Building Analytics Market Outlook:

Building Analytics Market size was valued at USD 8.3 billion in 2025 and is projected to reach USD 18 billion by the end of 2035, rising at a CAGR of 8.1% during the forecast period 2026-2035. In 2026, the industry size of building analytics is estimated at USD 8.9 billion.

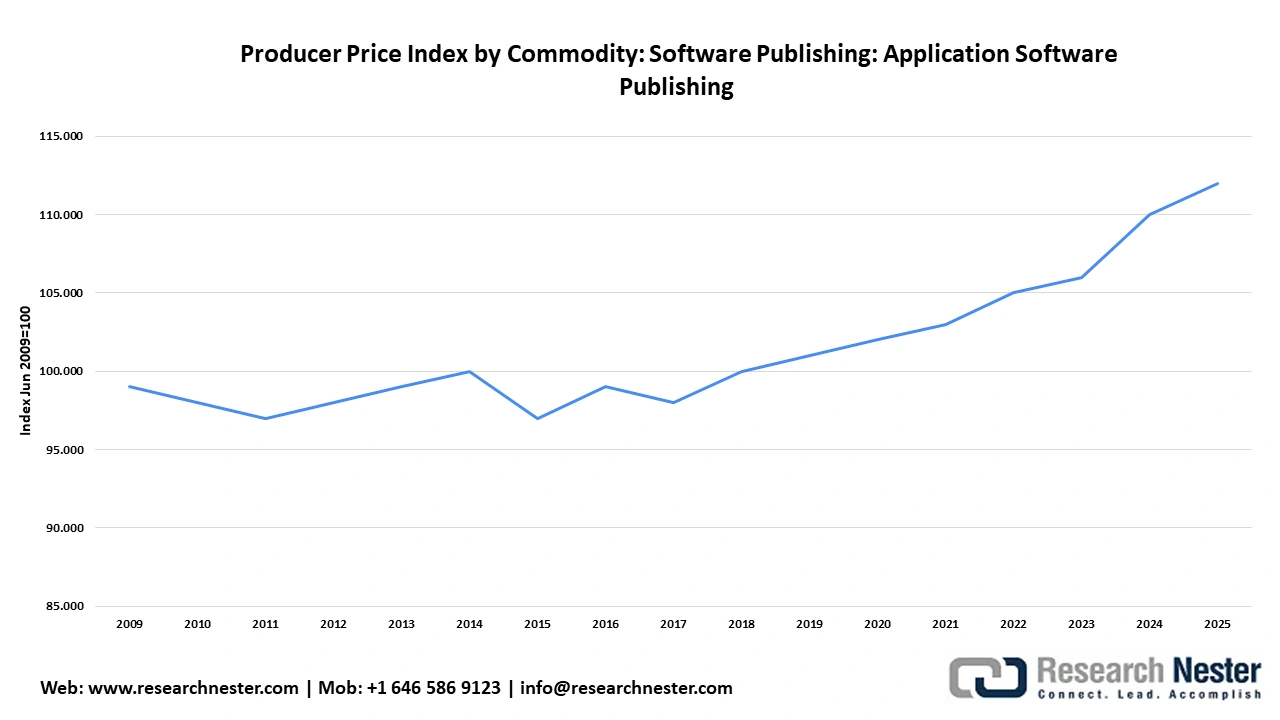

The market’s growth trajectory is favorably influenced by the rising adoption of smart building technologies that are able to optimize energy consumption. Multiple factors, ranging from the rising urbanization to the growth in smart city initiatives, are impacting the market dynamics. In terms of economic indicators, the producer price index (PPI) for application software publishing stood at 112.538 in August 2025, according to the Federal Reserve Bank of St. Louis.

Source: Federal Reserve Bank of St. Louis

In terms of operational metrics of the market, hybrid models of workflow have contributed to the fluctuation in utilization patterns. From the real estate sector, occupancy variances are increasing in certain urban hubs, leading to the rising demand for analytics solutions that bolster dynamic space management. Additionally, the regional pressure has intensified the adoption of building analytics. For instance, the EU’s Energy Performance of Buildings Directive (EPBD) and California’s Title 24 have pushed greater adoption of advanced analytics.

The market's supply chain is multifaceted, spanning software development and hardware production. The trade flow is experiencing a transfer of high-tech software solutions from developed markets to emerging economies. Moreover, the hardware components are flowing from APAC to North America and Europe. The global market is also impacted by a bifurcated investment pattern, especially with the capital expenditures for hardware manufacturing reflecting moderate levels of growth. The trends highlight that the market is poised to maintain its expansion throughout the anticipated timeline.

Key Building Analytics Market Insights Summary:

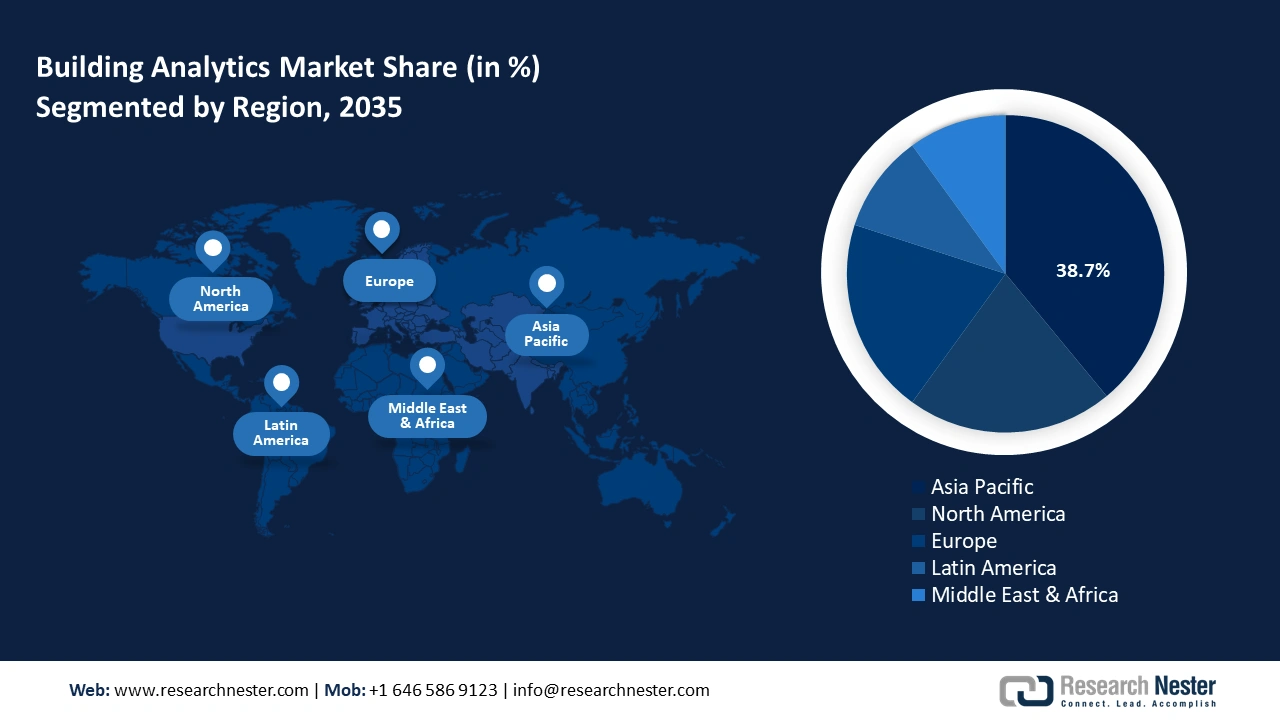

Regional Insights:

- North America is poised to secure a 38.7% share by 2035 in the Building Analytics Market, attributed to the region’s strong economic integration that supports building technology flows.

- The APAC market is projected to expand at a 12.9% CAGR during 2026–2035, stemming from improved regional trade flows and the proliferation of smart city initiatives.

Segment Insights:

- The fault detection and diagnostics segment is projected to hold a 42.6% share by 2035 in the Building Analytics Market, propelled by the escalating reliance on FDD tools for proactive efficiency and system fault identification.

- The software segment is expected to secure the largest share through 2035, sustained by expanding adoption of analytics-driven solutions that enhance operational effectiveness and real-time monitoring.

Key Growth Trends:

- Energy benchmarking compliance driving adoption

- Real-time detection bolstered by edge computing improving operational resilience

Major Challenges:

- Fragmented data ecosystem hindering integrated analytics delivery

- High deployment and integration costs

Key Players: Schneider Electric,Siemens AG,Johnson Controls,Honeywell International,IBM Corporation,BuildingIQ,ICONICS,Delta Electronics,CopperTree Analytics,General Electric,ENGIE Insight,GridPoint,Planon,Altus Group,Matterport

Global Building Analytics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.3 billion

- 2026 Market Size: USD 8.9 billion

- Projected Market Size: USD 18 billionby 2035

- Growth Forecasts: 8.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.7% Share by 2035)

- Fastest Growing Region: APAC

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, Indonesia, Vietnam, United Arab Emirates, Brazil

Last updated on : 29 September, 2025

Building Analytics Market - Growth Drivers and Challenges

Growth Drivers

- Energy benchmarking compliance driving adoption: A significant catalyst of the building analytics market is the push by regulatory compliance. In 2023, multiple jurisdictions, such as Local Law 97 of New York City, the Minimum Energy Efficiency Standards (MEES) of the UK, and the EU’s updated Energy Performance Buildings Directive (EPBD), mandated commercial buildings to report energy consumption annually. Additionally, the metrics underscoring measurable growth are to be highlighted via MEES's enforcement, leading to the increasing compliance rates in the U.K. The market is projected to leverage these trends and maintain its expansion by the end of 2035. In May 2024, the updated Energy Performance of Buildings Directive (EPBD) (EU/2024/1275) set stronger rules for new buildings to save energy and to be zero-emission by 2030.

- Real-time detection bolstered by edge computing improving operational resilience: The rapid advancements in edge computing, converging with the advent of AI algorithms, have enabled improved fault detection and predictive maintenance in building systems. This creates a favorable ecosystem for the heightened adoption of building analytics. The shift is particularly impacted by the rising IoT sensor deployment, and to avoid the surging cost of downtime in critical commercial infrastructures such as hospitals. The convergence of analytics improvements driven by technological advancements and the rising connectivity across the world is poised to ensure that the market's momentum remains prolific throughout the forecast timeline.

- Technological trends: The global market is evolving due to technological advancements driving improvements in analytics platforms. Another major advancement has been the proliferation of digital twins, which has significantly bolstered predictive maintenance. Due to the convergence of AI and ML, product development has been bolstered within the global market. In May 6, 2025, Kyvos Insights launched Kyvos Dialogs, a new AI-powered tool for analyzing data. This tool lets business users ask questions in everyday language to quickly get accurate and relevant insights from all their company data. Thus, the major companies in the market are leveraging AI-driven simulations to accelerate design cycles.

Challenges

- Fragmented data ecosystem hindering integrated analytics delivery: The building analytics market suffers due to the fragmented nature of the data sources and regulatory standards. The diversity of heterogeneous datasets has exacerbated the impediments to integration. This leads to increased downtimes impacting various facets of the market, from the consumer to the operator. Additionally, the market’s reliance on multiple vendors void of unified data protocols compounds the challenge.

- High deployment and integration costs: High upfront deployment and integration costs are a prime barrier to market growth. This factor is mainly reported in developing markets and among small to mid-sized facility owners. Implementing advanced building analytics requires high capex, which is not readily available to small companies. Thus, developing markets often show complex results for investors.

Building Analytics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

8.1% |

|

Base Year Market Size (2025) |

USD 8.3 billion |

|

Forecast Year Market Size (2035) |

USD 18 billion |

|

Regional Scope |

|

Building Analytics Market Segmentation:

Application Segment Analysis

The fault detection and diagnostics segment is projected to account for a leading revenue share of 42.6% by the end of 2035. A major driver of the segment is the surging reliance of energy managers and building operators on FDD tools to identify energy efficiency and system faults proactively. Additionally, the users benefit from automated diagnostics, which reduce downtime considerably whilst also optimizing the overall energy consumption. These trends converge with a growing push to adhere to sustainability targets as well as regulatory guidelines, fueling the overall market growth.

Component Segment Analysis

The software segment is projected to capture the largest market share throughout the study period. Modern buildings are key users of software solutions as they act as the core enabler of data-driven decision-making. Many buildings highly invest in actionable analytics solutions for operational effectiveness. Facility managers and building owners also use these technologies for energy optimization, fault detection, and real-time monitoring. In May 2022, ThoughtSpot introduced new editions of its analytics tool for individuals and teams to make the Modern Analytics Cloud accessible to everyone. These editions allow companies of any size to use data for their business, paying only for what they use instead of buying expensive, unused licenses from traditional analytics companies. This indicates that continuous innovations are anticipated to fuel the application of software solutions.

End user Segment Analysis

The residential segment is estimated to account for a high market share through 2035, due to the surge in smart homes. The growing energy efficiency requirements and consumer-driven demand for comfort and cost-saving technologies are accelerating the adoption of building analytics. The Association for Smart Home Professionals projects that the U.S smart home market was estimated at USD 29 billion in 2024. Residential buildings are prime adopters of connected devices, including smart meters, HVAC systems, lighting controls, and home automation platforms.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Component |

|

|

Deployment Mode |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Building Analytics Market - Regional Analysis

North America Market Insights

North America market is poised to account for a leading revenue share of 38.7% by the end of 2035. The market's growth is favorably impacted by a higher degree of economic integration, which is mapped by the intra-continental flows of building tech components in the region. Moreover, this creates a well-established value chain in the region. The market is supported by a favorable regulatory ecosystem, such as the North American Energy Standards Board, implementing homogenous energy efficiency policies. Additionally, in terms of demographic trends, the urban population has expanded massively across the major metros, correlating with the surging deployment of smart buildings. These trends, converging together, are poised to ensure that the market maintains its dominant revenue share during the forecast timeline.

U.S. building analytics market is poised to maintain its leading share in North America. The market is characterized by state-level differentiation, with the most lucrative opportunities for vendors concentrated in Texas, California, and New York. Federal policies, such as the Inflation Reduction Act (IRA), impact sub-markets, resulting in high improvements in fault detection adoption in commercial real estate. Strategic intelligence highlights that firms that are leveraging localized regulatory knowledge also capture premium pricing whilst expanding service portfolios.

The Canada market is anticipated to expand steadily throughout the forecast period. The stringent energy efficiency regulations are accelerating the trade of building analytics. The green building certifications and government-backed sustainability programs are also boosting the demand for building analytics solutions. The Canada Green Building Council projects that the green building sector of the country is estimated to create 1.5 million direct green building jobs and around USD 150 billion in GDP by 2030. Thus, this industry is likely to be the key booster of building analytics solutions.

APAC Market Insights

The APAC market is slated to increase at a CAGR of 12.9% throughout the forecast timeline. A driving force behind APAC’s growth is the improvement in trade flow across the economies of APAC and a greater proliferation of smart city initiatives. Additionally, Petri and Plummer's research shows that the RCEP trade agreement is set to boost global incomes by 2030. China, Japan, and South Korea are expected to gain the most from it. Additionally, bilateral agreements between Vietnam and South Korea, Indonesia, and Japan have spurred the technology transfer. The market also benefits from sovereign wealth funds such as the GIC of Singapore and Khazanah of Malaysia through the proactive investments in regional green building infrastructure. By the end of 2035, the surging urbanization across APAC has the potential to ensure a sustained market growth.

China building analytics market is expected to register rapid growth owing to the Dual Circulation strategy. The domestic consumption has risen in tier 1 cities, including Shanghai. The tier 2 cities in Wuhan and Chengdu are where large-scale infrastructure modernization is driving the deployment of building analytics. In terms of trends, consumers and businesses in China have exhibited a high responsiveness to green building certification, which bolsters the intent among end users to adopt building analytics tools, serving as a key bottom-of-the-funnel indication.

India building analytics market is projected to be driven by the rising urbanization and increasing smart city initiatives. The government-backed energy efficiency programs are accelerating the trade of building analytics. According to the Press Information Bureau (PIB), 94% of the 8,067 projects in the Smart Cities Mission are finished, with around USD 1.98 trillion spent on them. Smart city projects are creating large-scale opportunities for building management system and analytics platform producers.

Europe Market Insights

The Europe market is estimated to hold a significant revenue share through 2035, owing to the stringent environmental regulations and energy efficiency mandates. The rapid digital transformation and increasing expansion of smart cities are further opening high-earning opportunities for building analytics companies. The green building trend is also accelerating the adoption of HVAC and lighting systems

Germany leads the sales of building analytics, owing to its strict energy regulations such as the Energy Saving Ordinance (EnEV) and the Renewable Energy Heat Act (EEWärmeG). The commercial and industrial buildings are prime end users of building analytics. The country’s strong industrial base and high penetration of smart buildings further accelerate the deployment of IoT-enabled sensors and cloud analytics.

The U.K. market is projected to be driven by the expanding government initiatives promoting energy efficiency and carbon neutrality. Programs such as the UK Green Building Council (UKGBC) initiatives and mandatory energy reporting for large commercial buildings are significantly boosting the trade of building analytics platforms. The commercial offices, retail spaces, and healthcare facilities are prime adopters of building analytics platforms.

Key Building Analytics Market Players:

- Schneider Electric

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Siemens AG

- Johnson Controls

- Honeywell International

- IBM Corporation

- BuildingIQ

- ICONICS

- Delta Electronics

- CopperTree Analytics

- General Electric

- ENGIE Insight

- GridPoint

- Planon

- Altus Group

- Matterport

The global building analytics market is projected to maintain its growth during the stipulated timeframe. The market is characterized by a mix of specialized firms and established conglomerates. Leading players include Schneider Electric, Siemens AG, Johnson Controls, etc. The mid-tier companies in the market have been successful so far in carving out niches by offering cloud-based analytics solutions targeted to specific building types.

The table below highlights the major players in the market:

Recent Developments

- In November 2024, Johnson Controls announced big improvements to the AI features in its OpenBlue Enterprise Manager. This is part of their OpenBlue digital ecosystem, which includes various digital tools.

- In May 2024, Honeywell announced the launch of the Forge Performance for utilities platform. The AI-powered solutions have integrated digital twin capabilities with machine learning to bolster predictive maintenance. The platform seeks to bolster grid reliability to balance energy supply and demand.

- Report ID: 3258

- Published Date: Sep 29, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Building Analytics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.