Botulinum Toxin Market Outlook:

Botulinum Toxin Market size was over USD 12.19 Billion in 2025 and is projected to reach USD 28.07 Billion by 2035, witnessing around 8.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of botulinum toxin is evaluated at USD 13.14 Billion.

The growth of the market can be attributed to the globally increasing proportion of the geriatric population, which is more prone to deal with numerous health and skin issues. Further, the rising demand for minimally invasive or noninvasive surgeries such as - glabellar lines, and chemical browlift treatments is estimated to propel market growth during the forecast period. As per the estimations, it is found that noninvasive treatments such as dermal fillers and botox rose by over 180% in the United States, and in 2018 more than 70% of U.S surgeons noted the increase in the use of injectables among people under 30 years.

In addition to these, factors that are believed to fuel the market growth of botulinum toxin include the rising ratio of people who are dealing with premature aging issues or photoaging, since the premature aging issue is such a significant factor that has been playing a pivotal role in the surging level of various kinds of cosmetic surgeries. Additionally, soaring investment by the major key players to enhance the research and development, coupled with growing expenditure for developing advanced healthcare infrastructure, and rising amendments in reimbursement policies to cover the botulinum procedures and injections are anticipated to present the potential for botulinum toxin market expansion over the projected period. Besides this, a worldwide surge in healthcare expenditure is also estimated to expand the market size of botulinum toxin in the coming years.

Key Botulinum Toxin Market Insights Summary:

Regional Highlights:

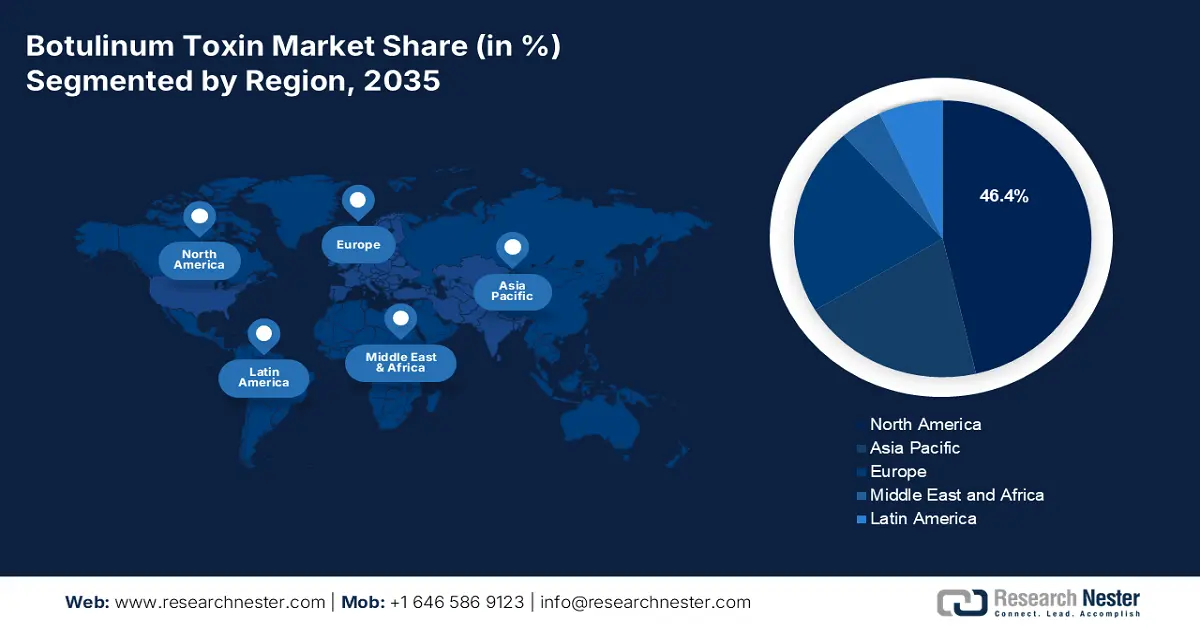

- The North America botulinum toxin market will dominate more than 46.4% share by 2035, driven by increasing spending capacity, rising number of cosmetic procedures, and advancements in medical and aesthetic procedures.

Segment Insights:

- The botulinum toxin a (botulinum toxin market) segment is anticipated to hold a significant share by 2035, fueled by growing use of botulinum toxin A for headaches and aesthetic purposes.

- The hospitals segment in the botulinum toxin market is projected to maintain the largest share by 2035, driven by the increasing number of hospitals and rising awareness of aesthetic procedures.

Key Growth Trends:

- Increasing Disposable Income of Individuals

- Growing Prevalence of Neurological Disorders

Major Challenges:

- Associated Side Effects with the Botulinum Toxin Procedures

- High Cost of Botulinum Toxin Methods

Key Players: Merz Pharma GmbH & Co. KGaA, USWM, LLC, Medytox Inc., Hugel, Inc., Ipsen Group, Revance Therapeutics, Inc., AbbVie Inc., Galderma S.A.

Global Botulinum Toxin Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 12.19 Billion

- 2026 Market Size: USD 13.14 Billion

- Projected Market Size: USD 28.07 Billion by 2035

- Growth Forecasts: 8.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (46.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 10 September, 2025

Botulinum Toxin Market Growth Drivers and Challenges:

Growth Drivers

- Increasing Disposable Income of Individuals – Botox is an expensive treatment, and not everytreatments are estimated to propel market growth during the forecast period. The disposable income of the U.S. rose from -0.4% in Jun 2022 to 0.1% in Aug 2022 as per the Bureau of Economic Analysis.

- Growing Prevalence of Neurological Disorders – As per medical terms, neurological diseases are issues that impact the brain as well as the nerves found throughout the human body, including the spinal cord. A variety of symptoms can be triggered by structural, metabolic, or electrical dysfunctions in the brain, spinal cord, or other nerves. The surging prevalence of this condition is expected to boost the growth of the botulinum toxin market. As per the observations, more than 18 million Americans suffer from some kind of neuropathy issue, and over 15% of U.S households have at least one person with a brain impairment disorder. Thus, the demand for botulinum toxin has been massively increasing. As botulinum neurotoxin A (BoNT/A) has transformed the treatment of dystonia and focal spasticity by becoming a helpful tool in the treatment of neurological illnesses related to increased muscular tone.

- Rising Number of Product Approvals and Launch – For instance, it has been estimated that the number of Botox injections rose by about 450% between 2000-2020 across the globe.

- Increasing Number of Cosmetic Surgeries – It is estimated that in the U.S. in 2020, more than USD 15 billion was spent on aesthetic treatments.

- Elevating Use of Botulinum Toxin Injection for the Treatment of Glabellar, Chemical Browlift, Perioral, and Periorbital Lines – For instance, nearly 85% of the 15 million cosmetic procedures done are minimally invasive, such as botulinum toxin or soft tissue filler injections.

person is able to afford it. On the other hand, with rising disposable income, people are focusing more on how they look and are willing to spend on facial treatments. Botox costs about USD 10-15 per unit anywhere across the globe, and more than USD 400 for the full treatment. The rising adoption of minimally invasive procedures and the high willingness of people to spend on aesthetically looking

Challenges

- Associated Side Effects with the Botulinum Toxin Procedures - Botulinum toxin injections are generally well-tolerated with few side effects. Idiosyncratic reactions are rare, usually mild, and temporary. Moderate injections cause discomfort, and local edema, erythema, temporary numbness, headache, malaise, or mild nausea are possible. Thus, this factor is estimated to dampen the market’s growth during the projected time frame.

- High Cost of Botulinum Toxin Methods

- Rise of COVID – 19

Botulinum Toxin Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.7% |

|

Base Year Market Size (2025) |

USD 12.19 Billion |

|

Forecast Year Market Size (2035) |

USD 28.07 Billion |

|

Regional Scope |

|

Botulinum Toxin Market Segmentation:

End-user Segment Analysis

The global botulinum toxin market is segmented and analyzed for demand and supply by end-user in hospitals, dermatology clinics, spas, and cosmetic centers. Amongst these four segments, the hospitals segment is anticipated to hold the largest market size by the end of 2035. The growth of this segment can be attributed to the increasing number of hospitals with advanced cases and facilities, followed by the rising awareness regarding aesthetic procedures in individuals. For instance, the number of hospitals in the United Kingdom has increased to nearly 29 per one million people in the year 2019. Moreover, a growing number of medical spas and cosmetic centers is another significant factor that is estimated to boost the growth of the market, as the surge in cosmetic centers and spas generate more traction in people to access beauty procedures. For instance, in the U.S. there are about 20,000 health and wellness spas as of 2022.

Product Type Segment Analysis

The global botulinum toxin market is also segmented and analyzed for demand and supply by product type into botulinum toxin A and botulinum toxin B. Out of these, the botulinum toxin A segment is expected to garner a significant share. The significant growth in this segment is backed by the escalating utilization of botulinum toxin A to treat headaches as of hypertension, chronic migraine, and several primary neurological diseases. In addition to these, the penetration of botulinum toxin A products has been growing in the wide range of aesthetic purposes, therefore, the proliferating demand for aesthetic beauty products is also anticipated to fuel the growth of the market during the forecast period.

Our in-depth analysis of the global market includes the following segments:

|

By Product Type |

|

|

By Application |

|

|

By Gender |

|

|

By Age Group |

|

|

By End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Botulinum Toxin Market Regional Analysis:

North American Market Insights

North America region is expected to account for more than 46.4% market share by 2035, driven by increasing spending capacity, rising number of cosmetic procedures, and advancements in medical and aesthetic procedures. For instance, the consumer spending capacity of U.S. people rose from -0.2% in July 2022 to 0.6% in July Sept 2022, as per the Bureau of Economic Analysis. Further, the rising number of cosmetic procedures to look beautiful, escalating adoption of facial injectables, and the rapid adoption of aesthetic procedures among individuals, are also anticipated to contribute to the market growth in the region. In addition to this, the growing advancements in medical and aesthetic procedures are some more factors that are estimated to propel market’s growth further throughout the forecast period in the region.

APAC Market Insights

Whereas, the Asia Pacific botulinum toxin market is anticipated to witness a larger CAGR over the projected time frame on the back of the presence of a larger patient pool for minimally invasive surgeries, along with, increasing demand for botulinum toxins in the countries such as China, and Japan. Additionally, the highly growing beauty consciousness, coupled with the surge in wellness tourism, is elevating the number of spas, and cosmetic centers in the countries such as Korea, Thailand, Singapore, and so on. These are other significant factors that are projected to propel the growth of the market during the projected timeframe in the region. For instance, in 2018, the number of wellness spas in the Asia Pacific region reached approximately 93,565. Such an extraordinary boost in the count of wellness spas in this region is indicating a higher increase in the same over the coming years, which is projected to further drive market growth in the region.

Botulinum Toxin Market Players:

- Merz Pharma GmbH & Co. KGaA

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- USWM, LLC

- Medytox Inc.

- Hugel, Inc.

- Ipsen Group

- Revance Therapeutics, Inc.

- AbbVie Inc.

- Galderma S.A.

Recent Developments

-

Allergan, an AbbVie Inc. announced the U.S Food and Drug Administration (FDA) approval to expand the label of botox to include eight more muscles to treat adults with upper limb spasticity. The new approval was significant as it treated disabling neurological conditions influencing the quality of life of a patient.

-

Ipsen Group declared that Dysport, a clostridium botulinum type A toxin-haemagglutinin complex received the U.S. FDA. Dysport is the first UK botulinum toxin to get approved for pediatric spasticity therapy in upper and lower limbs.

- Report ID: 4546

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Botulinum Toxin Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.