Brain PET-MRI Systems Market Outlook:

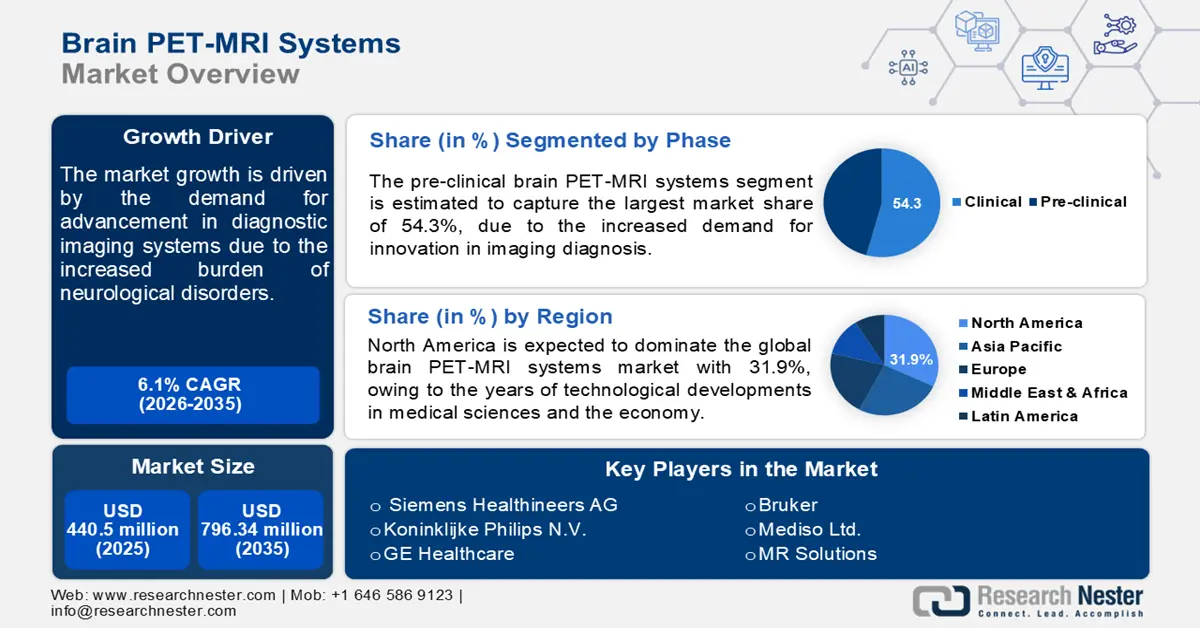

Brain PET-MRI Systems Market size was over USD 440.5 million in 2025 and is projected to reach USD 796.34 million by 2035, witnessing around 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of brain PET-MRI systems is assessed at USD 464.68 million.

The demand for neurological advancement is witnessing a rise due to the increased burden of neurological disorders. In evidence, a report published by NLM (National Library of Medicine), in 2020, states that in the past 30 years, the number of deaths due to neurological disorders has increased by 39% and the disability-adjusted life-years has increased by 15%, despite declines in infectious neuro-disorders.

The PET scanning devices are designed to provide enhanced and detailed reports in support of accurate diagnosis for the neurological system. Precise alignment with the anatomical structure and pathological alterations, made its integration with other imaging diagnostic systems as MRI, more frequent. This is further accumulating the urge for additional development in the market. More companies are aiming to build dedicated brain PET inserts that can augment stand-alone MRI systems, which is cheaper than a full hybrid system, making PET/MRI more attractive as a financially reasonable modality.

Key Brain PET-MRI Systems Market Insights Summary:

Regional Highlights:

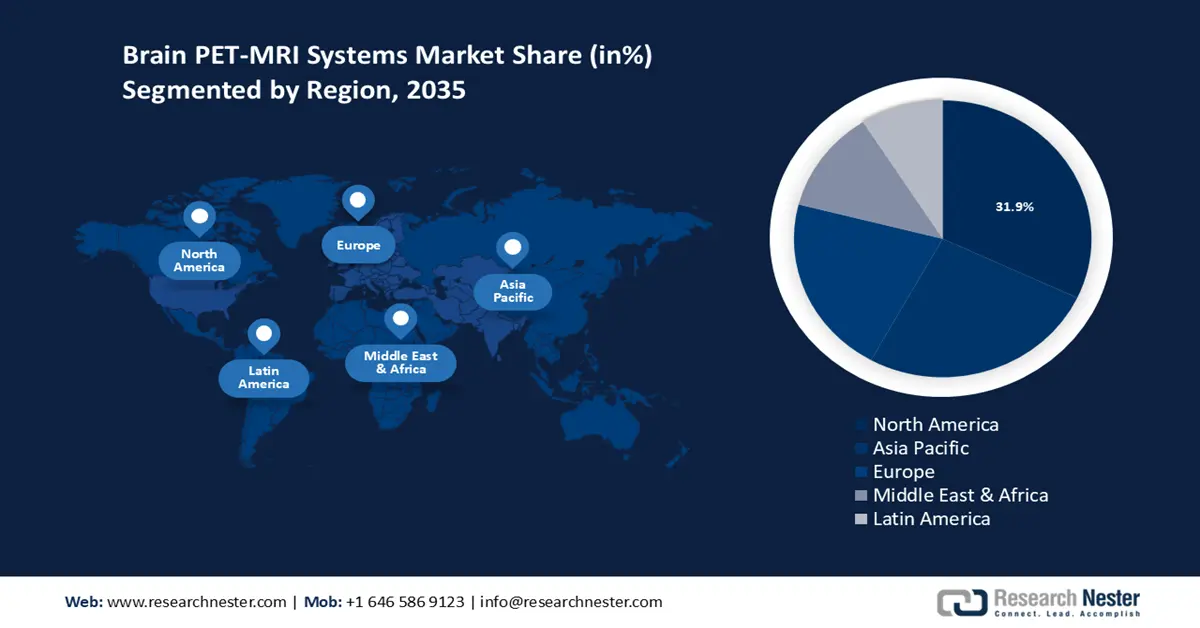

- North America leads the Brain PET-MRI Systems Market with a 31.9% share, supported by technological developments in medical sciences and the economy, enhancing growth prospects through 2026–2035.

- APAC's brain PET-MRI systems market is expected to capture a substantial share by 2035, attributed to improvements in healthcare infrastructure and governmental initiatives for research and development in medical devices.

Segment Insights:

- The Helium-free Systems segment is projected to experience substantial growth by 2035, fueled by enhanced operational efficiency and cost-effectiveness.

- Pre-clinical phase segment is anticipated to capture a 54.3% share by 2035, driven by demand for innovative imaging and detailed brain analysis for clinical research.

Key Growth Trends:

- Improvement in diagnostic results

- Governmental association and investment

Major Challenges:

- Strignenet regulations

- Impact on performance during development

- Key Players: Siemens Healthineers AG, Koninklijke Philips N.V., GE Healthcare, Bruker, Mediso Ltd., MR Solutions, Cubresa Inc., Aspect Imaging.

Global Brain PET-MRI Systems Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 440.5 million

- 2026 Market Size: USD 464.68 million

- Projected Market Size: USD 796.34 million by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (31.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 14 August, 2025

Brain PET-MRI Systems Market Growth Drivers and Challenges:

Growth drivers

-

Improvement in diagnostic results: The hybrid of MRI and PET is efficiently enhancing the quality of imaging facilities in healthcare sectors. According to a research report published by JNM (The Journal of Nuclear Medicine) in August 2020, the PET-MRI system can deliver improved lesion detection in selected cancers, promoting fast, efficient local and whole-body staging in one step. Besides, it can potentially benefit younger patients, by reducing radiation exposure. This two-in-one imaging system is 50% more efficient than a PET/CT in detecting abnormal findings in the Brain, which are useful in treating Alzheimer’s, epilepsy, and brain tumors. Based on their usefulness and diverse service range, many doctors are now recommending PET/MRI, further stimulating remarkable growth in demand.

- Governmental association and investment: Government healthcare authorities are investing in new and improved diagnostic systems in medical facilities. In October 2023, Novo Nordisk Foundation offered a grant of DKK 17 million to the researchers from the Faculty of Health and Medical Sciences at the University of Southern Denmark (SDU). the grant is aimed at acquiring a new simultaneous preclinical PET/MRI scanner, escalating their research and treatment facility. In November 2022, the Ireland government announced funding of USD 44.7 million under the DTIF (Disruptive Technologies Innovation Fund) for 11 projects across health and wellbeing, advanced robotics, and machine learning. Such involvement of governing bodies in individual regional brain PET-MRI market is manifesting noteworthy growth.

- Inflated demand for non-invasive diagnosis: There has been a noticeable increment in the requirement for non-invasive diagnosis, majorly since the COVID-19 pandemic, indicating the scope of growth in the brain PET-MRI systems market. The surge is inspiring leading companies to contribute to innovations in the diagnostic sector. The next-generation multimodality function of PET-MRI systems is perfectly aligned with this investment plan. The complete analysis provides complementary data, which helps doctors determine the root cause and stage of the neurological diseases.

Challenges

-

Strignenet regulations: The regulatory approval from medical authorities and governing bodies is the major setback in the process of PET-MRI systems production. The evaluation process of functionality and patient safety can make the process elongated, further restraining fast growth. The regulations for medical devices are non-flexible with respect to regional markets, which creates uncertainty in distribution.

- Impact on performance during development: PET systems with photomultiplier tubes (PMTs) are extremely sensitive to high magnetic fields, which creates attenuation maps for PET images, further impacting the effectiveness of the device. This developmental restriction can cause a decline in the future growth of the brain PET-MRI systems market.

Brain PET-MRI Systems Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 440.5 million |

|

Forecast Year Market Size (2035) |

USD 796.34 million |

|

Regional Scope |

|

Brain PET-MRI Systems Market Segmentation:

Phase (Clinical, Pre-clinical)

The pre-clinical segment in brain PET-MRI systems market is estimated to capture the largest revenue share of 54.3% by 2035, due to the increased demand for innovation in imaging diagnosis. This multimodality system combined the strength of PET and MRI, allowing the researchers to get a brain region-specific detailed analysis. Established research institutions such as the University of Manchester are also investing in acquiring hybrid imaging modalities to get high-quality anatomical illustrations. The rising scope of clinical research, facilitated by governing authorities is one of the positive influences impacting the market hike.

Product Type (Traditional Systems, Helium-free Systems)

The traditional PET-MRI systems segment is estimated to hold a brain PET-MRI systems market share of 57.7% by 2035. Better contrast among soft tissues and functional imaging capabilities has made it preferable to other imaging devices. Therefore, the segment is leading the market with an escalated amount of integration in the clinical and educational sectors. Alternatively, the enhanced operational efficiency and elimination of valuable elements as Helium, are captivating the focus of key market players such as Siemens Healthineers, and Philips Healthcare. Companies are aiming to bring innovative solutions in the production of helium-free brain PET-MRI systems, exhibiting a CAGR of 6.5%.

Our in-depth analysis of the global market includes the following segments:

|

Phase |

|

|

Product type |

|

|

End Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Brain PET-MRI Systems Market Regional Analysis:

North America market analysis

North America has dominated the global brain PET-MRI systems market, owing to over the years technological developments in medical sciences and the economy. The region is expected to hold a 31.9% share during the forecast period. The overall growth is driven by the inflating demand for innovative imaging solutions for accurate diagnosis.

The U.S. dominated the North America market majorly with a share of 81.5%. In recent years, the U.S. has been emerging as the fastest-growing region in research and developments for neuroscience. Implementation of several innovative non-invasive imaging systems in clinical and research facilities is also broadening the pathway of optimum PET-MRI integration. In March 2022, UC Davis Health Hospital announced the installation of a Swoop Portable MR Imaging system for diagnosing traumatic brain injuries.

Canada is also poised to witness a rapid growth in the market. The country is raising funding for more research developments in imaging systems and tools. In September 2023, the Minister of Health announced USD 96 million investment through CFI for future innovations and advancement in medical sector. Such investments are helping in higher growth imaging systems market, including brain PET-MRI systems.

APAC market statistics

The Asia Pacific brain PET-MRI systems market will capture a share of 28.5% by 2035. Improvement in healthcare infrastructure and governmental initiatives for research and development in medical devices will boost the market demand.

India, as the region’s developing country, has witnessed an exceptional rise in investment in the newest technologies in brain PET-MRI systems. According to a report published by NITI Aayog, in 2021, India is building opportunities for greater investment in the healthcare industry and there are nearly 600 investment opportunities worth USD 32 billion in the country’s hospital/medical infrastructure sub-sector. Additionally, the involvement of the government in PET-MRI system integration in research institutions indicates the hope for future development in the market. In October 2021, the former vice president of India inaugurated a PET-MRI wing at the State Cancer Institute in Guwahati, imparting upgraded cancer care and research facilities for patients.

The China brain PET-MRI systems market is predicted to witness massive growth during the forecast period. Growing demand for efficient imaging systems for early detection of neurological disorders is inspiring market leaders to invest in this region. According to an article published by JNM, in May 2024, the number will be doubled, with PET/CT scanners increasing to more than 1,600 and PET/MRI scanners increasing to more than 200 in daily use. Prominently increasing the demand for advanced brain PET-MRI systems.

Key Brain PET-MRI Systems Market Players:

- Siemens Healthineers AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Koninklijke Philips N.V.

- GE Healthcare

- Bruker

- Mediso Ltd.

- MR Solutions

- Cubresa Inc.

- Aspect Imaging

Companies are developing devices that are comfortable for patients and convenient for operators. For instance, In June 2024, Siemens Healthineers introduced the Biograph Trinion, a high-performance, energy-efficient positron emission tomography/computed tomography (PET/CT) scanner with a wide range of clinical capabilities and a low lifetime operational cost. Additionally, GE Healthcare introduced SIGNA PET/MR AIR, which not only is designed to deliver clarity in analyzed data but also is capable of making the patient’s experience more comfortable. The leaders are also associating with the government plans to grab the market with stable supply. Some of the prominent players include:

Recent Developments

- In August 2024, Siemens Healthineers AG (SHL) announced the acquisition of Novartis' molecular imaging unit, bidding over EUR 200 million to enhance its PET imaging capabilities crucial for cancer diagnostics. This strategic acquisition allows SHL to strengthen its position in the nuclear medicine market, particularly in Europe.

- In July 2024, Philips India partnered with Star Imaging to Launch the first MRI Training School in India, increasing the awareness about PET-MRI, and helping the market reach to escalate.

- In October 2023, Philips launched an AI-enabled MR imaging and Quibim’s AI-enabled image analysis software, which aimed to help clinicians deliver faster, easier prostate cancer care, to help mitigate staff shortages and lower the cost of care.

- Report ID: 6622

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Brain PET-MRI Systems Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.