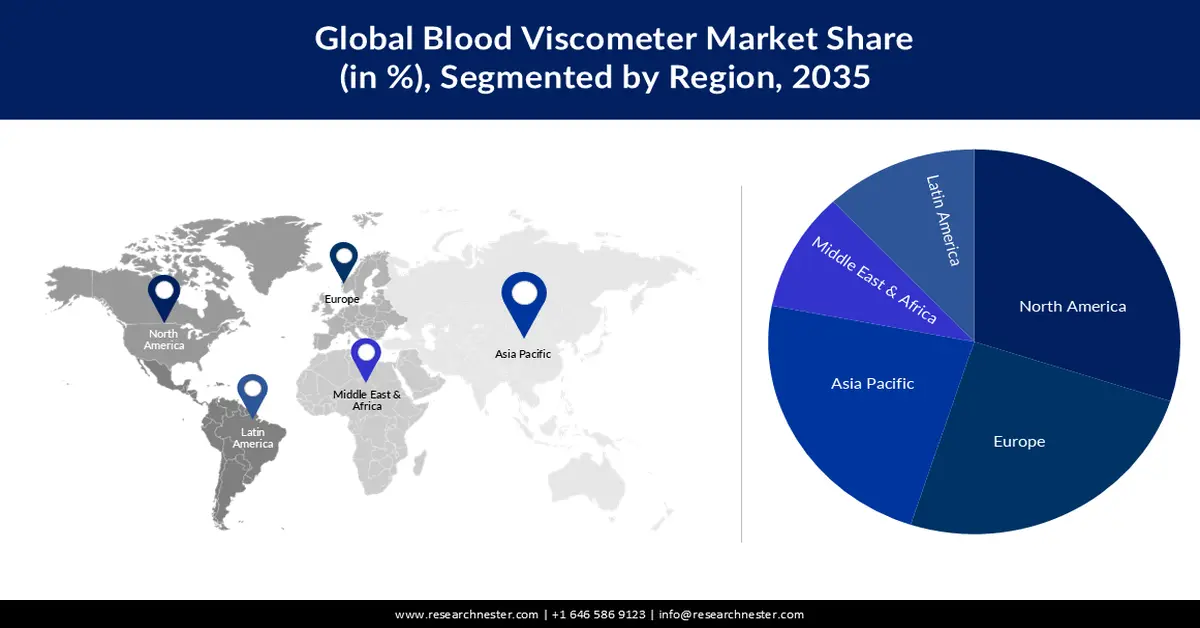

Blood Viscometer Market - Regional Analysis

North America Market Insights

North America blood viscometer market is expected to hold the largest revenue share of 30% by 2035. The region has a large patient pool, with hemophilia A and B affecting 3,900 people in Canada. Additionally, 300,000 people have inherited bleeding disorder genes, contributing to CVD incidences. In 2024, 89,190 lymphoma cases were registered in the U.S. and 62,770 were leukemia. The U.S. heavily invests in Medicare and related infrastructure to support social security and healthcare accessibility. 14.3% or USD 423 million of the FY2025 obligated U.S. budget of USD 3 trillion has been allocated to Medicare, signifying the country’s potential for future growth.

In 2023, the U.S. supplied USD 34.8 billion worth of medical instruments, making it the exporter globally. In the same year, medical instruments emerged as the 11th most supplied item from the country. The primary destinations were the Netherlands (USD 5.91 billion), China (USD 3.26 billion), Germany (USD 3.17 billion), Mexico (USD 3.15 billion), and Japan (USD 2.8 billion). In November 2024, the medical instruments outbound trade amounted to USD 3 billion and imports USD 3.42 billion, resulting in a trade deficit of USD 412 million. Between November 2023 and November 2024, the outbound supply increased by USD 22.1 million (0.74%), i.e. from USD 2.98 billion to USD 3 billion, while imports surged by USD 60.1 million (1.79%), i.e. from USD 3.36 billion to USD 3.42 billion. In November 2024, the primary recipients of medical instruments were Netherlands (USD 515 million), Mexico (USD 355 million), Canada (USD 278 million), China (USD 277 million), and Japan (USD 222 million).

Europe Market Insights

Blood viscometer market in Europe is anticipated to hold the second-largest revenue share of about 25% during the forecast period. Europe has positioned itself as a major contributor to the worldwide trade of medical devices, including blood viscometers. Germany and Ireland were among the top five exporters, valuing USD 341 million and USD 266 million, finds OEC. The November 2024 sure in medical device year-by-year exports can be explained primarily by growth in demand in the Netherlands (USD 128 million, at 36.1% share). Moreover, Ireland accounted for 22% of the overall trade, positioning Europe as a key contender in the blood viscometer market.

Germany’s government spending as a share of GDP was 31.5% in 2023, whereas the spending on healthcare was a staggering 12.65%. The presence of a robust, yet self-governing insurance system facilitates the blood viscometer market growth in the nation. In matters concerning social or public health coverage, the Federal Joint Committee (G-BA) holds the primary decision-making abilities, in support of the Institute for Quality Assurance and Transparency in Health Care (IQTIG) and the Institute for Quality and Efficiency in Health Care (IQWiG).