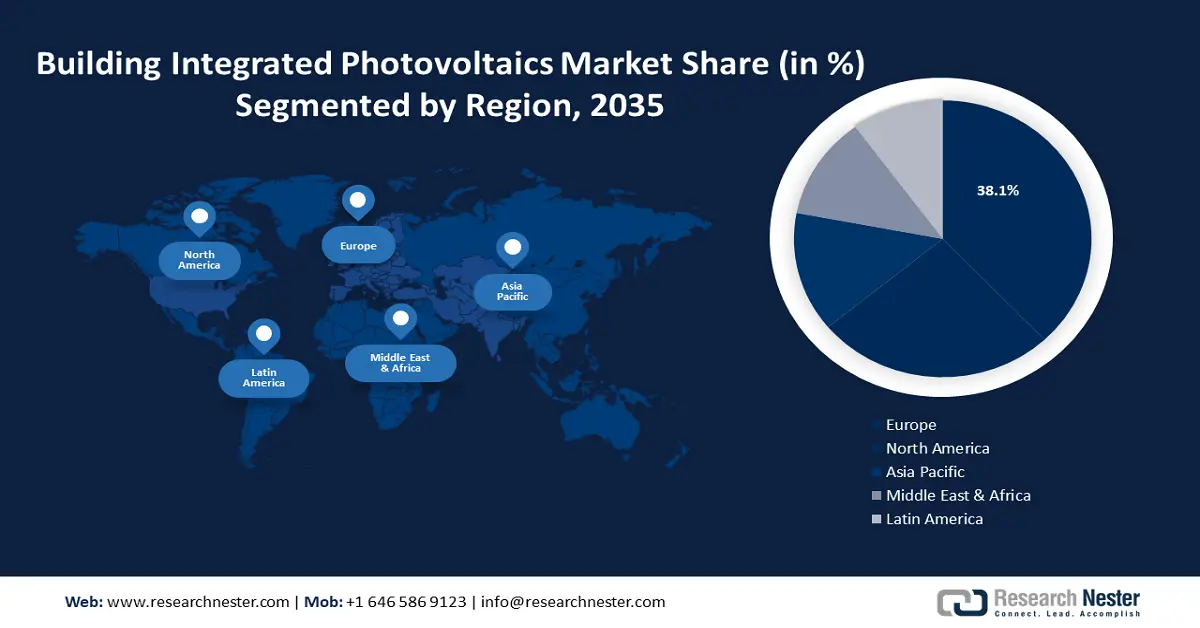

Building-integrated Photovoltaics Market Regional Analysis:

Europe Market Insights

Europe in building-integrated photovoltaics market is anticipated to account for more than 38.1% revenue share by the end of 2035. The market expansion is attributed to the growing awareness among consumers, businesses, and governments about the benefits of renewable energy and sustainable building practices. This increasing demand for green buildings and energy-efficient solutions supports the growth of the BIPV market in the region. European Environment Agency published a report in 2024, stating that the greenhouse gas emissions in the EU slowed down since 1990 while achieving their renewable energy target of 20% in 2020. Furthermore, in 2022, about 22.5% of the consumed energy was credited to renewable resources.

Germany has a long-standing commitment to renewable energy and sustainability, backed by policies such as the Renewable Energy Sources Act (EEG) and the Energy Efficiency Strategy for Buildings. These policies provide incentives, feed-in tariffs, and subsidies for BIPV installations, driving market growth. The EEG 2023 aims to make renewable energy account for at least 80% of total power consumption by 2030.

The United Kingdom government has set targets for reducing greenhouse gas emissions and increasing renewable energy generation. For instance, the Clean Growth Strategy, published in 2017, states that the UK government expects to meet its target of cutting emissions by 80% by 2050.

North America Market Insights

North America building-integrated photovoltaics market is expected to grow at massive CAGR through 2035, owing to the growing demand for accessible and reliable power generation, driven by population growth, and a shift toward the use of clean energy. According to a report by the U.S. Energy Information Administration, in 2022 the usage of natural gas was about 33% of the whole energy consumption.

In the United States, there has been an increase in government campaigns and investments aimed at raising awareness about the use of renewable energy. According to a survey conducted in 2023, it was revealed that more than 66% of U.S. adults prioritize using an alternative energy source like solar, hydrogen, and wind power.

Canada is predicted to have a high electricity demand which is further encouraging collaboration with the energy & power sector. Hence, this factor is estimated to impact the overall growth of the building-integrated photovoltaics industry in Canada. According to a report in 2023, the energy consumption in Canada tremendously increased to 8585 petajoules from 2022 to 2021.