Boric Acid Market Outlook:

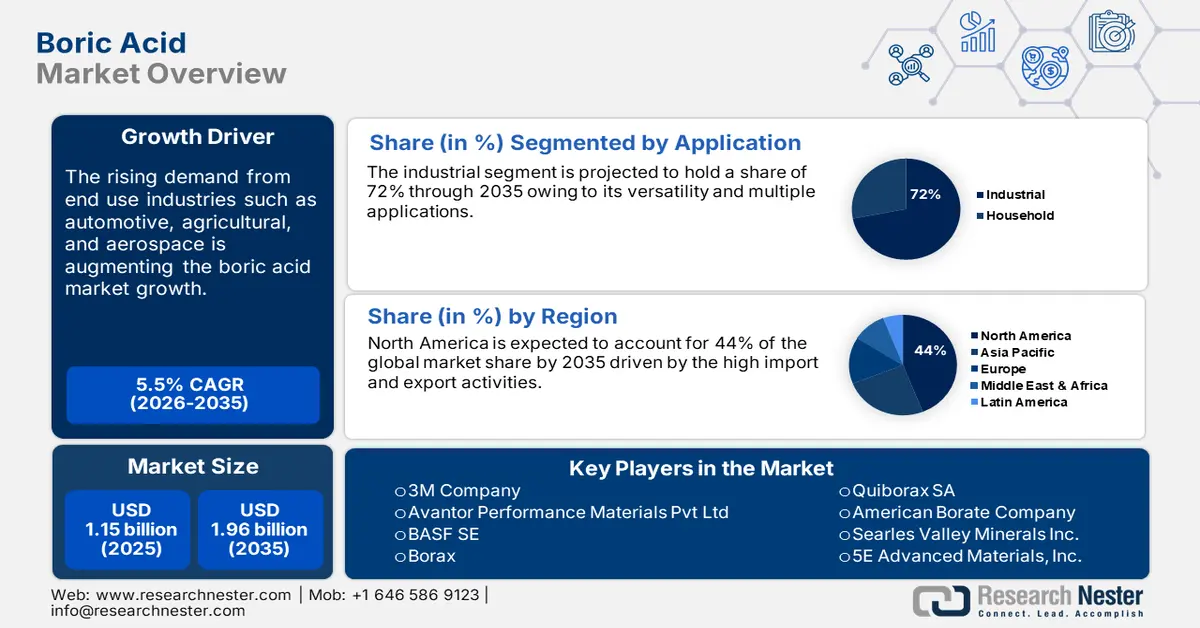

Boric Acid Market size was valued at USD 1.15 billion in 2025 and is set to exceed USD 1.96 billion by 2035, expanding at over 5.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of boric acid is estimated at USD 1.21 billion.

The Observatory of Economic Complexity report reveals that the global trade of boric acid totaled USD 694 million, in 2022 and held the 2592nd position as the most traded product. The exports of boric acid increased by 26% from 2021 to 2022. The U.S., Turkey, Chile, Russia, and Peru are some of the top exporters of boric acid. The U.S. and Turkey exported around USD 202 million and USD 194 million of boric acid, in 2022. Whereas, by holding top positions as importers in the same year, China and Brazil totaled USD 262 million and USD 54.5 million.

The rising use of boric acid in automotive and aerospace component manufacturing is positively fueling the overall boric acid market growth. In automotive, boric acid enhances the manufacturing of high-efficiency engine coolants, preventing the engine from overheating, and also acts as a lubricant additive, which mitigates fiction in vehicle pistons. The boric-sulfuric anodizing process aids in corrosion protection and paint adhesion in aerospace components.

The report by the United States Geological Survey (USGS) reveals that over 200 boron minerals occur naturally, but only 4 of them account for 90% of borate usage in industries globally. The boric acid-based technical ceramic products are widely used in aerospace, electronics, and ballistics. The ceramic industry is anticipated to hold over 15% of the global boron consumption.

Key Boric Acid Market Insights Summary:

Regional Highlights:

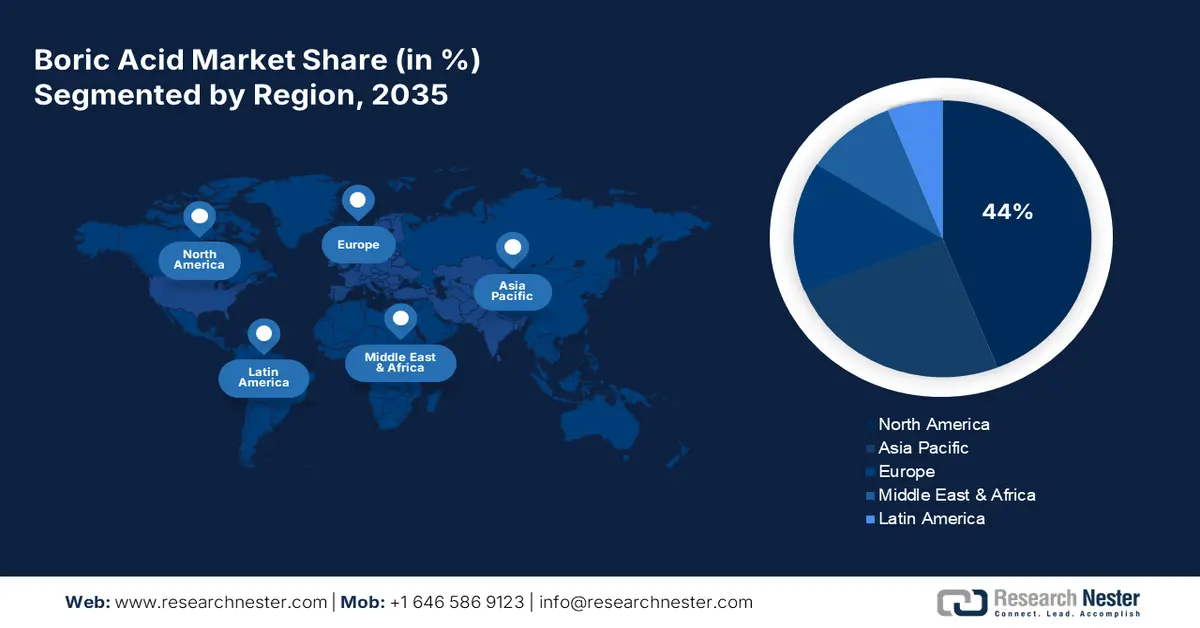

- North America leads the Boric Acid Market with a 44% share, driven by demand in automotive and aerospace, and strong domestic production, ensuring robust growth by 2035.

- Asia Pacific’s boric acid market is projected for high growth through 2026–2035, driven by rising demand in agriculture, glass production, and consumer electronics.

Segment Insights:

- The Industrial segment is forecasted to achieve a 72% market share by 2035, driven by the versatility of boric acid in lubricants and machinery-intensive industries.

- The Fiberglass segment of the Boric Acid Market is projected to maintain a 35.40% share by 2035, propelled by boric acid's flame-retardant quality and improved fiberglass strength.

Key Growth Trends:

- Adoption of sustainable energy systems & EVs

- Enhancing electronic glass displays

Major Challenges:

- Regulatory challenges

- Competition from alternatives

Key Players: 3M Company, Avantor Performance Materials Pvt Ltd, BASF SE, Borax, ETI Maden, and 5E Advanced Materials, Inc.

Global Boric Acid Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.15 billion

- 2026 Market Size: USD 1.21 billion

- Projected Market Size: USD 1.96 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (44% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, France

- Emerging Countries: China, India, Japan, South Korea, Chile

Last updated on : 14 August, 2025

Boric Acid Market Growth Drivers and Challenges:

Growth Drivers

- Adoption of sustainable energy systems & EVs: The rising adoption of renewable sources such as solar panels and photovoltaic cells coupled with the advancements in energy storage systems particularly in electric vehicles (EVs) is augmenting the sales of boric acid. The global energy policies shift towards the adoption of sustainable energy systems is playing a vital role in promoting the use of boric acid in the production of energy-efficient technologies.

For instance, the International Energy Agency (IEA) revealed that around 1 in 5 cars sold were EVs, in 2023. The rise in EV sales directly boosts the consumption of boric acid in battery production. The same source also estimated that the EV battery demand increased by over 750 GWh in 2023. The U.S. and Europe are mainly contributing to this growth by accounting for over 40.0% YoY, followed by China at 35.0%.

Furthermore, a study by Solar Power Europe estimates that around 17.2 GWh of new battery energy storage systems were installed in Europe, a rise of 92% compared to the previous year. The residential sector accounted for a major 63% of capacity followed by large-scale battery systems for 21% and commercial and industrial systems for around 9%. - Enhancing electronic glass displays: Boric acid is finding high applications in electronic devices as a thermal protection layer. It enhances the heat resistance quality of the glass used in flat panel displays, leading to high-quality product production. The rise in the demand for high-tech electronics and flat-screen displays is set to fuel the consumption of boric acid.

Challenges

- Regulatory challenges: The use of boric acid is generally regarded as safe in various applications including ceramics, tiles, and agriculture. Still, some regulatory pressure in their use in cosmetic and pharma products can limit their adoption rates in these particular industries. Also, the regulations vary from region to region leading to strict bans or limited use of boric acid, hindering the revenue growth of key manufacturers.

- Competition from alternatives: The availability of alternative chemicals often hampers the sales of boric acid to some extent. In applications such as pesticides or flame retardants, boric acid faces strong competition from alternative chemicals such as antimony oxide and dichlorophenoxyacetic acid. Thus, competition from substitutes is expected to lower the use of boric acid in the coming years.

- Environmental effects: Even if boric acid is less harmful than many other chemicals, its production and disposal can have environmental impacts such as the release of toxic by-products or pollution from mining operations. This drives attention to adopt sustainable production methods, pressuring high capital investments.

Boric Acid Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.5% |

|

Base Year Market Size (2025) |

USD 1.15 billion |

|

Forecast Year Market Size (2035) |

USD 1.96 billion |

|

Regional Scope |

|

Boric Acid Market Segmentation:

End user (Tiles, Ceramics, Fiberglass, Flame Retardants, Agriculture, Wood Preservation, Pharmaceuticals, Cosmetics)

Fiberglass segment is projected to hold boric acid market share of over 35.4% by the end of 2035. The flame retardant quality of boric acid is majorly driving its use in fiberglass making. It makes the fiberglass more suitable for applications that require a high level of fire safety such as construction materials, electrical insulation, aircraft parts, and automotive components. Reduction in resin shrinkage and improved strength & mechanical properties are further contributing to the use of boric acid in fiberglass production.

For instance, the report by the National Institutes of Health (NIH) reveals that the boric acid consumption in textile-grade glass fibers is 35% and 20% in borosilicate glasses. The Bureau of Labor Statistics estimates that the top-paying industry for fiberglass laminators and fabricators in the U.S. is aerospace products and parts manufacturing. Furthermore, the global demand for glass fiber was valued at USD 18.18 billion in shipments, in 2023.

Application (Industrial, Household)

In boric acid market, industrial segment is anticipated to dominate revenue share of over 72% by 2035. The versatility of boric acid is primarily boosting its use in industrial facilities. Antiseptic & disinfectant, lubricant & greases, glass & ceramic, pest control, and agriculture are some of the prime end use industries of boric acid. In industrial applications, boric acid is widely used in lubricants to improve their performance and thermal conductivity. The growing automation and machinery-intensive processes across several industries including automotive and manufacturing are driving healthy demand for boric acid-based lubricants.

Our in-depth analysis of the boric acid market includes the following segments:

|

End user |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Boric Acid Market Regional Analysis:

North America Market Forecast

North America boric acid market is set to capture revenue share of around 44% by the end of 2035. The strong presence of key market players and high use in the automotive and aerospace components is fueling the overall market growth. The U.S. and Canada both are lucrative marketplaces for boric acid producers.

As per the analysis by the United States Geological Survey (USGS), most of the boric acid products consumed in the U.S. are domestically manufactured. The countries that imported boric acid in 2023 from the U.S. are Mexico, China, Japan, and Malaysia. Further, the Observatory of Economic Complexity report reveals that 29.1% of boric acid exports across the world were from the U.S.

According to the World Integrated Trade Solution Report 2023 around 12,339,900 kg of boric acid was imported into Canada. Wherein, in 2022 the boric acid import value amounted to USD 12.1 million. The swiftly expanding pharma and pesticide industries are pushing the sales of boric acid in the country.

Asia Pacific Market Statistics

In Asia Pacific, the consumption of boric acid is estimated to increase at a high pace during the projected period. The rapidly expanding industrial activities in sectors such as automotive, agriculture, pharma, cosmetics, and aerospace are generating profitable opportunities for boric acid producers. Japan, China, India, and South Korea are the most profitable marketplaces for boric acid manufacturers.

India’s swiftly increasing agricultural sector is positively influencing the consumption of boric acid. Boric acid is also finding widespread use in fertilizers to accelerate the growth of crops such as cotton, rice, wheat, and fruits. The growing demand for high-yield quality crops is propelling the use of boric acid in fertilizers. Furthermore, India being the 2nd largest producer of wheat, rice, and fruits is creating a win-win opportunity for boric acid manufacturers.

The report by the Observatory of Economic Complexity reveals that China totaled around USD 262 million in boric acid imports in 2022. The rising production of glass particularly fiberglass and flat glass is augmenting the sales of boric acid. Furthermore, the growing demand for energy-efficient buildings, EVs, and consumer electronics is pushing the demand for boric acid.

Key Boric Acid Market Players:

- 3M Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Avantor Performance Materials Pvt Ltd

- BASF SE

- Borax

- ETI Maden

- Gujarat Boron Concern OJSC

- Southern Agricultural Insecticides Inc,

- Quiborax SA

- American Borate Company

- Searles Valley Minerals Inc.

- 5E Advanced Materials, Inc.

Leading companies in the boric acid market are employing various organic and inorganic strategies to earn high profits. The product diversification tactics are aiding the companies to attract specific end use industries such as pharmaceuticals, cosmetics, and electronics by offering high-value boric acid solutions. They are also employing merger and acquisition strategies to expand their product offering and strengthen their market position. Using these tactics, the industry giants often acquire smaller companies or start-ups with advanced portfolios.

Key players are targeting high-potential economics wherein agriculture, industrial, and urban activities are taking a boom. By establishing production facilities in such regions, they are able to capture the increasing demand opportunity and double their revenue shares. Strategic partnerships & collaborations are further helping boric acid market players to maximize their distribution networks.

Some of the key players include:

Recent Developments

- In April 2024, 5E Advanced Materials, Inc. revealed the launch of its first production facility of boric acid with U.S. government Critical Infrastructure designation for its 5E Boron Americas Complex. The company initiated this move considering the rising demand for boric acid.

- In March 2023, Borax announced the launch of Optibor BQ a powder-grade orthoboric acid. This high-pure solution is specifically designed for use in batteries and capacitors.

- Report ID: 6797

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Boric Acid Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.