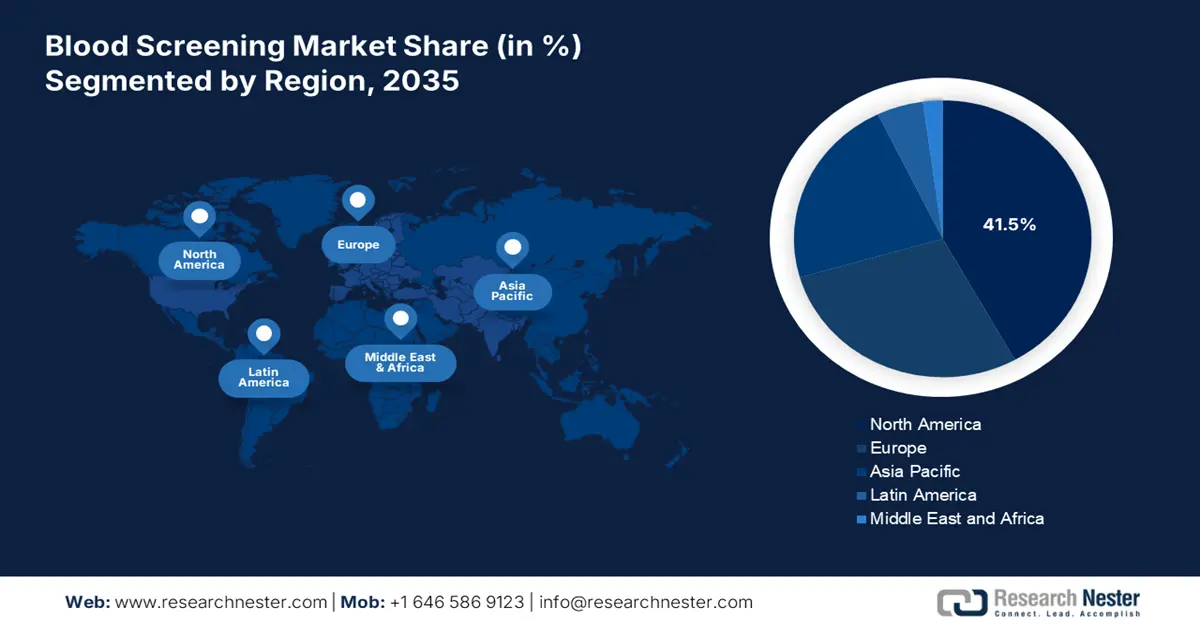

Blood Screening Market - Regional Analysis

North America Market Insights

North America in the blood screening industry is expected to be the dominant region, garnering the largest share of 41.5% by the end of 2035. The market’s growth in the region is highly propelled by the presence of strict regulations, funding dominance, and leadership in technological innovations. As per an article published by NLM in May 2024, newborn bloodshot screening has been readily implemented for successfully screening 400,000 newborns across 29 states in the U.S. Besides, an increase in population is also driving the market demand, with the U.S. comprising 335 million across 51 jurisdictions, thus suitable for the market’s growth.

The blood screening market in the U.S. is significantly growing, owing to the presence of Medicaid and Medicare coverage services, R&D activities in the private sector, and pathogen inactivation. As stated in the 2025 Medicaid Government report, almost half a million children between 1 to 5 years of age in the country possess blood lead levels more than 3.5 micrograms per deciliter. Therefore, it is crucial that children get enrolled in Medicaid programs to achieve suitable blood lead screening tests. Regardless of the coverage, children are poised to receive these tests between 12 months and 24 months, thereby denoting growth opportunity for the market.

The market in Canada is also growing due to provincial decentralization, the availability of public blood banks, and a focus on indigenous health. As per the April 2022 NLM article, Canadian Blood Services and Héma-Québec have readily extended their role in public health surveillance, and nearly 1 million blood samples can be made available in the country. In addition, with the presence of 90% repeated donors, there is a huge possibility of longitudinal sampling in Canada. Meanwhile, Héma-Québec has been evaluating more than 18,600 blood donations by collaborating with the government.

Hepatitis B Virus (HBV) and Hepatitis C Virus (HCV) Prevalence in North America

|

Countries/Components |

Mean Age |

Men (%) |

Number of Patients |

HIB |

HCV |

|

Canada |

57 |

61 |

164,085 |

8% (4 to 13) |

36% (22 to 50) |

|

U.S. |

57 |

62 |

866,810 |

3% (3 to 4) |

37% (34 to 39) |

Source: NLM, May 2022

APAC Market Insights

Asia Pacific in the blood screening market is considered to be the fastest-growing region, with a projected share of 22.1% during the forecast timeline. The market’s development in the country is highly fueled by the presence of diversified regulations, variability in pathogens, and cost sensitivity. Besides, the October 2024 NLM article denoted that WHO's External Quality Assurance Programme (EQAP) was implemented in Southeast Asia regions, leading to 100% concordance achievement among regional laboratories, which indicated increased testing standards. Therefore, with all these factors, the market is gradually growing in the region.

The market in China is gaining increased traction, owing to centralized funding, the presence of regional tech organizations, public and private collaborations, and the division between rural and urban areas. As per an article published by MedNexus in November 2023, the country has readily witnessed an increase in its healthcare spending for the past five years by 166%, thereby denoting a huge opportunity for strong private and public partnerships. As a result, hospital providers, physician groups, medical devices, and technical organizations collaborate with each other to uplift the market in the country.

The blood screening market in India is also growing due to a surge in the HBV burden, the existence of a decentralized system, and diagnostic feasibility and validations. As stated in the January 2024 NLM article, a clinical study was conducted on 416 urban slum people to successfully validate haemoglobin between the non-invasive EzeCheck and invasive haematology analyzer. The invasive device demonstrated 91.5% results, with a 1.5% difference, and the non-invasive displayed 43.5%, with the absence of any difference. Therefore, bulk screening in communities and schools with the non-invasive device is useful for identifying anaemic people and ensuring early diagnosis.

Microscopes 2023 Import and Export in the Asia Pacific

|

Countries |

Import |

Export |

|

China |

USD 359 million |

USD 487 million |

|

Japan |

USD 209 million |

USD 439 million |

|

Singapore |

USD 79.9 million |

USD 249 million |

|

South Korea |

USD 74.7 million |

- |

|

India |

USD 70.7 million |

- |

Source: OEC, July 2025

Europe Market Insights

Europe in the blood screening market is expected to account for a considerable share of 28.3% during the projected timeline. The market’s growth in the region is subject to harmonization in administration, cross-border partnerships, and a surge in the aging population. According to a report published by the Joint United Kingdom (UK) Blood Transfusion and Tissue Transplantation Services Professional Advisory Committee in March 2024, the Commission Directive 2002/98/EC of the Europe-based Parliament has set standards for safety and quality processing, testing, collection, distribution, and storage of blood components and human blood by amending the Directive 2001/83/EC, thus suitable for market’s upliftment.

The market in Germany is steadily growing, driven by the integration of automation, increased medical and healthcare spending, and a focus on allogeneic transplant. As stated in an article published by eBioMedicine in December 2024, there is a presence of 8% to 10% of intracranial lesion cases, requiring blood-based brain biomarkers. In addition, a clinical study was conducted in 16 emergency departments, wherein a 10 ml blood sample was collected, and the testing was performed utilizing VIDAS 3 in automatic pipetting mode. The analytical measuring interval (AMI) of the VIDAS TBI assay ranged between 10.0 pg/ml and 320.0 pg/ml, thus denoting the importance of blood tests before conducting any procedures.

The blood screening sector in the UK is also gaining increased traction due to genomic screening, public health prioritization, and post-Brexit self-sufficiency. According to the April 2025 NLM article, a workforce-based survey analysis was conducted on 2,814 individuals, of which 31.3% of responders have been delivering genomic services. Besides, 75.9% and 85.7% stated the demand for genomics training and education. In addition, the survey was conducted in the country, comprising 10% oncologists, demanding genomic medication integration in clinical practice, thereby suitable for enhancing the market’s exposure in the country.