Bone Graft and Substitutes Market Outlook:

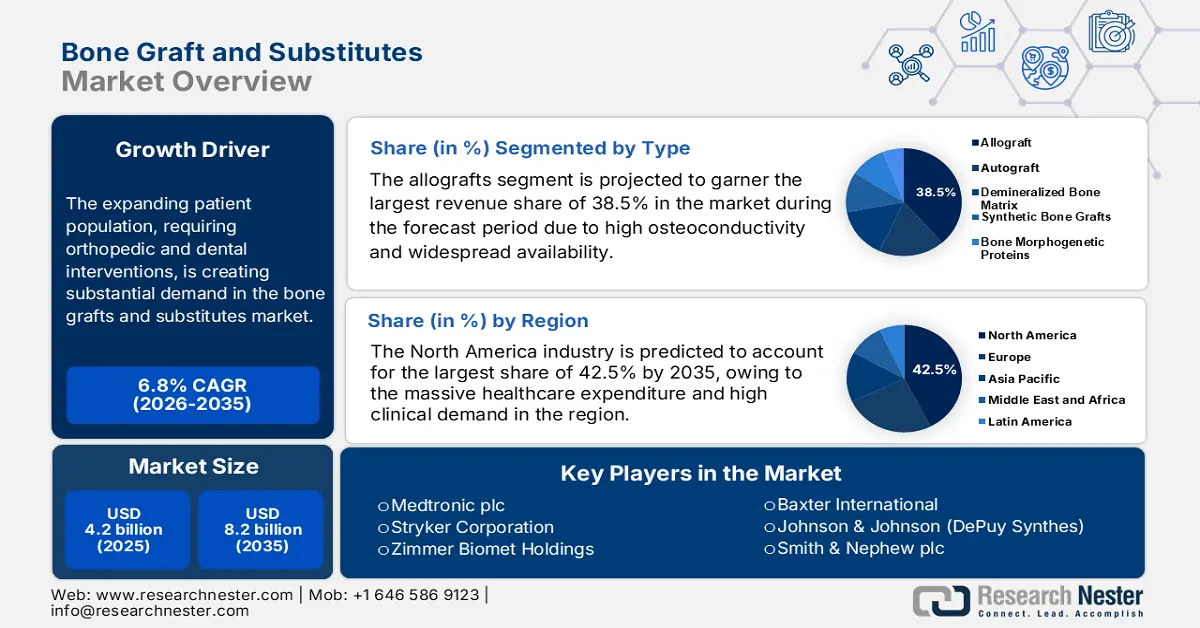

Bone Graft and Substitutes Market size was valued at USD 4.2 billion in 2025 and is projected to reach USD 8.2 billion by the end of 2035, rising at a CAGR of 6.8% during the forecast period, i.e., 2026-2035. In 2026, the industry size of bone graft and substitutes is estimated at USD 4.5 billion.

The expanding patient population, requiring orthopedic and dental interventions, is creating substantial demand in the bone graft and substitutes market. In this regard, the World Health Organization in July 2022 revealed that around 1.7 billion people are experiencing musculoskeletal conditions across all nations, and it is the leading cause of disability. Moreover, the demographic expansion reflects both the growing burden of bone-related conditions and the increasing adoption of advanced grafting technologies to address their medical needs.

Instead of the growing demand, inflation in payers' pricing for both producers and consumers of the bone graft and substitutes market is still persistent. As per an NIH article published in October 2023, a cost-effectiveness study found that while decellularized bone allografts offer slightly better health outcomes than fresh-frozen allografts, the production cost is £39,017 per surgery, creating a need for value-based graft technologies with greater affordability and efficiency.

Key Bone Grafts and Substitutes Market Insights Summary:

Regional Insights:

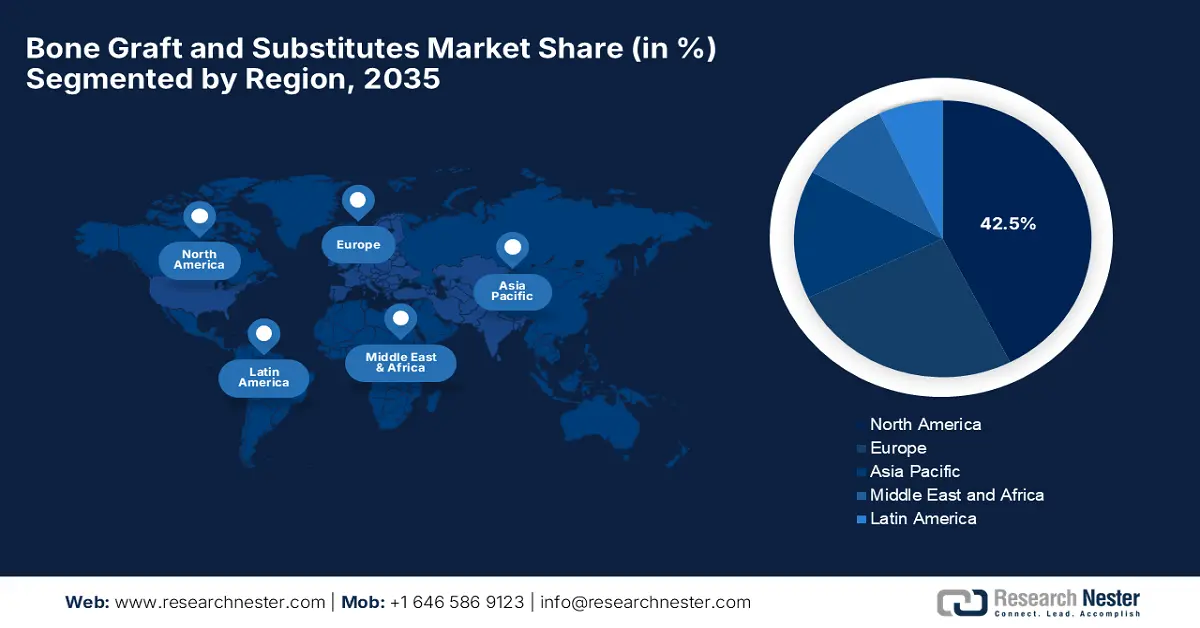

- North America is expected to command a 42.5% share by 2035 in the Bone Graft and Substitutes Market, owing to high healthcare expenditure and escalating clinical demand.

- Asia Pacific is anticipated to witness the fastest growth during 2026–2035, impelled by rapid technological advancements, demographic expansion, and increased healthcare investments.

Segment Insights:

- The allografts segment is projected to account for a 38.5% revenue share by 2035 in the Bone Graft and Substitutes Market, propelled by its high osteoconductivity and broad availability eliminating the need for autograft harvesting.

- The spinal fusion segment is anticipated to hold a 35.8% share by 2035, driven by the increasing prevalence of degenerative spinal disorders and osteoporosis.

Key Growth Trends:

- Aging Population & rise in orthopedic procedures

- Benefits gained through innovation:

Major Challenges:

- Competition from generic alternatives

- Ethical and sourcing issues with allografts

Global Bone Grafts and Substitutes Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.2 billion

- 2026 Market Size: USD 4.5 billion

- Projected Market Size: USD 8.2 billionn by 2035

- Growth Forecasts: 6.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: India, China, South Korea, Malaysia, Brazil

Last updated on : 16 September, 2025

Bone Graft and Substitutes Market - Growth Drivers and Challenges

Growth Drivers

- Aging Population & rise in orthopedic procedures: The increasing volume of orthopedic interventions due to conditions such as arthritis, fractures, and osteoporosis creates new growth opportunities for the bone graft and substitutes market. As evidence, the report from the World Health Organization in February 2025 estimates that people aged 60 and older are expected to increase from 1.1 billion in 2023 to 1.4 billion by the end of 2030, especially in developing economies, hence denoting a wider market scope.

- Benefits gained through innovation: As the investments in research and development increase, the pipeline in the bone graft and substitutes market is expanding. For instance, in October 2023, Orthofix Medical Inc. announced the launch and 510k approval from the U.S. FDA and full commercial launch of OsteoCove, which is an advanced bioactive synthetic graft available in both a putty and strip configuration, hence denoting a positive market outlook.

- Expanding healthcare infrastructure: The supportive healthcare policies and expanding healthcare infrastructure create a great potential for the bone graft and substitutes market. In October 2024, Pharmed Limited notified the launch of the India Bone Health Initiative (IBHI), which is a program aimed at enhancing the health and well-being of people across India. The company also stated that the initiative focuses on addressing which addresses the growing concern of osteoporosis and bone health issues.

Global and Regional Burden of Musculoskeletal Disorders in 2021: Prevalence, Incidence, DALYs, ASRs, and EAPCs

|

Region / SDI Level |

Prevalence (millions) |

Prevalence ASR (per 100,000) |

Incidence (thousands) |

Incidence ASR (per 100,000) |

DALYs (millions) |

DALYs ASR (per 100,000) |

|

Global |

1686.5 |

19.8 |

367.1 |

4.4 |

161.9 |

1.9 |

|

High SDI |

363.8 |

23.7 |

78.4 |

5.4 |

35.4 |

2.3 |

|

High-middle SDI |

337.1 |

19.2 |

75.7 |

4.5 |

31.5 |

1.8 |

|

Middle SDI |

524.5 |

19.1 |

108.3 |

4.0 |

49.3 |

1.8 |

|

Low-middle SDI |

332.0 |

19.6 |

72.0 |

4.2 |

32.7 |

1.9 |

|

Low SDI |

127.8 |

17.8 |

32.3 |

4.2 |

12.7 |

1.7 |

|

Asia |

975.6 |

19.0 |

200.8 |

4.0 |

92.1 |

1.8 |

|

High-income North America |

134.4 |

27.6 |

27.2 |

5.8 |

13.2 |

2.8 |

|

U.S. |

121.6 |

27.9 |

24.8 |

5.9 |

12.0 |

2.8 |

|

Southeast Asia |

124.7 |

17.2 |

26.1 |

3.6 |

11.8 |

1.6 |

Source: NIH

Revenue Opportunities from Bone Graft and Biologics Developments

|

Year |

Company |

Product/Launch |

Revenue Opportunity |

|

2023 |

ZimVie |

RegenerOss CC Allograft & Bone Graft Plug |

Expansion in the dental biomaterials market across North America adds variety in grafting solutions |

|

2023 |

BONESUPPORT |

Next-gen CERAMENT G |

Enhanced surgical efficiency and sustainability; longer shelf life; launch begins in Europe |

|

2022 |

Bone Biologics |

Supply agreement with MTF Biologics (DBM) |

Access to a large allograft tissue portfolio via MTF Biologics supports the spine fusion product pipeline |

Source: Company Official Press Releases

Challenges

- Competition from generic alternatives: The competition from generic alternatives is one of the considerable hurdles in the bone graft and substitutes market. The preference for lower-cost alternatives is contributing to the sector's modest expansion. Moreover, the widespread use of off-label options reflects cost pressures on manufacturers in this sector. Besides, this trend also reflects a broader shift in market dynamics wherein the economic pressures and reimbursement limitations are pushing patients to opt for less expensive materials.

- Ethical and sourcing issues with allografts: The difficulties from quality control and outsourcing of allografts often impose restrictions on the bone grafts and substitutes market. Also, the aspect of quality control heavily depends upon rigorous donor screening, tissue processing, and sterilization protocols, is a major concern hindering market expansion. Furthermore, the inconsistent standards between tissue banks or sourcing organizations can result in variability in product quality, raising safety risks.

Bone Graft and Substitutes Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.8% |

|

Base Year Market Size (2025) |

USD 4.2 billion |

|

Forecast Year Market Size (2035) |

USD 8.2 billion |

|

Regional Scope |

|

Bone Graft and Substitutes Market Segmentation:

Type Segment Analysis

Based on type allografts segment is projected to garner the largest revenue share of 38.5% in the bone grafts and substitutes market during the forecast period. The dominance of the segment is attributable to the high osteoconductivity and widespread availability without a second surgical site for autograft harvesting. In September 2024, LifeNet Health declared that it had launched PliaFX Pak bone allografting solution developed in collaboration with Johnson & Johnson. The company also stated that the allograft is designed with interlocking bone chips and fibers.

Application Segment Analysis

In terms of application spinal fusion segment is predicted to gain a significant share of 35.8% in the market by the end of 2035. The growth in the segment originates from the rising global prevalence of degenerative spinal disorders and osteoporosis. In June 2025, Cerapedics Inc. announced that it received the premarket approval for PearlMatrix P-15 Peptide Enhanced Bone Graft from the U.S. FDA, making it the first and only proven bone growth accelerator approved for use in single-level transforaminal lumbar interbody fusion procedures in adults with degenerative disc disease.

Material Segment Analysis

Based on the material ceramic-based segment is anticipated to capture a share of 32.3% in the bone grafts and substitutes market during the discussed timeframe. Their biocompatibility, osteoconduction, and tunable resorption rates are the key factors behind this leadership. Also, these materials are extensively utilized as extenders for autografts and stand-alone options. Furthermore, the prominent organizations across different nations are promoting research into enhancing the bioactivity and mechanical properties of these synthetic materials, hence denoting a wider segment scope.

Our in-depth analysis of the bone graft and substitutes market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Application |

|

|

Material |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Bone Graft and Substitutes Market - Regional Analysis

North America Market Insights

North America is anticipated to hold the largest share of 42.5% in the bone grafts and substitutes market throughout the discussed timeframe. With the massive healthcare expenditure and high clinical demand, the region is solidifying its leadership for the upcoming years. As per a clinical study by the Bone Health & Osteoporosis Foundation, it estimates that osteoporosis will result in 3 million fractures, thereby adding USD 25.3 billion in costs by the end of 2025, thus benefiting overall market growth.

The U.S. is demonstrating its dominance in the regional bone grafts and substitutes market, on account of substantial Medicare expansion and high trauma incidence. In this context, Medtronic in July 2025 stated that its INFUSE Bone Graft for TLIF had achieved an early success in its IDE study, encouraging the Data Monitoring Committee to recommend halting further enrollment. Besides the FDA-approved protocol amendment introduced a Bayesian adaptive design and reduced sample size, thereby enhancing the trial's efficiency, hence suitable for market growth.

Canada in the bone grafts and substitutes market is expanding at a steady pace, which is primarily backed by expansion strategies and innovation through local R&D efforts, particularly in bioactive ceramic technologies. In February 2025, Contura Orthopedics announced that it had launched Contura Orthopedics (Canada) Ltd, thereby bringing the availability of its hydrogel injection to patients with knee pain caused by osteoarthritis in the region, hence strengthening the country’s position in this field.

Key Statistics from BHOF's CDC-Funded Osteoporosis Awareness Initiative (2024)

|

Statistic |

Value |

|

U.S. osteoporosis cases |

10 million |

|

Number of individuals with low bone mass in the U.S. |

44 million |

|

Risk of fracture in women aged 50+ due to osteoporosis |

1 in 2 |

|

Risk of fracture in men aged 50+ due to osteoporosis |

Up to 1 in 3 |

|

Annual cost of osteoporotic fractures in 2018 |

USD 57 billion |

|

Projected annual cost by 2040 without reforms |

Over USD 95 billion |

|

Duration of CDC grant |

3 years |

|

Grant funding start date |

September 30, 2024 |

|

Number of organizations selected by CDC |

6 |

|

Year one funding amount from CDC |

USD 375,000 |

Source: BHOF

APAC Market Insights

Asia Pacific is propagating with the highest CAGR in the global bone grafts and substitutes market during the analyzed tenure. In this landscape, Japan leads with premium innovations, such as the PMDA-approved 3D-printed grafts to serve its rapidly aging population. On the other hand, India is focusing on affordable synthetics with a notable budget increase. Simultaneously, South Korea is escalating adoption in this category by promoting robotic-assisted surgical technologies, and Malaysia is enhancing patient access with the expanding medical tourism industry. Moreover, demographic expansion, technological advancement, and strategic healthcare investments position APAC as the global growth leader in bone graft solutions.

China is augmenting dominance in the regional bone grafts and substitutes market on account of strong government support, constant efforts from emerging firms, and its innovative tiered pricing model for synthetic grafts has which has boosted the nation's penetration. For instance, in March 2022, CGbio stated that it had signed a five-year export contract worth ₩10 billion with China’s Kerunxi Medical for its Bongros Dental bone graft material, which is proven to reduce alveolar bone union time by half compared to heterogeneous grafts.

India represents a lucrative opportunity in the Asia Pacific’s bone grafts and substitutes market, which is highly stimulated by substantial unmet need and continued administrative support. In January 2025, SCTIMST introduced two drug-eluting bone graft products, called BONYX and CASPRO, wherein BONYX comprises bioceramic beads designed for controlled, sustained antibiotic release to treat bone infections and promote regeneration. On the other hand, CASPRO is a bioactive, moldable bone cement that delivers drugs locally while repairing bone defects through a synthetic mineral-based putty.

Europe Market Insights

The bone grafts and substitutes market in Europe is growing at a consistent pace, which is propelled by its expanding patient pool, requiring orthopedic procedures. In March 2025, BEGO Implant Systems and NovaBone announced they had entered into a strategic alliance to distribute NovaBone’s advanced bone graft substitutes across the region. Besides, this collaboration also aims to enhance access to clinically proven, biocompatible materials for dental professionals, hence denoting a positive market outlook.

Germany leads the regional bone grafts and substitutes market, backed by its sophisticated healthcare system and high clinical demand, boosting adoption. For instance, in March 2023, Evonik and BellaSeno together reported that they are expanding their partnership to commercialize 3D-printed, bioresorbable bone scaffolds made with RESOMER polymers, targeting large and complex bone defects, thereby marking a major advancement in bone and soft tissue regeneration.

The UK in Europe’s bone grafts and substitutes market is extensively growing, supported by the country's enlarging consumer base and geographic expansion of prominent firms. In this context, Biocomposites in September 2024 announced the distribution of its NanoBone range in the country, which is are next-generation osteoinductive bone grafts featuring nanostructured hydroxyapatite for use in orthopaedics and related fields, hence making it suitable for standard market growth.

Cost and Effectiveness Comparison of Fresh-Frozen vs. Decellularised Bone Allografts in Revision Hip Arthroplasty in the U.K. 2022

|

Aspect |

Fresh-Frozen Allograft |

Decellularized Allograft |

|

Cost per Surgery |

£16,343 |

£39,017 |

|

Quality-Adjusted Life Years (QALYs) |

6.86 |

6.93 |

|

Incremental Cost |

- |

+£20,834 |

|

Incremental QALY Gain |

- |

+0.077 |

|

ICER (Cost per QALY) |

- |

£270,059 |

Source: NIH

Key Bone Graft and Substitutes Market Players:

- Medtronic plc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Stryker Corporation

- Zimmer Biomet Holdings

- Baxter International

- Johnson & Johnson (DePuy Synthes)

- Smith & Nephew plc

- NuVasive, Inc.

- Wright Medical Group (Stryker)

- DJO Global (Enovis)

- Orthofix Medical Inc.

- Geistlich Pharma AG

- CeramTec GmbH

- Bioventus LLC

- Xtant Medical Holdings

- Aap Implantate AG

- Surgalign Holdings

- Graftys SA

- TBF Genie Tissulaire

The bone grafts and substitutes market is controlled by major MedTech pioneers, where Medtronic, Stryker, and Zimmer Biomet collectively attained 45.3% of the global revenue share. To retain this leadership, Stryker purchased Wright Medical to strengthen its trauma portfolio and made a significant R&D investment in the development of cutting-edge technologies, such as 3D-printed grafts and stem cell-based solutions. Moreover, companies are also leveraging regulatory partnerships to maintain competitive advantages through innovation-intensive strategies.

Such key players are:

Recent Developments

- In February 2025, Evergen announced the launch of an AI-powered bone graft image processing software to significantly enhance the speed and precision of CT scan analysis in bone graft procedures, and the product was developed in partnership with the University of Florida’s Department of Mechanical and Aerospace Engineering.

- In January 2025, Kuros Biosciences USA, Inc. reported that it had entered a five-year exclusive sales agency agreement with Medtronic’s spinal division, thereby granting Medtronic the rights to sell MagnetOs bone graft products in select U.S.

- Report ID: 7872

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Bone Grafts and Substitutes Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.