Butyl Methacrylate Market Outlook:

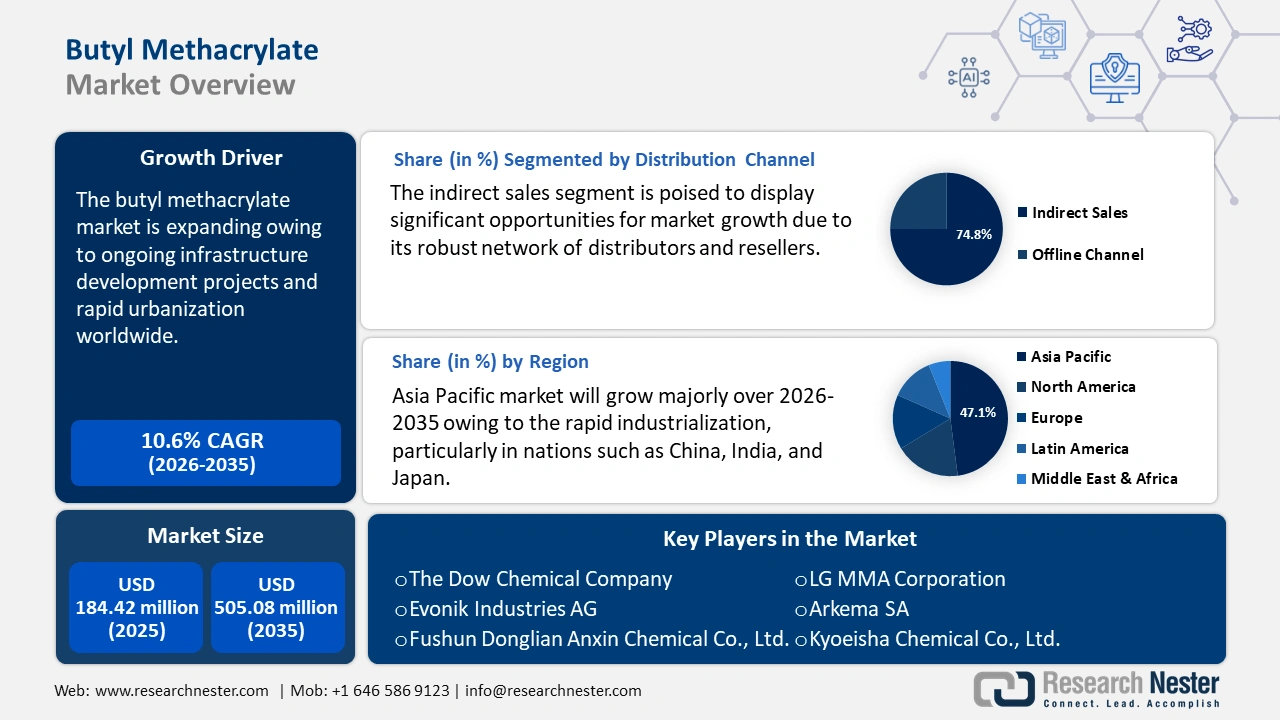

Butyl Methacrylate Market size was valued at USD 184.42 million in 2025 and is expected to reach USD 505.08 million by 2035, registering around 10.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of butyl methacrylate is evaluated at USD 202.01 million.

The growth of the butyl methacrylate market is driven by its versatility and adaptability across various industries. The demand for high-quality architectural coatings and adhesives has increased due to the ongoing infrastructure development projects and rapid urbanization worldwide. The Global Infrastructure Hub revealed that at a record 60% of all private investment in infrastructure projects, global private investment in infrastructure projects was greener than ever in 2021. The worldwide shift from non-renewables persisted, accounting for 11% of all private investment in energy projects, and the shift toward green infrastructure projects was evident across all socioeconomic categories.

Butyl methacrylate is an excellent choice for architectural coatings, sealants, and adhesives used in construction applications because of its strong adhesion properties, weatherability, and UV resistance. As construction activities continue to increase, particularly in emerging economies, the demand for Butyl Methacrylate is predicted to rise even further.

Coupled with its extensive use in many key industries, butyl methacrylate market expansion is greatly aided by technological developments and improvements in its manufacturing methods. To increase production efficiency, lower costs, and improve product quality, manufacturers are constantly investing in research and development projects. Also, to meet the increasing demand for butyl methacrylate while reducing the environmental impact, new manufacturing methods are being investigated, such as continuous process technologies and bio-based feedstocks.

Key Butyl Methacrylate Market Insights Summary:

Regional Highlights:

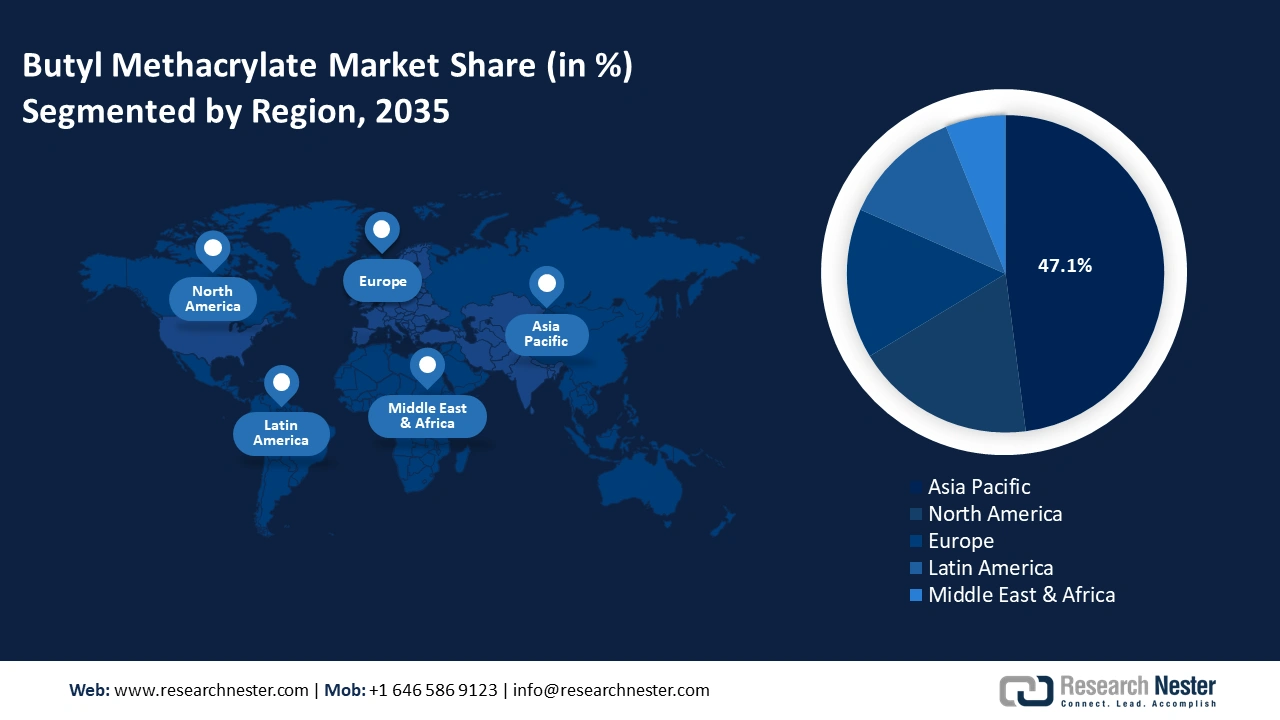

- Asia Pacific butyl methacrylate market will account for 47.10% share by 2035, driven by rapid industrialization and growing demand in manufacturing, construction, and automotive sectors.

Segment Insights:

- The indirect sales segment in the butyl methacrylate market is expected to dominate by 2035, driven by a strong distributor network and accessibility to remote end-users across industries.

- The n-butyl methacrylate (type) segment in the butyl methacrylate market is expected to achieve a significant share by 2035, driven by its widespread use in paints, adhesives, and sealants due to flexibility and weather resistance.

Key Growth Trends:

- Rapid transition toward bio-based butyl methacrylate

- Growing technological advancements

Major Challenges:

- Fluctuating raw material prices

- Stringent regulations

Key Players: The Dow Chemical Company, Evonik Industries AG, Fushun Donglian Anxin Chemical Co., Ltd., Huayei Hefeng Chemical Specialties (Zibo) Co., Ltd., Kyoeisha Chemical Co., Ltd., LG MMA Corporation, Shuzhou Hechuang Chemical Co., Ltd., Arkema SA, Dhalop Chemicals, Ashley Polymers.

Global Butyl Methacrylate Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 184.42 million

- 2026 Market Size: USD 202.01 million

- Projected Market Size: USD 505.08 million by 2035

- Growth Forecasts: 10.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (47.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Indonesia

Last updated on : 18 September, 2025

Butyl Methacrylate Market Growth Drivers and Challenges:

Growth Drivers

-

Rapid transition toward bio-based butyl methacrylate: Compared to traditional competitors, bio-based butyl methacrylate, derived from renewable feedstocks such as biomass or bioethanol, offers several advantages. The World Bioenergy Association has reported that a total of 57.5 exajoules (EJ) of biomass were produced domestically globally in 2020. Asia emerged as the predominant source, contributing 40% to the worldwide supply, with solid biomass sources comprising the majority at 86%. In terms of liquid biofuels, the Americas took the lead, supplying over 60% of the total, thereby establishing themselves as the second most significant source. Therefore, this growing production and supply of biomass is significantly contributing to the expansion of the bio-based butyl methacrylate market.

Primarily, bio-based butyl methacrylate contributes to reducing carbon emissions and mitigates reliance on fossil fuels, aligning with environmental and global sustainability objectives. Furthermore, this material represents a favorable alternative for companies and individuals who prioritize environmental stewardship, as it utilizes renewable resources to minimize the carbon footprint associated with its production process. Additionally, the use of bio-based butyl methacrylate helps leaders to stand out from the competition and differentiate their products. Businesses can establish themselves as industry leaders and attract eco-aware customers and companies seeking eco-friendly solutions by embracing sustainability and providing bio-based substitutes for traditional chemicals. -

Growing technological advancements: Manufacturers of butyl methacrylate can introduce niche products and customized formulations to satisfy particular butyl methacrylate market demands as industries change and the need for specialized, high-performance materials increases. Furthermore, new approaches, including polymer engineering and nanotechnology, are improving the functionality and performance of materials based on butyl methacrylate. Manufacturers can enhance the strength, resilience, and other vital characteristics of butyl methacrylate products by adding nanomaterials and cutting-edge additives, creating prospects in cutting-edge industries, including renewable energy, healthcare, and aerospace.

-

Surging demand in the electronics industry: The compound is a crucial part of the production of optical fibers, LED displays, and electronic adhesives as a result of its remarkable chemical resistance, transparency, and dielectric qualities. The demand for butyl methacrylate is anticipated to expand significantly as the demand for electronic devices and components continues to rise internationally due to technological improvements and rising consumer electronics use.

Challenges

-

Fluctuating raw material prices: For its manufacturing process, the butyl methacrylate market mainly depends on raw ingredients such as methyl methacrylate (MMA), butanol, and methacrylic acid. The butyl methacrylate supply chain is immediately impacted by any disruption or volatility in the pricing or availability of these raw ingredients, which can result in supply shortages, cost increases, and manufacturing delays. For instance, abrupt changes in the price of crude oil, the key raw material used to produce methacrylic acid and butanol, can highly impact the cost structure of companies that produce butyl methacrylate, which in turn can change the dynamics of the butyl methacrylate market. Furthermore, supply chain interruptions are worsened by geopolitical unrest and trade disagreements, especially when it comes to raw materials purchased from foreign markets. Manufacturers of butyl methacrylate may experience supply shortages and higher procurement prices as a result of trade barriers, tariffs, and export restrictions implemented on major raw material sources.

-

Stringent regulations: Manufacturers must comply with strict laws controlling the production, handling, and disposal of chemicals, which raises operating expenses and regulatory risks. Furthermore, strict environmental controls and sustainability standards within the butyl methacrylate business are required due to increased environmental consciousness about the effects of chemical emissions and waste disposal techniques on ecosystems and human health.

Butyl Methacrylate Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.6% |

|

Base Year Market Size (2025) |

USD 184.42 million |

|

Forecast Year Market Size (2035) |

USD 505.08 million |

|

Regional Scope |

|

Butyl Methacrylate Market Segmentation:

Distribution Channel Segment Analysis

Indirect sales segment is anticipated to dominate butyl methacrylate market share of over 74.8% by 2035. The robust network of distributors and resellers that expand butyl methacrylate's reach to numerous end customers across numerous industries is primarily responsible for this distribution channel's success. These collaborations improve accessibility and customer service by making it easier to efficiently provide resources, even to far-flung areas.

Type Segement Analysis

The N-butyl methacrylate segment in butyl methacrylate market is anticipated to garner a significant share during the assessed period. Its widespread application in paints, adhesives, and sealants—where its ability to increase polymer flexibility and weather resistance is highly prized—benefits this industry considerably. Its market strength is greatly influenced by the demand in the construction and automotive industries, where these applications are essential.

Our in-depth analysis of the global butyl methacrylate market includes the following segments:

|

Type |

|

|

Application |

|

|

End use |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Butyl Methacrylate Market Regional Analysis:

APAC Market Insights

By 2035, Asia Pacific butyl methacrylate market is poised to capture over 47.1% revenue share. The market dominance in the region is attributable to the rapid industrialization, particularly in nations such as China, India, and Japan. The need for butyl methacrylate has increased as a result of this industrial growth in numerous industries, including manufacturing, construction, and the automotive sector. Large-scale infrastructure projects that mostly use butyl methacrylate for coatings, adhesives, and specialty polymers are another factor driving the region's growth. Butyl methacrylate technologies are also adopted more widely across industries as a result of the rising focus on sustainability and energy efficiency.

Furthermore, with China’s ongoing urbanization and infrastructure development, there is a rising demand for paints, coatings, adhesives, and sealants, all of which utilize butyl methacrylate for its excellent weather resistance and flexibility. Additionally, the government’s support for domestic production and innovation in high-performance materials has led to increased investment in chemical manufacturing facilities. The European Chemical Industry Council revealed that the EU27's capital expenditures in 2023 were 53% higher than their pre-crisis levels from 2014 to 2019. Over the last ten years (2013–2023), chemical businesses have significantly expanded their capital investment by about 70%, with China accounting for roughly 47% of the total world investment. Also, the growth of the e-commerce and packaging industries further boosts demand for acrylic-based resins, where butyl methacrylate plays a key role.

Furthermore, in India, the growing middle-class population and disposable incomes are leading to increased demand for consumer goods and automobiles, further boosting the need for durable, weather-resistant coatings. The India Brand Equity Foundation (IBEF) indicated that the nation's disposable per capita income has been increasing over the last several years and is expected to continue rising. India's per capita disposable income increased from USD 2.11,000 in 2019 to USD 2.54,000 in 2023. By 2029, it's expected to reach USD 4,34,000.

India’s cost-effective manufacturing capabilities and improving regulatory environment are also attracting global chemical companies to invest and expand operations locally, thereby strengthening the domestic supply chain for butyl methacrylate.

North American Market Insights

North America butyl methacrylate market is expected to grow at a significant rate during the projected period. Due to their sophisticated industrial sectors and focus on low-VOC products, North America has the majority of the market. Furthermore, in the U.S., the automotive industry plays a significant role, as butyl methacrylate is used in high-performance paints and coatings that meet evolving environmental and aesthetic standards.

The Trading Economics reported that in March 2025, sales of light vehicles in the jumped to a seasonally adjusted yearly pace of 17.77 million units, the highest since March 2021 and significantly higher than the 15.8 million units sold in January and February combined. Therefore, this upsurge in sales is driving the demand for high-performance coatings in the automotive sector. Also, the expanding electronics manufacturing base in the country drives demand for specialty polymers and resins derived from butyl methacrylate.

Butyl Methacrylate Market Players:

- The Dow Chemical Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Evonik Industries AG

- Fushun Donglian Anxin Chemical Co., Ltd.

- Huayei Hefeng Chemical Specialties (Zibo) Co., Ltd.

- Kyoeisha Chemical Co., Ltd.

- LG MMA Corporation

- Shuzhou Hechuang Chemical Co., Ltd.

- Arkema SA

- Dhalop Chemicals

- Ashley Polymers

A number of large companies are fiercely competitive. Furthermore, a few powerful competitors currently control the majority of the market in terms of butyl methacrylate market share. These market-leading companies are broadening their clientele by entering new countries. Many businesses use strategic collaboration projects to boost their market share and profit margins. In order to expand their product capabilities, industry players are also acquiring start-ups that specialize in enterprise network equipment technologies.

Recent Developments

- In November 2023, OCI Global, the world's third-largest producer of nitrogen fertilizer and ammonia, is supplying bio-ammonia to Röhm, a leading methacrylate manufacturer, for the production of methyl methacrylate (MMA), an important precursor for PLEXIGLAS, the world's most popular acrylic glass brand.

- In September 2023, BASF expanded its bio-based monomer offering with a patented technology for producing 2-Octyl Acrylate (2-OA). The new product demonstrates BASF's strong commitment to innovation for a sustainable future, with 73% 14C-tracable bio-based content, according to ISO 16620. Aside from the standard bio-based 2-Octyl Acrylate, BASF introduced a new product called 2-Octyl Acrylate BMB ISCC Plus.

- Report ID: 7497

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Butyl Methacrylate Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.