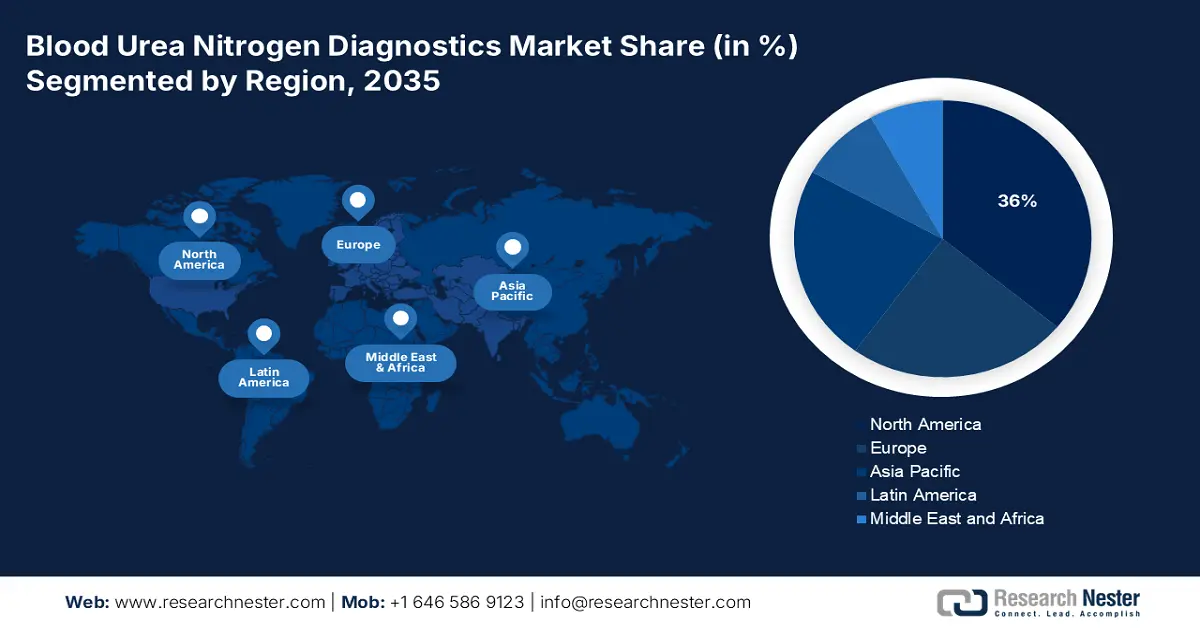

Blood Urea Nitrogen Diagnostics Market - Regional Analysis

North America Market Insight

North America is anticipated to reach 36% of market share by 2035. Some of the principal drivers of this market are an expanding patient pool suffering from chronic kidney ailments, monetization or reimbursement systems, and widespread adoption of prophylactic diagnostics. Rising healthcare expenditure, incorporation of digital systems in diagnostics, Medicare, and Medicaid policy enhancements into basic care are a premium advantage to the region. As per a report by NIH in September 2024, in the U.S., there are more than 808,000 persons living with ESKD, or end-stage renal disease (ESRD), with 68% on dialysis and 32% with a kidney transplant.

The market in the U.S. is witnessing rapid expansion owing to the chronic diseases, and hence setting new federal priority health issues and supporting reimbursement schemes. Besides, medical agencies such as AMA and BIO support wider access to testing, promoting the use of AI-facilitated analyzers and interoperable systems. Together, such policy alterations and government injections keep the demand and growth curve strong for the industry. Additionally, as per a report by NIH in September 2024, a total of 27,332 kidney transplants were conducted across the U.S. in 2023. Continued advancements in point-of-care testing and integration of AI are expected to further enhance diagnostic accuracy and patient outcomes in the coming years.

Canada market is growing due to an increase in the incidence of chronic kidney disease and diabetes, as well as rising awareness about monitoring kidney function at very early stages. This is backed by rapidly advancing diagnostic technologies, a strong health infrastructure, and various governmental healthcare initiatives. As per a report by NLM in February 2023, chronic kidney disease (CKD) is one of the major health concerns affecting almost 4 million people in the country and 11% to 13% of the population globally. Government programs that encourage the early detection and treatment of kidney diseases actually drove the demand.

Medical Instruments Trade by Country in 2023

|

Country |

Export Value (USD) |

Import Value (USD) |

|

U.S. |

34.8 billion |

37.7 billion |

|

Mexico |

17.6 billion |

4.6 billion |

|

Costa Rica |

5.9 billion |

828 million |

|

Dominican Republic |

2.1 billion |

— |

|

Canada |

1.2 billion |

3.7 billion |

Source: OEC

Asia Pacific Market Insight

The Asia Pacific is the fastest-growing region in the blood urea nitrogen diagnostics market by 2035 due to factors such as rising healthcare investments, increasing chronic kidney disease incidence, and advanced diagnostic technologies. Several governments across the region have taken active steps to counter chronic kidney diseases, including programs on integrated diagnostics and screening for blood on a regular basis. As per a report by the Open Access Government in July 2025, an increase in the market can be attributed to the aging population of about 173.3 million by 2050, from 77.4 million in the last 5 years.

China holds the Asia-Pacific blood urea nitrogen diagnostics market due to a huge patient population base, government programs targeted at kidney health, and rapid modernization of healthcare. As per a report by NLM in December 2024, incident hemodialysis patients have seen steadily rising numbers from 70,961 (52.2 per million population, pmp) to 156,645 (111.9 pmp) in 2022. With almost a two-fold increase, it shows an urgent requirement for some highly efficient mechanism to monitor kidney function, BUN diagnostics being one possibility. At the same time, the growing awareness due to educational programs and increasing insurance coverage are at the same time pull forces toward the early diagnosis and treatment of kidney diseases in China.

The market in India is expanding as nephrology-related ailments are fast gaining awareness, with growing access to health in rural areas and Government programs geared toward timely diagnosis and early treatment in cases of chronic diseases such as diabetes and hypertension. As per a report by NLM in April 2023, kidney disease weighty public health issue in India, has high morbidity and mortality rates and the Million Death Study estimated deaths from chronic kidney disease at 50% up. Also, cheaper diagnostic instruments are being made available increasingly for more widespread screening and monitoring in both urban and rural populations.

Europe Market Insight

The blood urea nitrogen diagnostics market in Europe is expected to grow steadily owing to an aging population, the increased suffering of chronic kidney diseases, and the broad implementation of universal healthcare systems under which testing for kidney function is considered a routine. As per a report by Bruegel in March 2025, by 2050, the working-age population would decrease or is projected to decrease further in 22 out of 27 countries in Europe, while the share of the 85+ age group would more than double in Europe as a whole by 2050. This demographic shift will increase the demand for regular kidney health checks.

UK market is growing due to the rising occurrences of diabetes and hypertension, drastic awareness programs for the promotion of early diagnostic screening, and the installation of advanced diagnostic systems in NHS facilities. As per a report by the Government of the UK in March 2025, from March 2024, the prevalence of type 2 diabetes among adults over 17 years of age in England was around 7.0%, an increase over the 6.8% from March 2023. Such an increase in chronic conditions raises demand for greater administration of kidney functioning tests, including those for BUN, so that complications might be averted.

The blood urea nitrogen diagnostics market in Germany has been bordering upon high healthcare spending, having a well-established industry for diagnostics and clinical attention to early renal disorder detection and its management through standardized blood-testing protocols. Under the country's healthcare infrastructure, further impetus is provided for the updating of diagnostic equipment, therefore including BUN testing. Further, government initiatives related to chronic disease management have led to increased monitoring of kidney function. This awareness among medical practitioners for early detection tends to build a growing demand for dependable and fast BUN diagnostic methods. The synergy of all these factors leads to the steady growth of the German market.