Boron Doped Diamond Electrode Market - Regional Analysis

North America Market Insights

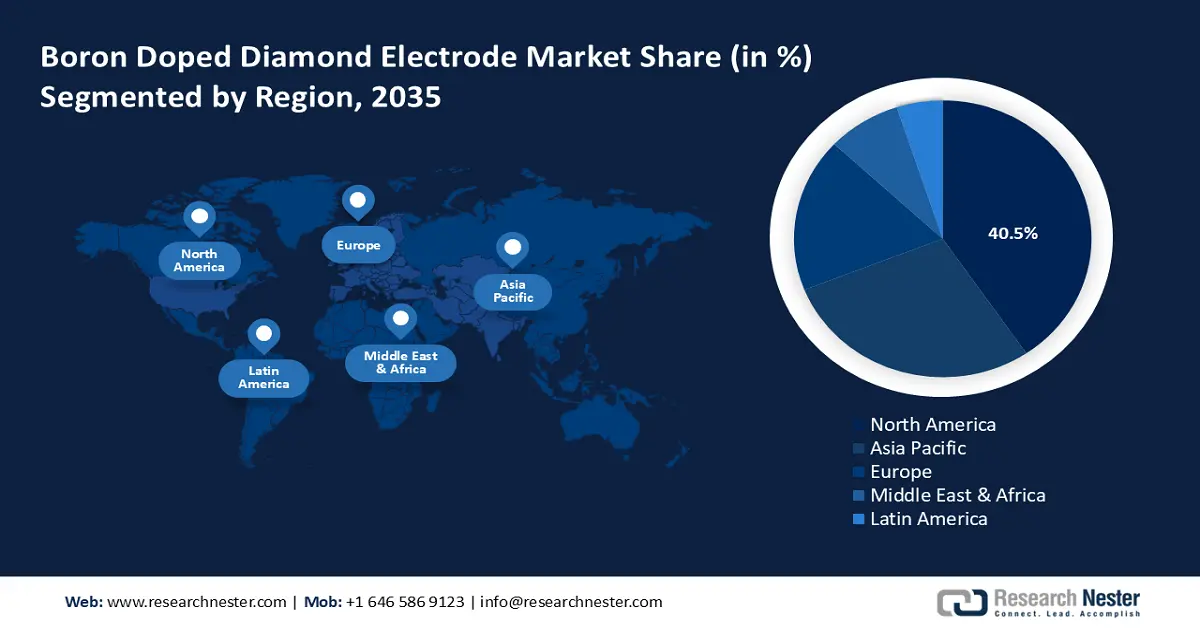

The boron doped diamond electrode market in North America is anticipated to hold a 40.5% share by 2035, due to stringent environmental regulations and the increasing demand for advanced water treatment technologies. The U.S. Environmental Protection Agency (EPA) and other regulatory bodies are actively promoting the use of innovative solutions like BDD electrodes to reduce water pollution, thereby boosting the market in this region. These electrodes are highly efficient in degrading organic pollutants and are being used in various industrial and municipal water treatment facilities. Furthermore, the presence of key players such as Element Six and SP3 Diamond Technologies in the region contributes to the market’s growth by driving innovation and improving the availability of BDD products.

The U.S. boron doped diamond electrode market is expected to witness significant growth, owing to the increasing adoption of BDD technology in water treatment and electrochemical applications. Advancements in technology are further boosting market demand and development. The BDD market is witnessing an upsurge in demand from the biomedical and electrochemical sectors as advanced properties of BDD, such as high thermal conductivity, chemical stability, and a wide potential window, make it a favorable choice in applications ranging from biosensing to electro-synthesis. Its low capacitive current and high signal-to-noise ratio are especially beneficial for sensitive analytical measurements, which are otherwise challenging with traditional electrode materials. The Environmental Protection Agency (EPA) and U.S. states have named nearly 70,000 water bodies below quality standards. Approximately 170,000 water and wastewater systems, many of which are becoming increasingly automated, are subject to cyber threats from states and criminals. EPA estimates that over the next 20 years, more than $1 trillion will be needed to modernize and replace America’s clean water and wastewater infrastructure to protect the public health and safety, and reliability.

Typical Treatment Efficiencies of Municipal Sewage Treatment for Specific Pollutants

|

Pollutant |

Sewage Ponds |

Secondary Treatment |

Advanced Treatment |

|

Biological Oxygen Demand |

50-95 |

95 |

95 |

|

Nitrogen |

43–80 |

50 |

87 |

|

Phosphorus |

50 |

51 |

85 |

|

Suspended solids |

85 |

95 |

95 |

Source: EPA

The boron-doped diamond electrode market in Canada is influenced by environmental policy and clean-technology practices. Federal and provincial programs supporting innovative water purification technologies or storage for renewable energy technologies all help drive research and development forward. Both academic entities and newly established laboratories are investigating electrochemical sensing and electrochemical systems for energy applications. Given its wealth of raw materials and progressive regulations, Canada fosters collaborative research programs between research organizations and industry to strengthen its position as a niche market participant in high-performance electrode materials for sustainable infrastructure and next-generation electrochemical systems.

Asia Pacific Market Insights

The boron doped diamond electrode market in Asia Pacific is anticipated to hold a 29% share by 2035, due to rapid industrial expansion and stricter environmental guidelines in developing nations. Countries such as India, Japan, and South Korea are emphasizing investments in advanced water treatment solutions, where BDD electrodes play an important role. National initiatives supporting digital transformation and clean energy adoption are further encouraging market demand. The rise in semiconductor and electronics production is surging the need for high-precision electrochemical systems. Collaborative R&D efforts between academic institutions and private firms are also fostering innovation in electrode technologies.

The China boron doped diamond electrode market is projected to hold the largest revenue share in APAC during the forecast period, fueled by substantial government funding in sustainable technologies and stringent environmental mandates. The Ministry of Industry and Information Technology (MIIT) is promoting the integration of advanced materials in electronic manufacturing and water treatment infrastructure. The large-scale expansion of smart cities and 5G networks is highlighting the demand for BDD-based sensor applications as domestic producers are expanding output capabilities, capitalizing on growing global interest in these technologies. China's strategic emphasis on technological self-sufficiency is also boosting innovation and the wider adoption of BDD electrodes. As of 2023, China treated 254 million metric tons of municipal waste, moving from landfill disposal to incineration as a result of land issues, illegal dumping, and significant public opposition. With 927 incineration plants and more than 300 waste-to-energy facilities, China has one of the largest capacities in the world. However, rapid expansion has surpassed the ability of the incineration industry to manage byproducts, such as fly ash, furnace slag, and toxic pollutants derived from incineration.

The market for boron-doped diamond electrodes in India is driven by increasing demand for cutting-edge water purification, electrochemical sensing, and energy-related applications. Furthermore, government initiatives supporting clean energy and more stringent environmental regulations are driving industrial wastewater treatment initiatives. Moreover, local universities and research institutes are developing cost-effective synthesis methods, which may create opportunities for domestic production of boron-doped diamond electrodes. In addition, rapid urbanization and the expansion of infrastructure are increasing interest in applications in the chemical, pharmaceutical, and electronics sectors, positioning India as a new player in next generation electrochemical technologies and sustainable manufacturing processes.

State-Wise Sewage Generation and Installed Treatment Capacity of Urban Centers in MLD

|

States / UTs |

Sewage Generation |

Installed Capacity |

Proposed Capacity |

Total Treatment Capacity |

Operational Treatment Capacity |

|

Andhra Pradesh |

2882 |

833 |

20 |

853 |

443 |

|

Bihar |

2276 |

10 |

621 |

631 |

0 |

|

Chandigarh |

188 |

293 |

0 |

293 |

271 |

|

Chhattisgarh |

1203 |

73 |

0 |

73 |

73 |

|

Gujarat |

5013 |

3378 |

0 |

3378 |

3358 |

|

Haryana |

1816 |

1880 |

0 |

1880 |

1880 |

|

Jammu & Kashmir |

665 |

218 |

4 |

222 |

93 |

|

Karnataka |

4458 |

2712 |

0 |

2712 |

1922 |

|

Madhya Pradesh |

3646 |

1839 |

85 |

1924 |

684 |

|

Maharashtra |

9107 |

6890 |

2929 |

9891 |

6366 |

|

Uttar Pradesh |

8263 |

3374 |

0 |

3374 |

3224 |

Source: PIB

Europe Market Insights

The boron doped diamond electrode market in Europe is anticipated to hold a significant share by 2035, driven by demand from advanced water treatment, electrochemical sensors, and energy storage R&D. A regulatory focus on cleaner industrial processes and a sufficient supply of R&D funding are ensuring a continual flow of innovation from both academics and commercial laboratories. The collaborations between chemical manufacturers and technology firms are leading to an increasing number of pilot projects. The commitment to sustainability by the EU is likely to further support confidence in BDD technology for applications ranging from wastewater remediation, electrosynthesis, and electroanalytical applications where quality or performance has relevance.

The UK market for boron doped diamond electrodes is characterized by a strong academic research infrastructure and several government clean technology initiative programs. Universities are actively working with electrochemical companies on next-generation water purification and sensing devices. Interest in long-lasting, low-maintenance electrodes is growing in both environmental monitoring and industrial treatment. Supportive policy frameworks that promote green chemistry and the development of advanced materials place the UK as an up-and-coming center for BDD electrode development and commercial pilot work.

Germany is characterized by strong precision engineering, a robust chemical manufacturing sector, and numerous advanced schools and research institutes that feed into the boron doped diamond electrode market. German firms are largely engaged with applications in industrial water treatment, electrochemical synthesis, and renewable energy bodies. Federal funding for sustainable chemistry and green industrial processes supports collaborative R&D projects between universities and industry. More than 10,000 sewage treatment plants treat wastewater. The sewage system is roughly 515,000 kilometres long, which is enough to make 13 full orbits of the Earth. Wastewater treatment facilities are typically under the jurisdiction of municipalities. However, there are also sewage treatment facilities in the industry that are privately owned. Public wastewater treatment facilities treat about 9.4 billion cubic meters of wastewater annually.