Butyl Alcohol Market Outlook:

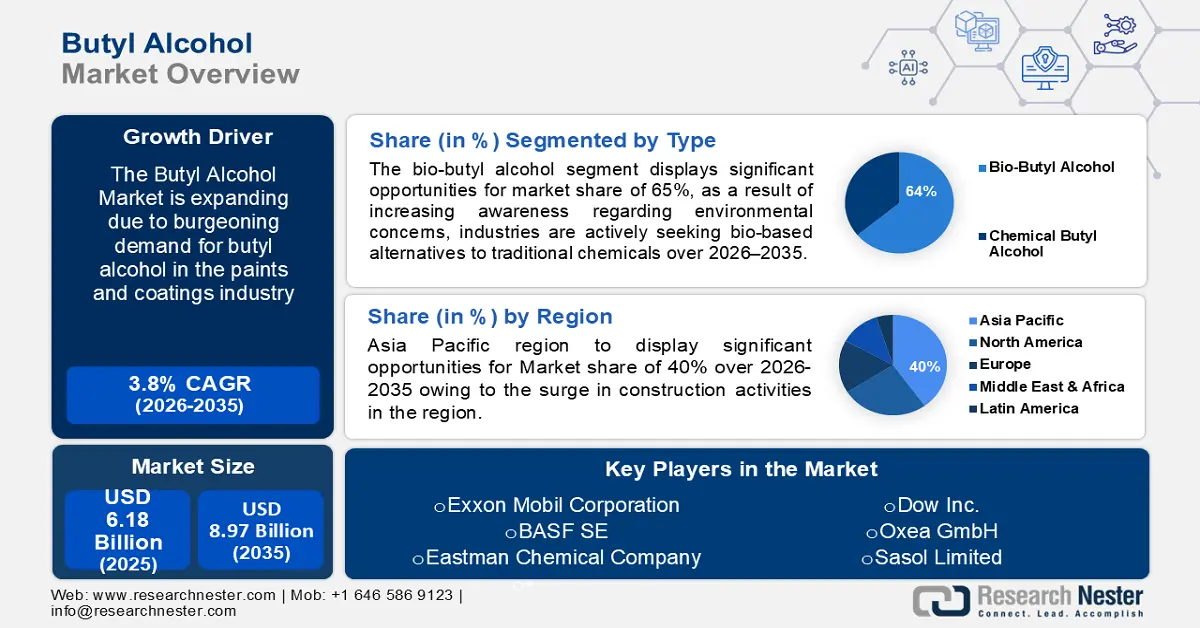

Butyl Alcohol Market size was valued at USD 6.18 billion in 2025 and is expected to reach USD 8.97 billion by 2035, registering around 3.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of butyl alcohol is evaluated at USD 6.39 billion.

The burgeoning demand for butyl alcohol in the paints and coatings industry stands out as a primary growth driver for the butyl alcohol market. As urbanization and industrialization continue to surge globally, the construction and automotive sectors, major consumers of paints and coatings, are experiencing substantial growth.

Butyl alcohol, specifically n-butanol and isobutanol, plays a pivotal role as a solvent in the formulation of these coatings, contributing to its heightened demand. The inherent properties of butyl alcohol, such as its solubility and compatibility with various resins, make it an indispensable component in the production of high-quality paints and coatings.

As infrastructure development and automotive manufacturing escalate, the need for durable, weather-resistant coatings grows, propelling the demand for butyl alcohol. Moreover, stringent environmental regulations emphasizing the use of eco-friendly solvents further elevate the significance of butyl alcohol, as it is considered a comparatively greener option within the solvent landscape. This aligns with the growing industry trend towards sustainable and environmentally responsible practices.

Key Butyl Alcohol Market Insights Summary:

Regional Highlights:

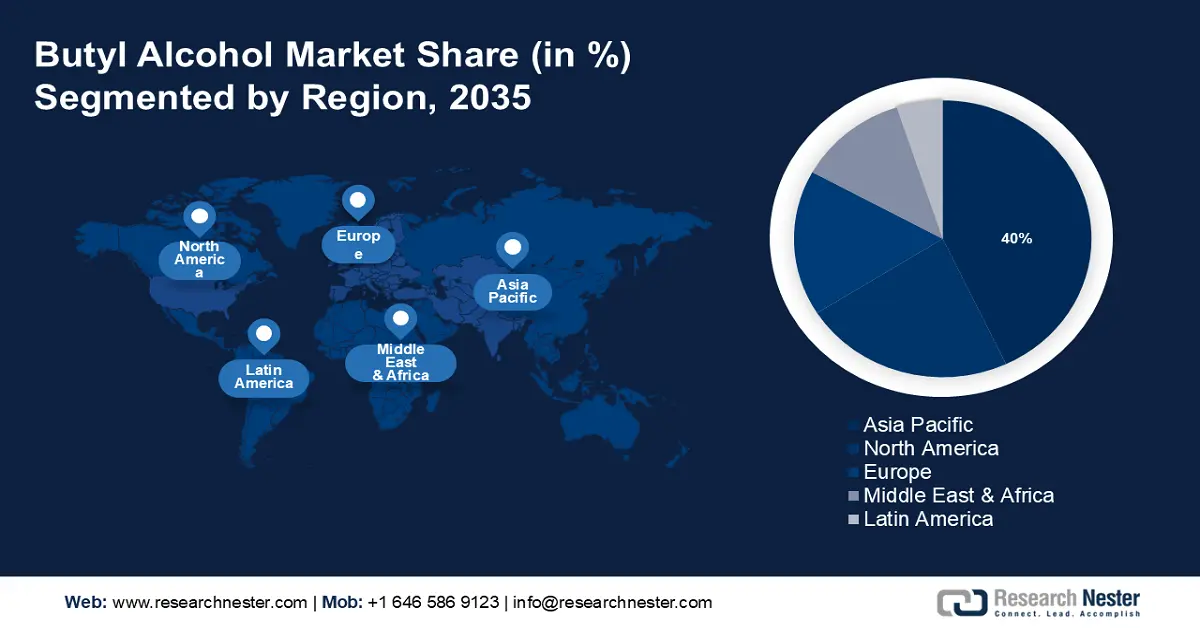

- Asia Pacific butyl alcohol market achieves a 40% share by 2035, driven by rapid urbanization and increased construction activities.

Segment Insights:

- The bio-butyl alcohol segment in the butyl alcohol market is forecasted to achieve a 64% share by 2035, propelled by rising environmental awareness and regulatory frameworks promoting bio-based chemical alternatives.

Key Growth Trends:

- Surging demand in the automotive industry

- Growing emphasis on eco-friendly solutions

Major Challenges:

- Competition from alternative solvents can pose a concern to the market.

- Global supply chain disruptions that have an impact on activity, trade, and prices impede butyl alcohol market growth

Key Players: BASF SE, The Dow Chemical Company, Eastman Chemical Company, Sasol Limited, Mitsubishi Chemical Corporation, Oxea GmbH (OQ Chemicals), LG Chem, Ltd., Elekeiroz S.A., China National Petroleum Corporation (CNPC), INEOS Group.

Global Butyl Alcohol Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.18 billion

- 2026 Market Size: USD 6.39 billion

- Projected Market Size: USD 8.97 billion by 2035

- Growth Forecasts: 3.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, South Korea

- Emerging Countries: China, India, Brazil, Mexico, Indonesia

Last updated on : 16 September, 2025

Butyl Alcohol Market Growth Drivers and Challenges:

Growth Drivers

- Surging demand in the automotive industry - The automotive sector relies heavily on butyl alcohol, particularly in the production of coatings, adhesives, and sealants. Butyl alcohol's application as a solvent in these formulations enhances their durability and performance. With an increasing number of vehicles being manufactured globally, the demand for butyl alcohol is poised to escalate further.

Moreover, the trend towards lightweight materials in the automotive industry, where butyl alcohol-based adhesives and sealants are integral, reinforces its role as a growth driver. As of 2021, the global automotive industry witnessed a steady rise, with approximately 77.8 million passenger cars sold worldwide, marking a notable recovery from the previous year's challenges. - Growing emphasis on eco-friendly solutions - The escalating awareness and emphasis on sustainability and environmental considerations represent a pivotal growth driver for the butyl alcohol market. Environmental regulations and consumer preferences are steering industries toward greener alternatives. Butyl alcohol is recognized for its relatively lower environmental impact compared to other solvents.

The increasing stringency of environmental regulations, such as restrictions on volatile organic compound (VOC) emissions, has heightened the demand for eco-friendly solvents like butyl alcohol. Industries are adopting sustainable practices, and butyl alcohol aligns with these initiatives due to its biodegradability and lower environmental impact. - Expanding construction sector in emerging markets - The burgeoning construction industry in emerging markets serves as a prominent growth driver for butyl alcohol. Emerging economies are witnessing rapid urbanization and infrastructure development, leading to an increased demand for construction materials and chemicals.

Butyl alcohol is extensively used in the construction sector for manufacturing coatings, sealants, and adhesives. The predicted surge in construction activities globally, especially in emerging butyl alcohol market, indicates a heightened requirement for these products, consequently driving the demand for butyl alcohol.

Challenges

- Raw material price volatility - The butyl alcohol production process relies on raw materials derived from petrochemical feedstocks. Fluctuations in crude oil prices directly impact the cost of these raw materials, leading to volatility in production costs for butyl alcohol. This poses a challenge for manufacturers in maintaining stable pricing and profit margins.

Environmental regulations aiming to reduce the emission of volatile organic compounds (VOCs) pose a challenge for the butyl alcohol market. Butyl alcohol, while considered relatively environmentally friendly, may still face scrutiny due to its VOC content. Compliance with increasingly strict regulations requires continuous innovation and investment in environmentally sustainable processes. - Competition from alternative solvents can pose a concern to the market.

- Global supply chain disruptions that have an impact on activity, trade, and prices impede butyl alcohol market growth

Butyl Alcohol Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

3.8% |

|

Base Year Market Size (2025) |

USD 6.18 billion |

|

Forecast Year Market Size (2035) |

USD 8.97 billion |

|

Regional Scope |

|

Butyl Alcohol Market Segmentation:

Type Segment Analysis

In butyl alcohol market, bio-butyl alcohol segment is poised to account for around 64% share by 2035. As awareness regarding environmental concerns continues to rise, industries are actively seeking bio-based alternatives to traditional chemicals. Bio-butyl alcohol, derived from renewable resources such as biomass or bio-based feedstocks, aligns with this sustainability trend. The steady growth in the adoption of bioenergy underscores the broader shift towards bio-based solutions, including bio-butyl alcohol, across various industries. According to a report by the International Energy Agency (IEA), the use of bioenergy increased by 40% from 2000 to 2019.

Regulatory frameworks promoting the use of bio-based chemicals create a conducive environment for the development and adoption of bio-butyl alcohol. Incentives, subsidies, and policy measures that encourage the transition towards bio-based alternatives provide a strong impetus for industries to invest in and adopt bio-butyl alcohol in their processes. The positive correlation between regulatory support and the growth of the bioeconomy underscores the significance of government initiatives in fostering the bio-butyl alcohol segment.

End User Segment Analysis

The pharmaceuticals segment in butyl alcohol market is expected to garner a significant share in the year 2035. As economies grow and populations expand, there is a corresponding increase in healthcare investments. Pharmaceutical products, including various medications, play a crucial role in healthcare delivery. The escalating healthcare spending globally indicates a growing demand for pharmaceuticals to address a wide range of medical conditions.

The pharmaceuticals segment benefits from this sustained financial commitment to healthcare infrastructure and services. As individuals age, there is a higher likelihood of developing chronic health conditions. The pharmaceutical industry plays a crucial role in providing medications to manage and treat these conditions, ranging from cardiovascular diseases to diabetes. The increasing incidence of chronic illnesses within an aging population contributes to sustained demand for pharmaceutical products, driving growth in the pharmaceuticals segment.

Our in-depth analysis of the global butyl alcohol market includes the following segments:

|

Type |

|

|

End User |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Butyl Alcohol Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is expected to hold largest revenue share of 40% by 2035. As countries in the Asia Pacific region undergo rapid urbanization, there is a surge in construction activities, including infrastructure development, residential buildings, and commercial spaces. Butyl alcohol, with its applications in coatings, sealants, and adhesives, has become indispensable in the construction industry.

The increasing urban population and the subsequent demand for infrastructure create a sustained need for butyl alcohol in the region. According to the Asian Development Outlook 2020 by the Asian Development Bank (ADB), Asia's urban population is expected to increase by 1.1 billion people by 2050. The push towards green chemistry aligns with the use of solvents like butyl alcohol, which is considered relatively eco-friendly. Government initiatives and stringent environmental regulations promoting the adoption of green and sustainable practices encourage industries to choose greener alternatives.

North American Market Insights

The butyl alcohol market in the North American region is projected to hold the second-largest share during the forecast period. The abundant availability of shale gas has led to a significant expansion of the petrochemical industry in North America. Butyl alcohol, a derivative of petrochemical feedstocks, benefits from the increased production capacity. The growth of the petrochemical sector in the region provides a stable and cost-effective source of raw materials for butyl alcohol production, driving the overall growth of the butyl alcohol market.

Butyl alcohol is widely used in coatings, adhesives, and sealants, making it essential for applications in the automotive and construction industries. The consistent growth in these sectors, driven by factors such as population expansion, infrastructure development, and urbanization, directly contributes to increased demand for butyl alcohol. The strong performance of these key end-use industries propels the overall growth of the butyl alcohol market in North America.

Butyl Alcohol Market Players:

- Exxon Mobil Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BASF SE

- Eastman Chemical Company

- Dow Inc.

- Oxea GmbH

- Sasol Limited

- Gevo Inc.

- INEOS Group Holdings S.A.

- Kyowa Hakko Bio Co., Ltd.

- Tokuyama Corporation

Recent Developments

- Gevo Inc. purchased the Butamax patent estate. This adds important patents to its portfolio for producing renewable isobutanol and derivative renewable fuel products.

- Exxon Mobil Corporation is expanding its biofuels production capacity to meet the growing demand for cleaner and renewable energy sources. This includes investing in facilities that convert plant-based materials into biofuels like biodiesel.

- Report ID: 5797

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Butyl Alcohol Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.