Bucket Testing Software Market Outlook:

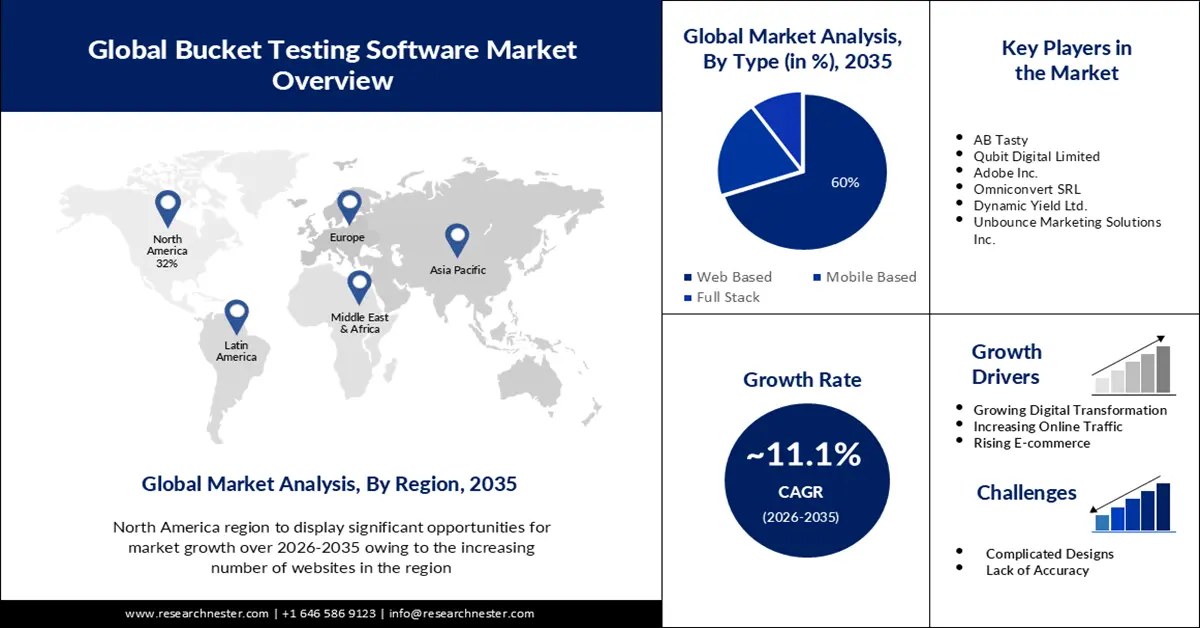

Bucket Testing Software Market size was valued at USD 2.93 billion in 2025 and is set to exceed USD 8.39 billion by 2035, registering over 11.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of bucket testing software is evaluated at USD 3.22 billion.

The rising digitalization of economies and the growing global e-commerce businesses are majorly responsible for the increasing demand for bucket testing or A/B testing software to maximize revenue by optimizing their websites and increasing sales volume.

Bucket testing software is being widely employed for conversion rate optimization and to enhance the responses of customers by attracting them towards a call to action. The software experiments with two or more variants of a page and performs statistical analysis to ascertain which variation responds better to a given conversion goal. According to our research, in a 2022 survey, it was found that more than 55% of companies worldwide make use of bucket testing to optimize their conversion rate. Also, around 35% of companies plan to adopt the testing method.

Key Bucket Testing Software Market Insights Summary:

Regional Highlights:

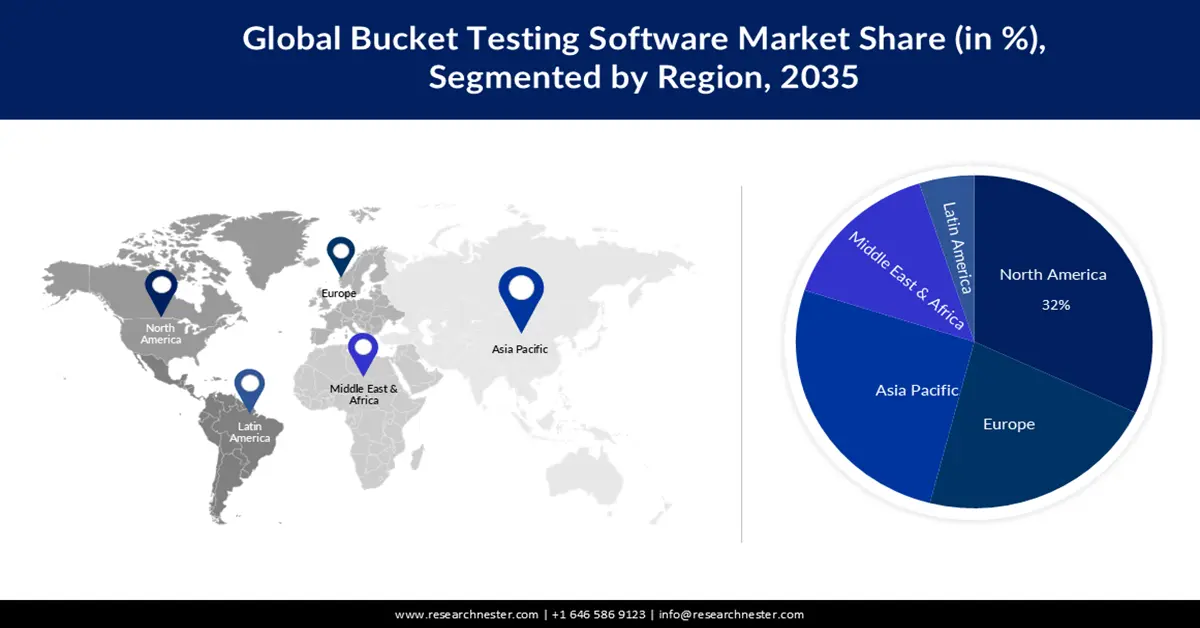

- By 2035, North America is projected to secure a 32% share of the Bucket Testing Software Market, attributed to the rapid expansion of e-commerce and the rising number of high-traffic websites across the U.S. and Canada that necessitate optimization tools to reduce bounce rates and enhance customer satisfaction.

- The Asia Pacific region is expected to account for about 26% share by 2035, underpinned by accelerating digitalization in emerging economies and the increasing adoption of split-testing technologies to improve user experiences and boost online sales.

Segment Insights:

- The web-based segment in the Bucket Testing Software Market is anticipated to capture a 60% share by 2035, propelled by expanding online traffic volumes and the growing digital footprint of businesses that rely on bucket testing to elevate conversions per page.

- The email marketing segment is projected to record around 70% growth during 2026–2035, supported by rising email campaign usage aimed at strengthening consumer engagement through more precise audience segmentation.

Key Growth Trends:

- Rising Need for Improved User Experience

- Enabling Data Driven Decisions

Major Challenges:

- Lack of Knowledge

- Reluctancy in Adoption

Key Players: Optimizely, Inc., AB Tasty, Qubit Digital Limited, Adobe Inc., Omniconvert SRL, Dynamic Yield Ltd., Unbounce Marketing Solutions Inc., Wingify Software Pvt. Ltd., Evolv Technology Solutions Inc.

Global Bucket Testing Software Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.93 billion

- 2026 Market Size: USD 3.22 billion

- Projected Market Size: USD 8.39 billion by 2035

- Growth Forecasts: 11.1%

Key Regional Dynamics:

- Largest Region: North America (32% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, United Kingdom, Germany, Japan

- Emerging Countries: India, Brazil, South Korea, Singapore, Australia

Last updated on : 20 November, 2025

Bucket Testing Software Market - Growth Drivers and Challenges

Growth Drivers

- Rising Need for Improved User Experience – With the increasing penetration of the internet and the accompanying digital transformation, it is necessary to assess which version of a landing page engages consumers the most. Testing various elements of a page, website, application, advertisement, email, or product can aid in the implementation of necessary changes that will increase consumer engagement by improving the overall user experience.

- Enabling Data-Driven Decisions – The growing number of websites and the increasing online traffic necessitate businesses to make data-driven decisions for optimizing a website's and page's performance. Bucket testing eliminates the requirement for subjective judgments with respect to the page’s layout or design. As this software guides decision-making based on the quantitative information obtained in the test process, it aids in making valid decisions.

Challenges

- Lack of Knowledge - Although the market is growing rapidly, it may be constrained by a lack of understanding of the many aspects of software tools and how they affect business values. Adobe reports that 85% of digital marketers believe it is challenging for their businesses to know how to test properly.

- Reluctancy in Adoption

- Lengthy Procedures & Complicated Designs

Bucket Testing Software Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

11.1% |

|

Base Year Market Size (2025) |

USD 2.93 billion |

|

Forecast Year Market Size (2035) |

USD 8.39 billion |

|

Regional Scope |

|

Bucket Testing Software Market Segmentation:

Type Segment Analysis

The web-based segment in the bucket testing software market is anticipated to garner a major revenue share of 60% by 2035. As per recent data, around 1.13 billion websites are available on the internet in 2023 compared to 1.12 billion in 2022. The growing digital presence of businesses, services, and products and the expanding volume of online traffic is promoting the use of bucket-testing website software as it aids in acquiring conversions per page. The highest-trafficked pages are forecasted to earn high revenue by increasing website sales.

Application Segment Analysis

The email marketing segment is predicted to witness noteworthy growth of 70% over the forecast period. The growing use of email campaigning in the digitized world to build consumer engagement and improve loyalty. Bucket testing improves audience categorization and aid in developing targeted content.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Application |

|

|

End User Enterprises |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Bucket Testing Software Market - Regional Analysis

North American Market Insights

The bucket testing software market in North America industry is predicted to hold largest revenue share of 32% by 2035. The rapid expansion of e-commerce and enlarging volume of websites for shopping, gaming, and other purposes in countries such as the United States and Canada are influencing the application of such software to reduce bounce rates and improve customer satisfaction, resulting the positive market growth in the region.

APAC Market Insights

The Asia Pacific bucket testing software market is estimated to register a share of about 26% by 2035, backed by the growing digitalization of various private and government sectors in emerging economies such as China, Japan, and India, which is leading to the rapid adoption of advanced technologies such as split testing software to enable better user experiences, which, in turn, is expected to increase online sales. According to a study survey, digital transformation was cited as the top priority by about 65% of respondents in the Asia Pacific region.

Bucket Testing Software Market Players:

- Optimizely, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- AB Tasty

- Qubit Digital Limited

- Adobe Inc.

- Omniconvert SRL

- Dynamic Yield Ltd.

- Unbounce Marketing Solutions Inc.

- Wingify Software Pvt. Ltd.

- Evolv Technology Solutions Inc.

Recent Developments

- Optimizely Inc., collaborated with Openpay, a leading provider of Buy Now, Pay Later (BNPL) services, to deliver scalable software solutions that may allow the company to manage trade accounts end-to-end.

- AB Tasty launched product analytics solutions in partnership with over 25 firms, including Amplitude, Heap, and Mixpanel, among others.

- Report ID: 3837

- Published Date: Nov 20, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Bucket Testing Software Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.