Business Process Outsourcing Market Outlook:

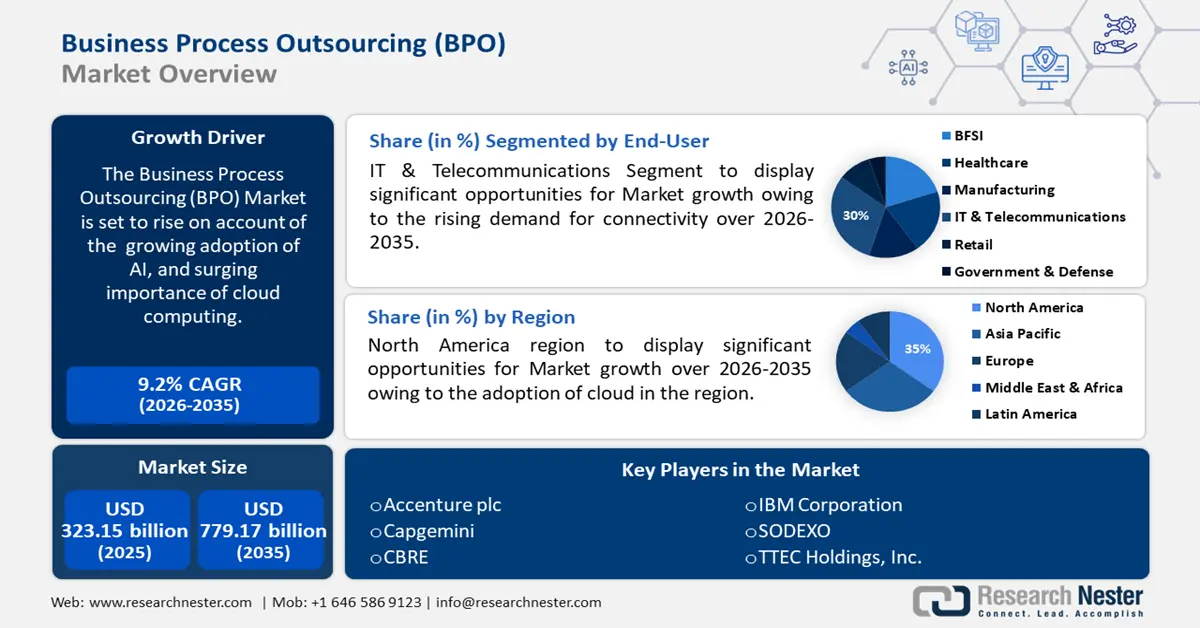

Business Process Outsourcing Market size was valued at USD 323.15 billion in 2025 and is expected to reach USD 779.17 billion by 2035, expanding at around 9.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of business process outsourcing is evaluated at USD 349.91 billion.

This growth in the market revenue is poised to be dominated by the growing adoption of AI in several nations. For instance, according to the UK government, over 15% of organizations in the UK will adopt AI technology by 2022 which equates to 432,000 companies. AI in BPO allows effective and precise data collection and analysis. Also, AI-powered technologies may gather, organize, and analyze enormous quantities of data. They give helpful insights for corporate projections, decision-making, and procedure improvement by identifying patterns and trends.

Key Business Process Outsourcing (BPO) Market Insights Summary:

Regional Highlights:

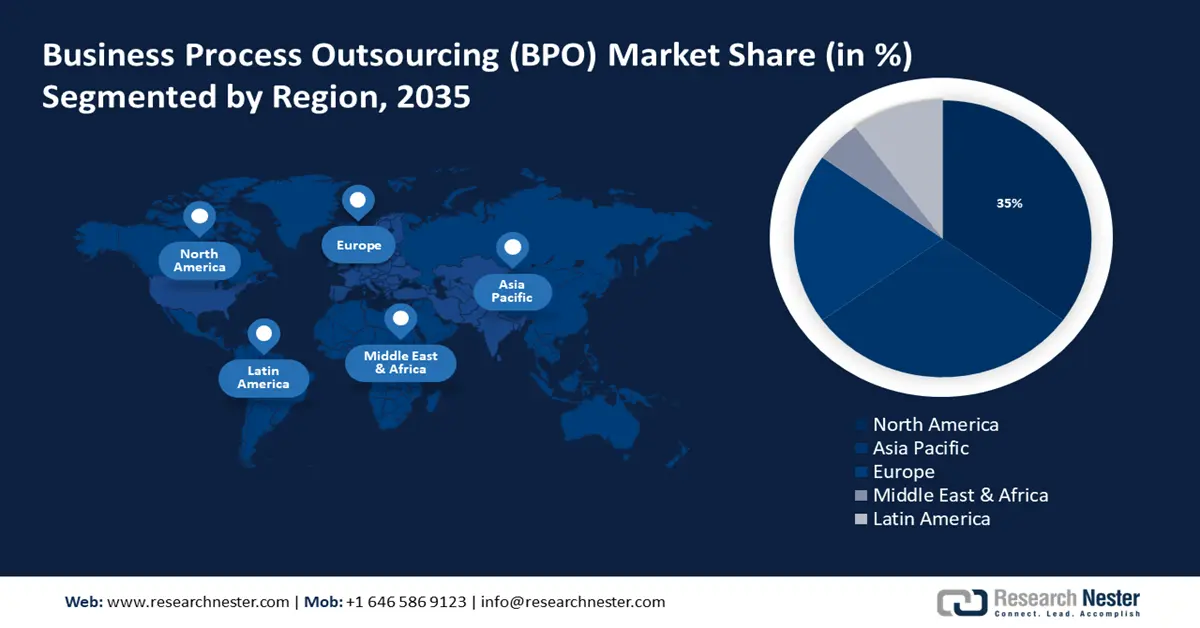

- North America business process outsourcing (bpo) market will hold more than 35% share by 2035, driven by growing adoption of public cloud and government cloud spending.

- Asia Pacific market will experience the fastest CAGR during 2026-2035, driven by rising disposable income and smartphone adoption.

Segment Insights:

- The it & telecommunications segment in the business process outsourcing market is expected to experience substantial growth till 2035, driven by the rising demand for connectivity and outsourced customer services.

- The finance & accounting segment in the business process outsourcing market is anticipated to experience notable CAGR through 2026-2035, driven by cost-saving and efficiency needs in standardized finance operations.

Key Growth Trends:

- Growing trend of robotic process automation (RPA)

- Growing focus toward enhanced efficiency, time effectiveness, and cost efficiency

Major Challenges:

- Surging concern for data security

- Lack of professional workforce

Key Players: Accenture plc, Capgemini, CBRE, Cognizant, Delta BPO Solutions, HCL Technologies Limited, TTEC Holdings, Inc.

Global Business Process Outsourcing (BPO) Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 323.15 billion

- 2026 Market Size: USD 349.91 billion

- Projected Market Size: USD 779.17 billion by 2035

- Growth Forecasts: 9.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: India, United States, Philippines, China, United Kingdom

- Emerging Countries: China, India, Japan, Singapore, South Korea

Last updated on : 17 September, 2025

Business Process Outsourcing Market Growth Drivers and Challenges:

Growth Drivers

-

Growing trend of robotic process automation (RPA) - By 2022, it is estimated that 85% of super huge and large organizations have deployed RPA across the globe, according to data published in 2024. Hence, the BPO is anticipated to be greatly affected by the adoption of RPA. When a robotic process automation program in BPO functions smoothly, it offers huge cost savings opportunities.

The time investment expected is not significant, therefore the need to employ new personnel or train them to do their jobs effectively is reduced. Another key benefit of employing RPA in BPO is the fact that it is scalable and versatile. Hiring more employees takes a period however with this technology, businesses may add or remove as many workers as they want without incurring additional fees. - Growing focus toward enhanced efficiency, time effectiveness, and cost efficiency - Business process outsourcing has grown into a popular and economical approach in the digital age of today. It additionally enables business owners to lessen the workload and concentrate on other critical parts of their operations. Moreover, significant investment has been made across the globe in digitalization which is also encouraging the BPO market growth.

For instance, The EU intends to invest USD 195 million in innovative digital technologies, the latest in an assortment of Horizon Europe Programme proposals to stimulate joint research and development across the Union. Developed countries, particularly Japan, the United Kingdom, and the United States, consistently prefer to outsource their commercial processes. To prosper in the era of the digital revolution, businesses need to transition from traditional business process services (BPS) to technical features that include business processes as a service.

- Growing importance of cloud computing - Business process outsourcing (BPO) providers are now offering a cloud computing solution termed Business Process-as-a-solution (BPaaS), which uses computing technology to offer an adaptable means to perform IT-intensive business processes. The integration of cloud computing and BPO offers several benefits to both clients and suppliers.

Challenges

- Surging concern for data security - Data security has become more crucial than ever before, and numerous individuals are concerned with how BPO businesses handle it. While business process outsourcing is becoming more popular, several organizations are concerned that interacting with a third-party BPO vendor may jeopardize their data security.

- Lack of professional workforce - Most business process outsourcing (BPO) organizations face attrition and a lack of competent experts as a few of their most significant difficulties. Attrition in the business process outsourcing (BPO) market has devastating consequences for the organization. High attrition costs significantly increase the organization's costs.

The more individuals leave an organization or corporation, the more assets become depleted, including recruitment costs, training, orientation fees, and time. The high attrition rate decreases the organization's productivity. - High price of the software

Business Process Outsourcing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.2% |

|

Base Year Market Size (2025) |

USD 323.15 billion |

|

Forecast Year Market Size (2035) |

USD 779.17 billion |

|

Regional Scope |

|

Business Process Outsourcing Market Segmentation:

Service Type

Through 2035, customer services segment in the business process outsourcing market is expected to register lucrative growth. The main aim of customer service is to satisfy the customer's needs and maintain their loyalty. Moreover, growth in a number of people using digital channels such as social media is also foreseen to influence the segment growth. Between April 2022 and April 2023, there were approximately 149 million new social media users. Hence, this has influenced the scope of customer services.

Moreover, the finance & accounting segment is also projected to have notable growth by 2035. Clients employ F&A outsourcing services to help them save money, simplify processes, and satisfy regulatory requirements. Complex procedures in the finance and accounting sector, which include external reporting, budgeting, accounting, organizing, and projections, continue to be outsourced as these operations become more standardized.

End-User

IT & telecommunications segment is projected to account for around 30% business process outsourcing market share by 2035. The major element to dominates the segment expansion is the rising demand for connectivity. Data released by the International Telecommunication Union (ITU) in 2021 reveal a significant rise in Internet utilization, with the anticipated number of individuals who used the Internet rising to 4.9 billion in 2021, in contrast to over 4.1 billion in 2019.

On account of this factor, the IT & telecommunications industry is expanding further driving the growth of the business process outsourcing market. This is because they notably outsource call center services along with billing operators to connect with the customers regarding new offers and updates regarding services.

Enterprise Size

The large enterprise segment is evaluated to grow at a significant pace during the forecast period. Large organizations frequently operate complex, diverse operations across multiple regions, requesting a wide range of assistance to preserve efficiency and competitiveness. Due to their huge scale, even minor efficiencies obtained through outsourcing may result in substantial savings in costs and operational advantages.

Additionally, major organizations frequently possess adequate funds to invest in outsourcing to enhance and concentrate on core skills, promote innovation, and achieve scalability. This renders BPO services especially appealing to multinational corporations looking to increase their global competitiveness.

Our in-depth analysis of the business process outsourcing market includes the following segments:

|

Service Type |

|

|

Deployment |

|

|

Enterprise Size |

|

|

End-User |

|

|

Location |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Business Process Outsourcing Market Regional Analysis:

North American Market Insights

North America industry is poised to account for largest revenue share of 35% by 2035. The main element to dominate the BPO market expansion in this region is the growing adoption of public cloud, and also, the spending by the government on the cloud is surging. For instance, it is predicted that federal agencies in the US are projected to invest about USD 10 billion in cloud services in 2022. This indicates a rise of over 33% compared to the previous year.

Additionally, in the US business process outsourcing (BPO) market is expected to have notable growth in this region owing to the growing number of startups.

Moreover, the Canadian market is also set to rise in this region on account of the growing digitalization of healthcare which is additionally boosting the adoption of BPO.

Asia Pacific Market Insights

Business process outsourcing market for Asia Pacific region is projected to witness fastest CAGR till 2035. This growth of the market in this region is poised to be encouraged by the growing adoption of smartphones owing to rising disposable income. As per the predictions by EIA, the disposable income is set to rise by USD 20512 by 2050 in contrast to the year 2022, which determines a rise of about 3.3% between the year 2022 to 2050.

Furthermore, the China BPO market is set to observe the highest growth in the Asia Pacific region owing to the rise in foreign travelers who are further boosting the need for several services.

Moreover, the market in India is also estimated to rise along with other nations owing to the rising number of e-commerce platforms.

Additionally, the shortage of workers on account of the surging geriatric population in Japan is poised to boost the market for business process outsourcing (BPO).

Business Process Outsourcing Market Players:

- Accenture plc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Capgemini

- CBRE

- Cognizant

- Delta BPO Solutions

- Go4Customer

- HCL Technologies Limited

- IBM Corporation

- SODEXO

- TTEC Holdings, Inc.

The business process outsourcing market consists of several key players who are launching various initiatives to promote their services in the market. Some of them include:

Recent Developments

- May 28, 2024: Accenture announced the acquisition of Customer Management IT and SirfinPA, a pair of jointly-owned Italian consultancies that function in close synergy and provide advanced services and technology solutions for public safety, and justice sectors.

- April 23, 2024: TTEC Holdings, Inc. and Bright Software, Inc., to dramatically improve contact center associate performance and engagement announced a strategic alliance.

- May 8, 2024: Amdocs announced that Paramount Global has selected Vubiquity, an Amdocs company, to assume all operational activities and management under a new licensing agreement of affiliates for MTV in Japan.

- June 4, 2024: Infosys announced a collaboration with Nihon Chouzai (TSE), to expand healthcare access in Japan with advanced online medication guidance services and payment solutions.

- Report ID: 6153

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Business Process Outsourcing (BPO) Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.