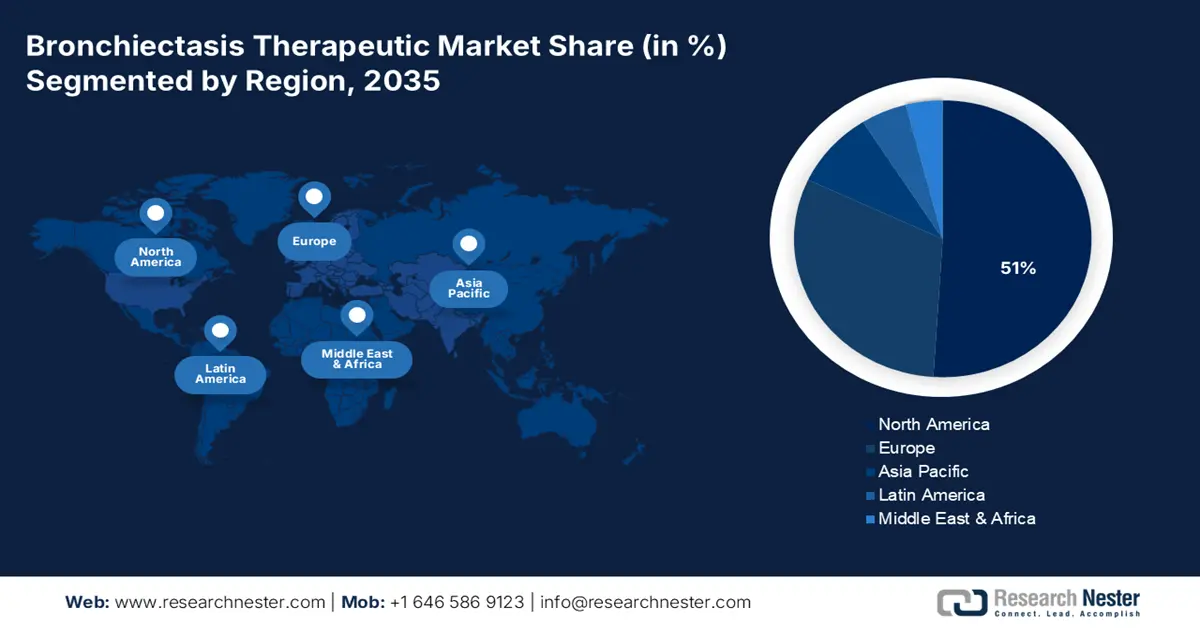

Bronchiectasis Therapeutic Market Regional Analysis:

North America Market Insight

The bronchiectasis therapeutic market in North America is expected to hold the highest growing market with 51% market share within the forecast period due to a strong pharma ecosystem, high diagnosis rates, advanced drug delivery technologies, increasing geriatric population, and prevalence of chronic respiratory disease. As per a report by NLM published in April 2024, as the baby boomer population in the region gets older and moves towards the age of retirement, the proportion of the population aged 65 or older is expected to increase significantly from 17% in 2022 to 21% in 2030 to 23% in 2050. Such a population growth trend would drive long-term demand for maintenance therapies as well as respiratory care innovation.

The bronchiectasis therapeutic market in the U.S. is projected to grow in the forecast period due to favorable FDA channels, excessive levels of awareness among patients, availability of prominent industry players, and elevated insurance coverage for novel therapies. As per a report by NLM in April 2024, the population aged 65 years and older in the US is expected to increase by 40% by 2050, from 58 million in 2022 to 82 million by 2050. The population 85 years and older and aging bring with them new challenges for the medical system, including the market for bronchiectasis therapy. Increased patient knowledge, driven by intensified screening efforts and education campaigns by health institutions, is leading to early diagnosis and use of treatment.

The bronchiectasis therapeutic market in Canada is expected to grow within the forecast period government funding for respiratory health, a growing older population, increased COPD burden, and advances in pulmonology research infrastructure. Exacerbation of COPD is the second leading cause of hospitalization in Canada. According to the report of NLM September 2023, in Canada, COPD currently affects an impressive 10% of the adult population and almost 1 in 5 individuals aged over 70 years. This heavy burden has triggered national efforts directed towards chronic respiratory disease management. As awareness and diagnostic capabilities improve, more bronchiectasis cases are being identified and treated earlier.

Asia Pacific Market Insight

The bronchiectasis therapeutic market in the Asia Pacific is expected to be the fastest-growing market within the forecast period due to rising healthcare expenditure, growing burden of non-cystic fibrosis bronchiectasis, supportive government initiatives, and growth of pharmaceutical firms in countries such as Japan and China. As per a report by NLM, September 2024, the overall prevalence of bronchiectasis is 464 per 100,000 population in Korea and 1,200 per 100,000 persons over 40 years old in China. Governments across the region are placing increasing focus on respiratory health in national healthcare policy, subsidies, and coverage for chronic respiratory therapies under public insurance schemes.

The bronchiectasis therapeutic market in China is expected to grow within the forecast period due to urbanization, respiratory issues arising out of it, increased usage of Western therapy, a high number of undiagnosed patients, and increasing clinical research activity. As per a report by NLM, September 2024, the economic burden of bronchiectasis in patients of Asia is notable, with epidemiological data from China indicating an annual per capita cost of USD 7,697 for patients with bronchiectasis. The increasing economic burden has motivated a greater government focus on disease management and health system strengthening.

The bronchiectasis therapeutic market in India is expected to grow within the forecast period due to the growing incidence of post-TB bronchiectasis, health access improvement, generic manufacturing of drugs, and growing pulmonology specialty care. The patients in India with bronchiectasis also have a high comorbidity rate and are mostly suffering from asthma and COPD. As per a report by NLM, September 2024, the prevalence of diabetes mellitus among patients in India is approximately 14%, much higher than that in other countries of Asia. Furthermore, coronary heart disease among bronchiectasis patients of India is higher at 16.2%, which indicates a large cardiovascular burden.

Comparison of the Clinical Characteristics of Bronchiectasis Between Countries in Asia (2024)

|

Comparison of the clinical characteristics of bronchiectasis between Asian countries |

Korea |

India |

China |

|

Demographics |

|||

|

Age, years |

66 (60 to 72) |

56 (41 to 66) |

57 (48 to 64) |

|

Men |

264 (44.1) |

1249 (56.9) |

48.4% |

|

Body mass index, kg·m−2 |

22.9 (20.7 to 25.4) |

21.5 (18.5 to 24.5) |

21.5 (19.0 to 23.9) |

|

Current or former smokers |

211 (35.3) |

619 (28.2) |

22.2% |

|

Comorbidities |

|||

|

COPD |

226 (37.8) |

512 (23.3) |

12.9% |

|

Asthma |

134 (22.4) |

485 (22.1) |

8.8% |

|

Osteoporosis |

70 (11.7) |

130 (5.9) |

21.2% |

|

GORD |

89 (14.9) |

346 (15.8) |

18.4% |

|

Neoplastic disease |

50 (8.4) |

17 (0.8) |

NA |

|

Disease severity |

|||

|

BSI score |

6 (4 to 9) |

7 (3 to 10) |

9 (5 to 11) |

|

BSI score risk class |

|||

|

- Mild |

171 (29.4) |

728 (33.2) |

6.5% |

|

- Moderate |

257 (44.1) |

674 (30.7) |

33.8% |

|

- Severe |

154 (26.5) |

793 (36.1) |

59.7% |

|

Clinical status |

|||

|

mMRC dyspnoea scale |

1 |

2 (1 to 3) |

1 (0 to 2) |

|

Exacerbation in the previous year |

1 (0 to 2) |

1 (0 to 2) |

1 (0 to 3) |

|

≥1 hospital admission in the previous year |

109 (18.2) |

851 (38.8) |

59.9% |

|

Microbiology |

|||

|

Pseudomonas aeruginosa |

66 (11.0) |

301 (13.7) |

24.0% |

|

Haemophilus influenzae |

9 (1.5) |

11 (0.5) |

7.8% |

|

Staphylococcus aureus |

4 (0.7) |

50 (2.3) |

1.0% |

|

Moraxella catarrhalis |

3 (0.5) |

22 (1.0) |

0.1% |

|

Enterobacteriaceae |

23 (3.9) |

215 (9.8) |

5.3% |

|

Treatment |

|||

|

Long-term antibiotics |

23 (3.9) |

271 (12.3) |

3.9% |

|

Inhaled antibiotics |

0 |

79 (3.6) |

1.6% |

Source: NLM, September 2024

Europe Market Insight

The bronchiectasis therapeutic market in Europe is expected to grow steadily within the forecast period due to government health insurance programs, high rate of clinical diagnosis that is high, aging population, and increased R&D spending on respiratory diseases. In addition, growing awareness of bronchiectasis among physicians supports early treatment adoption and diagnosis. Technological innovation in targeted therapies and biologics propels market innovation, while effective collaborations between healthcare institutions and pharma companies enhance patient access. Furthermore, strict regulatory standards ensure the safety and effectiveness of new therapeutic options, enhancing market confidence.

The bronchiectasis therapeutic market in the UK is expected to grow within the forecast period due to NHS-approved treatment availability, rising asthma and COPD comorbidity, expansion of biologics trials, and strong regulatory backing. As per a report by Asthma and Lung published in November 2022, new COPD diagnoses in the country dropped by 51% due to the pandemic, and the proportion of all five core treatments that the patients received fell from 24.5% to 17.6%, representing a drop of 6.9%. However, increased government spending on COPD and bronchiectasis, better patient knowledge, and adoption of novel treatments are driving steady market expansion.

The bronchiectasis therapeutic market in Germany is expected to grow within the forecast period due to a healthy pharma sector, rising hospitalizations caused by exacerbations, good quality diagnostic imaging equipment, and rising consumption of antibiotics and anti-inflammatory drugs. Additionally, increased government encouragement for respiratory disease management and ongoing clinical trials facilitate market growth. Rising patient sensitivity and improved health infrastructure further drive earlier diagnosis and treatment adoption. Furthermore, collaborations between doctors and pharmaceutical companies speed up the process of developing new medications.