Building Automation Systems Market Outlook:

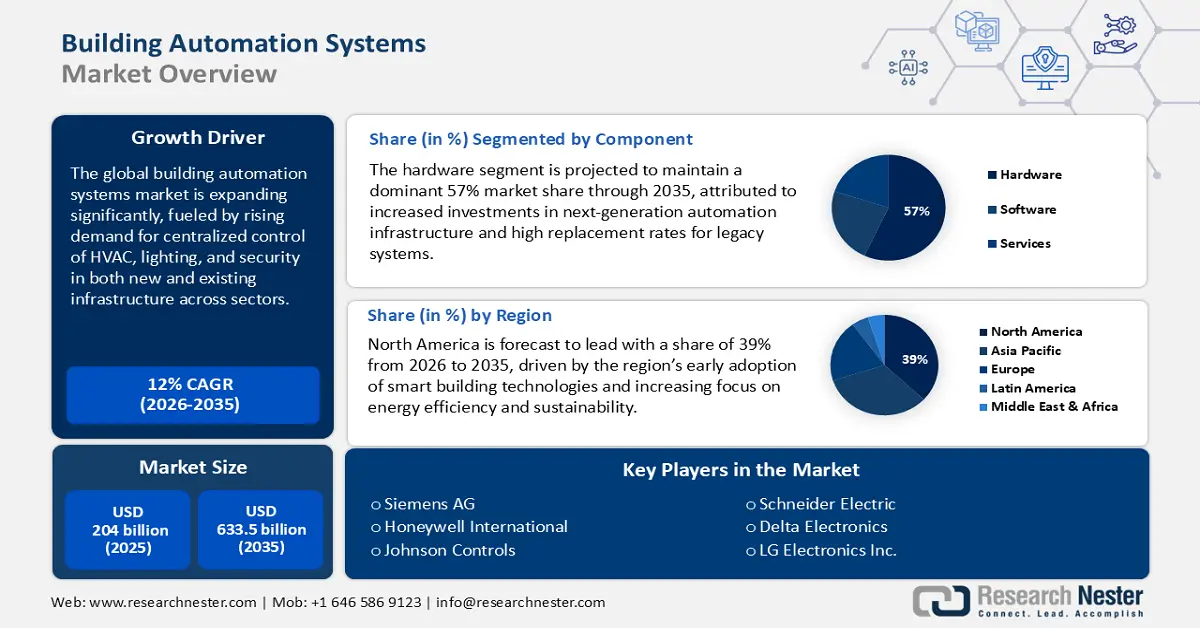

Building Automation Systems Market size is valued at USD 204 billion in 2025 and is projected to reach a valuation of USD 633.5 billion by the end of 2035, rising at a CAGR of 12% during the forecast period, i.e., 2026-2035. In 2026, the industry size of building automation systems is anticipated to reach USD 228.4 billion.

The building automation systems (BAS) industry is being transformed through the convergence of operational efficiency goals, energy management requirements, and sustainability needs. The expansion is characterized by a shift from standalone controls to networked, intelligent platforms that provide integrated management of HVAC, lighting, and security. Highlighting the trend, Honeywell rolled out its Advanced Control for Buildings platform in January 2024, a solution that marries machine learning with an installed building wiring to achieve performance without human oversight and enhance cybersecurity. The move is a hallmark of the industry's focus on creating smarter, more resilient commercial and institutional buildings.

Government action and regulatory mandates are equally powerful drivers powering the marketplace. Globally, energy efficiency and greenhouse gas reduction policies are compelling building owners to adopt advanced automation. A step in this direction is the U.S. General Services Administration's (GSA) September 2024 decision to standardize on Tridium's Niagara Framework for its building automation products. The initiative is to keep cybersecurity threats at bay and promote competition, signaling a broader public-sector trend toward secure, interoperable BAS platforms.

Key Building Automation Systems Market Insights Summary:

Regional Highlights:

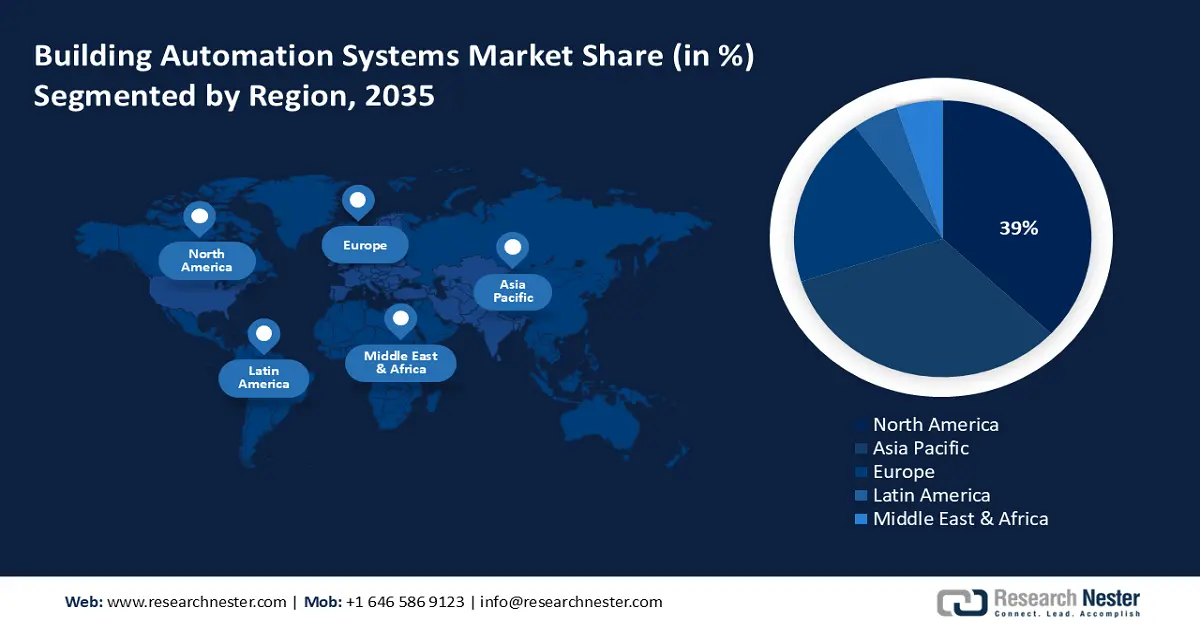

- North America in the building automation systems market is projected to secure a 39% share by 2035, upheld by robust government incentives for energy efficiency, a well-established construction ecosystem, and strong consumer awareness of smart building technologies.

- Asia Pacific is anticipated to post a notable CAGR of 13% from 2026–2035, underpinned by rapid urbanization, expanding construction activity, and intensified government initiatives supporting smart cities and energy-efficient infrastructure.

Segment Insights:

- The hardware segment in the building automation systems market is projected to command a dominant 57% share by 2035, reinforced by its foundational role in BAS deployments and continuous advancements in device technologies.

- The access control and security segment is set to capture a 52% share by 2035, propelled by rising demand for safeguarding physical assets and ensuring occupant safety.

Key Growth Trends:

- Integration of AI and IoT for predictive control

- Need for interoperable and smart ecosystems

Major Challenges:

- Growing cybersecurity risks in networked systems

- Complexity of integrating legacy infrastructure

Key Players: Honeywell International Inc., Siemens AG, Johnson Controls International plc, Schneider Electric SE, ABB Ltd., Carrier Global Corporation, Cisco Systems, Inc., Robert Bosch GmbH, Emerson Electric Co., Legrand SA, Tata Elxsi, Samsung C&T Corporation, Hitachi, Ltd., Mitsubishi Electric Corporation, Panasonic Corporation

Global Building Automation Systems Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 204 billion

- 2026 Market Size: USD 228.4 billion

- Projected Market Size: USD 633.5 billion by 2035

- Growth Forecasts: 12% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, France, Canada, Japan

- Emerging Countries: India, China, South Korea, Malaysia, Thailand

Last updated on : 3 October, 2025

Building Automation Systems Market - Growth Drivers and Challenges

Growth Drivers

- Integration of AI and IoT for predictive control: The integration of the Internet of Things (IoT) and artificial intelligence (AI) is one of the main market drivers, pushing buildings from reactive buildings to predictive, self-tuning environments. AI-powered analytics enable predictive maintenance, reducing downtime and operation costs, and IoT sensors provide fine-grained information required for granular control. In December 2024, Trane Technologies acquired BrainBox AI, a specialist in autonomous HVAC optimization. This acquisition highlights the strategic importance of AI and will strengthen Trane Technologies' AI-driven energy management services.

- Emphasis on energy efficiency and sustainability: Increased global consciousness of climate change and fluctuating energy prices are leading building owners and operators to focus on energy efficiency. Modern BAS platforms lead this charge with sophisticated technology to monitor, analyze, and reduce energy consumption in building portfolios. In December 2024, Daikin announced the release of its new Smart Control System (SCS), a plug-and-play solution for managing hydronic HVAC plants in commercial buildings. The SCS is designed to optimize the working conditions of an entire HVAC system for improved comfort and cost savings.

- Need for interoperable and smart ecosystems: There is a growing requirement for open, interoperable platforms that can potentially displace proprietary silos and form a unified smart building ecosystem. This allows for seamless integration of numerous systems, from lighting and HVAC to security and access control, to provide improved functionality and simplify management. This trend is being accelerated through strategic alliances. In October 2024, the Zumtobel Group and ABB formed a partnership. This collaboration aims to integrate ABB's i-bus KNX building automation systems with Zumtobel's LITECOM lighting management systems to advance smart lighting and DC power solutions.

U.S. Residential & Commercial Energy Consumption (2023)

The significant energy consumption by residential and commercial buildings-representing 36.9% of total U.S. energy use when including electrical system losses-creates substantial demand for building automation systems to optimize efficiency. This energy footprint highlights the critical need for smart HVAC controls, lighting automation, and energy management systems that can reduce operational costs and environmental impact. Building automation technologies directly address this opportunity by enabling real-time monitoring, predictive maintenance, and automated optimization of energy-intensive systems.

|

Sector |

End-Use Consumption |

Including Electrical System Losses |

Total Energy Consumption |

|

Residential |

20.6 quadrillion Btu |

+ Electrical losses |

19.7% of total U.S. consumption |

|

Commercial |

Part of 20.6 quadrillion Btu |

+ Electrical losses |

17.2% of total U.S. consumption |

|

Combined |

20.6 quadrillion Btu (27.6% of U.S. total) |

+ Electrical losses |

36.9% of total U.S. consumption |

Source: EIA

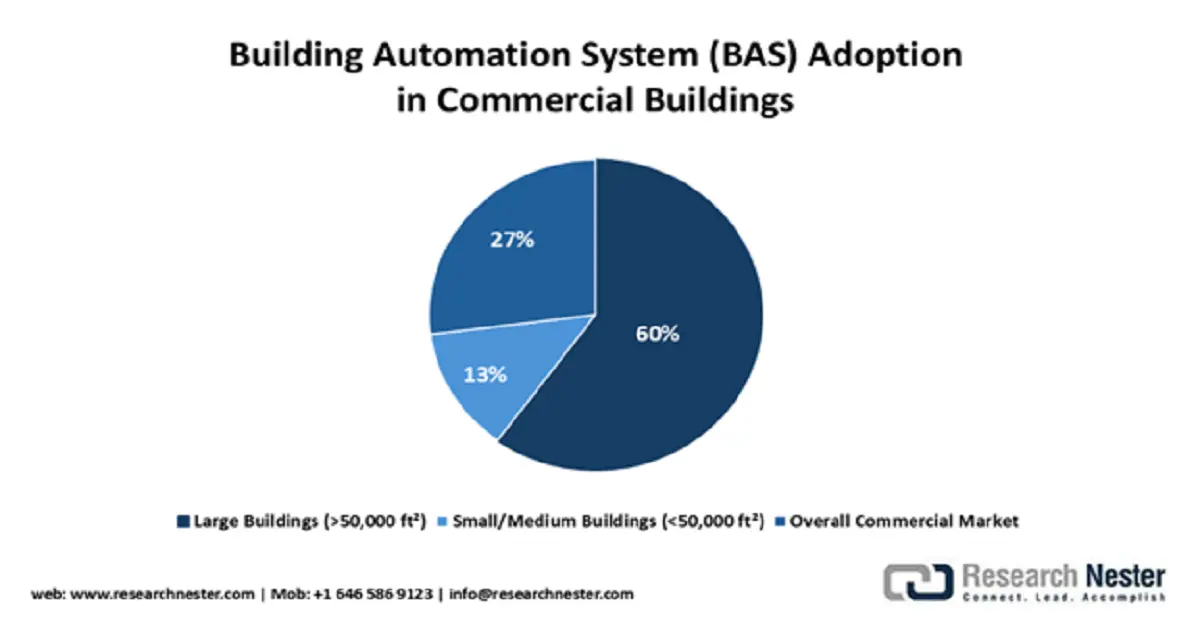

Building Automation System (BAS) Adoption in Commercial Buildings

Source: NIST

Challenges

- Growing cybersecurity risks in networked systems: As building automation systems get increasingly networked to IT networks and to the cloud, they are subjected to more cybersecurity risks, threatening critical infrastructure and data privacy. Securing this expanding attack surface without compromising operational performance is a top industry challenge. This issue is attracting high-level government interest. In October 2023, the U.S. Department of Defense continued to implement its Unified Facilities Criteria (UFC) for cybersecurity, mandating strict security controls for all facility control systems within military bases and encouraging the implementation of more secure BAS hardware and software.

- Complexity of integrating legacy infrastructure: Integration of new BAS platforms within existing legacy systems is a significant technical and cost roadblock for the majority of building owners. Different communication protocols, proprietary hardware, and antiquated wiring may complicate deployments and limit the potential of new automation technologies. The overcoming this challenge is most crucial to widespread market adoption, especially in existing building inventories. To help mitigate this roadblock, a 2024 study sponsored by the U.S. Building Technologies Office of the Department of Energy described the process of creating a cost-effective, open-source BAS reference design for making access to this technology more convenient for small- and medium-sized commercial buildings.

Building Automation Systems Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

12% |

|

Base Year Market Size (2025) |

USD 204 billion |

|

Forecast Year Market Size (2035) |

USD 633.5 billion |

|

Regional Scope |

|

Building Automation Systems Market Segmentation:

Component Segment Analysis

The hardware segment, which includes controllers, sensors, and actuators, is anticipated to occupy a dominant 57% share of the building automation systems market during the forecast period. This leadership position is underpinned by the underlying nature of these elements to any BAS deployment and by continuous innovation in device technology. The strategic significance of the hardware marketplace is underscored by big-ticket transactions. In a high-profile deal, Honeywell announced in December 2023 to acquire Carrier's Global Access Solutions business for $4.95 billion in a transaction intended to strengthen its product offering in building automation and security hardware. This agreement highlights the ongoing mergers in the building automation market, with companies vying for a greater share of the important hardware segment.

System Type Segment Analysis

The access control and security segment in the building automation systems market is expected to capture a 52% share by 2035, driven by the growing need to protect physical assets and encourage occupant safety. Integrating security solutions into broader building automation platforms makes it possible to respond faster and more coordinated to potential threats. The market sees increased collaboration to develop these capabilities further. Hikvision and Can'nX signed a technology partnership in March 2024 to integrate its security solutions, such as facial recognition terminals and video intercoms, directly to the KNX protocol, enhancing building automation for commercial and residential buildings. This collaboration is a reflection of the trend towards comprehensive, intelligent security solutions that are central to building management in contemporary times.

Communication Technology Segment Analysis

The wired communications technology market is forecast to hold a 63% market share through 2035, reflecting its persistent relevance in providing secure, low-latency connectivity for critical building systems. Even as wireless technologies gain popularity, the reliability and security of wired connections like Ethernet and purpose-specific protocols remain intrinsic to base BAS operation. New, high-performance Building Automation Systems (BAS) are being planned with a focus on network efficiency and reliability, favoring wired infrastructure. A prime example is the September 2024 release of Johnson Controls' Metasys 14.0, which features increased IP device capacity and improved network performance. This reliance on cabled systems ensures that building automation is resilient and cost-effective, capable of responding to the changing demands of modern infrastructure.

Our in-depth analysis of the building automation systems market includes the following segments:

|

Segments |

Subsegments |

|

Component |

|

|

System Type |

|

|

Communication Technology |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Building Automation Systems Market - Regional Analysis

North America Market Insights

North America is projected to lead the market with a 39% market share during the forecast period and remain the dominant building automation system market. It is driven by encouraging government incentives towards energy efficiency, a mature construction industry, and excellent consumer awareness of smart building technology. The region has many leading BAS vendors and is an innovation hub for the industry. This trend will persist, further cementing North America's position as a world leader in building automation.

The U.S. market is a leader in BAS adoption due to a combination of federal and state-level programs aimed at improving energy efficiency and reducing carbon emissions. In 2024, the U.S. Department of Energy, through its Bonneville Power Administration (BPA), published its Energy Efficiency Implementation Manual. The manual dictates commercial and industrial customer programs and incentives for installing energy-saving technologies like advanced building automation and HVAC control systems to help achieve regional energy efficiency goals.

Canada's economy is experiencing consistent growth with the support of solid government commitments to greenness and sustainability, as well as the greening of the public infrastructure. The Greening Government Strategy, under which all new federal buildings were, as of 2024, to be net-zero carbon, is one of the primary drivers for the adoption of state-of-the-art building automation systems. Natural Resources Canada (NRCan) also spurred its ISO 50001 implementation assistance program throughout 2024 with funding assistance for organizations to deploy this international standard for energy management.

APAC Market Insights

Asia Pacific building automation systems market is likely to record a strong CAGR of 13% from 2026 to 2035, with the support of urbanization, a booming construction sector, and high government focus on energy efficiency and the establishment of smart cities. Increased adoption of global building norms is also one of the main drivers of market growth. Increased demand for smart and sustainable infrastructure in the region is also enhancing this growth.

China is a lucrative market in the region, with a significant construction industry and government encouragement of green structures and energy efficiency. In December 2023, China's Technical Standard for Nearly Zero Energy Buildings remained at the forefront of ultra-low-energy building construction. This government-backed standard requires the installation of high-end building automation systems for precise control of HVAC, lighting, and window shading to minimize energy consumption in residential as well as commercial buildings and thus generate a massive market demand for BAS technology.

India market is poised for rapid growth driven by a growing economy, increasing urbanization, and a strong government push towards energy conservation. In 2024, India's Bureau of Energy Efficiency (BEE) continued to evolve its Energy Conservation Building Code (ECBC). These standards mandate minimum energy performance and promote the adoption of advanced energy management systems, high-efficiency lighting, and HVAC controls. This initiative is expected to drive the expansion of building automation, thereby stimulating growth in India construction market.

Europe Market Insights

Europe building automation systems market is projected to keep rising steadily through 2035, fueled by the continent's grand climate aspirations and a complete regulatory framework for energy-efficient structures. The Fit for 55 package and the Energy Performance of Buildings Directive (EPBD) are the policy drivers compelling building owners to invest in advanced automation and control technologies.

Germany is garnering growth, with a strong focus being given to high-performance buildings and a well-established, strong network of engineering firms and technology providers. Financial incentives for building refurbishment and the application of energy-efficient technologies are offered by the German government in substantial amounts. In 2024, Germany's Federal Funding for Efficient Buildings (BEG) program continued to provide large subsidies for retrofitting existing buildings, a major incentive for the installation of advanced building automation, like smart thermostats and integrated energy management systems.

The UK market is being driven by the legally binding net-zero target by the UK, as well as by legislation to improve the energy efficiency of the country's building stock. In 2024, the UK government continued to enforce the Energy Performance of Buildings Directive (EPBD), which mandates non-residential buildings with elaborate HVAC systems to deploy building automation and control systems by 2025. This is driving the adoption of BAS technology in the commercial sector as building owners seek to achieve compliance as well as improve energy management.

Key Building Automation Systems Market Players:

- Honeywell International Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Siemens AG

- Johnson Controls International plc

- Schneider Electric SE

- ABB Ltd.

- Carrier Global Corporation

- Cisco Systems, Inc.

- Robert Bosch GmbH

- Emerson Electric Co.

- Legrand SA

- Tata Elxsi

- Samsung C&T Corporation

- Hitachi, Ltd.

- Mitsubishi Electric Corporation

- Panasonic Corporation

The building automation systems market is marked by intense rivalry among global industrial and technology majors like Honeywell International Inc., Siemens AG, Johnson Controls International plc, Schneider Electric SE, and ABB Ltd. Companies are bent on providing integrated, cloud-based products and services centered on AI and IoT to offer more value to clients. Competition is also being driven by strategic alliances and acquisitions to expand technological expertise as well as geographic reach.

One of the key trends is the combination of generative AI with building management platforms to provide operators with more user-friendly and resilient tools. Schneider Electric issued a major announcement in March 2025 of new capabilities for its EcoStruxure Automation Expert platform, including the Automation Copilot, a generative AI copilot developed in collaboration with Microsoft. The action marks the trend in the market towards the application of sophisticated AI to create more efficient, sustainable, and user-centric building automation solutions.

Here are some leading companies in the building automation systems market:

Recent Developments

- In June 2025, Schneider Electric announced an expanded range of home electrical and automation products under its Wiser smart home ecosystem. The hardware launch included new wireless lighting controls, smart switches, and other devices aimed at expanding automation for residential customers.

- In June 2025, Honeywell launched its Connected Solutions platform, which integrates critical building software and technologies, including fire and life-safety systems, into a single AI-powered interface. This solution uses data from connected systems to provide real-time visibility, helping operators to address challenges more efficiently and improve overall building safety.

- In December 2024, Delta Electronics launched "Delta Intelligent Building Technologies (DIBT)," its new one-stop shop for building automation, energy management, and security in North America. The offering integrates Delta Controls, Amerlux lighting, LOYTEC automation, and March Networks surveillance for enhanced building management in commercial facilities.

- Report ID: 3697

- Published Date: Oct 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Building Automation Systems Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.