Body Worn Camera Market Outlook:

Body Worn Camera Market size was over USD 2.12 billion in 2025 and is poised to exceed USD 8.21 billion by 2035, growing at over 14.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of body worn camera is evaluated at USD 2.4 billion.

The body worn camera market is driven by a confluence of technological advancements, regulatory changes, and increasing public demand for transparency and accountability in both law enforcement and private security sectors. For instance, in October 2024, Utility Inc. unveiled next-generation public safety solutions and a vision of the future at IACP 2024. New EOS EXO Body worn camera, AI-powered reporting, and unified sister brands set the gold standard in public safety innovation.

The body worn cameras are instrumental in fostering the clarification of operations, improved evidence collection, and accountability. In addition, advancements in camera technology have come to encompass higher resolution, longer battery life, and improved data storage solutions that lead to greater reliability and cost-effectiveness in BWCs. For instance, in October 2024, Veritone, Inc. announced that Getac Technology Corporation, offered its customers Veritone Redact, an AI-powered software designed to streamline the redaction process for body worn cameras, in-car video, interview rooms, and transport camera footage. The Evidence Management System by Getac will thus incorporate this Redaction of Veritone so that law enforcement agencies get an advanced tool meant for video evidence management under privacy regulations.

State and federal government mandates and regulations now require BWCs in many countries as part of standard law enforcement protocols, which further fuels body worn camera market growth. Concurrently, the growing integration of BWCs with cloud storage, AI-driven analytics, and real-time streaming capabilities is enhancing functionality, which is increasingly becoming a useful tool in both real-time monitoring and post-event analysis. Thus, the market size of body worn cameras is likely to continue growing across the various sectors with improved security, efficient management of data, and increased public trust and accountability.

Key Body Worn Camera Market Insights Summary:

Regional Highlights:

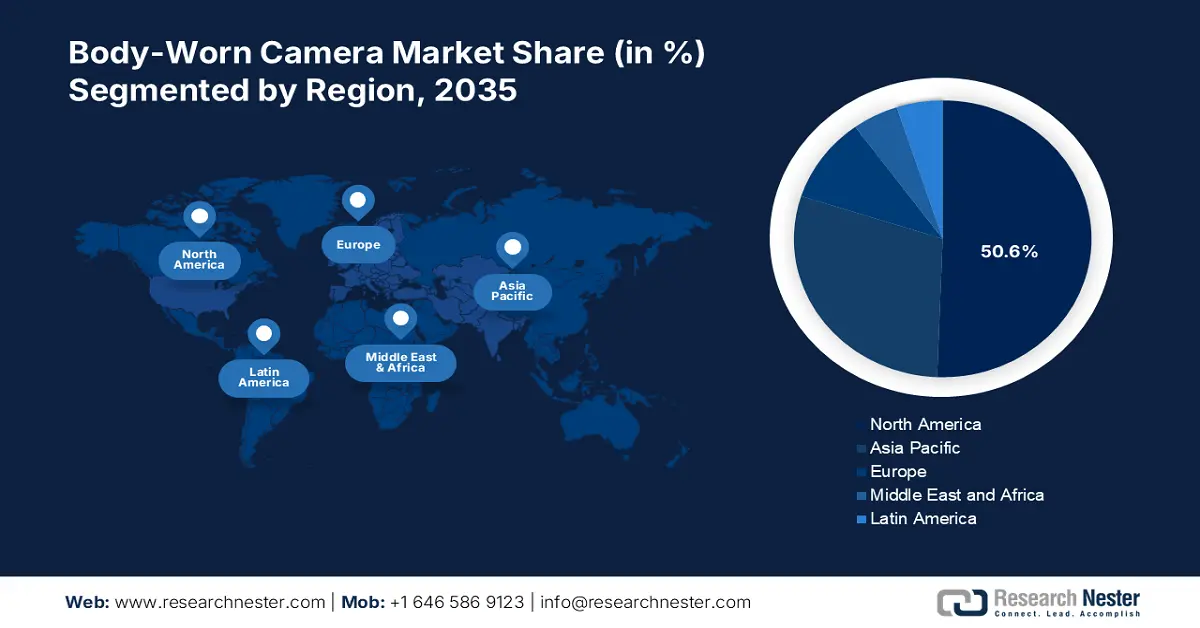

- North America leads the body worn camera market with a 50.6% share, fueled by social and political pressure to restore transparency through 2026–2035.

- The Asia Pacific region is experiencing rapid growth in the Body Worn Camera Market through 2026–2035, driven by demand in densely populated countries and integration with advanced surveillance systems.

Segment Insights:

- The Full HD segment is projected to capture over 66.7% market share by 2035, driven by demand for reliable video evidence in legal and security contexts.

- The Recording Type segment is projected to remain the largest market by 2035, attributed to the reliability and continuity of video imagery during interactions.

Key Growth Trends:

- Rising concerns about transparency and accountability

- Support for real-time streaming & live monitoring

Major Challenges:

- High initial costs

- Integration with existing systems

- Key Players: Axon Enterprise, Inc., GoPro Inc., Reveal Media, Digital Ally Inc., Intrensic.

Global Body Worn Camera Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.12 billion

- 2026 Market Size: USD 2.4 billion

- Projected Market Size: USD 8.21 billion by 2035

- Growth Forecasts: 14.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (50.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, United Kingdom, Germany

- Emerging Countries: China, Japan, South Korea, India, UAE

Last updated on : 14 August, 2025

Body Worn Camera Market Growth Drivers and Challenges:

Growth Drivers

-

Rising concerns about transparency and accountability: As public scrutiny of police conduct becomes more intense, BWCs are viewed as a shining necessity that promotes the transparent nature of public interaction and offers unbiased documentation of events. For instance, in May 2024, Panasonic launched the new LUMIX S9, the world's smallest and lightest full-frame mirrorless camera in the LUMIX S Series. The LUMIX S9, is an introduction to its line-up of cameras, making the journey from capturing moments to sharing them around the globe seamless and intuitive. Consequently, the demand for BWCs is accelerating, as both citizens and policymakers push for greater oversight and ethical policing practices.

-

Support for real-time streaming & live monitoring: Streaming in real-time and live monitoring support drive significant growth in the body worn camera market this improves situational awareness and working efficiency. Real-time transmission is the best feature of event monitoring as it helps command centers monitor the event in real time. For instance, in October 2024, Iveda Corporation announced today its new VEMO Body Cam, the industry's first wearable body camera solution using real-time AI video analytics. Therefore, crucial situations are responded to in time, increasing officer safety while ensuring proper actions take place. It increases the use of BWCs in most sectors because it aids proper decision-making at the right time, amongst others. Real-time documentation by security agencies and law enforcers helps enhance quick intervention.

Challenges

-

High initial costs: The body worn cameras are expensive as they come with a high initial cost due to storage infrastructure, installation of software, and constant maintenance expenses. These costs are very expensive and chargeable to agencies that have tight financial constrictions. Therefore, so far as transparency and accountability are issues concerned, there are evident advantages in BWCs, but the financial barrier will most certainly be a restriction to widespread adoption, especially among those with fewer resources in regions.

-

Integration with existing systems: In the body worn camera market, integration is one of the significant challenges as many law-enforcement agencies and organizations rely on legacy systems for data management and incident reporting. Compatibility issues between new BWC technologies and infrastructure, such as records management systems, video storage solutions, or case management software, can make implementation difficult and costly, as expensive upgrades may be needed. Poor interoperability can therefore hamper the seamless use of BWCs, leading to operational disruptions and associated financial costs for agencies that want to update systems.

Body Worn Camera Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

14.5% |

|

Base Year Market Size (2025) |

USD 2.12 billion |

|

Forecast Year Market Size (2035) |

USD 8.21 billion |

|

Regional Scope |

|

Body Worn Camera Market Segmentation:

Resolution (Full HD, 4K, HD, Others)

Full HD segment is predicted to dominate body worn camera market share of over 66.7% by 2035. Full HD resolution ensures that video recordings provide accurate documentation of incidents so their value in legal proceedings and investigations will be improved. For instance, in May 2021, Hytera launched a full series of 4G or LTE body worn cameras, which captures full HD video as evidence for trials. More importantly, they can send back live video to the control center over a 4G network. In addition, with the police and other law enforcement and security agencies placing greater emphasis on the reliability and quality of evidence, there has been a new demand for full HD cameras, making this a market driver.

Operation (Recording Type, Live Streaming & Recording)

The recording type segment based on operations dominates the body worn camera market as the largest market segment, owing to its features including reliability and continuity of video imagery during interaction. Recording ensures that agencies document incidents in real-time, providing evidence for responsibility, transparency, and legal protection. For instance, in March 2022, CoxHealth upgraded the body worn cameras with benefits reaching higher safety for patients, visitors, and medical staff. The solution-based system integrates easily into CoxHealth's existing video management system, meeting the scalability required for this large organization and its various SW Missouri locations.

Our in-depth analysis of the global body worn camera market includes the following segments:

|

Resolution |

|

|

Operation |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Body Worn Camera Market Regional Analysis:

North America Market Statistics

North America industry is set to account for largest revenue share of 50.6% by 2035. Social and political pressure to help restore transparency to law enforcement procedures has been successful at mobilizing public support for BWCs as a means to document the event as objectively as possible in police-civilian interactions. Body worn cameras would assist in increasing trust between police and the served communities The video evidence derived from such cameras would give an unbiased and objective tool for recording their interactions with police personnel. In addition, officers mainly use them in performing duties that involve open and direct contact with the public, driving the body worn camera market demand in the region.

The U.S. landscape is evolving in its ability to capture the interaction when it occurs deters false claims, aids in clarifying legal disputes, and serves as a safeguard for officers in stressful situations. For instance, in March 2024, U.S. Immigration and Customs Enforcement announced the deployment of the first 1,600 body worn cameras to its two law enforcement components such as Homeland Security Investigations and Enforcement and Removal. This legal protection dimension brought about wider acceptance and high penetration levels of BWCs among police forces in the U.S. Since most jurisdictions require comprehensive efforts to minimize risks associated with the law and enhance accountability.

Canada landscape for the body worn camera market is driven by demand for technologies that offer transparency. Focus on improving community relations, coupled with increased government support for the implementation of BWCs across various provinces are boosting the market. For instance, from November 2024 onwards, frontline RCMP officers stationed at designated detachments nationwide will wear body worn cameras. Audio and video captured by body worn cameras will be uploaded and retained on a secure digital evidence management system. About 1,000 frontline RCMP officers with 90% of the frontline members will use body worn cameras, and complete deployment will be in the next 12 to 18 months.

Asia Pacific Market Analysis

Asia Pacific is the most rapidly growing region in the body worn camera market, driven by the demand in countries with high population densities and significant public events to ensure real-time evidence in policing and crowd management to enhance public trust and reduce incidents of misconduct. Also, this integration with advanced surveillance systems and AI analytics is supporting smart and smartly connected cities by these governments in the region, helping streamline law enforcement operations and position BWCs as significant components of modern security infrastructure in the region.

The primary growth driver for the body worn camera market in India is fueled by the increasing demand for police modernization and the urgent necessity to heighten public trust in law enforcement. For instance, in August 2021, Axon announced the Gujarat State Police will equip officers with 10,350 body worn cameras and Axon's digital evidence management solution. More cameras will also be used by the Gujarat State Police with Axon's real-time situational awareness software, giving access to location mapping and live streaming.

The body worn camera market in China is evolving at a steady pace attributable to As China continues to expand its urban centers, the need to monitor law enforcement activities and public events properly has increased. For instance, in October 2022, Hytera Communications Corp., Ltd. released the SC580 Smart 4G Body Camera and extended its series of body worn cameras. This new camera has a slim and robust body weighing just 177g. videos, audio, and photos are streamed from the field to the command center through private LTE networks, cellular networks, or WLAN.

Key Body Worn Camera Market Players:

- Digital Ally Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Reveal Media

- Axon Enterprise, Inc.

- Motorola Solutions, Inc.

- GoPro, Inc.

- Transcend Information, Inc.

- WatchGuard Technologies, Inc.

- COBAN Technologies, Inc.

- Pinnacle Response

- CP Plus International

- Wireless CCTV

- Wolfcom Enterprise

The body worn camera market is driven by a competitive landscape curated by the presence of well-established and emerging key players. The governments worldwide also support companies with funds to innovate body worn cameras. For instance, in July 2024, The Healey-Driscoll Administration announced over USD 3 million in grant funds to 32 local police departments, allowing municipal law enforcement agencies to implement or expand body worn camera programs.

Here’s the list of some key players:

Recent Developments

- In January 2024, Axon unveiled a new generation of body cameras, Axon Body Workforce designed specifically for frontline workers in retail stores and healthcare facilities. It adapts the life-saving technology trusted by more than 2,000 law enforcement agencies around the world for enterprise organizations.

- In September 2023, Axis Communications announced the AXIS W110 Body Worn Camera, the lightest and friendliest-looking type of body worn camera. It is specifically developed to protect staff and cut assaults in sectors as diverse as retail, healthcare, and transportation.

- Report ID: 6728

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Body Worn Camera Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.