Building Automation Systems Market - Growth Drivers and Challenges

Growth Drivers

- Integration of AI and IoT for predictive control: The integration of the Internet of Things (IoT) and artificial intelligence (AI) is one of the main market drivers, pushing buildings from reactive buildings to predictive, self-tuning environments. AI-powered analytics enable predictive maintenance, reducing downtime and operation costs, and IoT sensors provide fine-grained information required for granular control. In December 2024, Trane Technologies acquired BrainBox AI, a specialist in autonomous HVAC optimization. This acquisition highlights the strategic importance of AI and will strengthen Trane Technologies' AI-driven energy management services.

- Emphasis on energy efficiency and sustainability: Increased global consciousness of climate change and fluctuating energy prices are leading building owners and operators to focus on energy efficiency. Modern BAS platforms lead this charge with sophisticated technology to monitor, analyze, and reduce energy consumption in building portfolios. In December 2024, Daikin announced the release of its new Smart Control System (SCS), a plug-and-play solution for managing hydronic HVAC plants in commercial buildings. The SCS is designed to optimize the working conditions of an entire HVAC system for improved comfort and cost savings.

- Need for interoperable and smart ecosystems: There is a growing requirement for open, interoperable platforms that can potentially displace proprietary silos and form a unified smart building ecosystem. This allows for seamless integration of numerous systems, from lighting and HVAC to security and access control, to provide improved functionality and simplify management. This trend is being accelerated through strategic alliances. In October 2024, the Zumtobel Group and ABB formed a partnership. This collaboration aims to integrate ABB's i-bus KNX building automation systems with Zumtobel's LITECOM lighting management systems to advance smart lighting and DC power solutions.

U.S. Residential & Commercial Energy Consumption (2023)

The significant energy consumption by residential and commercial buildings-representing 36.9% of total U.S. energy use when including electrical system losses-creates substantial demand for building automation systems to optimize efficiency. This energy footprint highlights the critical need for smart HVAC controls, lighting automation, and energy management systems that can reduce operational costs and environmental impact. Building automation technologies directly address this opportunity by enabling real-time monitoring, predictive maintenance, and automated optimization of energy-intensive systems.

|

Sector |

End-Use Consumption |

Including Electrical System Losses |

Total Energy Consumption |

|

Residential |

20.6 quadrillion Btu |

+ Electrical losses |

19.7% of total U.S. consumption |

|

Commercial |

Part of 20.6 quadrillion Btu |

+ Electrical losses |

17.2% of total U.S. consumption |

|

Combined |

20.6 quadrillion Btu (27.6% of U.S. total) |

+ Electrical losses |

36.9% of total U.S. consumption |

Source: EIA

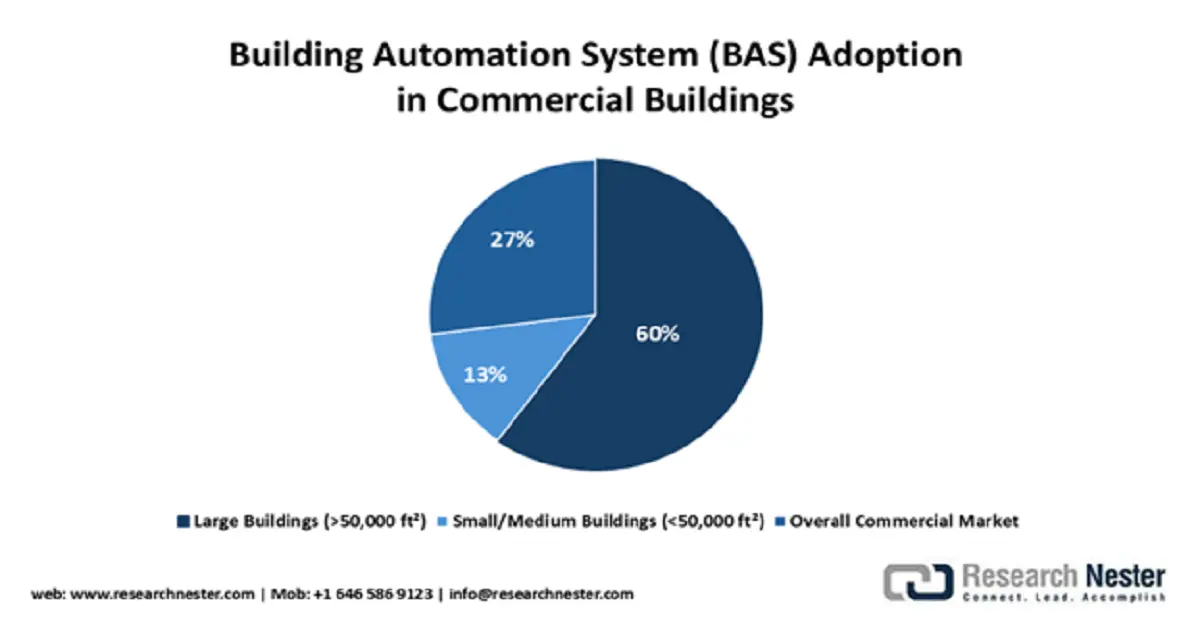

Building Automation System (BAS) Adoption in Commercial Buildings

Source: NIST

Challenges

- Growing cybersecurity risks in networked systems: As building automation systems get increasingly networked to IT networks and to the cloud, they are subjected to more cybersecurity risks, threatening critical infrastructure and data privacy. Securing this expanding attack surface without compromising operational performance is a top industry challenge. This issue is attracting high-level government interest. In October 2023, the U.S. Department of Defense continued to implement its Unified Facilities Criteria (UFC) for cybersecurity, mandating strict security controls for all facility control systems within military bases and encouraging the implementation of more secure BAS hardware and software.

- Complexity of integrating legacy infrastructure: Integration of new BAS platforms within existing legacy systems is a significant technical and cost roadblock for the majority of building owners. Different communication protocols, proprietary hardware, and antiquated wiring may complicate deployments and limit the potential of new automation technologies. The overcoming this challenge is most crucial to widespread market adoption, especially in existing building inventories. To help mitigate this roadblock, a 2024 study sponsored by the U.S. Building Technologies Office of the Department of Energy described the process of creating a cost-effective, open-source BAS reference design for making access to this technology more convenient for small- and medium-sized commercial buildings.

Building Automation Systems Market Size and Forecast:

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

12% |

|

Base Year Market Size (2025) |

USD 204 billion |

|

Forecast Year Market Size (2035) |

USD 633.5 billion |

|

Regional Scope |

|