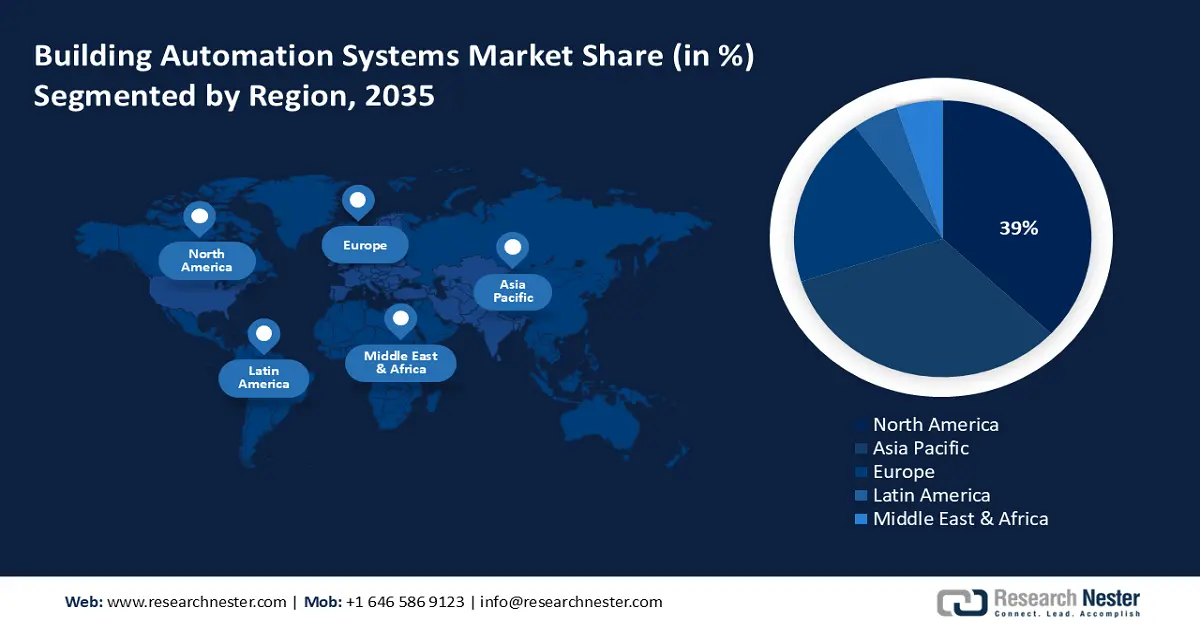

Building Automation Systems Market - Regional Analysis

North America Market Insights

North America is projected to lead the market with a 39% market share during the forecast period and remain the dominant building automation system market. It is driven by encouraging government incentives towards energy efficiency, a mature construction industry, and excellent consumer awareness of smart building technology. The region has many leading BAS vendors and is an innovation hub for the industry. This trend will persist, further cementing North America's position as a world leader in building automation.

The U.S. market is a leader in BAS adoption due to a combination of federal and state-level programs aimed at improving energy efficiency and reducing carbon emissions. In 2024, the U.S. Department of Energy, through its Bonneville Power Administration (BPA), published its Energy Efficiency Implementation Manual. The manual dictates commercial and industrial customer programs and incentives for installing energy-saving technologies like advanced building automation and HVAC control systems to help achieve regional energy efficiency goals.

Canada's economy is experiencing consistent growth with the support of solid government commitments to greenness and sustainability, as well as the greening of the public infrastructure. The Greening Government Strategy, under which all new federal buildings were, as of 2024, to be net-zero carbon, is one of the primary drivers for the adoption of state-of-the-art building automation systems. Natural Resources Canada (NRCan) also spurred its ISO 50001 implementation assistance program throughout 2024 with funding assistance for organizations to deploy this international standard for energy management.

APAC Market Insights

Asia Pacific building automation systems market is likely to record a strong CAGR of 13% from 2026 to 2035, with the support of urbanization, a booming construction sector, and high government focus on energy efficiency and the establishment of smart cities. Increased adoption of global building norms is also one of the main drivers of market growth. Increased demand for smart and sustainable infrastructure in the region is also enhancing this growth.

China is a lucrative market in the region, with a significant construction industry and government encouragement of green structures and energy efficiency. In December 2023, China's Technical Standard for Nearly Zero Energy Buildings remained at the forefront of ultra-low-energy building construction. This government-backed standard requires the installation of high-end building automation systems for precise control of HVAC, lighting, and window shading to minimize energy consumption in residential as well as commercial buildings and thus generate a massive market demand for BAS technology.

India market is poised for rapid growth driven by a growing economy, increasing urbanization, and a strong government push towards energy conservation. In 2024, India's Bureau of Energy Efficiency (BEE) continued to evolve its Energy Conservation Building Code (ECBC). These standards mandate minimum energy performance and promote the adoption of advanced energy management systems, high-efficiency lighting, and HVAC controls. This initiative is expected to drive the expansion of building automation, thereby stimulating growth in India construction market.

Europe Market Insights

Europe building automation systems market is projected to keep rising steadily through 2035, fueled by the continent's grand climate aspirations and a complete regulatory framework for energy-efficient structures. The Fit for 55 package and the Energy Performance of Buildings Directive (EPBD) are the policy drivers compelling building owners to invest in advanced automation and control technologies.

Germany is garnering growth, with a strong focus being given to high-performance buildings and a well-established, strong network of engineering firms and technology providers. Financial incentives for building refurbishment and the application of energy-efficient technologies are offered by the German government in substantial amounts. In 2024, Germany's Federal Funding for Efficient Buildings (BEG) program continued to provide large subsidies for retrofitting existing buildings, a major incentive for the installation of advanced building automation, like smart thermostats and integrated energy management systems.

The UK market is being driven by the legally binding net-zero target by the UK, as well as by legislation to improve the energy efficiency of the country's building stock. In 2024, the UK government continued to enforce the Energy Performance of Buildings Directive (EPBD), which mandates non-residential buildings with elaborate HVAC systems to deploy building automation and control systems by 2025. This is driving the adoption of BAS technology in the commercial sector as building owners seek to achieve compliance as well as improve energy management.