Bunker Fuel Market Outlook:

Bunker Fuel Market size was valued at USD 139.32 billion in 2025 and is expected to reach USD 206.23 billion by 2035, expanding at around 4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of bunker fuel is evaluated at USD 144.34 billion.

The rising global shipping trade activities are anticipated to positively influence bunker fuel sales in the coming years. The rapid expansion of the e-commerce sector owing to digital marketing trends is pushing the demand for shipping services, which directly is propelling the consumption of bunker fuel. The growth in the international shipping volumes is boosting the bunker fuel consumption to power vessels. According to a study by UN Trade and Organization (UNCTAD) Liberia (378,346), Panama (365,096), Marshall Islands (299,170), China Hong Kong SAR (200,075), and Singapore (134,985) were some of the top countries with largest fleet in 2023. The huge number of vessels in these countries are representing a hike in shipping trade activities.

The International Chamber of Shipping (ICS) states that in the world trade international shipping accounts for 90.0% of carriage activities. The U.S. Energy Information Administration (EIA) estimates that Singapore with the biggest bunkering fuel port in the world is substantially backing the sales of bunker fuels. This is majorly due to numerous tankers, vessels, and cargo ships preferring long routes to avoid the Red Sea. The bunker fuel demand increased year over year between December 2023 and Q1’24. The consistent growth and positive trend activities in maritime trade are expected to propel the overall bunker fuel market growth during the foreseeable period.

|

Bunker Sales Breakdown (‘000 Tonnes) |

January 2025 |

|

Total Bunker Sales |

4,462 |

|

Conventional Fuel Sales |

4,347 |

|

Biofuel Sales |

108 |

|

LNG Sales |

7 |

Source: Maritime and Port Authority of Singapore

Key Bunker Fuel Market Insights Summary:

Regional Highlights:

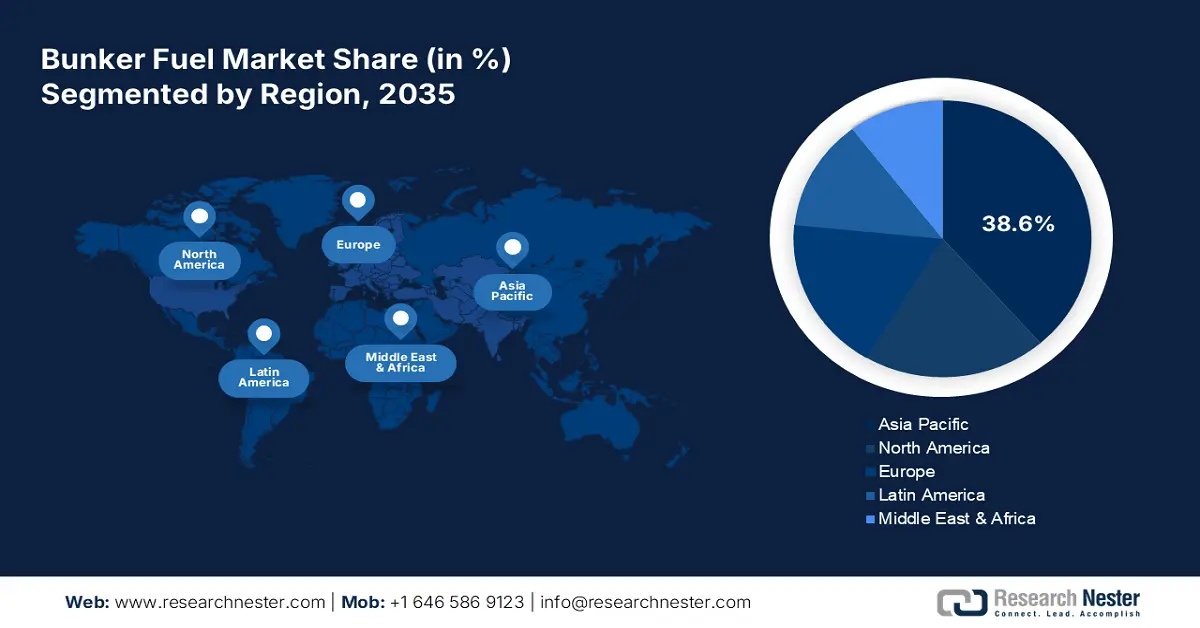

- Asia Pacific commands a 38.6% share in the Bunker Fuel Market, driven by high investments in port infrastructure development and rising maritime trade activities, fostering growth through 2035.

- North America's Bunker Fuel Market is expected to grow rapidly by 2035, attributed to continuous technological innovations and favorable investments.

Segment Insights:

- The Oil Majors Segment is projected to achieve a 38.7% share by 2035, fueled by their large-scale operations and competitive pricing in fuel supply chains.

- Low Sulfur Fuel Oil segment is expected to capture a 63% share by 2035, driven by strict emission regulations by the International Maritime Organization (IMO).

Key Growth Trends:

- Zero-carbon bunker fuels gaining traction

- LNG an opportunistic trade

Major Challenges:

- The fluctuations in oil prices are a prime challenge

- Environmental concerns surrounding biofuel and LNG

- Key Players: JuWonOil LLC, Bunker One, Chemoil Energy Limited, Aegean Marine Petroleum Network, Inc., and World Fuel Services Corporation.

Global Bunker Fuel Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 139.32 billion

- 2026 Market Size: USD 144.34 billion

- Projected Market Size: USD 206.23 billion by 2035

- Growth Forecasts: 4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (38.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, Singapore, United States, Japan, Netherlands

- Emerging Countries: China, Japan, South Korea, India, Singapore

Last updated on : 13 August, 2025

Bunker Fuel Market Growth Drivers and Challenges:

Growth Drivers

-

Zero-carbon bunker fuels gaining traction: The climatic commitments and strict environmental regulations are promoting the demand for zero-carbon bunker fuels. The World Bank Group states that the energy transition trend in the shipping and maritime industry is creating a favorable environment for carbon-neutral or zero-carbon bunker fuel producers. The new generation of alternative fuels such as blue ammonia and biofuels is poised to dominate over heavy fuel oil or fossil bunker fuels in the years ahead. For instance, the International Energy Administration (IEA) estimates that the global biofuel demand is expected to increase by 38 billion liters between 2023 to 2028, representing a 30.0% hike compared to the past half-decade. The ethanol and renewable diesel are foreseen to capture 2/3rd of the total biofuel demand by 2028.

- LNG an opportunistic trade: The rising popularity of LNG as a marine fuel is expected to double the revenues of bunker fuel producers. These fuels are emerging as a long-term solution to mitigate the carbon footprint of the maritime industry. The growing establishments of LNG bunkering infrastructure across key ports are set to drive their sales at a global scale. For instance, the Institute for Energy Economics and Financial Analysis (IEEFA) states that South Korea, Japan, and Europe capture over half of the worldwide LNG demand. By 2028, the global capacity of LNG is estimated to increase to 666.5 MTPA (millions of tonnes per annum). Furthermore, the study by the U.S. EIA highlights that the global trade of LNG surpassed 3.1% to 52.9 billion cubic feet per day (Bcf/d) in 2023.

Challenges

-

The fluctuations in oil prices are a prime challenge: The bunker fuel market is highly influenced by global oil prices and happenings, and the negative developments often hinder the financial stability of ship operators. The fluctuations in oil prices lead to high operational costs, challenging the profitability of shipping companies and limiting the sales of bunker fuel. Competitive pricing is one of the marketing strategies that aid bunker fuel market players in combating loss.

- Environmental concerns surrounding biofuel and LNG: Even though LNG is considered cleaner than traditional marine fuel it promotes methane emissions, a potent greenhouse gas. Similarly, the sustainability of biofuel is questioned particularly regarding their land use impact and competition with food production and their prices. These concerns have the potential to lower the adoption of LNG and biofuels and hamper the overall revenue growth of key players.

Bunker Fuel Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4% |

|

Base Year Market Size (2025) |

USD 139.32 billion |

|

Forecast Year Market Size (2035) |

USD 206.23 billion |

|

Regional Scope |

|

Bunker Fuel Market Segmentation:

Type (High Sulfur Fuel Oil, Low Sulfur Fuel Oil, Marine Gas Oil, Others)

Low sulfur fuel oil segment is projected to dominate bunker fuel market share of around 63% by the end of 2035. The strict emission regulations by the International Maritime Organization (IMO) are influencing bunker fuel sales in the shipping industry. The sulfur content mandates by IMO are driving the end users' attention toward low sulfur fuel oil consumption. The economic incentive and cost considerations are also prime factors driving the low sulfur fuel oil trade. According to market data from sources such as Ship & Bunker and S&P Global Platts, the average monthly price of very low sulfur fuel oil (VLSFO) stood at around USD 665 per metric ton in March 2024.

Commercial Distributors (Oil Majors, Large Independent Distributors, Small Independent Distributors)

In bunker fuel market, oil majors segment is estimated to hold revenue share of over 38.7% by the end of 2035. The strong existence of oil majors is primarily contributing to their dominance in the market. The large-scale operations of oil majors assist them in producing bunker fuels at reasonable prices, which further provides them a competitive edge over small companies. The availability of advanced infrastructure and refining capabilities to meet increasing demand are further assisting oil majors to attain top positions in a competitive landscape. The strong supply chain network, financial strength, and investment capacity are aiding oil majors in long-term gains.

Our in-depth analysis of the global bunker fuel market includes the following segments:

|

Type |

|

|

Commercial Distributors |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Bunker Fuel Market Regional Analysis:

Asia Pacific Market Forecast

Asia Pacific bunker fuel market is likely to hold more than 38.6% revenue share by 2035. The high investments in port infrastructure development aimed at enhanced fuel storage and transport are driving the market growth. The rising maritime trade activities are also propelling the sales of bunker fuels. The growth in the LNG demand and production capacities are generating profitable opportunities for bunker fuel manufacturers. The strong presence of maritime countries such as India, China, Japan, South Korea, and Singapore is further backing the sales of bunker fuels.

China’s carbon-neutrality goals are set to promote sales of bio-based or zero-carbon bunker fuels. The robust rise in the e-commerce trade leading to shipping services is further increasing the demand for bunker fuels. For instance, in November 2024, Maersk A/S announced that it converted its large container vessel to a dual-fuel methanol engine. This move was inspired by the company to meet the climatic goals and mitigate its carbon footprint.

India is the most opportunistic marketplace for bunker fuel manufacturers owing to supportive government policies and investments. The energy transition trends, rising shipping trade activities, and investments in port infrastructure developments are propelling bunker fuel sales. The country’s coastline over 7,516.6 km long and with 200 ports is directly driving the sales of bunker fuels. The majority of ships pass through Indian territorial waters, which boosts the bunker fuel trade activities.

North America Market Statistics

The North America bunker fuel market is foreseen to rise at the fastest pace during the assessed period. Continuous technological innovations and favorable investments are increasing the consumption of bunker fuels in the region. North America is particularly a key area for the trade of goods and commodities owing crucial marine corridor. The high visits of cargo ships are directly boosting the consumption of bunker fuels. The sustainability trend and zero emission goals are further set to augment the demand for carbon-neutral bunker fuels.

The U.S. government’s growing focus on the mitigation of carbon emissions and increasing investments in clean fuels are expected to propel the demand for zero-carbon fuels in the shipping and aerospace sectors. The continuous innovations in carbon-neutral fuel production are anticipated to uplift the revenues of bio-fuel and renewable oil fuel producers. For instance, the report by Growth Energy estimates that the country is the topmost manufacturer of bioethanol at the global level and consumes nearly 500 million bushels of corn annually for 15.0 billion gallons of bioethanol generation.

In Canada, the strong presence of key firms and advanced port infrastructure is propelling bunker fuel trade activities. Furthermore, the strict regulations on carbon emissions are pushing the consumption of zero-carbon bunker fuels. For instance, in July 2024, the Minister of Transport announced a domestic ban on the use and carriage of heavy fuel oil in the Arctic waters, while double-hulled ships are exempted from this ban till July 2029. Such moves are opening lucrative opportunities for bio-based and clean energy fuel producers.

Key Bunker Fuel Market Players:

- JuWonOil LLC

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Bunker One

- Chemoil Energy Limited

- Aegean Marine Petroleum Network, Inc.

- World Fuel Services Corporation

- Gulf Agency Company Ltd.

- Gazpromneft Marine Bunker LLC

- BP Marine Ltd.

- Exxon Mobil Corporation

- Royal Dutch Shell Plc

- Bunker Holding A/S

- BP Plc

- Sinopec Group

- Chevron Corporation

- Titan LNG

The bunker fuel market is mainly characterized by the presence of industry giants owing to hefty investments in production, storage, and transport infrastructure. The key players are employing several organic and inorganic market strategies such as innovations, new product launches, collaborations and partnerships, mergers and acquisitions, and regional expansions to earn high profits and maximize their sales. Expansion in the clean fuel production segment is foreseen to uplift the bunker fuel market shares of leading companies in the coming years.

Some of the key players include:

Recent Developments

- In October 2024, Bunker One announced that it is set to launch LNG bunker supply in Northwestern Europe by January 2025. The company is expanding its current fuels portfolio by adding physical LNG and mass-balanced LBM (Liquefied Bio Methane).

- In September 2024, JuWonOil LLC announced the expansion of its operations in marine lubricants across the ports and anchorages of Texas. This firm is an exclusive distributor of Q8 marine lubricants in Texas.

- Report ID: 7198

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Bunker Fuel Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.