Global Building Management System Market

- An Outline of the Global Building Management System Market

- Market Definition

- Market Segmentation

- Assumptions and Abbreviations

- Research Methodology & Approach

- Primary Research

- Secondary Research

- SPSS Methodology

- Data Triangulation

- Executive Summary

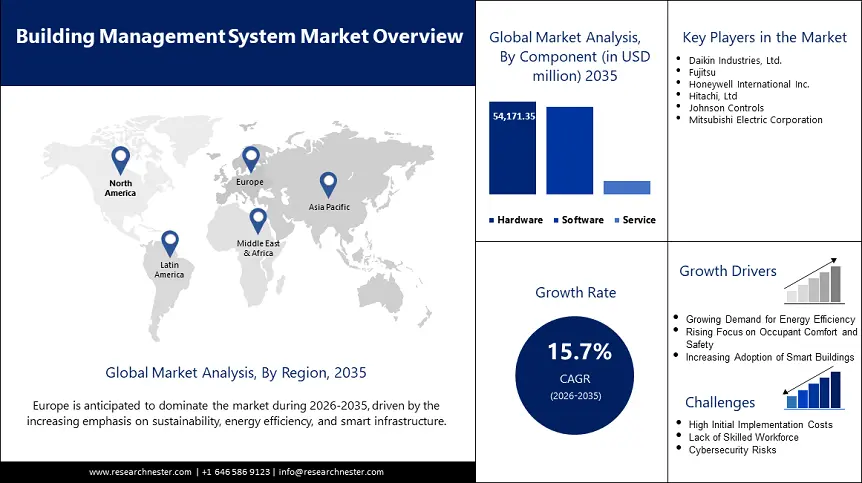

- Growth Drivers

- Major Roadblocks

- Opportunities

- Prevalent Trends

- Government Regulation

- Comparative Analysis of the Current Technologies

- Up-Coming Technologies

- Growth Outlook

- Risk Overview

- SWOT

- Regional Demand

- Recent Development News

- Building Management System Software Overview

- Application Overview

- Use Case Overview

- The Future of Building Management: Key Business Models and Opportunities

- Exploring BMS Adoption: Regional Insights, Government Support, and Preferred Business Models

- Critical Decision-Making Factors in Building Management System Selection

- Root Cause Analysis (RCA) for discovering problems of the Building Management System Market

- Comparative Positioning

- Competitive Model

- Company Market Share

- Business Profile of Key Enterprise

- Daikin Industries, Ltd.

- Fujitsu

- Honeywell International Inc.

- Hitachi, Ltd

- Johnson Controls

- Mitsubishi Electric Corporation

- Global Building Management System Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), and Compound Annual Growth Rate (CAGR)

- Global Building Management System Market Segmentation Analysis (2024-2037)

- By Component

- Hardware, Market Value (USD Million) and CAGR, 2024-2037F

- Sensors and Actuators, Market Value (USD Million) and CAGR, 2024-2037F

- Controllers, Market Value (USD Million) and CAGR, 2024-2037F

- Networking Hardware, Market Value (USD Million) and CAGR, 2024-2037F

- Others, Market Value (USD Million) and CAGR, 2024-2037F

- Software, Market Value (USD Million) and CAGR, 2024-2037F

- Security Management, Market Value (USD Million) and CAGR, 2024-2037F

- Infrastructure Management, Market Value (USD Million) and CAGR, 2024-2037F

- Emergency Management, Market Value (USD Million) and CAGR, 2024-2037F

- Facility Management, Market Value (USD Million) and CAGR, 2024-2037F

- Energy Management, Market Value (USD Million) and CAGR, 2024-2037F

- Others, Market Value (USD Million) and CAGR, 2024-2037F

- Service, Market Value (USD Million) and CAGR, 2024-2037F

- Professional Service, Market Value (USD Million) and CAGR, 2024-2037F

- Managed Service, Market Value (USD Million) and CAGR, 2024-2037F

- Hardware, Market Value (USD Million) and CAGR, 2024-2037F

- By Application

- Residential, Market Value (USD Million), and CAGR, 2024-2037F

- Commercial, Market Value (USD Million), and CAGR, 2024-2037F

- Industrial, Market Value (USD Million), and CAGR, 2024-2037F

- By Region

- North America, Market Value (USD Million), Volume (Units), and CAGR, 2024-2037F

- Europe, Market Value (USD Million), Volume (Units), and CAGR, 2024-2037F

- Asia Pacific Excluding Japan, Market Value (USD Million), Volume (Units), and CAGR, 2024-2037F

- Japan, Market Value (USD Million), Volume (Units), and CAGR, 2024-2037F

- Latin America, Market Value (USD Million), and CAGR, 2024-2037F

- Middle East and Africa, Market Value (USD Million), and CAGR, 2024-2037F

- By Component

- North America Building Management System Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), and Compound Annual Growth Rate (CAGR)

- North America Building Management System Market Segmentation Analysis (2024-2037)

- By Component

- Hardware, Market Value (USD Million) and CAGR, 2024-2037F

- Sensors and Actuators, Market Value (USD Million) and CAGR, 2024-2037F

- Controllers, Market Value (USD Million) and CAGR, 2024-2037F

- Networking Hardware, Market Value (USD Million) and CAGR, 2024-2037F

- Others, Market Value (USD Million) and CAGR, 2024-2037F

- Software, Market Value (USD Million) and CAGR, 2024-2037F

- Security Management, Market Value (USD Million) and CAGR, 2024-2037F

- Infrastructure Management, Market Value (USD Million) and CAGR, 2024-2037F

- Emergency Management, Market Value (USD Million) and CAGR, 2024-2037F

- Facility Management, Market Value (USD Million) and CAGR, 2024-2037F

- Energy Management, Market Value (USD Million) and CAGR, 2024-2037F

- Others, Market Value (USD Million) and CAGR, 2024-2037F

- Service, Market Value (USD Million) and CAGR, 2024-2037F

- Professional Service, Market Value (USD Million) and CAGR, 2024-2037F

- Managed Service, Market Value (USD Million) and CAGR, 2024-2037F

- Hardware, Market Value (USD Million) and CAGR, 2024-2037F

- By Application

- Residential, Market Value (USD Million), and CAGR, 2024-2037F

- Commercial, Market Value (USD Million), and CAGR, 2024-2037F

- Industrial, Market Value (USD Million), and CAGR, 2024-2037F

- By Country

- U.S., Market Value (USD Million), Volume (Units), and CAGR, 2024-2037F

- Canada, Market Value (USD Million), Volume (Units), and CAGR, 2024-2037F

- By Component

- Europe Building Management System Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), and Compound Annual Growth Rate (CAGR)

- Europe Building Management System Market Segmentation Analysis (2024-2037)

- By Component

- Hardware, Market Value (USD Million) and CAGR, 2024-2037F

- Sensors and Actuators, Market Value (USD Million) and CAGR, 2024-2037F

- Controllers, Market Value (USD Million) and CAGR, 2024-2037F

- Networking Hardware, Market Value (USD Million) and CAGR, 2024-2037F

- Others, Market Value (USD Million) and CAGR, 2024-2037F

- Software, Market Value (USD Million) and CAGR, 2024-2037F

- Security Management, Market Value (USD Million) and CAGR, 2024-2037F

- Infrastructure Management, Market Value (USD Million) and CAGR, 2024-2037F

- Emergency Management, Market Value (USD Million) and CAGR, 2024-2037F

- Facility Management, Market Value (USD Million) and CAGR, 2024-2037F

- Energy Management, Market Value (USD Million) and CAGR, 2024-2037F

- Others, Market Value (USD Million) and CAGR, 2024-2037F

- Service, Market Value (USD Million) and CAGR, 2024-2037F

- Professional Service, Market Value (USD Million) and CAGR, 2024-2037F

- Managed Service, Market Value (USD Million) and CAGR, 2024-2037F

- Hardware, Market Value (USD Million) and CAGR, 2024-2037F

- By Application

- Residential, Market Value (USD Million), and CAGR, 2024-2037F

- Commercial, Market Value (USD Million), and CAGR, 2024-2037F

- Industrial, Market Value (USD Million), and CAGR, 2024-2037F

- By Country

- UK, Market Value (USD Million), and CAGR, 2024-2037F

- Germany, Market Value (USD Million), and CAGR, 2024-2037F

- France, Market Value (USD Million), and CAGR, 2024-2037F

- Italy, Market Value (USD Million), Volume (Units), and CAGR, 2024-2037F

- Spain, Market Value (USD Million), and CAGR, 2024-2037F

- Russia, Market Value (USD Million), and CAGR, 2024-2037F

- BENELUX, Market Value (USD Million), and CAGR, 2024-2037F

- Poland, Market Value (USD Million), and CAGR, 2024-2037F

- Rest of Europe, Market Value (USD Million), and CAGR, 2024-2037F

- By Component

- Asia Pacific Excluding Japan Building Management System Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), and Compound Annual Growth Rate (CAGR)

- Asia Pacific Excluding Japan Building Management System Market Segmentation Analysis (2024-2037)

- By Component

- Hardware, Market Value (USD Million) and CAGR, 2024-2037F

- Sensors and Actuators, Market Value (USD Million) and CAGR, 2024-2037F

- Controllers, Market Value (USD Million) and CAGR, 2024-2037F

- Networking Hardware, Market Value (USD Million) and CAGR, 2024-2037F

- Others, Market Value (USD Million) and CAGR, 2024-2037F

- Software, Market Value (USD Million) and CAGR, 2024-2037F

- Security Management, Market Value (USD Million) and CAGR, 2024-2037F

- Infrastructure Management, Market Value (USD Million) and CAGR, 2024-2037F

- Emergency Management, Market Value (USD Million) and CAGR, 2024-2037F

- Facility Management, Market Value (USD Million) and CAGR, 2024-2037F

- Energy Management, Market Value (USD Million) and CAGR, 2024-2037F

- Others, Market Value (USD Million) and CAGR, 2024-2037F

- Service, Market Value (USD Million) and CAGR, 2024-2037F

- Professional Service, Market Value (USD Million) and CAGR, 2024-2037F

- Managed Service, Market Value (USD Million) and CAGR, 2024-2037F

- Hardware, Market Value (USD Million) and CAGR, 2024-2037F

- By Application

- Residential, Market Value (USD Million), and CAGR, 2024-2037F

- Commercial, Market Value (USD Million), and CAGR, 2024-2037F

- Industrial, Market Value (USD Million), and CAGR, 2024-2037F

- By Country

- China, Market Value (USD Million), and CAGR, 2024-2037F

- India, Market Value (USD Million), and CAGR, 2024-2037F

- South Korea, Market Value (USD Million), and CAGR, 2024-2037F

- Australia, Market Value (USD Million), Volume (Units), and CAGR, 2024-2037F

- Indonesia, Market Value (USD Million), and CAGR, 2024-2037F

- Malaysia, Market Value (USD Million), and CAGR, 2024-2037F

- Vietnam, Market Value (USD Million), and CAGR, 2024-2037F

- Thailand, Market Value (USD Million), and CAGR, 2024-2037F

- Singapore, Market Value (USD Million), and CAGR, 2024-2037F

- New Zealand, Market Value (USD Million), and CAGR, 2024-2037F

- Rest of APEJ, Market Value (USD Million), and CAGR, 2024-2037F

- By Component

- Japan Building Management System Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), and Compound Annual Growth Rate (CAGR)

- Japan Building Management System Market Segmentation Analysis (2024-2037)

- By Component

- Hardware, Market Value (USD Million) and CAGR, 2024-2037F

- Sensors and Actuators, Market Value (USD Million) and CAGR, 2024-2037F

- Controllers, Market Value (USD Million) and CAGR, 2024-2037F

- Networking Hardware, Market Value (USD Million) and CAGR, 2024-2037F

- Others, Market Value (USD Million) and CAGR, 2024-2037F

- Software, Market Value (USD Million) and CAGR, 2024-2037F

- Security Management, Market Value (USD Million) and CAGR, 2024-2037F

- Infrastructure Management, Market Value (USD Million) and CAGR, 2024-2037F

- Emergency Management, Market Value (USD Million) and CAGR, 2024-2037F

- Facility Management, Market Value (USD Million) and CAGR, 2024-2037F

- Energy Management, Market Value (USD Million) and CAGR, 2024-2037F

- Others, Market Value (USD Million) and CAGR, 2024-2037F

- Service, Market Value (USD Million) and CAGR, 2024-2037F

- Professional Service, Market Value (USD Million) and CAGR, 2024-2037F

- Managed Service, Market Value (USD Million) and CAGR, 2024-2037F

- Hardware, Market Value (USD Million) and CAGR, 2024-2037F

- By Application

- Residential, Market Value (USD Million), and CAGR, 2024-2037F

- Commercial, Market Value (USD Million), and CAGR, 2024-2037F

- Industrial, Market Value (USD Million), and CAGR, 2024-2037F

- By Component

- Latin America Building Management System Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), and Compound Annual Growth Rate (CAGR)

- Latin America Building Management System Market Segmentation Analysis (2024-2037)

- By Component

- Hardware, Market Value (USD Million) and CAGR, 2024-2037F

- Sensors and Actuators, Market Value (USD Million) and CAGR, 2024-2037F

- Controllers, Market Value (USD Million) and CAGR, 2024-2037F

- Networking Hardware, Market Value (USD Million) and CAGR, 2024-2037F

- Others, Market Value (USD Million) and CAGR, 2024-2037F

- Software, Market Value (USD Million) and CAGR, 2024-2037F

- Security Management, Market Value (USD Million) and CAGR, 2024-2037F

- Infrastructure Management, Market Value (USD Million) and CAGR, 2024-2037F

- Emergency Management, Market Value (USD Million) and CAGR, 2024-2037F

- Facility Management, Market Value (USD Million) and CAGR, 2024-2037F

- Energy Management, Market Value (USD Million) and CAGR, 2024-2037F

- Others, Market Value (USD Million) and CAGR, 2024-2037F

- Service, Market Value (USD Million) and CAGR, 2024-2037F

- Professional Service, Market Value (USD Million) and CAGR, 2024-2037F

- Managed Service, Market Value (USD Million) and CAGR, 2024-2037F

- Hardware, Market Value (USD Million) and CAGR, 2024-2037F

- By Application

- Residential, Market Value (USD Million), and CAGR, 2024-2037F

- Commercial, Market Value (USD Million), and CAGR, 2024-2037F

- Industrial, Market Value (USD Million), and CAGR, 2024-2037F

- By Country

- Brazil, Market Value (USD Million), and CAGR, 2024-2037F

- Argentina, Market Value (USD Million), and CAGR, 2024-2037F

- Mexico, Market Value (USD Million), and CAGR, 2024-2037F

- Rest of Latin America, Market Value (USD Million), and CAGR, 2024-2037F

- By Component

- Middle East & Africa Building Management System Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), and Compound Annual Growth Rate (CAGR)

- Middle East & Africa Building Management System Market Segmentation Analysis (2024-2037)

- By Component

- Hardware, Market Value (USD Million) and CAGR, 2024-2037F

- Sensors and Actuators, Market Value (USD Million) and CAGR, 2024-2037F

- Controllers, Market Value (USD Million) and CAGR, 2024-2037F

- Networking Hardware, Market Value (USD Million) and CAGR, 2024-2037F

- Others, Market Value (USD Million) and CAGR, 2024-2037F

- Software, Market Value (USD Million) and CAGR, 2024-2037F

- Security Management, Market Value (USD Million) and CAGR, 2024-2037F

- Infrastructure Management, Market Value (USD Million) and CAGR, 2024-2037F

- Emergency Management, Market Value (USD Million) and CAGR, 2024-2037F

- Facility Management, Market Value (USD Million) and CAGR, 2024-2037F

- Energy Management, Market Value (USD Million) and CAGR, 2024-2037F

- Others, Market Value (USD Million) and CAGR, 2024-2037F

- Service, Market Value (USD Million) and CAGR, 2024-2037F

- Professional Service, Market Value (USD Million) and CAGR, 2024-2037F

- Managed Service, Market Value (USD Million) and CAGR, 2024-2037F

- Hardware, Market Value (USD Million) and CAGR, 2024-2037F

- By Application

- Residential, Market Value (USD Million), and CAGR, 2024-2037F

- Commercial, Market Value (USD Million), and CAGR, 2024-2037F

- Industrial, Market Value (USD Million), and CAGR, 2024-2037F

- By Country

- GCC, Market Value (USD Million), Volume (Tons) CAGR & Y-o-Y Growth Trend, 2024-2037F

- Israel, Market Value (USD Million), Volume (Tons) CAGR & Y-o-Y Growth Trend, 2024-2037F

- South Africa, Market Value (USD Million), Volume (Tons) CAGR & Y-o-Y Growth Trend, 2024-2037F

- Rest of Middle East & Africa, Market Value (USD Million), Volume (Tons) CAGR & Y-o-Y Growth Trend, 2024-2037F

- By Component

- About Research Nester

Building Management System Market Outlook:

Building Management System Market size was over USD 23.41 billion in 2025 and is projected to reach USD 100.63 billion by 2035, witnessing around 15.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of building management system is evaluated at USD 26.72 billion.

The global BMS market is on the cusp of significant expansion due to factors such as rising decarbonization targets, advancements in digital infrastructure, and the adoption of advanced automation solutions. Current regulatory policies that require smarter building systems, improved energy conservation, and better safety measures are changing the way commercial, residential, and industrial buildings are managed. In October 2023, Siemens unveiled Connect Box, an IoT-based smart BMS specifically designed for small and mid-sized buildings. This innovation introduces the capability of real-time monitoring and controlling, predictive maintenance, and data-driven control to decentralized structures, further broadening the application of digital control in buildings. Companies are delivering integrated building automation solutions, offering a clear glimpse into how next-gen BMS tools are becoming the cornerstone of energy-efficient structures.

The building management system market growth is further facilitated by the integration of intelligent control ecosystems and energy storage at the building level. In May 2024, Energy Vault and SOM signed a groundbreaking deal to incorporate gravity-based storage systems into the building design. This advancement enables BMS to regulate energy flows, minimize peak loads, and also improve the sustainability of a building. The partnership is a significant turning point in how future buildings will use energy and store it at the same time. With escalating complexities in distributed energy systems, BMS platforms are becoming control centers for managing building performance and reducing operational expenses.

Key Building Management System Market Insights Summary:

Regional Highlights:

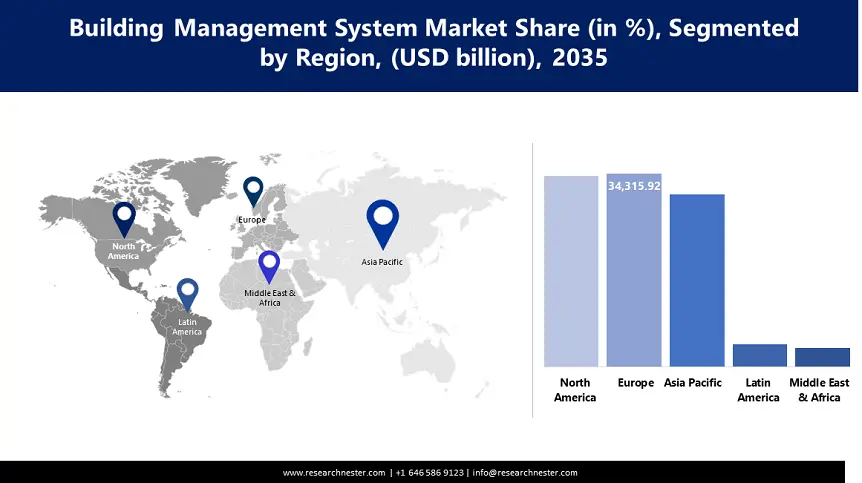

- Europe leads the Building Management System Market with a 30.1% share, driven by increased climate goals and smart monitoring developments, advancing its dominance through sustainable technologies by 2035.

- The Building Management System Market in Asia Pacific excluding Japan is witnessing significant growth through 2026–2035, attributed to urbanization, policy changes, and development of digital infrastructure.

Segment Insights:

- Commercial Buildings segment are expected to hold over 47.2% share by 2035, propelled by the rising need for energy-efficient infrastructure in various facilities.

- Hardware segment is projected to hold around a 47.2% share by 2035, fueled by the growing use of smart sensors, energy meters, and IoT-enabled devices in intelligent building infrastructure.

Key Growth Trends:

- Government policies and energy efficiency targets

- Surging investment in smart infrastructure and retrofit solutions

Major Challenges:

- Complex system integration and interoperability barriers

- Cybersecurity vulnerabilities in smart infrastructure

- Key Players: Daikin Industries, Ltd., Fujitsu, Honeywell International Inc., Hitachi, Ltd., Johnson Controls, Mitsubishi Electric Corporation.

Global Building Management System Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 23.41 billion

- 2026 Market Size: USD 26.72 billion

- Projected Market Size: USD 100.63 billion by 2035

- Growth Forecasts: 15.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe (30.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: Germany, United States, China, United Kingdom, Japan

- Emerging Countries: China, Japan, South Korea, India, Brazil

Last updated on : 12 August, 2025

Building Management System Market Growth Drivers and Challenges:

Growth Drivers

- Government policies and energy efficiency targets: Restrictions and policies being formulated by governments are proving to be influential in driving the global building management system market. Governments are imposing increased compliance with efficiency measures by setting up more ambitious net-zero targets and green building codes and certification systems. BMS technologies are critical in the integration of renewable energy systems such as solar and wind power into the building’s system, making BMS an overarching part of energy transformation as identified by the U.S. Department of Energy. Specifically, in July 2024, the United States General Services Administration (GSA) and the Department of Energy (DOE) chose advanced BMS solutions for the creation of net-zero federal buildings. These trends demonstrate that public initiatives are the driving force behind the growth of intelligent building solutions and the increased profitability of energy-efficient infrastructure.

- Surging investment in smart infrastructure and retrofit solutions: Globally, there has been a significant increase in spending on the installation of digital automation systems in aging structures. In March 2024, Schneider Electric released an enhanced version of its EcoStruxure Building Operation that integrated artificial intelligence analytics, real-time performance tracking, and third-party system compatibility. This launch is a significant step forward in the retrofitting domain, particularly for existing systems that require modernization for sustainability and performance enhancements. The platform is a good example of how digital retrofitting can work to extend the lifespan of buildings, reduce energy consumption, and meet ESG standards without a complete overhaul of the structure.

- Increased demand for safety, security, and integrated control systems: The increasing emphasis on safety and security aspects has placed BMS in a strategic role of being an interface for controlling every aspect. In November 2024, Building Industry Partners divested Endeavor Fire Protection to APi Group as consolidation across safety technologies tied to BMS continued. The deal points to increasing interest in integrated fire protection, access control, and monitoring solutions under a single automation platform. With safety systems becoming increasingly integrated within buildings, BMS will continue to play a core role in delivering safe, compliant infrastructure.

Challenges

- Complex system integration and interoperability barriers: One of the key issues that are encountered when implementing BMS is the compatibility of various components from different vendors and their ability to interconnect and function as a single system. Modern buildings have complex systems that are made from various parts from different manufacturers, all of which may use different protocols and standards. This can lead to compatibility problems, making integration processes intricate and time-consuming. Interoperability between these various platforms is a critical aspect of developing a seamless and efficient BMS that can control all these systems.

- Cybersecurity vulnerabilities in smart infrastructure: With many BMS platforms integrating with cloud connections and internet-connected devices, the threats of cybersecurity and data protection have emerged as significant issues. These integrated systems can be susceptible to cyber threats, and this may result in unauthorized access or intrusion, leakage of data, or even control of the building systems. Securing occupant information and safeguarding BMS systems from cyber threats is a continuous effort that demands secure protocols and measures on a continual basis.

Building Management System Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

15.7% |

|

Base Year Market Size (2025) |

USD 23.41 billion |

|

Forecast Year Market Size (2035) |

USD 100.63 billion |

|

Regional Scope |

|

Building Management System Market Segmentation:

Component (Hardware, Software, Service)

Hardware segment is set to dominate building management system market share of around 47.2% by the end of 2035, due to the increasing need for smart sensors, control devices, energy meters, and actuators. In February 2024, Neilsoft launched a new business division, the Neil Automation Division, to sell complete automation solutions, highlighting the importance of smart controllers and IoT sensors. These physical devices are the foundation of decentralized decision-making and provide real-time intelligence of the building. The incorporation of edge computing technologies is expanding the usage of hardware components from simple tools to active participants in a digital network. Advances in hardware technology are now enabling building systems to self-regulate to changes in the environment, thereby improving comfort and performance. This advancement is revolutionizing the modularity and flexibility of BMS implementation in all kinds of structures and applications.

Application (Residential, Commercial, Industrial)

In building management system market, commercial buildings segment is expected to account for revenue share of more than 47.2% by the end of 2035, due to the rising need for energy-efficient offices, malls, healthcare buildings and schools. In June 2024, Schneider Electric introduced its SMART Buildings Division in Canada to offer AI-based BMS platforms suitable for commercial applications. The initiative is in tune with increasing customer demands for real-time occupancy control, lighting control, and HVAC control. As sustainability frameworks impact commercial real estate portfolios, stakeholders are using BMS to achieve sustainability targets and enhance asset value. Offices and other commercial structures are the first to integrate new digital systems and technologies for managing operations, people and energy use. As sustainability is increasingly established as a key driver of competitive advantage, BMS is increasingly becoming a strategic application in commercial construction and property management.

Our in-depth analysis of the global BMS market includes the following segments:

|

Component |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Building Management System Market Regional Analysis:

Europe Market Analysis

Europe in building management system market is estimated to hold over 30.1% revenue share by the end of 2035, following increased climate goals and smart monitoring developments. The EU Agency for Law Enforcement Cooperation reported that a burglary happens every 1.5 minutes within the EU, emphasizing the importance of integrated security. In November 2023, ABB and Zumtobel Group signed a partnership agreement to provide smart lighting and building automation solutions that are both energy-efficient and secure. Such partnerships demonstrate the direction that Europe is taking in the use of multi-functional BMS tools.

France is on the path towards digital transformation in building automation due to changes in energy and policies. The adoption of BMS is being spurred by urban regeneration projects and sustainable renovation grants for both commercial and residential buildings. Integrated smart systems are now considered standard design specifications to meet low carbon requirements and enhance certifications. The country’s ambitious climate target is driving the accelerated uptake of automation technologies in the built environment.

Germany government’s ambitious 65% emissions reduction target by 2030 has placed building energy efficiency at the forefront of the country’s agenda. These initiatives targeting smart building automation are a necessity for compliance with climate targets. BMS platforms are being used to control distributed energy resources, regulate heating and cooling systems, and maintain system-level efficiency in various facilities. The country is moving toward the use of AI-based control systems at a fast pace with the help of incentives and R&D spending.

Asia Pacific Market Statistics

Asia Pacific building management system market is expected to witness sustainable growth through 2035, due to factors such as urbanization, policy changes, and development of digital infrastructure. In March 2024, Exide Energy partnered with Honeywell to integrate progressive BMS technologies in its lithium-ion gigafactory in Bengaluru. Such a partnership underlines the commitment of this region to smart infrastructure in both the commercial and industrial sectors.

China remains committed to sustainable construction through national policies such as the 13th Five-Year Plan for Ecological and Environmental Protection. These directives have encouraged the adoption of smart buildings, especially in Tier-1 and Tier-2 cities. BMS solutions are helping to achieve energy-efficient development in line with the objectives of the government, and public-private partnerships are advancing the application of BMS solutions. Local innovation hubs are also participating in the localization of BMS solutions and designs.

Smart infrastructure is on the rise in India, with a growing adoption of BMS in residential apartments, malls, airports, and hospitals. In March 2024, LG CNS launched its Smart Building DX initiative for AI-based BMS solutions suitable for high-rise buildings in cities. The green building certification in India and rising energy costs have forced developers to adopt intelligent systems to reduce costs and increase operational efficiency. These factors combined are anticipated to make India a lucrative BMS market for players looking for expansion in new markets or diversify their product portfolios.

Key Building Management System Market Players:

- Daikin Industries, Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Fujitsu

- Honeywell International Inc.

- Hitachi, Ltd

- Johnson Controls

- Mitsubishi Electric Corporation

The building management system market is highly competitive, and the players are diversifying their focus areas in AI, IoT, energy optimization, and safety automation. Some of the leading vendors in the BMS market are Daikin Industries, Ltd., Fujitsu, Honeywell International Inc., Hitachi, Ltd., Johnson Controls, and Mitsubishi Electric Corporation. Market participants are using partnerships, acquisitions, and digital innovations to create competitive advantage and satisfy quickly changing customer needs. In September 2024, Honeywell launched a new BMS solution called Advance Control for Buildings, which is a highly integrated, modular, real-time, and secure BMS with advanced analytics. The launch further establishes Honeywell as the leading provider of intelligent building systems and presents a vision into the direction of the industry’s evolution—toward more adaptive, robust, and interconnected infrastructures.

Here are some leading companies in the building management system market:

Recent Developments

- In December 2024, ABB acquired the Solutions Industry Building unit to expand its cable protection systems portfolio in intelligent buildings. This acquisition strengthens ABB’s ability to deliver integrated power and automation infrastructure. The move supports the growing convergence of electrical systems and building management technologies. ABB continues to reinforce its position as a holistic BMS solutions provider.

- In January 2024, ABB unveiled its Cylon Smart Building Management System at the Light + Middle East exhibition, targeting mid-sized commercial facilities. The modular system features intuitive interfaces, cloud connectivity, and scalable automation capabilities. It aims to democratize access to smart building technology. Cylon strengthens ABB’s position in the mid-tier BMS segment.

- In January 2024, Honeywell launched its Advance Control for Buildings platform, a BMS designed to enhance operational efficiency and cybersecurity. Leveraging existing infrastructure, the system offers scalable control and energy optimization. It simplifies deployment while meeting evolving energy mandates. The platform reflects growing demand for intelligent, secure building systems.

- Report ID: 7386

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Building Management System Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.