Building Technology Market Outlook:

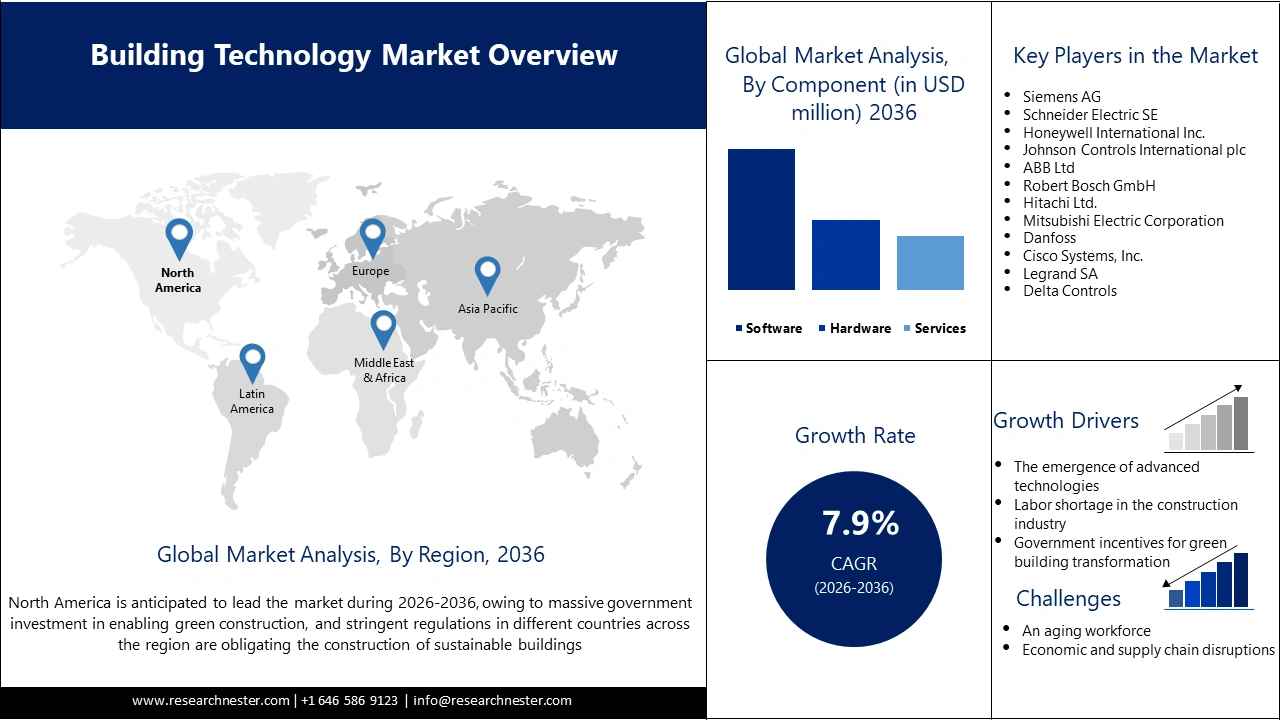

Building Technology Market size was valued at USD 152.1 billion in 2025 and is expected to reach USD 325.3 billion by the end of 2036, registering a CAGR of 7.9% during the forecast period, i.e., 2026-2036. In 2026, the industry size of building technology is assessed at USD 164.2 billion.

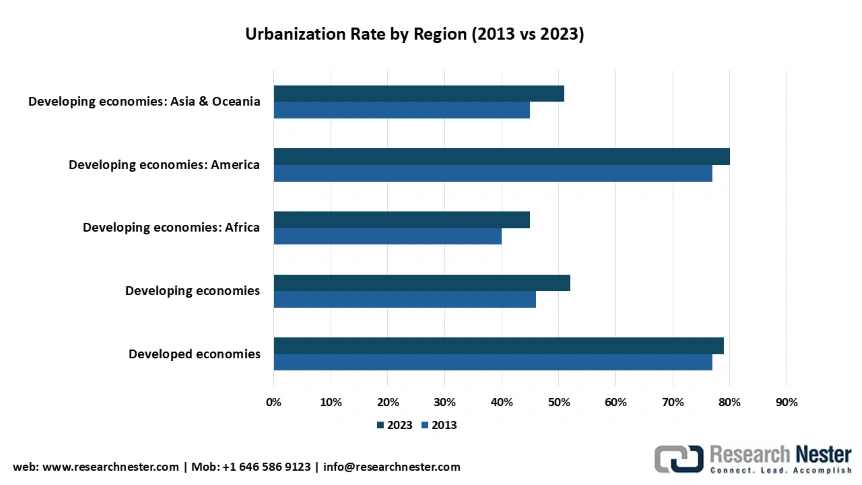

Rapid urbanization globally is expected to fuel the market growth during the forecast period. With rapid urbanization, the demand for different building technologies, such as building management systems (BMS), energy management systems (EMS), IoT, AI, sensors, and others, is expected to increase. As per the World Bank Group, over half of the global population, which accounts for more than 4 billion people, is living in urban areas of cities. The trend is likely to increase to 68% by 2050, as per the report by the United Nations. Moreover, urbanization is occurring at the fastest rate in many developing economies, which is expected to accelerate the use of different building technologies.

Source: UNCTAD

Stringent environmental regulations that encourage energy efficiency in construction are also fueling the demand for advanced building technologies. Especially, the use of energy-efficient building technologies like high-performance insulation that includes rigid foam boards, spray foam, and cellulose, is likely to increase with the regulatory push to make buildings increasingly energy-efficient. As reported by the European Investment Bank in June 2025, governments and companies have started to use AI-incorporated technologies with the motive of increasing efficiency in accomplishing tasks related to energy-saving in constructions, including homes and offices.

Key Building Technology Market Insights Summary:

Regional Highlights:

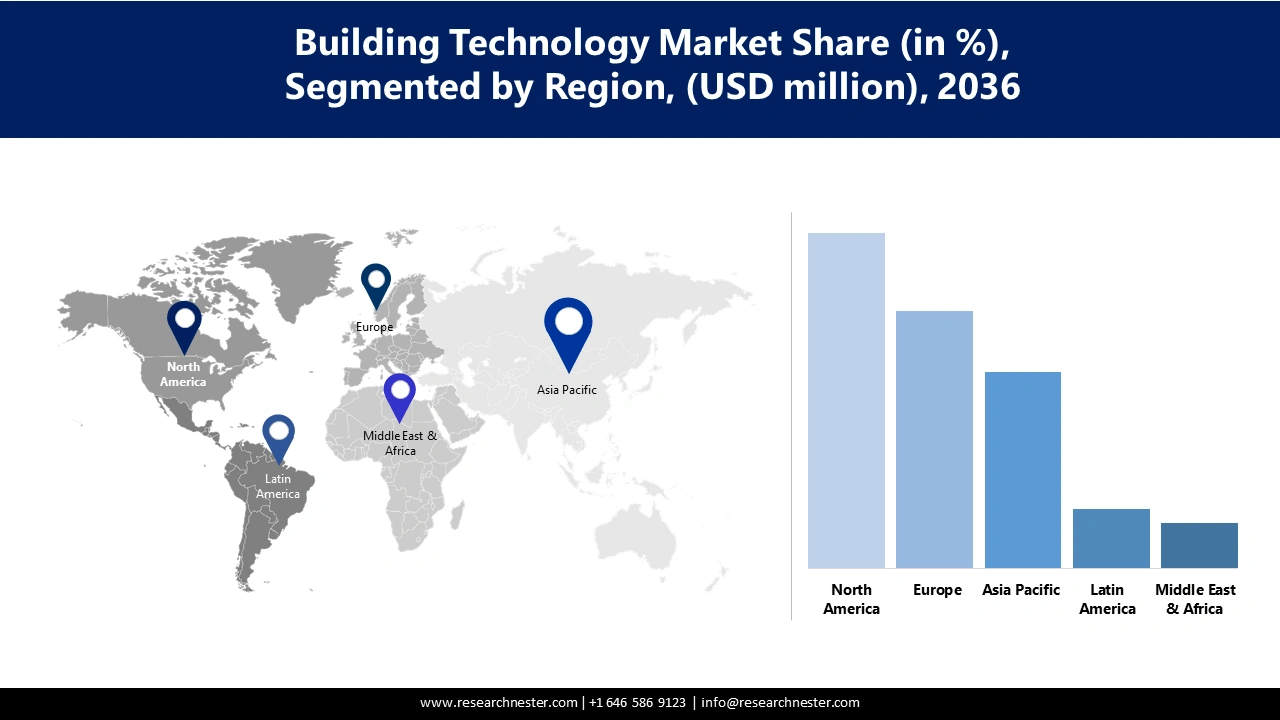

- The North America region in the building technology market is projected to command a 38.2% share by 2036, stimulated by large-scale government investments in green construction and the implementation of stringent regulations promoting sustainable building practices.

- Europe is anticipated to achieve a remarkable revenue share by 2036, fostered by zero-emission building mandates under the revised EPBD (EU/2024/1275) and the compulsory adoption of BIM in public construction projects.

Segment Insights:

- The building segment in the building technology market is forecasted to secure a significant share by 2036, propelled by the growing demand for energy-efficient infrastructure and the adoption of advanced technologies such as AI, IoT, and BIM.

- The building management system (BMS) segment is expected to attain a notable revenue share by 2036, driven by the expanding integration of smart sensors and automated systems for optimized energy management and building operations.

Key Growth Trends:

- The emergence of advanced technologies

- Labor shortage in the construction industry

Major Challenges:

- Economic and supply chain disruptions

Key Players:Siemens AG, Schneider Electric SE, Honeywell International Inc., Johnson Controls International plc, ABB Ltd, Robert Bosch GmbH, Hitachi Ltd., Mitsubishi Electric Corporation, Danfoss, Cisco Systems, Inc., Legrand SA, Delta Controls, Lutron Electronics Co., Inc., Acuity Brands, Inc., Eaton Corporation

Global Building Technology Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 152.1 billion

- 2026 Market Size: USD 164.2 billion

- Projected Market Size: USD 325.3 billion by 2036

- Growth Forecasts: 7.9% CAGR (2026-2036)

Key Regional Dynamics:

- Largest Region: North America (38.2% Share by 2036)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, United Kingdom, Japan

- Emerging Countries: India, South Korea, Indonesia, Brazil, United Arab Emirates

Last updated on : 29 September, 2025

Building Technology Market - Growth Drivers and Challenges

Growth Drivers

- The emergence of advanced technologies: The emergence of advanced building technologies that are AI-incorporated BMS, digital twins, IoT, 5G, and mobile and cloud-based platforms is expected to fuel building technology market growth during the forecast period. With the development of these building technologies, consumers are increasingly drawn to using data-driven insights, performing predictive maintenance, and generating user-centric solutions in building management. Companies are also investing in the development of building technologies aided by modern accessories. For instance, in November 2024, Johnson Controls announced the capability expansion of its OpenBlue Enterprise Manager suite of digital solutions. The building technology was incorporated with customer-facing generative AI applications that can help enable more autonomous building controls.

- Labor shortage in the construction industry: The labor shortage in the global construction industry has become a significant matter of concern. As reported by the International Code Council in June 2024, the count of vacant jobs in the construction industry in the U.S. averaged between 300,000 to 400,000 per month. This is expected to increase the inclination towards automated building technologies, robotics, prefabrication, and digital construction technologies to keep construction productivity in balance, reduce dependency on manual tasks, and increase construction efficiency.

- Government incentives for green building transformation: Governments across different countries are raising financial and non-financial incentives to support people in transforming their constructions into sustainable buildings. Such a trend is noticed in the developing economies as well. As per the report by the Green Business Certification Inc., published in February 2023, the government of India offers numerous incentives, including tax benefits, loans, public procurement, state-level incentives, fast-track approvals, and others, to promote green building and LEED certification. As a result, accessing financial and non-financial support in the adoption and utilization of green building technologies is likely to be easier for people.

Challenges

-

Economic and supply chain disruptions: Economic and supply chain disruptions that can be driven by geopolitical tensions and others are expected to hamper the growth of the market. An economic downturn in the near future can reduce the income level of people, and as a result, affording advanced building technologies can be challenging, hindering the rate of adoption. Similarly, with disruptions in the supply chains of materials integral to the production of different building technologies, production delays can take place, and this can reduce the market accessibility of building technologies.

Building Technology Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.9% |

|

Base Year Market Size (2025) |

USD 152.1 billion |

|

Forecast Year Market Size (2035) |

USD 325.3 billion |

|

Regional Scope |

|

Building Technology Market Segmentation:

Component Segment Analysis

The building segment is expected to account for a significant market share by the end of 2036, owing to the growing need to increase energy efficiency in buildings. The rapid development of building technologies, such as AI, IoT, Building Information Modeling (BIM), cloud-based construction software, and others, is influencing the dominance of the segment in the near future. For example, in November 2024, Trimble unveiled the free version of Trimble ProjectSight. This version of the software technology is incorporated with AI and advanced tools, allowing contractors to remain connected to data and the construction workflow.

Solution Type Segment Analysis

The building management system (BMS) is anticipated to acquire a remarkable revenue share by the end of 2036, owing rising demand for energy-efficient buildings. Building management systems are nowadays incorporated with smart sensors and integrated control mechanisms that enable automated monitoring and control over different elements of building operations, including cooling, heating, lighting, and others. The involvement of companies in carrying out advancements of the BMS also indicates the future domination of the segment. For example, in December 2024, Siemens highlighted the sustainability of its building management systems, including Gridscale X, Electrification X, and Building X. The company revealed that the BMSs were extremely helpful in grid decarbonization, energy management, and optimization of buildings.

End Use Segment Analysis

The commercial building segment that includes offices, retail stores, healthcare organizations, and others, is projected to garner a market share of 68.3% by the end of 2036, on account of rapid industrialization across developing economies. The engagement of the government of India in growing investments in industrialization across the country is a significant example of government support for rapid industrialization in developing economies. As reported by the Press Information Bureau in March 2025, through initiatives such as the National Industrial Corridor Programme, Start-up India, Make in India, and others, the government is trying to make industrialization rapid. The regulatory pressure for commercial buildings to be energy-efficient is also expected to increase the adoption of green building technologies.

Our in-depth analysis of the market includes the following segments:

|

Segments |

Subsegments |

|

Component |

|

|

Solution type |

|

|

Deployment |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Building Technology Market - Regional Analysis

North America Market Insights

The North America building technology market is projected to acquire a market share of 38.2% by the end of 2036, due to massive government investments in green construction. As reported by the U.S. Department of the Treasury in January 2025, the government announced a tax credit allocation of USD 6 billion in the advanced energy projects encompassing energy efficiency in the construction sector. This is expected to make funding for the adoption of green building technologies more accessible. In addition, stringent regulations in different countries across the region are obligating the construction of sustainable buildings, increasing the likelihood of rising adoption of advanced building technologies.

The building technology market in the U.S. is expected to witness a rapid CAGR from 2026 to 2036, owing to the rapid development of AI and IoT technologies, influencing the emergence of smarter building technologies. Companies based in the U.S. are also consistent in investment for the development of modern building technologies, contributing to increasing industrial sustainability. For instance, in February 2024, Higharc announced Series B funding of USD 53 million for the development of its cloud-based connected home building platform. The business aimed to boost the market growth and expand the automated features of the platform.

Canada building technology market is anticipated to grow exponentially during the forecast period, on account of the net-zero emissions targets of the government. The government is taking several initiatives to boost the construction of carbon-neutral buildings, contributing to increasing the adoption of green building technologies. As revealed by the Natural Resources Canada (NRCan), the government raised funds of more than USD 15 billion as of 2024 to help the population upgrade their homes and reduce energy bills. The following table represents several new housing, sustainable, and retrofit initiatives and budget allocations by government.

New Green Building, Housing, and Retrofit Initiatives- Canada Budget 2024

|

Theme |

Initiative / Program |

Description / Budget Allocation |

|

Accelerate Retrofits |

Canada Greener Homes Affordability Program (CGHAP) |

$800M retrofit program to support low- to median-income Canadians upgrading their homes. |

|

Greening Government Strategy |

Crown corporations are now expected to align with or adopt equivalent commitments in significant areas of operations. |

|

|

Build Green and Affordable from the Start |

Rapid Housing Stream (Affordable Housing Fund) |

$976M in Budget 2024 for a new Rapid Housing Stream. |

|

Canada Housing Infrastructure Fund |

$6B in Budget 2024 to construct/upgrade housing-enabling infrastructure; enable new housing supply; improve densification. |

|

|

Apartment Construction Loan Program |

$15 Billion in Budget 2024 (new loan funding), bringing total program funding to $55B. |

|

|

Support Indigenous and Local Solutions |

First Nations Climate Resiliency |

$145.2 Million in Budget 2024 to develop climate resiliency and structural mitigation strategies. |

|

Next Generation Manufacturing Canada (NGen) |

$50 Million in Budget 2024 for Homebuilding Technology & Innovation Fund. |

|

|

Regional Development Agencies |

$50 Million to support local innovative housing solutions nationwide. |

|

|

Shape the Building Sector of the Future |

Energy Efficiency Act Modernization |

Update legislative tools to reflect modern online retail and energy-using products. |

|

National Labelling Approach |

$30 Million in Budget 2024 to develop a Framework for nationally consistent home labelling. |

|

|

‘Buy Clean’ Policy |

Leverage federal procurement and investment to promote the use of low/no-carbon construction materials/designs. |

|

|

Energy Efficiency Regulations Amendments |

Between 2024 and 2026: new amendments, including Amendment 18- cover addition of energy efficiency standards/testing for appliances and energy-using products. |

Source: Government of Canada

Europe Market Insights

Europe is expected to emerge as a highly profitable building technology market, acquiring a remarkable revenue share by the end of 2036, on account of the sustainability mandates for the construction sector. The revision of the EPBD (EU/2024/1275), which was effective from May 2024, obligated all the newly buildings to be constructed to meet zero emissions building standards by 2030. Existing buildings were also mandated for renovations to meet the zero-emissions standards. These mandates are likely to fuel the adoption of building technologies that can be helpful in achieving carbon neutrality. In addition, the necessity of using BIM in public construction projects imposed by the EU member states is expected to increase the use of building technologies.

Germany market is projected to undergo a robust expansion during the forecast period, as a consequence of stringent regulatory pressure to make constructions optimally sustainable. As reported by the International Energy Agency in May 2023, amendments to the Building Energy Act were approved by the Federal Government to promote the reduction of renewable energy by at least 65% in new heating systems. As a result, the demand for building technologies, such as air-source and geothermal heat pumps, is expected to increase. Increasing involvement of companies based in Germany in the production of building technologies is also expected to boost the market growth significantly.

The UK building technology market is poised to expand steadily during the forecast period, as a consequence of the government mandates to enable optimal carbon-neutral construction. The requirement of carbon emissions reduction in buildings by at least 75-80% as per the New Home Standards is a significant example of government mandates, fueling the demand for building technologies that can be integrated to achieve carbon neutrality. Labor shortage in the construction sector influences a rising need for building technologies that can be used to enable automated construction operations.

Asia Pacific Market Insights

The Asia Pacific building technology market is anticipated to garner a high revenue by the end of 2036, attributed to government-led smart city initiatives. For instance, the Regional Smart City Guidelines were launched by the Economic and Social Commission for Asia and the Pacific for both policymakers and urban practitioners, fueling urban development and climate action. Such initiatives are expected to attract building technologies that can be incorporated in smart city development through sustainable building construction. Governments of different countries across the region are also taking measures to enhance the digital skills of the population, creating the opportunity to engage adequately skilled individuals in building technology handling in the construction sector.

China market is projected to witness a rapid expansion between 2026 and 2036, owing to massive investments in technological research and development. As per the report by the Information Technology and Innovation Foundation, published in April 2025, the government spent USD 110 billion on research and development, including building technologies in 2023. Rapid urbanization in China is another factor influencing the growing need for smart building technologies. The obligation to use BIM in all the centrally funded construction projects is accelerating the use of building technologies.

India is projected to emerge as a steadily expanding building technology market during the forecast period, on account of the Smart Cities Mission. As revealed by the Press Information Bureau in June 2025, through the Smart Cities Initiative, the government intends to serve the population with enhanced quality of life and sustainable solutions. The motive of the government to provide people with sustainable construction solutions is expected to increase the demand for building technologies used for energy efficiency and carbon neutrality.

Government Incentives to IGBC-Rated Green Building Projects

|

State / Authority |

Incentive Description |

Eligibility |

|

Central Government (MoEFCC) |

Fast-track environmental clearance |

Projects pre-certified / provisionally certified by IGBC |

|

Punjab |

1) An additional 5% FAR free for IGBC Gold or above 2) Additional FAR + exemption of building scrutiny fee: 5%, 7.5%, 10% for Silver, Gold, Platinum IGBC ratings respectively |

Dept. of Local Govt (Town Planning Wing); Dept. of Housing and Urban Development; applies to IGBC Silver/Gold/Platinum rating |

|

West Bengal |

Additional 10% FAR for projects Pre-certified / Provisionally Certified as Gold or above, for: - Kolkata Municipal Corporation - New Kolkata Development Authority |

IGBC Gold or above; for KMC and NKDA jurisdictions |

|

Uttar Pradesh |

1) 10% additional FAR for IGBC Gold or above 2) GNIDA offers an additional 5% FAR free of charge for IGBC Gold or above

|

Housing & Urban Planning Dept.; GNIDA |

|

Himachal Pradesh |

An additional 10% FAR for IGBC Gold / Platinum rating |

Town & Country Planning Dept. of Himachal Pradesh |

|

Jharkhand |

Additional FAR of 3%, 5% and 7% for IGBC Silver, Gold, and Platinum, respectively |

Urban Development & Housing Department, Jharkhand |

|

Haryana |

Additional FAR of 9%, 12% and 15% for IGBC Silver, Gold, and Platinum, respectively |

As per the amendment in Ch. 6 of Haryana Building Code 2017 (dated 8 May 2018) by the Town & Planning Dept. |

|

Maharashtra |

- Urban Development Dept: Additional FAR of 3%, 5%, 7% for IGBC Silver / Gold / Platinu - Pune Municipal Corporation & Pune Metropolitan Region Development Authority: similarly, 3%,5%,7% FAR -PWD: mandate that govt projects (new & renovation) use a suitable IGBC Green Building Rating -Integrated Townships (UDCPR Maharashtra) must have at least a silver rating |

Applies across relevant departments; for both government & private projects in some cases; mandates in some policies (UDCPR) |

|

Goa |

Additional FAR of 10% may be granted (with Government approval) for IGBC pre-certified / provisionally certified projects; completion certificate issued post-cert; certification to be renewed every 5 years |

Town & Country Planning Dept, Goa; for IGBC pre/provisional certification; subject to renewal every 5 years |

|

Tamil Nadu |

-TN Industrial Policy 2021: 25% subsidy on the cost of environmental protection infrastructure (up to ₹1 crore) for industrial projects with IGBC certification - TN Data Centre Policy 2021: Data Centre Units with IGBC rating eligible for 25% subsidy on cost of green initiatives, up to ₹5 Crore -Integrated Townships Development Draft Policy 2022: mandates IGBC norms compliance |

Applies to industrial, data centre, township/development sector in TN; subject to policy limits and drafts |

|

Kerala |

Up to 50% reduction in one-time building tax; up to 1% reduction in Stamp Duty; up to 20% reduction in Property Tax, for projects obtaining IGBC green building certification |

Local Self Government Dept, Kerala; for IGBC-certified green buildings |

Source: IGBC

Key Building Technology Market Players:

- Siemens AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Schneider Electric SE

- Honeywell International Inc.

- Johnson Controls International plc

- ABB Ltd

- Robert Bosch GmbH

- Hitachi Ltd.

- Mitsubishi Electric Corporation

- Danfoss

- Cisco Systems, Inc.

- Legrand SA

- Delta Controls

- Lutron Electronics Co., Inc.

- Acuity Brands, Inc.

- Eaton Corporation

The building technology market globally is highly competitive for a range of factors, including the association of a large pool of key players, growing demand for building technologies, diversity of options for potential users, and many more. A push towards consolidation has started to take place with the acquisition of small companies by large key players. Large businesses are also investing increasingly in the adoption of advanced equipment, advancing building technologies further. Engagement in research and development is at the core of all the large and small key players.

Below is the list of the key players operating in the global building technology market:

Recent Developments

- In February 2025, Liebherr showcased its newly developed eighth-generation PR 776 Crawler Dozer at Bauma 2025. The flagship mining dozer was specially designed for use in mining and quarrying operations.

- In January 2025, CASE Construction India unveiled seven new products at the Bharat Construction Equipment Expo 2025. The product line includes two all-new vibratory compactors, the 952 NX and 450 NX, which comply with the BS CEV V emission norms.

- In December 2024, the cutting-edge Beamo Digital Twin Solution was showcased by 3i Inc. and NTT Bizlin at JAPAN BUILD TOKYO 2024. The technology is likely to revolutionize the construction sector in Japan.

- Report ID: 8136

- Published Date: Sep 29, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Building Technology Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.