access to corporate resources through personal devices. The prime factors boosting the use of BYOD security solutions are their global reach and the presence of a sizeable workforce. To secure the data from third-party individuals or cyber attackers, larger companies often employ strict BYOD policies and advanced security solutions. Also, the remote and hybrid work models of large enterprises are further augmenting the sales of BYOD security solutions. For instance, as per the analysis by Cisco Systems, Inc., a cybersecurity, software, and network solution provider, over 40% of employees are working in hybrid models, worldwide. Thus, the existence of remote and hybrid working models is having a potential influence on the sales of BYOD security solutions.

Software (Mobile Data Security, Mobile Device Security, Network Security)

The mobile device security segment is expected to dominate BYOD security market share of over 70.6% by 2035. The high use of mobile devices for office work, which are more vulnerable to malware and ransomware attacks is a major factor augmenting the sales of mobile device security solutions. Considering this aspect, many market players are investing heavily in R&D activities to develop advanced and reliable mobile device security solutions. For instance, in July 2023, Samsung Electronics Co., Ltd, and Microsoft Corporation announced a collaborative launch of an advanced enterprise mobile device security solution for modern workspace. This hardware-backed device attestation technology works well with both office and personal mobile devices.

Our in-depth analysis of the global BYOD security market includes the following segments:

|

Device Type |

|

|

Software |

|

|

Solution |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

BYOD Security Market Regional Analysis:

North America Market Forecast

North America in BYOD security market is set to account for more than 42.9% revenue share by the end of 2035. The strong existence of international end use companies, continuous introduction of security technologies, and supportive BYOD policies are augmenting the sales of bring your own device security solutions in the region. The continuous advancements in the corporate sector are also positively influencing the demand for BYOD security market in both the U.S. and Canada.

In the U.S., the rise in the remote and hybrid working models is positively influencing the BYOD security solution sales. For instance, in Q2 2024, the hybrid working model observed a rise of 52.0% in the country. Furthermore, as per the analysis by the U.S., Bureau of Labor Statistics, around 41.1% of employees in the professionals, scientific, and technical service sectors were working remotely, in 2022. Thus, rise in the remote jobs is set to directly fuel the adoption of cloud-based BYOD security solutions.

In Canada, the strict implementation of data privacy laws such as the Privacy Act, the Personal Information Protection and Electronic Documents Act (PIPEDA), and provincial privacy laws are driving the adoption of BYOD security solutions. The high adoption of BYOD policies also necessitates corporate companies to employ advanced and reliable security solutions to ensure compliance. The increasing adoption of hybrid working models in the country is also augmenting the overall BYOD security market growth.

Asia Pacific Market Statistics

The Asia Pacific BYOD security market is expected to increase at a swift pace during the study period. The increasing adoption of digital technologies, ease of use of personal devices for corporate work, and rapid expansion and modernization of corporate work are increasing the adoption of advanced BYOD security solutions. The swift expansion of multinational companies with supportive BYOD policies is generating lucrative opportunities for key market players. China, India, Japan, and South Korea are some of the rapidly expanding marketplaces for BYOD security solution producers.

In India, the swift digitalization across industries such as healthcare, education, real estate, fintech, banking, and telecommunications is spurring a high demand for innovative BYOD security solutions. For instance, in December 2024, the India Brand Equity Foundation (IBEF) revealed that India is ranking 2nd to the U.S. in the number of consistently high-performing companies. These companies are constantly achieving a Return on Equity (ROE) of over 20% for more than 10 years to date. Thus, such a rise in the presence of advanced companies is propelling the sales of BYOD security solutions in the country.

Similar to India, China is witnessing a rise in digital transformation owing to supportive government policies. For instance, in November 2023, the State Council Information Office revealed that the country’s digital economy surpassed USD 6.99 trillion in 2022. The rising adoption of digital technologies by businesses coupled with supportive BYOD policies to access corporate networks with personal devices is fueling the demand for effective and reliable security solutions in the country.

Key BYOD Security Market Players:

- Logitech International S.A.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- GoTo

- Microsoft Corporation

- Zscaler, Inc.

- 1840 & Company

- IBM Corpoation

- Avaya LLC

- AT&T Intellectual Property

- Hewlett Packard Enterprise Development LP

- International Business Machines Corporation

- Citrix Systems, Inc.

- Good Technology Corporation.

- Mobileiron Inc.

- VMware, Inc.

- Fortinet Inc.

- Cisco Systems, Inc.

- Avaya Inc.

- Hewlett Packard Enterprise

- Symantec Corporation

- JumpCloud

The BYOD security market is characterized by the presence of industry giants and the increasing emergence of start-ups. The new companies are focusing on research and development activities to introduce advanced security solutions to stand out in the crowd. The leading companies are employing both organic and inorganic strategies to earn high profits and maximize their market reach. New product launches and technological innovations are some of the prime market strategies adopted by BYOD security solution producers. They are also adopting strategic collaborations and partnership tactics to introduce next-gen BYOD security solutions. Furthermore, mergers & acquisitions and regional expansion tactics are aiding them to boost the product offerings and reach a wider customer base.

Some of the key players in BYOD security market:

Recent Developments

- In October 2024, Logitech International S.A. announced the launch of Logitech Extend a simple, single-cable BYOD solution. This solution is effective for Android- and BYOD-based rooms where an individual can start a meeting using their laptop or other compatible device using a USB-C cable.

- In June 2023, GoTo introduced resolve mobile device management to securely manage all devices. GoTo Resolve MDM ensures strict compliance and streamlines all devices personal and office through a single pane of glass.

- Report ID: 6843

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

BYOD Security Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.