Building and Construction Sealants Market Outlook:

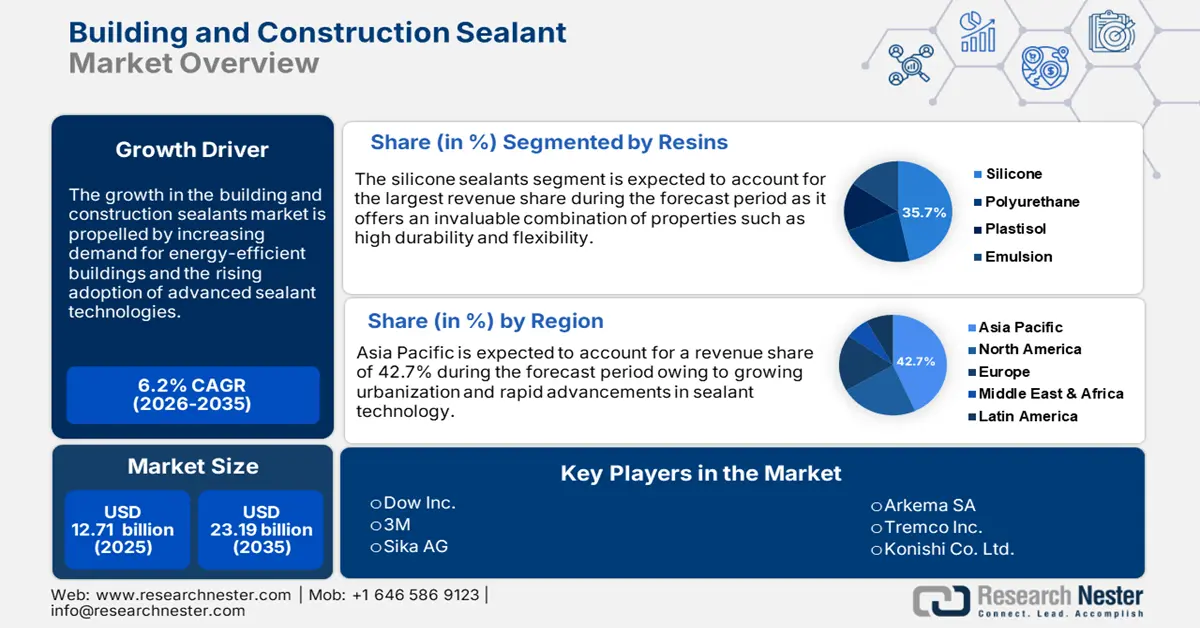

Building and Construction Sealants Market size was valued at USD 12.71 billion in 2025 and is set to exceed USD 23.19 billion by 2035, expanding at over 6.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of building and construction sealants is estimated at USD 13.42 billion.

The building and construction sealants market constitutes a vital part of the construction industry, with a broad range of materials and products applied to the building envelope to maintain structural integrity, energy efficiency, and weather tightness. The demand for energy-efficient buildings, along with the strict building codes and regulations instituted by many countries and the growing need for durable construction materials, propels the market. Growth in the sector is attributed to growing technological advancement and new product development within the building and construction sealants market.

Moreover, it offers opportunities for manufacturers, architects, and builders to stride towards sustainable, efficient, and resilient buildings by meeting the changing needs of the construction industry. For instance, Bostik offers MS Polymer hybrid sealants that are used in varied applications, from construction to industrial manufacturing. The company is focused on expanding its product offerings to meet the growing demand for high-performance and eco-friendly adhesives.

Key Building and Construction Sealants Market Insights Summary:

Regional Highlights:

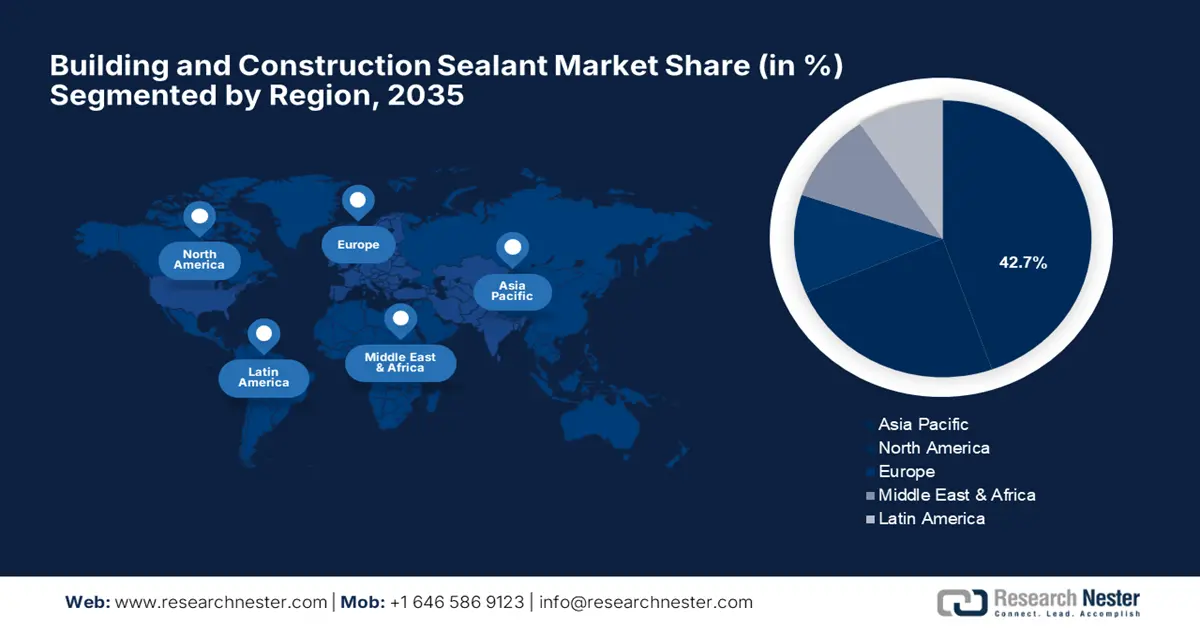

- Asia Pacific building and construction sealants market will account for 42.70% share by 2035, driven by rapid urbanization, government programs on infrastructure development, and growing construction demand.

- North America market will register the fastest growth during the forecast timeline, driven by renewed construction activities, energy-efficient building emphasis, and increased demand for sustainable sealants.

Segment Insights:

- The silicone sealants segment in the building and construction sealants market is expected to capture a 35.70% share by 2035, fueled by high durability, flexibility, and resistance against extreme environmental conditions.

- The water-based sealants segment in the building and construction sealants market is projected to see rapid growth till 2035, driven by ease of application, low odor, and environmental benefits across many substrates.

Key Growth Trends:

- Growing focus on sustainability

- Rising construction activities in emerging markets

Major Challenges:

- Increasing competition amongst low-cost manufacturers

Key Players: Henkel AG & Co. KGaA, Sika AG, 3M Company, Dow Inc., H.B. Fuller Company, BASF SE, Arkema S.A. (Bostik), Mapei S.p.A., Wacker Chemie AG, Momentive Performance Materials Inc.

Global Building and Construction Sealants Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 12.71 billion

- 2026 Market Size: USD 13.42 billion

- Projected Market Size: USD 23.19 billion by 2035

- Growth Forecasts: 6.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (42.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 18 September, 2025

Building and Construction Sealants Market Growth Drivers and Challenges:

Growth Drivers

- Growing focus on sustainability: The increasing focus on sustainable building methods and environmental concerns is driving up the pace of the adoption of green sealants in the building industry. Significantly, the use of low-volatile organic compound (VOC) sealants has risen, as builders and architects strive toward minimizing the environmental footprint. Additionally, other sustainable material-based sealants, like bio-polyurethane made from plants, are witnessing increased demand. Thus, to meet these demands, manufacturers have started investing in R&D, producing new, greener sealant products that emphasize recyclability, reusability, and minimizing waste. This trend toward sustainability is expected to continue to push growth in the sealants market in upcoming years.

- Rising construction activities in emerging markets: The developing economies are engaged in most of their construction activities, hence leading the sealants industry as one of the growth drivers. Consequently, rapid urbanization and economic growth in these regions face an exponential demand for infrastructure development, housing, and commercial and industrial establishments. This factor is boosting the demand for high-performance sealants that would provide sustainability, durability, and energy efficiency to the structures. The explosion in construction activities is likely to continue with population growth, urban migration, and government initiatives, thus opening greater prospects for lucrative opportunities to explore these emerging markets and capitalize on resultant growth prospects for sealant manufacturers.

- Sealants utilization in non-conventional applications: The significant reason for industrial growth is the expanding application of sealants into unconventional areas. Traditionally, sealants were widely used in construction and industrial applications, but owing to the advantages, sealants are being increasingly applied in a host of unconventional areas. For instance, sealants find their increasing uses in the automotive industry for bonding and insulation, in the electronic industry for protection and encapsulation, and in the medical area for wound care and assembling devices.

Moreover, due to the sustainable and eco-friendly demand, the use of sealants is extended to new areas such as renewable energy systems, energy storage devices, and roofing with greening functions. For instance, specialty sealants are used in special applications, such as fire stops, electrical or thermal insulation, and aircraft applications.

Challenges

- Complexities in expanding into new geographies: The building and construction sealants market is witnessing an expansion into new markets and geographies which involves dealing with various regulatory frameworks, adapting to local market preferences, and forming strategic partnerships with regional players. Also, diversifying operations into new geographies accommodates heavy investment in market research, localization of products, and supply chain infrastructures to ensure timely delivery and assistance. Sustaining these challenges sealant manufacturers fail to grasp new revenue streams and consequently retain their positions as global industry leaders.

- Increasing competition amongst low-cost manufacturers: The competition in the building and construction sealants market is growing intense owing to the emergence of low-cost manufacturers. They leverage benefits in cheap labor, favorable regulatory environments, and government incentives for export-oriented units to offer a raft of high-volume, low-cost sealant products. The competitive market has placed downward pricing pressure, minimizing the profit margin and thus compelling established manufacturers to restructure their pricing policy, product mix, and cost structures.

Building and Construction Sealants Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.2% |

|

Base Year Market Size (2025) |

USD 12.71 billion |

|

Forecast Year Market Size (2035) |

USD 23.19 billion |

|

Regional Scope |

|

Building and Construction Sealants Market Segmentation:

Resins Segment Analysis

The silicone sealants dominate the building and construction sealants market securing the largest share of 35.7% of global demand owing to an invaluable combination of properties such as high durability, flexibility, and resistance against extreme temperature, weathering, and chemical exposure. Moreover, silicone sealants usually exhibit outstanding adhesion to such substrates as glass, stone, metal, and concrete, thus enabling a multiplicity of usages within buildings and construction by offering a strengthened building framework.

The growing demand is owed to its unique feature of fulfilling specific performance requirements, including high-temperature resistance, UV stability, and mold and mildew resistance which makes them an ideal choice for building and other construction applications. For instance, in March 2024, WACKER announced a new production building for silicone sealants at the Nünchritz site in Germany as a major expansion project for its sealants business.

Technology (Water-based, Solvent-based, Reactive)

The water-based sealants segment in building and construction sealants market is expected to register rapid revenue growth during the forecast period owing to its wide applications in glazing, flooring, and roofing. Water-based sealants offer several advantages including ease of application, low odor, and minimal environmental impact. Also, water-based sealants are suitable for most substrates, including wood, metal, and concrete, thereby consolidating their position as the leading technology in the market.

Application Segment Analysis

The flooring segment leads the application type in the building and construction sealants market due to the growing demand for durable and resilient flooring solutions. Waterproofing is an essential feature of sealants used in flooring applications, which can avoid moisture damage, slips, and falls. This growth is attributed to the trend of using an increasing amount of the following sealant types in flooring such as epoxy, polyurethane, and acrylic. Also, the increasing demand for low-maintenance and easy-to-clean flooring has accelerated the usage of sealants in different commercial and residential construction projects.

Our in-depth analysis of the building and construction sealants market includes the following segments:

|

Resins |

|

|

Technology |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Building and Construction Sealants Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific industry is expected to hold largest revenue share of 42.7% by 2035. The combination of factors that have elevated the status of the Asia Pacific region to be the dominant force in the building and construction sealants market is attributed to rapid urbanization brought about by the huge migration of people from the countryside into the cities. The local governments have therefore begun several programs to develop transportation networks, public housing, and other commercial facilities to upgrade the infrastructure. All these factors serve to increase the demand for sealants.

The construction industry in the region is growing unparalleled due to the investment in residential, commercial, and industrial construction. Furthermore, the large and prospering middle-class population in the region has brought about an ever-increasing demand for housing infrastructure and construction projects. Such demand assists to surge the increased use of sealants in various applications. Therefore, the. It is expected to continue with its dominance in the foreseeable years. In India, in December 2021, Sika announced the inauguration of a new technology center and manufacturing plant for high-quality adhesives and sealants in Pune.

North America Market Insights

North America is the fastest growing region in the building and construction sealants market followed by the Asia Pacific. Advancements in renewed construction activities, greater emphasis on energy-efficient buildings, and increased demand for sustainable and eco-friendly sealant solutions also drive the demand in the building and construction sealants market. The construction industries in the region have been rising remarkably due to governmental initiatives, low interest rates on loans, and a healthy economy, which consequently raises the consumption of sealants across applications such as building construction, renovation, and maintenance activities. Furthermore, increased focus on energy-efficient buildings and sustainable construction methodologies has improved the usage of value-added sealant technologies such as low-VOC and silicone-based sealants, driving the building and construction sealants market further.

Growth in the U.S. building and construction sealants market is driven by its evolving and well-established construction industry such as Lord Corp., American Sealants Inc. involved in sealant manufacturing containing unique features to meet market demands. Canada also recorded remarkable growth in recent years impelled by local government investments in infrastructure development. Moreover, its rapid growth trajectory and increasing demand for sealants are escalating share in the global building and construction sealants market.

Building and Construction Sealants Market Players:

- Henkel AG & Co. KgaA

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Dow Inc.

- Shin-Etsu Chemical Company

- Wacker Chemie AG

- 3M

- Sika AG

- Arkema SA

- Tremco Inc.

Companies focus on continuous research and development activities to introduce innovation and breakthroughs in the industry. Additionally, advanced technologies support the shifting needs of customers and meet environmental standards. Thus, these companies are continuously collaborating, making agreements, expanding, and joining ventures for the growth of this industry and are estimated to be the major key players in building and construction sealants market.

Recent Developments

- In May 2024, Dow Chemical International Private Limited (Dow India) and Glass Wall Systems India collaborated to launch DOWSIL carbon-neutral silicone service and support the green construction for building frameworks.

- In July 2021, Arkema, implemented a program to strengthen its polyurethane (PU) sealants with an emphasis on sealing and bonding applications for the construction market.

- Report ID: 6441

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Building and Construction Sealants Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.