Board Management Software Market Outlook:

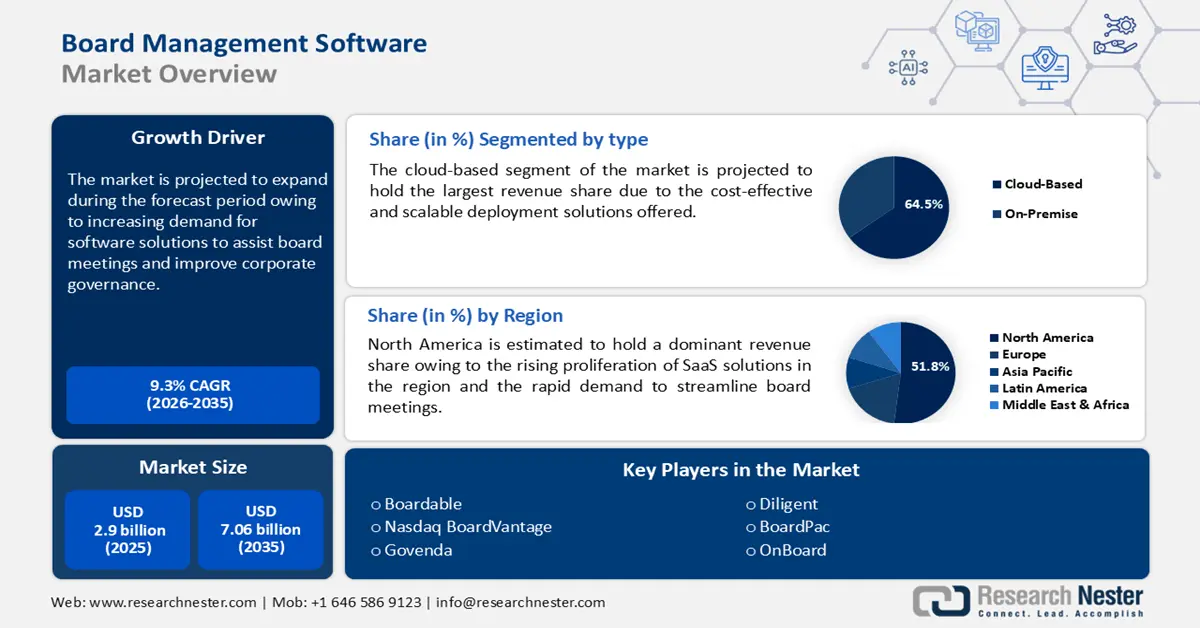

Board Management Software Market size was over USD 2.9 billion in 2025 and is projected to reach USD 7.06 billion by 2035, witnessing around 9.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of board management software is evaluated at USD 3.14 billion.

The rising demand for operational efficiency in corporate governance has resulted in an increasing need for board management software. The specialized software provides centralized software for board members to access documents and manage meetings securely. The broader trends of digital solutions rapidly replacing paper-based methods are expected to create sustained demand for board management software in corporations. The current market trends highlight corporations in both the private and public sectors adopting a digital-first strategy. Additionally, the integration of AI and ML has bolstered predictive analytics and automated routine tasks, improving the scope of management solutions.

Leading platforms are investing in companies providing AI-powered board management solutions, highlighting the growth potential. For instance, in August 2024, K1 Investment Management, a major investor in small-cap enterprise software companies, announced an investment in Board Intelligence, i.e., a leading player in the board management software market offering AI-powered solutions. Furthermore, the advent of remote work has increased driving the demand for digital platforms. Key players who are offering easy-to-use user interfaces with features such as task management and electronic voting are poised to increase their revenue share in the board management software market. With robust digitalization trends worldwide facilitating demands from emerging markets, the board management software sector is predicted to maintain its robust growth during the forecast period.

Key Board Management Software Market Insights Summary:

Regional Highlights:

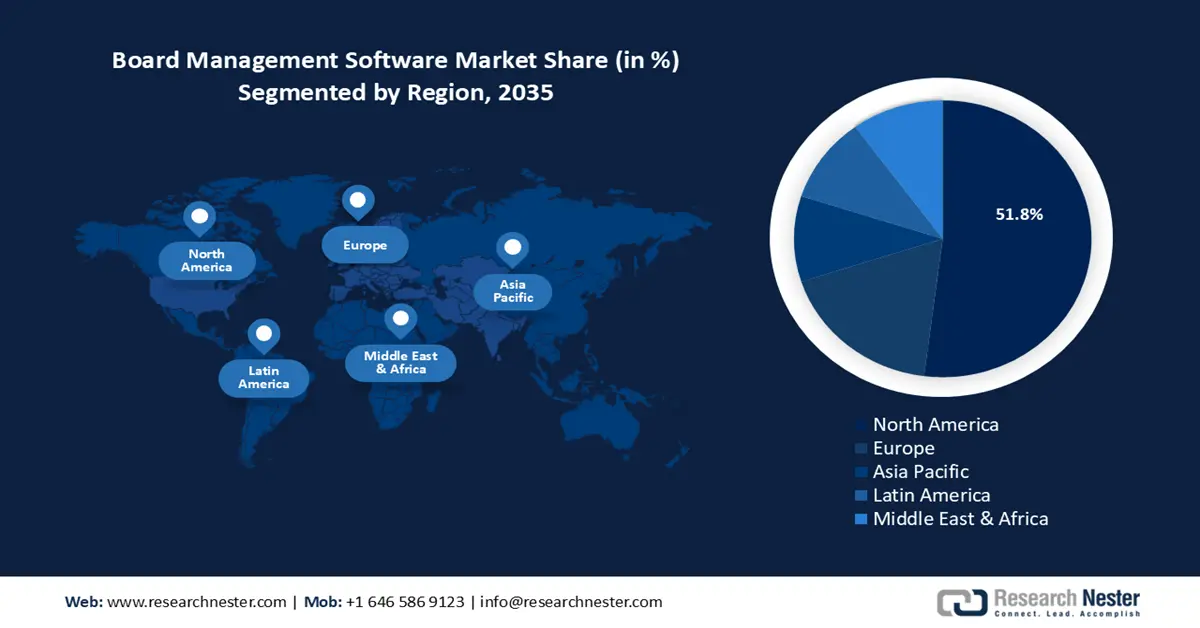

- North America commands a 51.8% share of the Board Management Software Market, propelled by surging adoption of board management software, government transparency directives, and early cloud deployment, solidifying its dominance through 2026–2035.

Segment Insights:

- The Cloud-Based segment is anticipated to capture a 64.5% share by 2035, driven by demand for remote collaboration and scalability in organizational management.

Key Growth Trends:

- Rising demand for improved corporate governance

- Growing demand for real-time collaboration

Major Challenges:

- Challenges in integration with smartphones

- Integration challenges with third-party software and cost constraints

- Key Players: Boardable, Nasdaq BoardVantage, BoardPro, BoardEffect LLC, Convene Inc., Diligent, Govenda, BoardPAC, OnBoard, Aprio Inc..

Global Board Management Software Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.9 billion

- 2026 Market Size: USD 3.14 billion

- Projected Market Size: USD 7.06 billion by 2035

- Growth Forecasts: 9.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (51.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Canada, United Kingdom, Germany, Japan

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 13 August, 2025

Board Management Software Market Growth Drivers and Challenges:

Growth Drivers

- Rising demand for improved corporate governance: Globally, public and private sector enterprises are prioritizing improved corporate government frameworks which is a significant factor in the growth of the board management software market. Board management software provides tools for transparent decision-making and allows organizations to improve record-keeping. Furthermore, streamlining communication between board members boosts productivity. Board management software facilities assist in adhering to compliance mandates that foster investor confidence. In September 2023, Cloud Ratings released a research coverage on the board management software vendors highlighting high market adoption of Board Intelligence, Boardable, BoardPro, Convene, and ProBoard.

- Growing demand for real-time collaboration: The rising demand for real-time collaboration among board members in various geographical settings drives demand for board management software solutions. Vendors offer solutions with platforms that streamline virtual meetings and instant document sharing, creating an all-in-one platform for all functions and purposes of board meetings. Furthermore, software solutions have enabled small-scale companies to hasten the leap to digitalization while allowing bigger organizations to create a library of key documents such as annual reports.

User insights indicate that the adoption of board management software has improved performance while streamlining continuous updates to the agenda. In 2022, the Namibian Ports Authority, i.e., Namport reported successful use of the Convene board management software to boost board engagements. The rising adoption rates highlight the lucrative opportunities in the sector. - Heightened emphasis on data security: The board management software market is exhibiting growth due to the rising demand for security in board meetings. Before the advent of software solutions, the time-intensive paper-based processes in board meetings led to security challenges. Additionally, the proliferation of IoT-connected devices and smartphones has heightened cybersecurity risks which requires robust layers of security. In September 2023, the U.S. Securities and Exchanges Commission’s (SEC) Cybersecurity Risk Management, Strategy, Governance, and Incident Disclosure ruling came into effect that requires companies to disclose if their board of directors has members with cybersecurity expertise. Companies must disclose if a board member or a board committee is responsible for the oversight of cyber threats.

Challenges

- Challenges in integration with smartphones: The board management software solutions can face challenges in integration with smartphones. The proliferation of smartphones has led to the demand for software solutions that can be seamlessly integrated with smartphones so that board members can leverage the software from any location. Key players investing in the mobile version of board management software solutions with an easy-to-use interface are expected to drive greater user adoption rates.

- Integration challenges with third-party software and cost constraints: Despite the advent of cloud-based solutions reducing costs, small and medium-sized enterprises continue to face cost-related challenges in adopting board management software solutions. The price range can raise ROI concerns for smaller enterprises operating with less than 100 employees. Furthermore, integration with outdated legacy systems can pose a challenge for the market by creating technical barriers during implementation.

Board Management Software Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.3% |

|

Base Year Market Size (2025) |

USD 2.9 billion |

|

Forecast Year Market Size (2035) |

USD 7.06 billion |

|

Regional Scope |

|

Board Management Software Market Segmentation:

Type (Cloud-Based, On-Premise)

The cloud-based segment is expected to capture board management software market share of over 64.5% by 2035, owing to the rising demand for remote collaboration tools. Cloud-based board management software solutions are experiencing greater user adoption metrics in comparison to on-premise solutions due to their scalability and cost-effectiveness. The ROI of cloud solutions is favorable for organizations. Additionally, the cloud-based deployment is favorable to small and medium-sized enterprises owing to the reduced requirement for substantial upfront investments in hardware. Moreover, small-scale organizations, such as Aprio, with a less than 15-person team, offering board management solutions reported more than USD 1 million in revenue in 2024.

Functionality (Board Communication, Document Management, Meeting Management, Agenda Management, Voting and Polling)

By functionality, the board communication segment of the board management software market is poised to account for a dominant revenue share during the stipulated timeline. A major driver of the segment is the rising demand from organizations for secure communications. Additionally, federal directives to increase transparency have bolstered the adoption of software that streamlines board communication. With the rising focus on efficient, technology-driven board communication that improves performance, the segment is projected to maintain its growth by the conclusion of the forecast period.

The document management segment of the board management software market is poised to expand its revenue share by the conclusion of 2035. The segment’s growth is propelled by the rising investments in SaaS solutions by corporations. Moreover, the demand for secure storage of critical board documents benefits the market’s growth. The functionality allows organizations to centralize board materials, such as agendas, minutes, reports, and presentations in a secure digital repository. With the growing advent of cyberattacks, the segment is poised to exhibit consistent demand to improve document management and security.

Our in-depth analysis of the global board management software market includes the following segments:

|

Type |

|

|

Functionality |

|

|

Deployment Type |

|

|

Industry Vertical |

|

|

Company Size |

|

|

Component |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Board Management Software Market Regional Analysis:

North America Market Forecast

North America board management software market is set to capture over 51.8% revenue share by 2035. The regional market’s large revenue share is owed to the surging adoption rate of board management software owing to government directives for transparency and the presence of a large number of corporations of various sizes, which require efficient board management solutions. Furthermore, the early adoption of cloud-based software deployment in public and private sector organizations is expected to fuel market growth.

The U.S. board management software market is poised to exhibit robust growth. The proliferation of SaaS solutions in the U.S. and the rising demand for board management solutions has bolstered the market’s growth. The U.S. is at the forefront of digitalization with private and federal agencies embracing digital solutions to maintain the region’s position as a global leader. These trends favor the increased user adoption of board management software solutions. Furthermore, Executive Order 14028 has increased the accountability of software vendors to strengthen cybersecurity which remains an emerging trend in the U.S. market.

The Canada board management software market will grow during the forecast period. The market’s growth is attributed to Canada’s shift toward digital transformation. Two major factors bolstering the sector’s growth in Canada are the rising demand for ESG-compliant and proactive stance to digital governance adoption. Furthermore, the advent of SaaS solutions in Canada benefits the sector’s continued growth. Moreover, vendors are poised to leverage the rising demand from public sector enterprises and non-profit organizations in the country by the conclusion of the forecasted timeline in 2035.

Europe Market Forecast

The Europe board management software market is projected to expand during the forecast period. A major market driver in Europe is the rising emphasis on efficient corporate governance and the growing demand for robust security solutions. Europe has experienced an increasing number of cyberattacks which has been a cause of concern for corporations operating in the region. To ensure streamlined communication and secure communication channels, the demand for board management software in the region is expected to increase.

The Germany board management software market is driven by the trends to modernize governance frameworks. The domestic market is characterized by the rapid adoption of digital governance by private and public sector enterprises. The European Union (EU) has set a 75% target for cloud adoption and Germany is on track to achieve it. With a rising number of companies in Germany adopting cloud computing, the opportunities for the adoption of board management software solutions are expected to increase during the forecast period.

The France board management software market is positioned to increase its revenue share during the sector’s stipulated timeframe of analysis. A key driver is the cultural emphasis on collaborative decision-making within organizations in France. Additionally, the corporations in France must adhere to stringent ESG guidelines. The improvement in performance analytics reported by organizations after the adoption of board management software solutions bodes well for opportunities within the France market.

Key Board Management Software Market Players:

- Boardable

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Nasdaq BoardVantage

- BoardPro

- BoardEffect LLC

- Convene Inc.

- Diligent

- Govenda

- BoardPAC

- OnBoard

- Aprio Inc.

The board management software market is poised to expand during the forecast period. Major players are investing to improve user interfaces while providing seamless integration with enterprise systems like CRM and ERP. Additionally, vendors offering customizable dashboards and role-based access controls are slated to have an edge in the competitive market. Major players in the market are seeking to offer competitive prices for cloud-based board management software solutions and forge long-term relationships with enterprises.

Here are some key players in the market:

Recent Developments

- In September 2024, Board Intelligence and TeamEngine announced a partnership to expand their geographic reach and improve the scope of their products. Board Intelligence’s AI-powered Lucia and the engineering capabilities of TeamEngine is expected to accelerate the development of innovative features.

- In May 2024, OnBoard announced the expansion of AI capabilities in the boardroom with the acquisition of Govenda. The acquisition is expected to expand the world-class support including personalized training and a white-glove approach to implementation.

- Report ID: 7053

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Board Management Software Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.