Brewery Inventory Software Market Outlook:

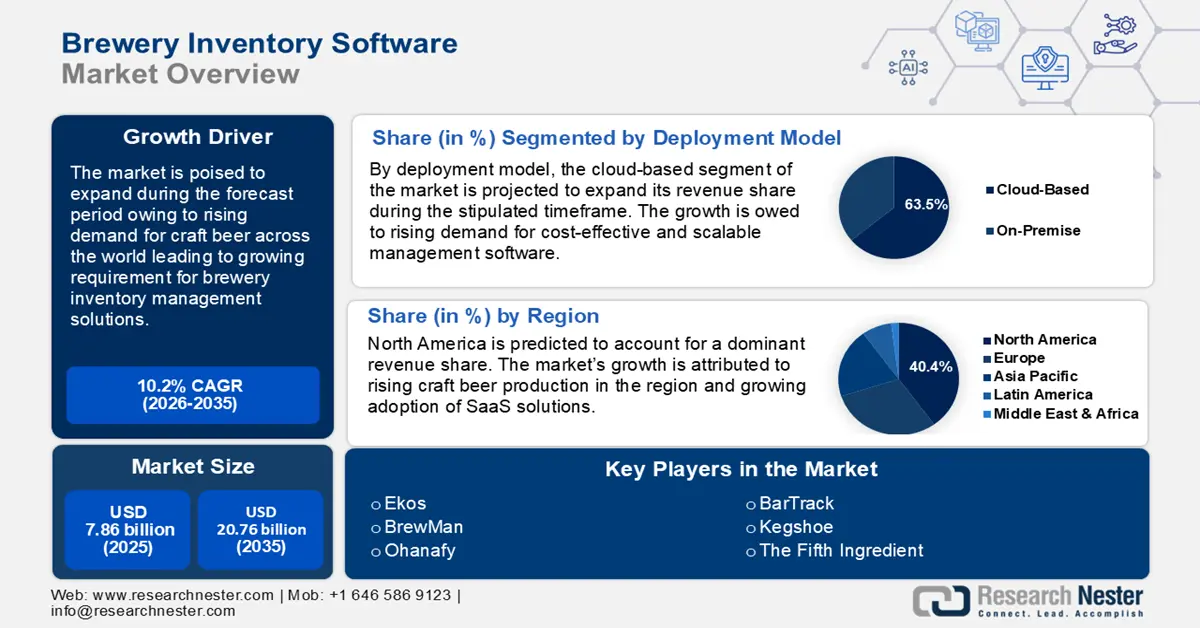

Brewery Inventory Software Market size was over USD 7.86 billion in 2025 and is projected to reach USD 20.76 billion by 2035, growing at around 10.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of brewery inventory software is evaluated at USD 8.58 billion.

The brewery inventory software market’s growth is attributed to the increasing adoption of digital solutions adopted to streamline operations within the brewery sector. Due to the proliferation of digital solutions, wineries, vineyards, and breweries must invest in advanced inventory software to ensure competitive edge in the market and to improve overall efficiency. Emerging trends within the global beer industry highlights the growing revenue share of craft beer, which is predicted to account for the surge in demand for brewery inventory software during the market’s period of analysis.

Refer to the table below for key trends in beer production in the U.S., and with the brewery inventory software market slated to account for a major share globally, an increase in the adoption of brewery inventory software bodes well for the rest of the world.

|

Beer Industry Trends 2023 (U.S.) |

|

|

Share of small and independent brewers |

|

|

Retail dollar sales of craft beer |

|

|

Beer sales volume |

|

Source: Brewers Association

The statistics highlight an increasing demand for real-time data to scale the increasing production of craft beer and keep pace with the brewery inventory software market demands. Furthermore, brewery inventory software assists in maintaining production schedules and in order fulfilment, and with the growing positive impact of automation trends in various sectors, the brewery industry is expected to adopt advanced brewery inventory software during the market’s forecast period. The table below highlights the global trade volume of beer.

|

Global Trade Volume of Beer (2022) |

|

|

World Trade Value |

|

|

Top Exporters |

|

|

Top Importer |

|

|

Share in World Trade |

|

Source: The Observatory of Economic Complexity

Furthermore, the brewery inventory software is expected to benefit from the rising emphasis on comprehensive brewery management solutions that extend beyond inventory control. Platforms that offer functionalities such as analytics, data-driven insights, sales forecasting, are poised to have an edge in the market. For instance, key players in the brewery inventory software market which are offering end-to-end Brewery Inventory Software solutions, with point-of-sale integrations are experiencing greater adoption as per the market trends. In February 2023, Loose Ends Brewing Company announced the application of Ekos to manage their growth and distribution in Ohio, U.S. With the rising demand for holistic brewery management approach, the brewery inventory software sector is poised to maintain its growth during the forecast period.

Key Brewery Inventory Software Market Insights Summary:

Regional Highlights:

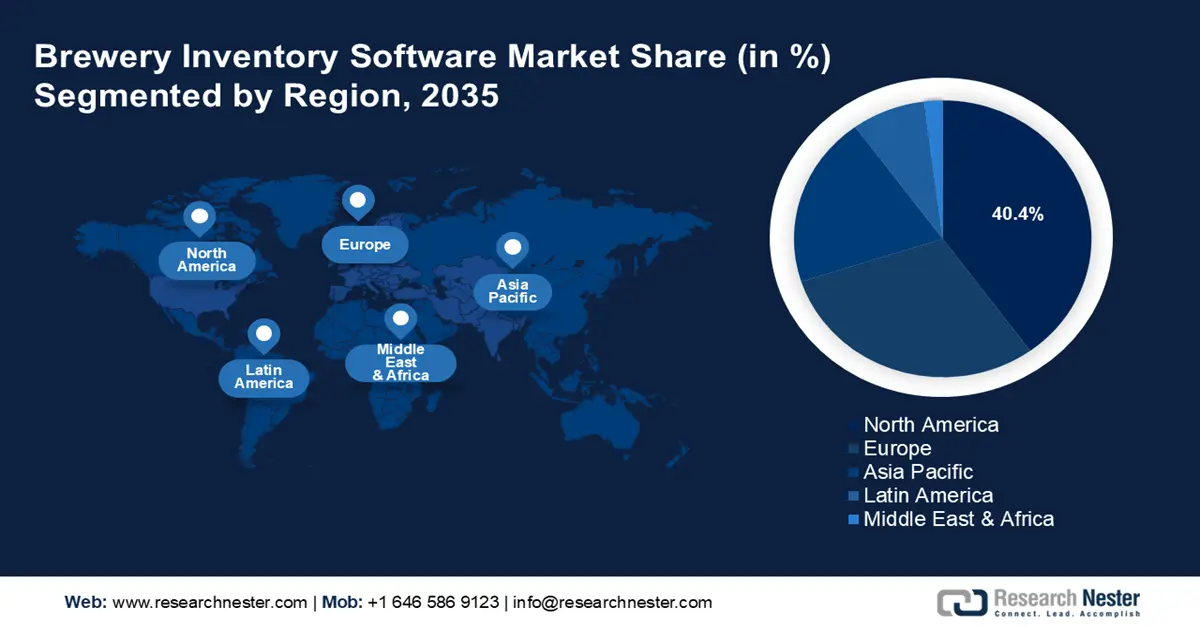

- North America brewery inventory software market will account for 40.40% share by 2035, driven by rising craft beer sales boosting need for efficient inventory software.

Segment Insights:

- The cloud-based segment in the brewery inventory software market is projected to hold a 63.50% share by 2035, driven by cost-effectiveness and scalability of cloud solutions.

- The inventory management segment in the brewery inventory software market is projected to hold a major revenue share by 2035, attributed to its impact on maintaining optimal stock levels and reducing waste.

Key Growth Trends:

- SKU rationalization and focus on core products

- Resurgence of local breweries amidst global crisis

Major Challenges:

- Integration with diverse brewing processes & equipment

Key Players: OrchestratedBEER (Orchestrated Spirits), Ekos Brewmaster, BrewPlanner, VicinityBrew Software, BrewMan (Premier Systems), BrewPOS, BeerRun Software, Brewtarget, Brewfather, BrewNinja Software.

Global Brewery Inventory Software Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.86 billion

- 2026 Market Size: USD 8.58 billion

- Projected Market Size: USD 20.76 billion by 2035

- Growth Forecasts: 10.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, China, Japan

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 18 September, 2025

Brewery Inventory Software Market Growth Drivers and Challenges:

Growth Drivers

-

SKU rationalization and focus on core products: The brewery inventory software market is poised to have an impact from the global trends in the beer sector. The shifting dynamics highlight rising operational costs leading to breweries across the world to focus on their core, high-demand earnings. SKU rationalization has assisted breweries in cutting down the complexities of managing a wide variety of products and instead focus on a smaller range of profitable, flagship beers. The trends have led to rising demand for advanced brewery inventory software as it provides breweries with precise tools to monitor and manage their leaner inventories.

Opportunities are expected to be rife in regions with rising production of craft beer, such as Europe and North America, and in APAC which is rapidly expanding its beer production. The rise of direct-to-consumer models has also fueled the demand for such inventory systems with breweries requiring automated stock management to fulfill e-commerce and subscription service orders. Additionally, the table below highlights the increasing number of operating breweries in the U.S. which is favorable for the expansion of opportunities in the brewery inventory software.

|

Craft Brewery Statistics in the U.S. (2023) |

|

|

Total number of operating craft breweries |

|

|

Total operational microbreweries |

|

|

Total operational brewpubs |

|

|

Total taproom breweries |

|

|

Total regional craft breweries |

|

|

Emerging trends |

|

Source: Brewers Association

- Resurgence of local breweries amidst global crisis: The resurgence of local breweries worldwide has widened the scope of applications for brewery inventory software. Global crisis, such as the conflict between Russia and Ukraine, has lead to investments to improve the local supply chain. Brewery inventory software provides critical solutions which allows businesses to manage the raw material procurement, track production schedules, and ensure consistency in product quality. Additionally, the proliferation of craft beer culture in emerging brewery inventory software markets such as in APAC, Latin America, Africa, etc., has driven the demand for brewery inventory software and the adoption of cloud-based solutions expands accessibility to small-and-medium sized breweries.

In January 2025, the U.S. Department of Agriculture highlighted an increase in global production of barley, which is a key component in beer production. An estimated increase in beer production with the increasing availability of raw materials, which has strengthened the supply chain, is a favorable trend for the growth of the brewery inventory software market. The table below highlights the worldwide production of barley in 2024.

|

World Barley Production (2024) |

|

|

Total barley production |

|

|

Total production from the European Union |

|

|

Total production from Russia |

|

|

Total production from Australia |

|

Source: U.S. Department of Agriculture

- Rapid technological advancements & automation: The brewery inventory software market benefits from the rapid automation trends which prompts businesses operating in the brewery industry to invest in brewery inventory software solutions. With businesses seeking to expand sales channels, and improve ROI, automated solutions by software are set to experience larger adoption. Managing the cost of goods sold (COGS) coupled with process optimization requirements are key drivers for the adoption of brewery inventory software. In September 2024, GoTab partnered with Beer30 by the Fifth Ingredient, to transform brewery operations via real-time data insights and assist in automatically syncing sales data and inventory levels. The table below indicates craft beer sales & production statistics of three states in the U.S., and the steady sales and production rates are favorable for greater demand for brewery inventory software.

State Craft Beer Sales & Production (2023)

|

Name of the State |

Production Stats |

|

California |

|

|

New York |

|

|

Pennsylvania |

|

Source: Brewers Association

Challenges

- Lack of data standardization: The lack of data standardization in diverse brewing practices can lead to data inconsistencies and difficulties in integrating with other systems. Regions such as Europe with diverse brewing equipment can lead to challenges where software solutions must be adaptable to a wide array of practices and scales. Large-breweries require high-volume automated production lines while the small-scale craft breweries require software solutions tailored to seasonal brewing. Additionally, brewery inventories store sensitive information and brewery inventory software solutions must comply with strict region-specific data regulations such as GDPR of the EU.

- Integration with diverse brewing processes & equipment: Breweries across the world vary in size and business models, which can cause off-the-shelf inventory software solutions to meet specific needs. Large-scale breweries with greater production and distribution volumes may require highly specialized features such as multi-site management. Additionally, craft breweries require efficient management of small-batch, seasonal, or experimental products. Any failure or bottlenecks by inventory software can adversely affect the sector’s growth.

Brewery Inventory Software Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.2% |

|

Base Year Market Size (2025) |

USD 7.86 billion |

|

Forecast Year Market Size (2035) |

USD 20.76 billion |

|

Regional Scope |

|

Brewery Inventory Software Market Segmentation:

Deployment Model Segment Analysis

By deployment model, cloud-based segment is projected to capture brewery inventory software market share of around 63.5% by the end of 2035. A major factor of the adoption of cloud-based brewery inventory software solutions is the cost-effectiveness and scalability options. Breweries seek to reduce operational budgets, and maintaining a robust in-house, on-premise infrastructure and add to costs. To mitigate additional operating costs, breweries globally are investing in SaaS solutions with pay-as-you-use models. Furthermore, cloud-based management software solutions can assist in expanding ROI for breweries, boosting the rate of adoption. For instance, in September 2024, Ekos, a cloud-based brewery management system, announced strategic partnership with GoTab, which is a leading POS platform, to address challenges faced by craft producers and assist them in improving operational efficiency. Such collaborations expand the scope of cloud-based software services which is expected to drive adoption rates.

Functionality Segment Analysis

By functionality, the inventory management segment in brewery inventory software market is expected to hold a major revenue share during the forecast period. Inventory management is a vital component of brewery software, which directly impacts a breweries ability to maintain optimal stock levels, and reduce beverage waste. Additionally, inventory management solutions assist breweries in meeting customer demands efficiently. Features such as automated stock alerts, batch tracking, sales and distribution channels integrations offer lucrative options for adoption. The rapid proliferation of digital solutions coupled with the growing popularity of SaaS management solutions is positioned to expand the scope of access for inventory management software to small-and-medium sized breweries.

Moreover, the advent of AI-based analytics has assisted key players in the brewery inventory software market to boost their portfolio. For instance, in June 2024, Barventory announced the launch of a state-of-the-art inventory management system for bars and restaurants to properly track everything associated with alcohol. The new launches highlight the competitiveness of the sector which is favorable for the end user.

Size of Enterprise Segment Analysis

By size of enterprises, the large enterprises segment of the brewery inventory software market is poised to register a larger portion of the revenue share. Large enterprises offer greater scope of application of brewery inventory software. With the advent of microbreweries, the growth of small-and-medium sized brewery enterprises have been rapid but key players in the brewery inventory software market are projected to find greater revenue streams in larger, well-established breweries. Large enterprises drive demand for management solutions capable of handling complex supply chains and multi-location operations with high-volume production schedules. For instance, AB InBev, the largest brewery in the world, leverages the Acadia performance platform to streamline global operations. With worldwide trends highlighting an increase in demand for craft beer, the opportunities to forge long-term partnerships with major breweries to offer software management solutions is positioned to increase.

Our in-depth analysis of the brewery inventory software market includes the following segments:

|

Deployment Model |

|

|

Size of Enterprise |

|

|

Functionality |

|

|

Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Brewery Inventory Software Market Regional Analysis:

North America Market Insights

North America brewery inventory software market is projected to account for revenue share of more than 40.4% by the end of 2035. The rising sales and production of craft beer in the region is a major market driver. The retail sales of craft beer increased in the U.S. in 2023 by 3%. The rising production requires efficient management solutions creating opportunities for Brewery Inventory Software solutions. Additionally, North America boasts a robust technological ecosystem and widespread proliferation of cloud-based software solutions, paving the way for brewery inventory software adoption. Furthermore, key players in the brewery inventory software market are set to find growing opportunities in an expanding number of breweries in the U.S. and Canada to position their brewery management tools for adoption. The table below highlights the top craft brewing companies in 2023 in the U.S.

Top Craft Brewing Companies in the U.S. by Volume (2023)

|

Craft brew production rank |

Name of Company |

|

1 |

D.G. Yuengling and Son Inc. |

|

2 |

Boston Beer Company |

|

3 |

Sierra Nevada Brewing Company |

|

4 |

Duvel Moortgat USA |

|

5 |

Gambrinus |

|

6 |

Tilray Beer Brands |

|

7 |

Artisanal Brewing Ventures |

|

8 |

Brooklyn Brewery |

|

9 |

Monster Brewing |

|

10 |

Athletic Brewing Company |

Source: Brewers Association

The U.S. brewery inventory software market is projected to hold a dominant share globally owing to an established brewing culture in the country, coupled with rising demand for craft beer. The growing profitability of brews has bolstered breweries of various enterprise sizes to scale production volumes, which creates a burgeoning market for the proliferation of brewery inventory software solutions. For instance, in December 2024, Anheuser-Busch announced the investment of USD 10 million in its brewery in Jacksonville, U.S. to facilitate upgrades to maintain quality standards. Such investments bode well for brewery inventory software solutions providers with strong presence in the U.S. The table below highlights the U.S. beer production volume by enterprise in 2023, excluding exports.

U.S. Beer Production Volume (2023)

|

Name of the State |

Production Stats |

|

Regionals |

65.7% |

|

Microbreweries |

17.9% |

|

Taprooms |

8.4% |

Source: Brewers Association

The Canada brewery inventory software market is estimated to expand during the forecast period. The adoption of automation and digital tools for inventory management in various sectors in the region benefits the Canada market. Rising demands to manage craft beer production to manage complexities associated with seasonal product variations, and regional distribution networks. Furthermore, beer is associated with the cultural identity of Canada and remains the most popular alcoholic beverage in the country. The increasing production of beer from microbreweries in Canada is poised to create a profitable revenue segment for the adoption of brewery inventory management software. In January 2025, the CRAFT Restaurant & Beer Market of Canada announced its foray into the U.S. market, and such expansions are supported by advanced management tools highlighting the successful use cases.

Europe Market Insights

The Europe brewery inventory software market is poised to account for the fastest revenue growth by the end of 2035. Europe has a vibrant beer consumption culture, with Germany and Belgium renowned globally for their beer production. The rich brewing heritage in Europe creates a lucrative market for investments in brewery inventory management solutions. Additionally, the brewery inventory software market in Europe is characterized by a blend of large-scale breweries and the growth of microbreweries across the region, which drives demand for brewery inventory management solutions. Moreover, the increase in barley production in Europe, highlighted in the table below, is poised to negate the adverse impact of the geopolitical conflict between Russia and Ukraine which impacted the supply chain of raw materials used in breweries.

Europe Barley Production (2024)

|

Name of Country |

Production Share in Europe |

|

France |

22% |

|

Germany |

20% |

|

Spain |

18% |

|

Denmark |

7% |

|

Poland |

6% |

Source: U.S. Department of Agriculture

The Germany brewery inventory software market is predicted to hold a significant share in Europe. The country is renowned globally for its beer purity laws and a prevalent beer consumption culture, with vibrant festivals such as Oktoberfest a testament of the craft beer culture. The presence of a large proportion of home brewers coupled with rising microbreweries has led to burgeoning demand for brewery inventory software solutions in Germany. In 2024, Germany beer sales accounted for recorded taxed sales worth more than 5 million hectoliters. The large sales create an impetus for an increased production of quality beverage which is poised to create a sustained demand for management software solutions in the region.

The Belgium brewery inventory software market is expected to expand during the forecast period. Belgium’s craft beer is renowned globally and has a dedicated consumer base. The surging demand for Belgian beer boosts investments to improve the production capabilities of breweries. To maintain sales along with effective operational management, the requirement of brewery inventory software market is poised to rise. Advanced software solutions can allow breweries in the country to handle complex production schedules and inventory. In 2022, the beer production in Belgium amounted to 23 million hectoliters. With the breweries striving to increase the production rates and maintain export quality of brews, the domestic opportunities for the adoption of brewery inventory software solutions is poised to increase.

Brewery Inventory Software Market Players:

- Ekos

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BrewMan

- Breww

- BarTrack

- Ohanafy

- Kegshoe

- Unleashed

- Acadia

- The Fifth Ingredient

The brewery inventory software market is poised to expand during the forecast period. Key players in the market are investing to increase the scope of services to penetrate emerging markets globally. Tie-ups with local breweries of various scales indicate successful use cases which is beneficial for the growth of the software solutions by boosting trust within the brewery inventory software market. In 2021, Ekos, a major player in the market, announced a 155% revenue growth and made the list in the fastest growing private companies in America. The growth of Ekos highlights the scope of revenue growth in the sector.

Here are some key players in the brewery inventory software market:

Recent Developments

- In March 2024, Arryved announced the acquisition of SimpleCircle, i.e., a San Francisco-based startup offering ERP software to craft brewers. The acquisition is poised to assist Arryven in offering a complete brewery management solution encompassing inventory management, production, sales, and distribution processes.

- In November 2023, BarTrack announced the release of its revolutionary draft monitoring solution, i.e., the Smart Draft System. The Smart Draft System is poised to assist bar, brewery, restaurant, and stadium management teams in increasing profits.

- Report ID: 6994

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Brewery Inventory Software Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.