Body Fat Reduction Market Outlook:

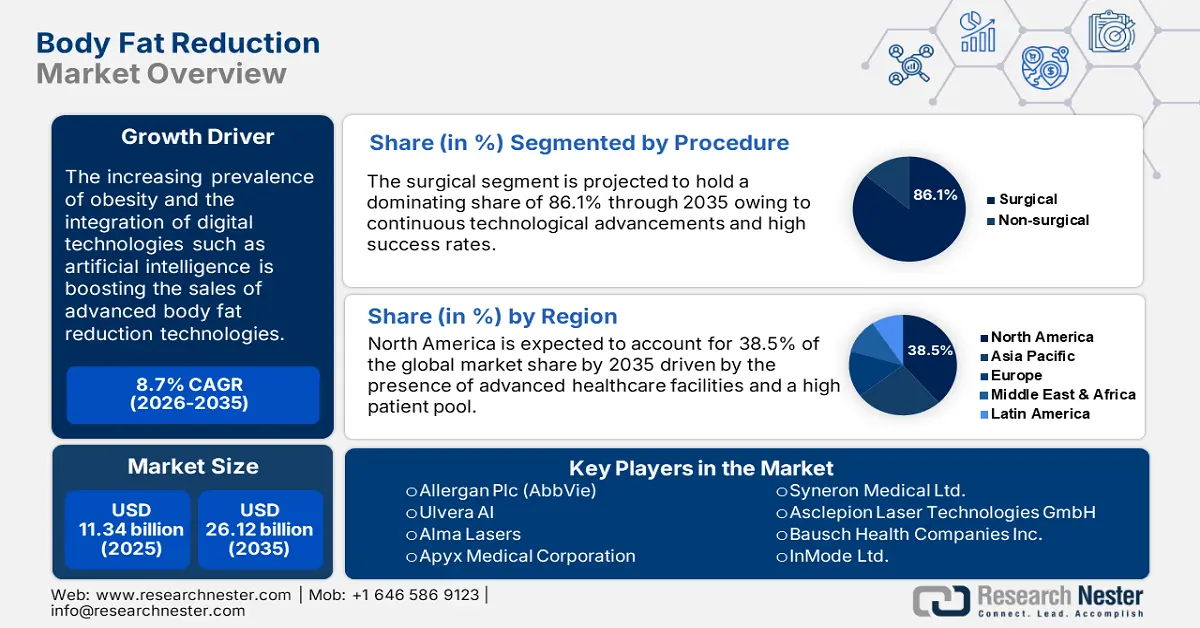

Body Fat Reduction Market size was over USD 11.34 billion in 2025 and is anticipated to cross USD 26.12 billion by 2035, growing at more than 8.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of body fat reduction is estimated at USD 12.23 billion.

out of these were living with obesity-related ailments. The study also estimates that improper diet and inadequate physical activities are set to double the prevalence rate in the coming years. Thus, a rise in obesity rates will boost the sales of body fat reduction technologies in the coming years.

Considering this a serious health challenge, many medical research organizations and companies are investing in R&D activities for accreted government approvals and introducing safe solutions to reduce body fat. For instance, in May 2023, Apyx Medical Corporation received 510(k) clearance from the U.S. Food and Drug Administration (FDA) for Medical’s Renuvion. This new APR Handpiece is estimated to be effective for the coagulation of soft tissues following liposuction. Furthermore, in July 2024, scientists from the University of California San Fransisco (UCSF) revealed that altering a protein in white fat cells can lead to the development of a new class of weight loss drugs.

Leading companies are employing various strategies including new product launches and acquisitions to maximize their revenue shares. For instance, in October 2024, AbbVie Inc. revealed its financial results for the third quarter ended September FY 24. The global net revenue reached USD 14.46 billion with an increase of 3.8% and 4.9%, on reported bases and operational basis, respectively. Whereas, the worldwide net revenue of the aesthetics portfolio is valued at USD 1.23 billion with a 1.8% rise on an operational basis. These statistics highlight that the company is earning positive shares from its aesthetic portfolio, contributing to the overall body fat reduction market growth.

Key Body Fat Reduction Market Market Insights Summary:

Regional Highlights:

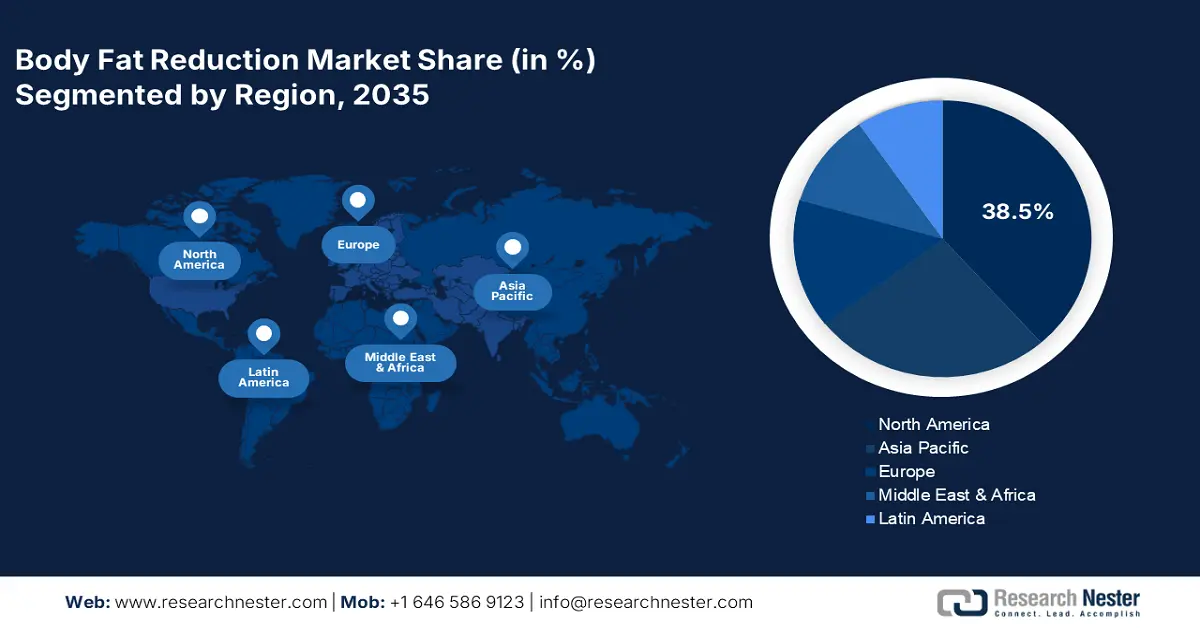

- North America commands a 38.5% share in the Body Fat Reduction Market, supported by the strong presence of research centers and advanced healthcare facilities, fostering growth through 2035.

- The Asia Pacific Body Fat Reduction Market is expected to see the fastest growth by 2035, propelled by increasing obesity cases and growing awareness of plastic surgeries.

Segment Insights:

- The hospitals segment is expected to secure a 32.5% share by 2035, driven by advanced healthcare facilities and skilled experts with next-gen technologies.

- The Surgical segment is expected to capture an 86.10% share by 2035, driven by high success rates and cost-effectiveness compared to non-invasive surgeries.

Key Growth Trends:

- Rise in aesthetic surgeries

- Technological advancements

Major Challenges:

- High treatment costs

- Side effects

- Key Players: Allergan Plc (AbbVie), Ulvera AI, Alma Lasers, Apyx Medical Corporation, and Sientra, Inc.

Global Body Fat Reduction Market Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 11.34 billion

- 2026 Market Size: USD 12.23 billion

- Projected Market Size: USD 26.12 billion by 2035

- Growth Forecasts: 8.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 14 August, 2025

Body Fat Reduction Market Growth Drivers and Challenges:

Growth Drivers

- Rise in aesthetic surgeries: The rising approach of individuals to look good, leading to the increasing adoption of fat reduction treatments is generating lucrative opportunities for body fat reduction market players. For instance, in September 2023, the International Society of Aesthetic Plastic Surgery (ISAPS) revealed the results of its global survey on Aesthetic/Cosmetic Procedures. According to the study, a significant rise of 41.3% was observed in aesthetic surgeries in the past 4 years. Over 14.9 million surgical and 18.8 million non-surgical operations were done worldwide.

Furthermore, the survey also revealed that in 2022 and 2021, over 2.3 million liposuction surgeries were performed, globally. The U.S. (22.0%) and Brazil (8.9%) account for the dominant global share. These statistics underscore that the rising adoption of aesthetic surgeries is set to fuel the sales of body fat reduction devices. - Technological advancements: Continuous innovations in fat reduction technologies such as laser, cryolipolysis, and ultrasound to make surgeries more safe, effective, and less painful are augmenting the market growth. These treatments are more refined and precise, and their increasing awareness worldwide is driving the attention of patients seeking plastic surgeries, contributing to the high sales of body fat reduction solutions.

Artificial intelligence (AI) customization, 3D mapping, and smart device integration are some of the latest trends anticipated to uplift the revenue shares of the industry giants. For instance, Ulvera AI is an Israel-based start-up, with innovative non-invasive body contouring technologies. The company offers ultrasound-guided personalized AI-based fat reduction skin tightening, and muscle stimulation treatments that enable quick and effective results. Thus, the emergence of start-ups with advanced technologies is highlighting the presence of opportunistic market space.

Challenges

- High treatment costs: Body fat reduction surgeries such as liposuctions or non-invasive procedures such as CoolSculpting and laser are often expensive. The high upfront costs make these advanced treatments inaccessible to patients with low incomes, hampering the body fat reduction market growth to some extent. Most cosmetic surgeries are not covered by insurance, which also deters many potential patients from opting for them, particularly in regions with low disposable incomes.

- Side effects: Adverse effects associated with surgical and non-invasive treatments such as uneven fat removal, infections, loosening of skin, or post-treatment complications discourage individuals from opting for these treatments. Many fat reduction surgeries offer short-term results and if proper care is not taken, the chance of doubling the fat cells is high. Such ill effects associated with these treatments can hinder the sales of body fat reduction technologies to some extent.

Body Fat Reduction Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.7% |

|

Base Year Market Size (2025) |

USD 11.34 billion |

|

Forecast Year Market Size (2035) |

USD 26.12 billion |

|

Regional Scope |

|

Body Fat Reduction Market Segmentation:

Procedure (Surgical, Non-surgical)

Surgical segment is set to account for more than 86.1% body fat reduction market share by the end of 2035. Surgical techniques such as liposuction and abdominoplasty are more evolved compared to their non-invasive counterparts. The high success rates and cost-effectiveness in comparison to non-invasive surgeries are contributing to the segmental growth. For instance, according to the International Society of Aesthetic Plastic Surgery (ISAPS) study, liposuction is the most prevalent surgical procedure and accounts for a rise of 21.1% in 2023.

Considering this aspect, many body fat reduction technology manufacturers and research centers are concentrating on the development of innovative liposuction devices and techniques. For instance, in September 2024, Phoenix Liposuction Center revealed that Aqualipo procedure is an innovative body contouring technique that uses smartlipo and laser technologies in water-guided liposuction to remove fat effectively and gently. This advanced surgical procedure offers faster recovery time and less pain. Thus, continuous advancements in surgical procedures are foreseen to boost the overall body fat reduction market growth.

Service Providers (Hospitals, Clinics, Medical Spas, Others)

By 2035, hospital segment is anticipated to hold more than 32.5% body fat reduction market share. Hospitals are the most advanced healthcare facilities with the presence of skilled experts and next-gen technologies. The hospitals are often at the forefront of clinical trials and medical research related to fat reduction and aesthetic surgeries. This enables them to offer advanced procedures and participation in innovation, which appeals to patients seeking the latest and most reliable treatment from these advanced healthcare facilities.

Furthermore, many hospitals have integrated departments of plastic and reconstructive surgeries that specialize in body contouring, offering comprehensive care to patients seeking fat reduction and body reshaping. For instance, as per the analysis by the American Society of Plastic Surgeons, around 4,243,737 cosmetic and 578,599 reconstructive procedures were performed in hospitals, in 2022, respectively.

Our in-depth analysis of the body fat reduction market includes the following segments

|

Procedure |

|

|

Gender |

|

|

Service Providers |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Body Fat Reduction Market Regional Analysis:

North America Market Forecast

North America industry is likely to dominate majority revenue share of 38.5% by 2035, The strong presence of research centers, top medical universities, and advanced healthcare facilities is promoting the overall market growth. Body fat reduction surgeries are widely performed in the region due to factors such as the high trend to appear aesthetically good and the easy availability of next-gen technologies.

In the U.S., the aesthetic surgery rate is highly driven by all demographic groups. For instance, the American Society of Plastic Surgeons study revealed that in 2022, liposuction and tummy tuck surgeries were increased by 25% to 50%, respectively among GenX patients. Furthermore, baby boomers held around 31% of the less invasive treatment procedures, in 2022. Thus, the U.S. is one of the lucrative for body fat reduction market technology providers.

The increasing prevalence of obesity among both men and women is positively influencing body fat reduction market growth in Canada. For instance, as per the report by Statistique Canada, in 2022, the prevalence rate of obesity among men and women each accounted for 30%. The strong presence of research centers, skilled surgeons, and advanced technologies is further supporting the overall market growth.

Asia Pacific Market Statistics

The Asia Pacific body fat reduction market is projected to increase at the fastest pace during the forecast period. The increasing cases of obesity, growing awareness of plastic surgeries, and rising healthcare expenditures are augmenting the sales of advanced body fat reduction technologies in the region. Furthermore, social media influencers majorly contribute to the increasing cosmetic procedures.

In China, the advancements in cosmetic surgical technologies and rising plastic surgery rates are boosting the body fat reduction market growth. In 2023, around 70% of non-surgical medical aesthetic treatments were performed in China. The increasing consumer awareness and ability to spend on medical aesthetics are also fueling the sales of body fat reduction technologies.

India is emerging as a hub for medical tourism and the presence of advanced technologies, skilled experts, and cost-effectiveness are prime contributors to this. The increasing investments in healthcare infrastructure developments are set to positively influence the body fat reduction market growth in the coming years. For instance, the India Brand Equity Foundation revealed that the government is focusing on introducing a credit incentive program worth USD 6.8 billion to enhance the healthcare infrastructure. Such investments increase the adoption rates of advanced medical technologies including body fat reduction solutions.

Key Body Fat Reduction Market Players:

- Allergan Plc (AbbVie)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Ulvera AI

- Alma Lasers

- Apyx Medical Corporation

- Sientra, Inc.

- Syneron Medical Ltd.

- Asclepion Laser Technologies GmbH

- Bausch Health Companies Inc.

- InMode Ltd.

- Lumenis

- Sciton, Inc.

- BTL Industries

- Cutera, Inc.

- Cynosure

- EndyMed Medical Ltd

- Fotona

Key players in the body fat reduction market are employing various strategies such as new product launches, strategic collaborations & partnerships, mergers & acquisitions, and regional expansions to maximize their revenue shares. They are forming strategic collaborations with research centers and universities to develop innovative body fat reduction technologies. Regional expansion strategies are aiding in tapping into high-potential marketplaces to cater to a wider consumer base.

Several start-ups are also entering the body fat reduction market considering the aesthetic wellness trends. The new companies are investing heavily in research and development activities to develop innovative technologies. This strategy is set to aid them in earning high profits and standing out of the crowd.

Some of the key players include:

Recent Developments

- In November 2024, Allergen now part of AbbVie announced November 20 as the 6th annual Botox Cosmetic Day. This announcement was made following its recent advancement in aesthetic technology Botox Cosmetic in adults.

- In May 2024, Cartessa Aesthetics revealed the launch of PHYSIQ 360 the latest and most advanced PHYSIQ body device. This award-winning device selectively targets fat and stimulates muscles for even fat reduction.

- Report ID: 6739

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Body Fat Reduction Market Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.