Boron Doped Diamond Electrode Market Outlook:

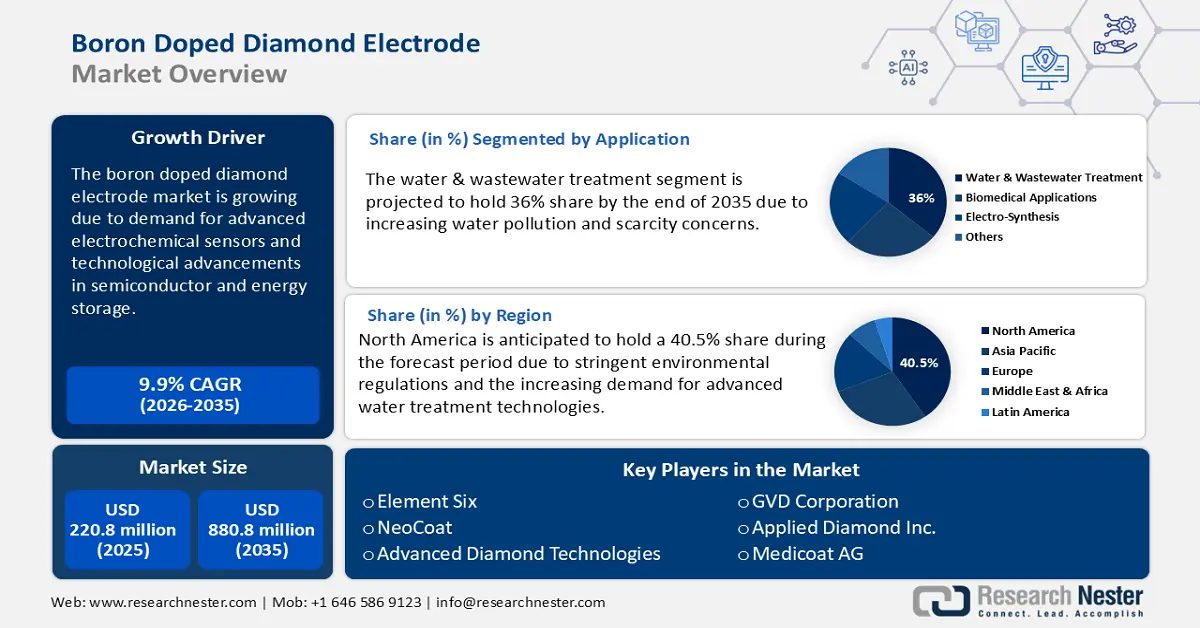

Boron Doped Diamond Electrode Market size was valued at USD 220.8 million in 2025 and is projected to reach USD 880.8 million by the end of 2035, rising at a CAGR of 9.9% during the forecast period, i.e., 2026-2035. In 2026, the industry size of boron doped diamond electrode is estimated at USD 290.9 million.

The global boron doped diamond electrode market is characterized by a multifaceted, complex supply chain consisting of the procurement of ultra-high-purity carbon substrates, boron sources, and advanced chemical vapour deposition (CVD) systems. Japan leads in the commercialization of CVD diamond technologies, supported by substantial public and private sector investments aimed at technological advancement. From January to November 2023, China’s water conservancy projects employed 2.6 million people, up 9.1% year-on-year, including 2.1 million rural workers. Wages totalled 50.5 billion yuan, with 38.1 billion for rural areas. The sector completed 17,881 rural water projects, benefiting 82.1 million residents, while over 4 billion yuan maintained 98,800 existing rural projects. In the U.S., the Department of Energy (DOE) has categorized certain essential materials important to renewable energy innovations, some of which may pertain to components used in BDD electrode manufacturing.

On the technology side, boron doped diamond electrodes are highly used in environmental applications, especially for breaking down stubborn contaminants such as per- and polyfluoroalkyl substances (PFAS). With 100 low-carbon treatment plants expected to be constructed by 2025, a January 2024 recommendation from the plan also combines sewage treatment with carbon emission control. The plan also includes upgrading and extending 45,000 kilometres of sewage collection networks and adding 12 million cubic meters of sewage treatment capacity per day. Although precise producer and consumer price indices are lacking, industry efforts are focused on enhancing cost-efficiency and scalability, reflecting a broader trend toward more affordable and commercially viable BDD technologies.

Key Boron Doped Diamond Electrode Market Insights Summary:

Regional Insights:

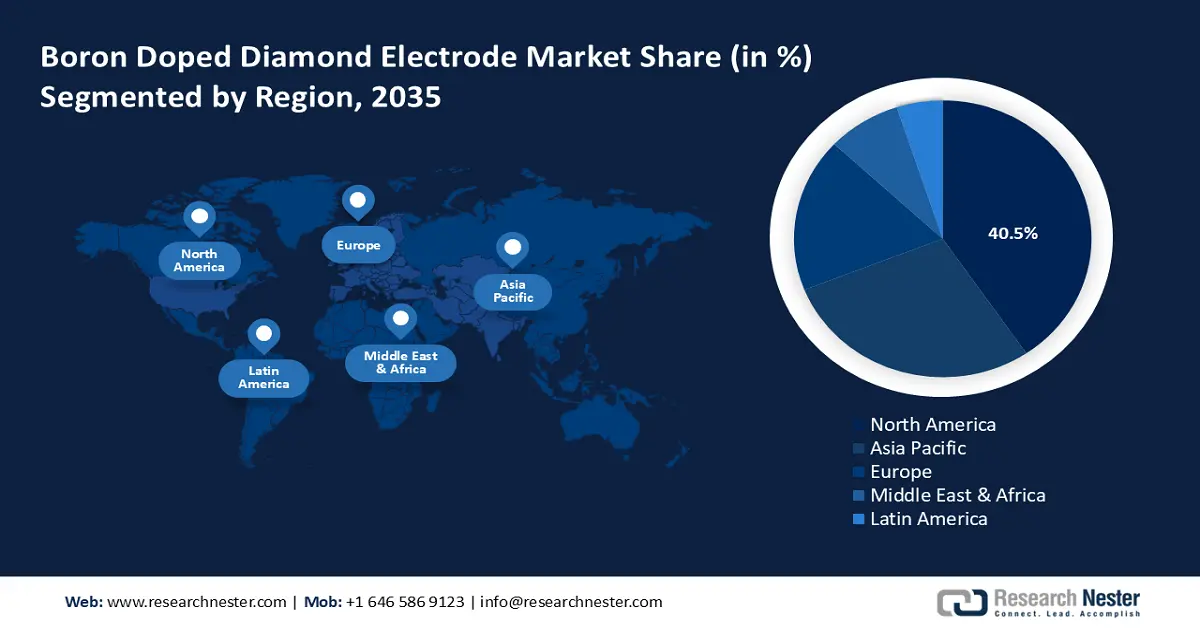

- North America is anticipated to hold a 40.5% share by 2035, driven by stringent environmental regulations and the increasing demand for advanced water treatment technologies.

- Asia Pacific is projected to hold a 29% share by 2035, owing to rapid industrial expansion and stricter environmental guidelines in developing nations.

Segment Insights:

- Water & Wastewater Treatment segment is projected to hold 36% share by 2035, propelled by increasing water pollution and scarcity concerns.

- Municipality segment is estimated to account for 32.5% share during the forecast period, impelled by urban expansion and the pressing need for efficient water treatment facilities.

Key Growth Trends:

- Rising demand for advanced electrochemical sensors

- Technological advancements in semiconductor and energy storage

Major Challenges:

- High initial investment costs

- Complex manufacturing process

Key Players: Element Six,NeoCoat,Advanced Diamond Technologies,GVD Corporation,Medicoat AG,CVD Equipment Corporation,Applied Diamond Inc.,Diamond Materials GmbH,Nanocarbon Co., Ltd.,Bharat Diamond Instruments,Diamond Advanced Technologies,Sumitomo Electric Industries,Tokai Carbon Co., Ltd.,Mitsubishi Electric Corporation,Showa Denko K.K.

Global Boron Doped Diamond Electrode Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 220.8 million

- 2026 Market Size:USD 290.9 million

- Projected Market Size: USD 880.8 million by 2035

- Growth Forecasts: 9.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.5% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, Germany, Japan, South Korea, United Kingdom

- Emerging Countries: India, China, Brazil, Singapore, UAE

Last updated on : 6 October, 2025

Boron Doped Diamond Electrode Market - Growth Drivers and Challenges

Growth Drivers

- Rising demand for advanced electrochemical sensors: The boron doped diamond electrode market is witnessing remarkable growth due to the rising need for high-performance electrochemical sensors in healthcare, environmental monitoring, and industrial wastewater treatment. BDDEs provide exceptional chemical inertness, wide potential windows, and low background currents, making them suitable for precise detection in harsh environments. In environmental monitoring cases, BDDEs are used for identifying trace levels of contaminants, aiding in regulatory compliance. Approximately 335,000 facilities were permitted in 2020, including over 700 municipalities with combined sewer overflows, which can be a significant source of pollution during periods of intense precipitation.

- Technological advancements in semiconductor and energy storage: With boron doped diamond electrodes possessing excellent thermal and chemical stability, they are being adopted in semiconductor fabrication, battery development, and fuel cell technologies. Companies such as Element Six and Applied Diamond are incorporating BDDEs into high-voltage electronics and electrochemical cells, helping to enhance device efficiency and lifespan. The Indian semiconductor market was valued at approximately $38 billion in 2023 and is projected to grow to $109 billion by 2030. With a total investment of ₹76,000 crore, the government has authorized the Semicon India program to build the nation's semiconductor and display manufacturing ecosystem. Taiwan manufactures around 90% of the most advanced semiconductors in the world, and more than 60% of all semiconductors worldwide.

- Government funding and environmental regulations: Strict environmental standards worldwide are pushing industries to adopt advanced solutions for pollution control and sustainable practices. BDDE-based solutions are preferred for chemical oxidation processes and electrolytic water purification systems. Programs such as the historic 2021 Bipartisan Infrastructure Law, or BIL, make $11.7 billion in DWSRF available to states throughout the country to upgrade and enhance drinking water infrastructure, including making them more disaster-resistant. Small-scale investments totalling $1.75 million are being made to assist drinking water systems in implementing resilience measures. Large-scale infrastructure upgrades to increase the resilience of the drinking water system (awarded a total of $9.98 million). This regulatory drive assures consistent demand for robust, efficient, and environmentally friendly electrode technologies.

1.Growing Semiconductors Market

Semiconductors facilitate the precise incorporation of boron in diamond, enhancing conductivity, electron transfer, and electrochemical stability for efficient sensing, water treatment, and advanced applications. India’s semiconductor market was about $38 B in 2023, projected at $45–50 B for 2024–2025, and $100–110 B by 2030.

India Semiconductor Mission with new fabrication

|

Date |

Company |

Location |

Investment |

Output Capacity |

|

JUN 2023 |

Micron Technology |

Sanand, Gujarat |

₹22,516 crore |

ATMP Facility, with phased ramp-up |

|

FEB2024 |

Tata Electronics (TEPL), in partnership with Powerchip Semiconductor Manufacturing Corp (PSMC) of Taiwan |

Dholera, Gujarat |

₹91,000 crore |

50,000 wafers/month |

|

FEB 2024 |

CG Power & Industrial Pvt Ltd in partnership with Renesas & Stars |

Sanand, Gujarat |

₹7,600 crore |

15 million chips/day |

|

FEB 2024 |

Tata Semiconductor Assembly and Test Pvt Ltd (TSAT) |

Morigaon, Assam |

₹27,000 crore |

48 million chips/day |

|

SEPT 2024 |

KaynesSemiconPvt Ltd |

Sanand, Gujarat |

₹3,307 crore |

6.33 million chips/day |

|

MAY 2025 |

HCL-Foxconn JV |

Jewar, Uttar Pradesh |

₹3,700 crore |

20,000 wafers/month |

|

AUGUST 2025 |

SicSem Private Limited |

Bhubaneshwar, Odisha |

₹2,066 crore |

60 thousand wafers per year; ATMP capacity: 96 million Units/year |

|

AUGUST 2025 |

3D Glass Solutions Inc. |

Bhubaneshwar, Odisha |

₹1,943 Cr |

Glass panels: 70 thousand units/year; ATMP: 50 million units/ year |

|

AUGUST 2025 |

CDIL (Continental Device) |

Mohali, Punjab |

₹117 Cr |

158 million units /year |

|

AUGUST 2025 |

ASIP (Advanced System in Package Technologies) |

Andhra Pradesh |

₹468 Cr |

96 million units /year |

Source: PIB

Challenges

- High initial investment costs: High production costs are a major restraint in the boron doped diamond electrode market. The production of BDD electrodes requires advanced manufacturing processes, notably CVD, which involves high temperatures, vacuum systems, and precise doping with boron. These energy-intensive processes demand specialized equipment, driving up capital and operational expenditures. Furthermore, the raw materials, such as high-purity carbon substrates and boron sources, are expensive and not generally available, adding to supply chain limitations. According to the U.S. Department of Energy, materials involving diamond coatings and critical elements often face scalability issues due to cost constraints. This restricts widespread adoption, especially in price-sensitive applications such as environmental monitoring in developing regions or small-scale biomedical devices. For instance, in environmental remediation technologies, although BDD electrodes have shown high efficiency in degrading pollutants like PFAS, their high unit cost has slowed large-scale deployments despite proven effectiveness.

- Complex manufacturing process: Fabricating BDD electrodes requires precise doping concentration for conductivity and diamond stability. It is technically difficult to achieve an even distribution of boron across the substrate and only a limited level of structural defects. Variation from the uniform distribution of boron will result in compromised electrochemical performance, durability, or fouling potential. All of this increases the complexities of the production process, extending production timelines, reducing overall yield, and increasing quality control costs, making it less appealing for small and medium enterprises to enter the market, and ultimately delaying the overall commercial advancement than using simpler electrodes.

Boron Doped Diamond Electrode Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

9.9% |

|

Base Year Market Size (2025) |

USD 220.8 million |

|

Forecast Year Market Size (2035) |

USD 880.8 million |

|

Regional Scope |

|

Boron Doped Diamond Electrode Market Segmentation:

Application Segment Analysis

The water & wastewater treatment segment is projected to hold 36% share by the end of 2035 due to increasing water pollution and scarcity concerns. BDD electrodes are highly powerful in degrading persistent organic contaminants such as PFAS, pharmaceuticals, and industrial chemicals through advanced electrochemical oxidation. According to the World Health Organization, in 2021, 2 billion people lived in water-stressed countries, and by 2022, 1.7 billion consumed faecally contaminated water, while 73% (6 billion) accessed safely managed drinking-water services, highlighting the crucial demand for effective water treatment technologies. Thus, regulatory bodies such as the U.S. EPA and the European Environment Agency are gradually enforcing stricter wastewater standards, driving demand for innovative treatment technologies. Additionally, rising investments in environmentally sustainable, decentralized water treatment solutions are surging the adoption of boron-doped diamond electrodes in municipal and industrial settings. Their durability, low maintenance, and ability to operate without added chemicals further contribute to their rising use in water purification systems.

End use Segment Analysis

The municipality segment is estimated to account for a 32.5% share during the forecast period, owing to a boost in urban expansion and the pressing need for efficient water treatment facilities. BDD electrodes provide superior oxidation capabilities, making them ideal for treating municipal wastewater containing emerging contaminants like pharmaceuticals and PFAS. Governments are investing heavily in modernizing ageing water systems to comply with stricter environmental rules and public health standards. According to the 2021 CPCB study, metropolitan areas generate an anticipated 72,368 MLD of sewage, whereas 31,841 MLD of treatment capacity is available, accounting for 44% of the sewage generation. Their long lifespan and low maintenance standards make BDD electrodes a cost-effective solution for large-scale municipal applications. As public pressure for cleaner water grows, municipalities are rapidly adopting advanced electrochemical technologies to ensure compliance and sustainability.

Product Type Segment Analysis

The microelectrodes segment is estimated to account for a significant share by 2035, mainly because it provides a higher surface‐to‐volume ratio, sensitivity, and more precise electrochemical performance than its counterparts. This makes microelectrodes favorable for applications including water treatment, environmental monitoring, and ultimate sensing. The ability of such electrodes to be operated in extreme pH and potential ranges while producing low background current has promoted their widespread use across the finite nature of both research laboratories and industrial electrochemical systems.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Application |

|

|

End use |

|

|

Product Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Boron Doped Diamond Electrode Market - Regional Analysis

North America Market Insights

The boron doped diamond electrode market in North America is anticipated to hold a 40.5% share by 2035, due to stringent environmental regulations and the increasing demand for advanced water treatment technologies. The U.S. Environmental Protection Agency (EPA) and other regulatory bodies are actively promoting the use of innovative solutions like BDD electrodes to reduce water pollution, thereby boosting the market in this region. These electrodes are highly efficient in degrading organic pollutants and are being used in various industrial and municipal water treatment facilities. Furthermore, the presence of key players such as Element Six and SP3 Diamond Technologies in the region contributes to the market’s growth by driving innovation and improving the availability of BDD products.

The U.S. boron doped diamond electrode market is expected to witness significant growth, owing to the increasing adoption of BDD technology in water treatment and electrochemical applications. Advancements in technology are further boosting market demand and development. The BDD market is witnessing an upsurge in demand from the biomedical and electrochemical sectors as advanced properties of BDD, such as high thermal conductivity, chemical stability, and a wide potential window, make it a favorable choice in applications ranging from biosensing to electro-synthesis. Its low capacitive current and high signal-to-noise ratio are especially beneficial for sensitive analytical measurements, which are otherwise challenging with traditional electrode materials. The Environmental Protection Agency (EPA) and U.S. states have named nearly 70,000 water bodies below quality standards. Approximately 170,000 water and wastewater systems, many of which are becoming increasingly automated, are subject to cyber threats from states and criminals. EPA estimates that over the next 20 years, more than $1 trillion will be needed to modernize and replace America’s clean water and wastewater infrastructure to protect the public health and safety, and reliability.

Typical Treatment Efficiencies of Municipal Sewage Treatment for Specific Pollutants

|

Pollutant |

Sewage Ponds |

Secondary Treatment |

Advanced Treatment |

|

Biological Oxygen Demand |

50-95 |

95 |

95 |

|

Nitrogen |

43–80 |

50 |

87 |

|

Phosphorus |

50 |

51 |

85 |

|

Suspended solids |

85 |

95 |

95 |

Source: EPA

The boron-doped diamond electrode market in Canada is influenced by environmental policy and clean-technology practices. Federal and provincial programs supporting innovative water purification technologies or storage for renewable energy technologies all help drive research and development forward. Both academic entities and newly established laboratories are investigating electrochemical sensing and electrochemical systems for energy applications. Given its wealth of raw materials and progressive regulations, Canada fosters collaborative research programs between research organizations and industry to strengthen its position as a niche market participant in high-performance electrode materials for sustainable infrastructure and next-generation electrochemical systems.

Asia Pacific Market Insights

The boron doped diamond electrode market in Asia Pacific is anticipated to hold a 29% share by 2035, due to rapid industrial expansion and stricter environmental guidelines in developing nations. Countries such as India, Japan, and South Korea are emphasizing investments in advanced water treatment solutions, where BDD electrodes play an important role. National initiatives supporting digital transformation and clean energy adoption are further encouraging market demand. The rise in semiconductor and electronics production is surging the need for high-precision electrochemical systems. Collaborative R&D efforts between academic institutions and private firms are also fostering innovation in electrode technologies.

The China boron doped diamond electrode market is projected to hold the largest revenue share in APAC during the forecast period, fueled by substantial government funding in sustainable technologies and stringent environmental mandates. The Ministry of Industry and Information Technology (MIIT) is promoting the integration of advanced materials in electronic manufacturing and water treatment infrastructure. The large-scale expansion of smart cities and 5G networks is highlighting the demand for BDD-based sensor applications as domestic producers are expanding output capabilities, capitalizing on growing global interest in these technologies. China's strategic emphasis on technological self-sufficiency is also boosting innovation and the wider adoption of BDD electrodes. As of 2023, China treated 254 million metric tons of municipal waste, moving from landfill disposal to incineration as a result of land issues, illegal dumping, and significant public opposition. With 927 incineration plants and more than 300 waste-to-energy facilities, China has one of the largest capacities in the world. However, rapid expansion has surpassed the ability of the incineration industry to manage byproducts, such as fly ash, furnace slag, and toxic pollutants derived from incineration.

The market for boron-doped diamond electrodes in India is driven by increasing demand for cutting-edge water purification, electrochemical sensing, and energy-related applications. Furthermore, government initiatives supporting clean energy and more stringent environmental regulations are driving industrial wastewater treatment initiatives. Moreover, local universities and research institutes are developing cost-effective synthesis methods, which may create opportunities for domestic production of boron-doped diamond electrodes. In addition, rapid urbanization and the expansion of infrastructure are increasing interest in applications in the chemical, pharmaceutical, and electronics sectors, positioning India as a new player in next generation electrochemical technologies and sustainable manufacturing processes.

State-Wise Sewage Generation and Installed Treatment Capacity of Urban Centers in MLD

|

States / UTs |

Sewage Generation |

Installed Capacity |

Proposed Capacity |

Total Treatment Capacity |

Operational Treatment Capacity |

|

Andhra Pradesh |

2882 |

833 |

20 |

853 |

443 |

|

Bihar |

2276 |

10 |

621 |

631 |

0 |

|

Chandigarh |

188 |

293 |

0 |

293 |

271 |

|

Chhattisgarh |

1203 |

73 |

0 |

73 |

73 |

|

Gujarat |

5013 |

3378 |

0 |

3378 |

3358 |

|

Haryana |

1816 |

1880 |

0 |

1880 |

1880 |

|

Jammu & Kashmir |

665 |

218 |

4 |

222 |

93 |

|

Karnataka |

4458 |

2712 |

0 |

2712 |

1922 |

|

Madhya Pradesh |

3646 |

1839 |

85 |

1924 |

684 |

|

Maharashtra |

9107 |

6890 |

2929 |

9891 |

6366 |

|

Uttar Pradesh |

8263 |

3374 |

0 |

3374 |

3224 |

Source: PIB

Europe Market Insights

The boron doped diamond electrode market in Europe is anticipated to hold a significant share by 2035, driven by demand from advanced water treatment, electrochemical sensors, and energy storage R&D. A regulatory focus on cleaner industrial processes and a sufficient supply of R&D funding are ensuring a continual flow of innovation from both academics and commercial laboratories. The collaborations between chemical manufacturers and technology firms are leading to an increasing number of pilot projects. The commitment to sustainability by the EU is likely to further support confidence in BDD technology for applications ranging from wastewater remediation, electrosynthesis, and electroanalytical applications where quality or performance has relevance.

The UK market for boron doped diamond electrodes is characterized by a strong academic research infrastructure and several government clean technology initiative programs. Universities are actively working with electrochemical companies on next-generation water purification and sensing devices. Interest in long-lasting, low-maintenance electrodes is growing in both environmental monitoring and industrial treatment. Supportive policy frameworks that promote green chemistry and the development of advanced materials place the UK as an up-and-coming center for BDD electrode development and commercial pilot work.

Germany is characterized by strong precision engineering, a robust chemical manufacturing sector, and numerous advanced schools and research institutes that feed into the boron doped diamond electrode market. German firms are largely engaged with applications in industrial water treatment, electrochemical synthesis, and renewable energy bodies. Federal funding for sustainable chemistry and green industrial processes supports collaborative R&D projects between universities and industry. More than 10,000 sewage treatment plants treat wastewater. The sewage system is roughly 515,000 kilometres long, which is enough to make 13 full orbits of the Earth. Wastewater treatment facilities are typically under the jurisdiction of municipalities. However, there are also sewage treatment facilities in the industry that are privately owned. Public wastewater treatment facilities treat about 9.4 billion cubic meters of wastewater annually.

Key Boron Doped Diamond Electrode Market Players:

- Element Six

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- NeoCoat

- Advanced Diamond Technologies

- GVD Corporation

- Medicoat AG

- CVD Equipment Corporation

- Applied Diamond Inc.

- Diamond Materials GmbH

- Nanocarbon Co., Ltd.

- Bharat Diamond Instruments

- Diamond Advanced Technologies

- Sumitomo Electric Industries

- Tokai Carbon Co., Ltd.

- Mitsubishi Electric Corporation

- Showa Denko K.K.

The boron doped diamond electrode market is intensely competitive, led by well-established companies from Europe and the USA that leverage technological advancements and substantial R&D investments. Industry leaders such as Element Six and NeoCoat concentrate on enhancing electrode performance through cutting-edge CVD technologies. Meanwhile, manufacturers from Asia, especially Japan and South Korea, are rapidly expanding their market share via strategic alliances and increased production capacities. Given below is a table of the top players in the market with their respective shares.

Recent Developments

- In March 2025, Element Six, a global leader in synthetic diamond materials, announced that its Diamox BDD electrodes were validated by the University of Surrey for effectively breaking down short-chain per- and polyfluoroalkyl substances (PFAS). The study showed that Diamox could break down over 90% of the fluorine content in persistent PFAS compounds like PFBA and PFBS, offering a scalable solution for water treatment applications.

- In February 2025, Swiss-based NeoCoat SA launched ultra-thin boron-doped diamond (BDD) coatings suited for wearable medical devices. These advanced coatings improve the sensitivity and durability of electrochemical sensors used in healthcare, supporting the rising demand for high-performance materials in medical diagnostics and monitoring technologies.

- Report ID: 391

- Published Date: Oct 06, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.