Construction Plastics Market Outlook:

Construction Plastics Market size was over USD 127.2 billion in 2025 and is poised to exceed USD 262.16 billion by 2035, witnessing over 7.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of construction plastics is estimated at USD 135.79 billion.

Increasing number of construction activities across industrial, commercial and residential settings is one of the primary factors boosting global construction plastics market growth. With the rapid urbanization and rising global population, there has been a substantial increase in the construction activities worldwide. Different types of plastics are widely used in the construction sector due to its lightweight, ability to form tight seals and thermal and electrical insulating properties. According to a recent survey published in Built Environment Journal, the building and construction sector consumes 20% of all plastics and 70% polyvinyl chloride (PVC) that is produced globally every year.

Plastics are used in a variety of building component applications, including seals, roofing, floor coverings, windows, doors, internal and external finishes, varnishes, stains, pipes, along with supportive structures and building insulations. Polyvinyl chloride, polycarbonate, high impact strength, weather and UV resistance, high light transmission and easy fabrication. However, this results in rising environmental concerns, including plastics pollution in ocean, landfills and ecosystems. To cater to these issues, many eco-conscious manufacturers and companies are focusing on recycling plastics. In 2020, Ocean Voyages Institute (OVI) partnered with ByFusion to clean up the plastics waste accumulated in the Pacific Ocean and collected more than 1oo tons of plastics to make large-scale building material called By Block.

Key Construction Plastics Market Insights Summary:

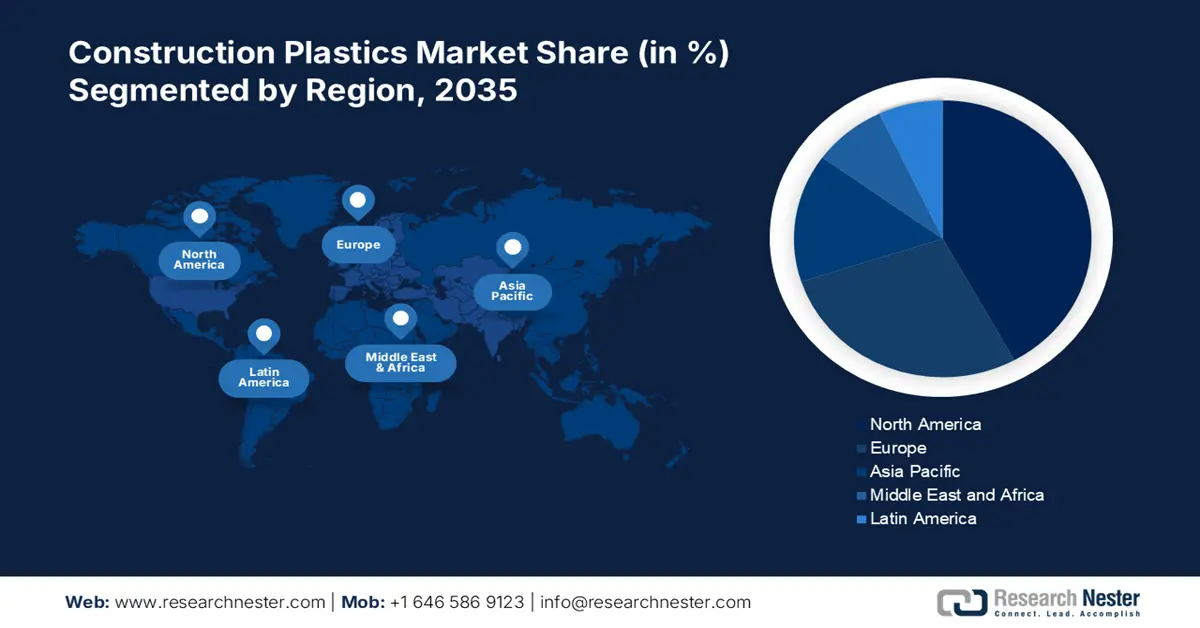

Regional Highlights:

- North America’s construction plastics market is anticipated to capture 33% share by 2035, driven by increasing investments in residential and commercial construction.

- Asia Pacific market will grow rapidly at a CAGR during 2026-2035, driven by government initiatives and construction activities in major economies like China and India.

Segment Insights:

- The polyvinyl chloride segment in the construction plastics market is set for substantial growth till 2035, fueled by widespread use in building and construction due to versatility and lightweight properties.

- The pipes & ducts segment in the construction plastics market is poised for significant growth over 2026-2035, attributed to superior performance and chemical/water resistance of plastics used in pipe systems.

Key Growth Trends:

- Growing demand for bioplastics materials in construction sector

- Increasing construction activities in the residential settings

Major Challenges:

- Low recycling rates

- Robust competition from alternative materials

Key Players: BASF, LG Chem Ltd, Lanxess Aktiengesellschaft, INEOS Group Holdings S.A., Koninklijke DSM N.V, Chevron Phillips Chemical Company, LLC, DowDuPont Inc.

Global Construction Plastics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 127.2 billion

- 2026 Market Size: USD 135.79 billion

- Projected Market Size: USD 262.16 billion by 2035

- Growth Forecasts: 7.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (33% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 18 September, 2025

Construction Plastics Market Growth Drivers and Challenges:

Growth Drivers

- Growing demand for bioplastics materials in construction sector: There has been a significant increase in the demand for bioplastics as these have emerged as a promising alternative to conventional plastics, especially in the building and construction sector. Bioplastics are revolutionizing the way houses and buildings were constructed, providing versatility, durability and sustainability. These materials are obtained from renewable resources and are used for insulation, roofing, windows, household objects, and cladding.

Several key players are investing to develop and expand their bioplastics product base. For instance, in June 2021, Green Dot Bioplastics, Inc. announced the launch of new construction project to double its bioplastics production capacity. - Increasing construction activities in the residential settings: In recent years, rapid urbanization, increasing global population and rising disposable income have resulted in rising demand for modern and luxurious homes. This has encouraged players in the plastics industry to develop high quality, durable plastics solutions that can be used in the construction activities. One such material is Polyrok, developed by an Australian company, Envra which is made from combination of recycled plastics and concrete. This product has been used in many projects, including Melbourne’s new DeerPark station.

Challenges

- Low recycling rates: Though many key players are focusing on recycling plastics, many types of plastics used in the construction activities have low recycling rates due to difficulties in collecting and processing them. Moreover, many construction projects often use a mixture of different plastics which can cause complications in the recycling processes. This can be a major factor that can affect market growth going ahead.

- Robust competition from alternative materials: Materials such as wood, metal, and composites are widely used as eco-friendly substitutes for plastics, lowering its adoption to a certain extent during the forecast period. Moreover, some plastics can degrade faster when exposed more in heat or UV radiation. This is also expected to affect global market growth during the forecast period.

Construction Plastics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.5% |

|

Base Year Market Size (2025) |

USD 127.2 billion |

|

Forecast Year Market Size (2035) |

USD 262.16 billion |

|

Regional Scope |

|

Construction Plastics Market Segmentation:

Product Segment Analysis

In terms of product, the polyvinyl chloride segment in the construction plastics market will account for 42.2% of revenue share by 2035. PVC is widely used in building and construction applications due to its low weight and ability to be molded and assembled into various shapes. It is mostly utilized to fabricate flexible and rigid products such as pipes, irrigation, electrical conduits, water distribution tubes and fittings, sewers, door frames and windows, gutters and downspouts, fencing and decking, roofing, and conveyor belts for food and chemical processing, as well as wall and floor covering.

In December 2023, INEOS announced the expansion of its PVC product range with the launch of NEOVYN to reduce overall carbon neutrality and circularity. The new product can be used across several sectors including, building and construction and is expected to significantly reduce carbon footprint which is 37% lower than the European industry average suspension PVC.

Application Segment Analysis

Pipes & ducts segment in the construction plastics market is estimated to register significant growth till 2035. Plastics pipes and tubing systems are used both inside and outside the building for a variety of purposes, such as water service, plumbing, geothermal piping systems, fire protection, hydronic heating and cooling, and snow melting. Polyethylene, polystyrene, polyvinyl chloride, and polypropylene are widely used in the pipe systems due to its superior performance and high chemical and water resistance.

Many leading companies are introducing high performance products to cater to the rising demand. In September 2020, PVC4Pipes, the value chain platform for the European PVC pipe industry launched an online training packaging for suppliers in the PVC pipe chain to provide comprehensive information about PVC materials for relevant applications from sewage, waste to drinking water.

Our in-depth analysis of the global market includes the following segments:

|

Product |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Construction Plastics Market Regional Analysis:

North America Market Insights

North America industry is estimated to hold largest revenue share of 33% by 2035. This growth can be significantly driven by rapid urbanization, increasing investments in the construction of residential, industrial as well as commercial settings, and presence of robust manufacturers.

The U.S. market is expected to account for significant revenue share during the forecast period owing to increasing construction activities all over the country and rapid technological advancements. The use of plastics in building and construction activities in the U.S. has been rapidly expanding across several applications such as piping and conducts, flooring, wall coverings, windows, and insulation. In addition, the U.S have building codes that favor materials that are long-lasting with good insulation properties. Thereby, boosting demand for different types of plastics in construction sector.

In Canada, the market for construction plastics sector is predicted to register steady revenue growth between 2024 and 2035 owing to ongoing commercial, industrial and residential infrastructural projects, rapid adoption of technologies in plastics components, high focus on developing sustainable and recycled plastics solutions for construction projects. Plaex Building Solutions is one of Canada well-known firm that offers crack and moisture resistant and cost-effective products for the construction sector made from recycled plastics and industrial waste.

Asia Pacific Market Insights

The construction plastics market in Asia Pacific is expected to expand at a rapid pace during the forecast period. This growth can be attributed to significant increase in construction activities in China, India, Japan, and South Korea, along with government initiatives and investments in infrastructure and housing.

In India, the construction plastics market is likely to expand at a rapid revenue CAGR during the forecast period owing to increasing construction activities to cater to rising population, and government projects including, Smart Cities Mission. Moreover, many key players are investing in infrastructural projects. For instance, Kimberly-Clark India partnered with Plastics for Change India Foundation to launch ‘Project Ghar’. The project aimed to build houses with recycled single-use plastics.

China is one of the largest markets for construction plastics in APAC owing large population base, ongoing residential and commercial building projects, and presence of leading players. Local government and manufacturers in China are focused on developing bioplastics and recycled plastics to cater to the rising environmental concerns.

Construction Plastics Market Players:

- BASF SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Solvay S.A.

- SABIC

- LyondellBasell Industries Holdings B.V.

- LG Chem Ltd

- LANXESS Aktiengesellschaft

- INEOS Group Holdings S.A.

- Koninklijke DSM N.V

- Chevron Phillips Chemical Company, LLC

- DowDuPont Inc.

The global construction plastics market is extremely competitive with multiple multinational corporations and local manufacturers who are focused on developing new products and technologies to cater to the growing demand for sustainable materials and solutions in the construction sector, stringent regulatory frameworks, and changing consumer preferences. These key players are adopting several strategies such as mergers and acquisitions, partnerships, product launches, and joint ventures to enhance their product base and retain their market position. Here is a list of key players operating in the global market.

Recent Developments

- In December 2022, LG Chem announced the launch of Aisa’s first plant material-based environmentally friendly ABS which can be used across various applications such as construction materials, household appliances, and automobiles.

- In 2019, UNICEF partnered with Conceptos Plasticsos, a Columbia-based social enterprise to develop a first-of-its-kind factory to convert plastics waste collected in Côte d'Ivoire into plastics bricks that will be used to build classrooms in the West African country.

- Report ID: 6381

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Construction Plastics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.