Boiler Combustion Chamber Market Outlook:

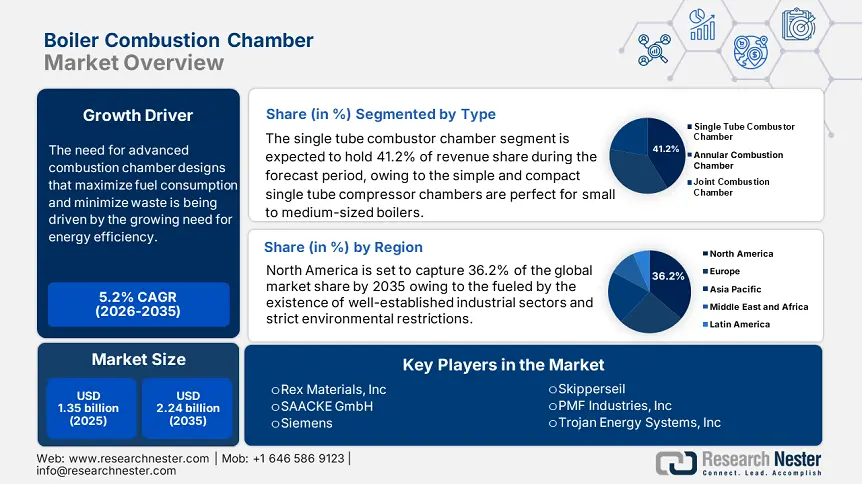

Boiler Combustion Chamber Market size was valued at USD 1.35 billion in 2025 and is likely to cross USD 2.24 billion by 2035, expanding at more than 5.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of boiler combustion chamber is assessed at USD 1.41 billion.

The growing need for energy efficiency and strict environmental laws meant to lower carbon emissions are the main factors propelling this boiler combustion chamber market's expansion. The need for advanced combustion chamber designs that maximize fuel consumption and minimize waste is being driven by the growing need for energy efficiency. Increasingly efficient boiler systems are becoming increasingly popular as a result of strict rules being put in place by governments worldwide to reduce emissions and increase the energy efficiency of industrial processes. Furthermore, industries are investing in technologies that can optimize fuel economy and lower operating costs as a result of the growing price of fossil fuels.

The combustion efficiency of the conventional biomass boiler was typically between 70% and 85%, and the technology was almost extensive. Fuel pretreatment technology, intelligent control systems, and combustion optimization design have all been used to greatly increase the combustion efficiency of industrial biomass boilers in recent years. In terms of lowering energy consumption and conserving energy, some high-efficiency biomass boilers can even achieve combustion efficiencies of above 90%. Optimize the combustion chamber's structure to increase flame stability. To increase combustion completeness and achieve up to 98% efficiency, combine a staged air supply and floating combustion technology. Fuel pretreatment improves combustion performance, optimizes particle size and proportion, and keeps the water content below 15%.

The boiler combustion chamber market is benefiting from the drive towards renewable energy sources. Particularly, biomass is becoming more and more popular as a sustainable boiler fuel alternative. By using forestry and agricultural waste, biomass not only lowers carbon emissions but also promotes waste management techniques. The need for combustion chambers that can effectively burn biomass and other renewable fuels is anticipated to increase as the globe shifts to cleaner energy sources, which will support boiler combustion chamber market expansion.

Key Boiler Combustion Chamber Market Insights Summary:

Regional Highlights:

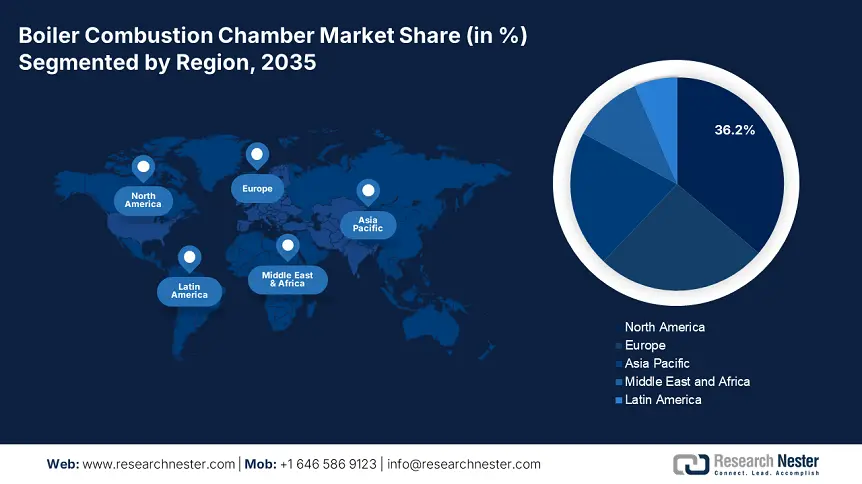

- North America commands a 36.2% share in the Boiler Combustion Chamber Market, driven by the presence of well-established industrial sectors and strict environmental restrictions, ensuring steady growth through 2026–2035.

Segment Insights:

- The Single Tube Combustor Chamber segment is anticipated to see robust growth over 2026-2035, propelled by its suitability for small to medium-sized boilers due to its simple, compact design.

Key Growth Trends:

- Increased demand for larger power plants

- Increasing demand for energy efficiency

Major Challenges:

- High initial investment cost

- Modern and outdated technology work issues

- Key Players: Rex Materials, Inc, SAACKE GmbH, Siemens, Skipperseil, PMF Industries, Inc, Trojan Energy Systems, Inc, Grayd-A Metal Fabricators, Design Integrated Technology, Inc, Hurst Boiler & Welding Co., Inc., Bosch Thermotechnology Ltd., and Thermax Limited.

Global Boiler Combustion Chamber Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.35 billion

- 2026 Market Size: USD 1.41 billion

- Projected Market Size: USD 2.24 billion by 2035

- Growth Forecasts: 5.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Indonesia

Last updated on : 12 August, 2025

Boiler Combustion Chamber Market Growth Drivers and Challenges:

Growth Drivers

- Increased demand for larger power plants: The need to accommodate expanding businesses, growing populations, and increased energy consumption is driving the need for larger power plants. Boiler combustion chambers for these larger plants must be able to effectively manage higher heat and pressure to maintain strict pollution rules and maximize energy output. Global producers are concentrating on creating reliable combustion chamber technologies that can satisfy the requirements of these progressively larger power production plants. Along with conventional fossil fuel sources, many modern power plants also use renewable energy sources such as solar or biomass.

- Increasing demand for energy efficiency: Advanced combustion technology investments are growing in popularity as firms seek to lower operating expenses. The necessity of effective boiler systems is further highlighted by the global movement toward renewable energy sources and reduced carbon emissions. boiler combustion chamber market growth is also being fueled by the industrial sector's rise, especially in emerging economies.

The U.S. Environmental Protection Agency has issued rules to encourage the use of cleaner technology, resulting in a rise in demand for new combustion chamber solutions. The quality of the air has dramatically improved as a result of the emissions reductions. Between 1990 and 2020, national concentrations of air pollutants increased by 73% for carbon monoxide, 86% for lead, 61% for annual nitrogen dioxide, 25% for ozone, 26% for 24-hour coarse particle concentrations, 41% for annual fine particles, and 91% for sulfur dioxide.

Challenges

- High initial investment cost: Advanced combustion technologies have high upfront expenditures, which may discourage smaller enterprises from modernizing their systems. Furthermore, many businesses face difficulties integrating new technologies into their current infrastructure due to their complexity, especially in sectors with narrow profit margins. Furthermore, organizations may find it challenging to commit to long-term boiler system expenditures due to the influence that variable fuel prices can have on operating costs.

- Modern and outdated technology work issues: While improved efficiency and lower emissions are promised by combustion chamber technology, adapting these improvements into boiler systems that already exist may provide compatibility challenges. Industries face challenges when integrating new technology with legacy systems as they look to upgrade their combustion chambers to meet contemporary efficiency and environmental standards. Often, this calls for specialized engineering and customized solutions to ensure a smooth integration without sacrificing performance or safety.

Boiler Combustion Chamber Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.2% |

|

Base Year Market Size (2025) |

USD 1.35 billion |

|

Forecast Year Market Size (2035) |

USD 2.24 billion |

|

Regional Scope |

|

Boiler Combustion Chamber Market Segmentation:

Type (Single Tube Combustor Chamber, Annular Combustion Chamber, and Joint Combustion Chamber)

The single tube combustor chamber segment in boiler combustion chamber market is projected to gain a 41.2% share through 2035. Simple and compact, single tube compressor chambers are perfect for small to medium-sized boilers when space is at a premium. Small-scale power generation and heating systems are among the many businesses that can benefit from these chambers' effective heat transmission and combustion performance. The round shape of annular combustion chambers, on the other hand, promotes even heat dispersion and effective combustion. Because they can withstand higher combustion temperatures and pressures, annular chambers, which are frequently found in larger boilers and power plants, are ideal for heavy-duty industrial applications that demand dependable and continuous operation.

Joint Combustion Chambers are a hybrid design that gives boiler combustion systems flexibility and scalability by combining aspects of single tube and annular layouts. These chambers can be used in a wide range of industrial applications since they can be adjusted to fit different boiler sizes and designs. Joint combustion chambers accommodate particular operational requirements, such as different fuel mixes and load demands, while optimizing heat transfer and combustion efficiency. The need for dependable, affordable, and environmentally friendly heating and power generation solutions across industries is driving the global boiler combustion chamber market, which is expected to continue growing and developing due to advancements in combustion chamber technology and rising demand for energy-efficient boiler systems.

Fuel Type (Natural Gas, Oil, Coal, Biomass, and Electricity)

Based on the fuel type, the natural gas segment in boiler combustion chamber market is likely to hold a noteworthy share by the end of 2035. As natural gas is more efficient and emits fewer emissions than other fossil fuels, it is one of the most often utilized fuels for boilers. The demand for natural gas-fired boilers is being driven by the move to greener energy sources and the availability of natural gas infrastructure in many areas. With the help of government initiatives to lower carbon emissions and promote cleaner energy sources, the use of natural gas as a fuel is predicted to keep expanding. In addition, oil is used extensively, especially in areas with inadequate natural gas infrastructure. Oil is a dependable fuel source for boilers and has a high energy density, particularly in industrial applications.

Boilers continue to use coal as a major fuel, especially in areas with large coal supplies. Boilers that burn coal are frequently employed in industrial operations and power generation. The need for coal-fired boilers is being impacted by the move to cleaner energy sources. Technologies such as carbon capture and storage (CCS) are being adopted by industries more frequently to lessen the negative environmental effects of burning coal. Boiler fuel made from biomass is becoming more and more renewable and sustainable. The benefit of employing waste materials such as organic waste, forestry leftovers, and agricultural residues as fuel is provided by biomass-fired boilers. Utilizing biomass promotes waste management techniques and lowers carbon emissions. The use of biomass-fired boilers is being propelled by the increased focus on sustainability and renewable energy.

Our in-depth analysis of the global boiler combustion chamber market includes the following segments:

|

Type |

|

|

Fuel Type |

|

|

Application |

|

|

Material |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Boiler Combustion Chamber Market Regional Analysis:

North America Market Analysis:

North America is expected to lead the boiler combustion chamber market with a share of 36.2% during the forecast period. Fueled by the existence of well-established industrial sectors and strict environmental restrictions. Advanced combustion chamber usage is being driven by the need for dependable and efficient boiler systems in sectors including food and beverage, chemical processing, and power generation.

In the U.S., the deployment of cutting-edge boiler technologies is being encouraged by the emphasis on lowering carbon emissions and increasing energy efficiency. With ongoing investments in sustainable practices and energy-efficient solutions, the boiler combustion chamber market is anticipated to rise steadily. In 2022, total emissions of CO2 were 35% and 28% of the total emissions of greenhouse gases in the U.S., resulting from the utilization of fossil fuels such as gasoline and diesel for the transportation of people and commodities. This sector was the biggest contributor to CO2 emissions. Air travel, rail, sea transportation, highway, and passenger cars are all included in this category of domestic transportation providers. The United States saw a 1.5% drop in carbon dioxide emissions from 1990 to 2022. Because of the addition of CO2 and other heat-trapping gases to the atmosphere, human activity has significantly contributed to climate change.

Canada boiler combustion chamber solutions are widely used in many industries, especially manufacturing, energy, and the automotive sector, as a result of increased emphasis on sustainability and emission control. boiler combustion chamber market demand is also fueled by the existence of significant industry players and a robust infrastructure for industrial expansion. Compared to a regular boiler, an ENERGY STAR-certified business boiler typically uses 15% less energy. Water heating accounts for 9% of the energy required in Canadian commercial and institutional operations, while space heating accounts for 45%. Consequently, selecting a commercial boiler that has earned the ENERGY STAR certification has a significant chance of lowering your energy costs and greening your environment.

Europe Market Analysis:

Europe is expected to experience a stable CAGR during the forecast period. The boiler combustion chamber market is being driven by strict environmental rules and a well-established industrial base. Advanced combustion chamber usage is being driven by the need for sustainable and efficient boiler systems in sectors including pulp and paper, chemical processing, and power generation. The deployment of innovative boiler technology is being encouraged by the focus on lowering emissions and energy consumption.

Germany's rapid urbanization, industrialization, and rising energy demand are driving the industry in this area. With ongoing expenditures in new materials and technology, it is anticipated to grow steadily. The use of advanced boiler technology is also being accelerated by government programs to lower emissions and encourage energy efficiency. The production of process heat accounts for the biggest portion of energy used in manufacturing and industry. 400 terawatt-hours of final energy are used by businesses in Germany alone for thermal processes. Thus, efficient heating technology is a key tool for lowering energy expenses and boosting competitiveness.

U.K. large number of manufacturing businesses and the continuous growth of the industrial sector are expected to increase demand for boiler combustion chambers. Innovative combustion chamber solutions are in high demand in the region as coal-fired power plants are being phased out and renewable energy sources proliferate. Advanced boiler technologies are becoming more and more popular as a result of government attempts to encourage energy efficiency and lower emissions.

Key Boiler Combustion Chamber Market Players:

- Rex Materials, Inc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- SAACKE GmbH

- Siemens

- Skipperseil

- PMF Industries, Inc

- Trojan Energy Systems, Inc

- Grayd-A Metal Fabricators.

- Design Integrated Technology, Inc

- Hurst Boiler & Welding Co., Inc.

- Bosch Thermotechnology Ltd.

- Thermax Limited

The boiler combustion chamber market is anticipated to rise steadily because of its adaptable qualities and rising demand in several industries, especially in the advanced manufacturing and automotive sectors. Future market expansion will depend on resolving issues with competition, raw material availability, and environmental concerns while taking advantage of new market possibilities and technical developments.

Here are some leading players in the boiler combustion chamber market:

Recent Developments

- In March 2025, the EU plans to gradually phase out the sale of new cars with combustion engines by 2035 and retain strict emissions standards. Approximately 25% of all emissions in the European Union (EU) are currently due to increasing road transport. The EU has set an aim of deploying at least 30 million zero-emission automotive, accounting for almost 12% of the overall vehicle fleet. Even while it will take a coordinated effort to reach this number, the sharp rise in EV registrations in recent years indicates it might be possible.

- In November 2024, Cheema Boilers Limited introduced modern biomass boilers that are incredibly effective and user-friendly due to their sophisticated temperature controls, automated fuel supply systems, and emission-reduction technologies. Biomass boilers will be essential to meeting global renewable energy targets and reaching net-zero emissions.

- Report ID: 7676

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Boiler Combustion Chamber Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.