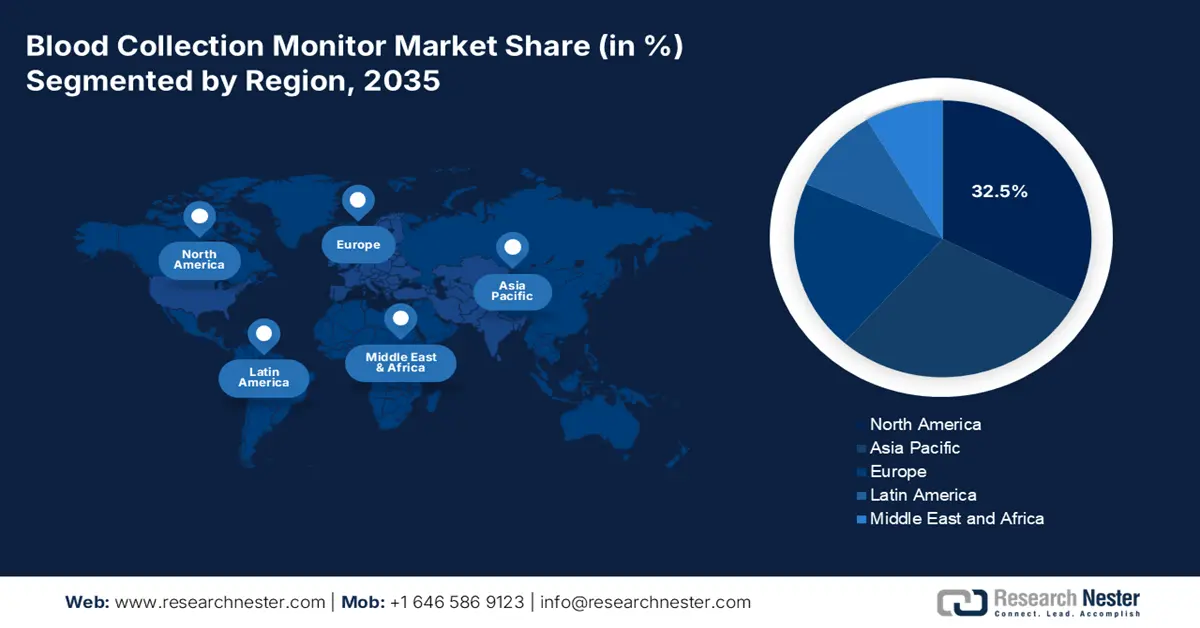

Blood Collection Monitor Market - Regional Analysis

North America Market Insights

North America is estimated to acquire the highest share of 32.5% in the global blood collection monitor market during the analyzed tenure. The region’s proprietorship in this sector is attributed to the rapid integration of smart technologies in the healthcare infrastructure, which is further complemented by the strong presence of leading MedTech pioneers. Besides, strong federal investment from entities such as the CDC, CMS, and Health Canada empowers the cohorts of patients served by an adequate blood supply. Moreover, the high surgical volumes in developed countries further foster a substantial consumer base for the merchandise in North America.

According to a 2022 report from the ADRP Public Awareness Committee, more than 204.9 million individuals living across the U.S. were eligible to donate blood, where at least one transfusion is performed every 2 seconds. Besides, each RBC transfusion recipient in the country required an average of 2.6 units, which underscores the robust demand for blood donations nationwide. These figures display the presence of a lucrative landscape in the U.S. for conducting profitable business in the market.

Policy harmonization and blood safety infrastructure deconsolidation are the two major growth factors in the Canada market. Several national organizations in the country are proactively participating in the cohort of maintaining optimum blood safety and availability. In this regard, the Transfusion Error Surveillance System (TESS) was formed, which was monitoring 4 provinces and territories and 16% of blood transfusion activities in Canada till 2022. Such entities are heavily investing in reinforcements of advanced BCM systems in maximum clinical settings.

APAC Market Insights

Asia Pacific is poised to register the highest pace of growth in the global blood collection monitor market by the end of 2035. The growth is propelled by growing elderly demographics, increasing burden of chronic disease requiring repeat blood diagnostics, and rejuvenation of healthcare infrastructure. The region is led by China, which is the greatest both in terms of volume and expenditure on account of an enlarging healthcare industry. It is further followed by India and South Korea, who augments considerable opportunities for market expansion, with rising populations of elderly individuals and chronic diseases. Malaysia is much smaller but is experiencing rapid growth in line with regional trends.

China stands out as the epicenter of both production and consumer base for the APAC blood collection monitor market. The rising demand for safe and efficient donation and preservation practices for hematological components is the major propeller of this sector. The country's governing bodies are also promoting voluntary blood donation, which accelerates the adoption of advanced BCM technologies. To support this cohort, in 2025, the National Health Commission (NHC) partnered with China Railway Group to display promotional videos and posters on 260,000 screens across more than 3,000 railway stations and over 4,200 high-speed trains nationwide.

The enlarging network of urban hospitals and blood banks is fueling the India blood collection monitor industry. Besides, the shifting preference toward fully automatic and semi-automatic BCM under the country’s ambitious goal of achieving complete healthcare modernization is improving the sector’s compliance with regulatory standards. Additionally, the push from both public and private organizations for rising awareness around donor safety is further propelling the market forward. For instance, in November 2023, Abbott extended its worldwide donor recruitment campaign, BETHE1, by launching a youth awareness campaign in India.

Dynamics of Blood Supply, Benefiting the Market

|

Country |

Demand/Shortage/Trend of Blood Supply |

|

China |

Need 57.5 million units by 2036; potential shortage of 21.2 million units |

|

South Korea |

Need 5.1 million units by 2045; supply declines to 1.4 million units by 2050 |

|

Australia |

54.3% of the population is non-donors; increased risk of variant Creutzfeldt‐Jakob disease (vCJD) transmission |

Source: NLM and JKMS

Europe Market Insights

The Europe blood collection monitor market is estimated to garner a notable revenue over the timeline between 2026 and 2035. The region’s consistent performance in this sector is primarily accomplished through robust healthcare digitization, tightening of blood safety regulations, and centralized healthcare procurement programs. The adoption of automated BCMs in national healthcare systems is also escalated by the strong emphasis of domestic MedTech pioneers on innovation. Particularly, in Germany, France, and the UK, public-private partnership initiatives, accompanied by promotional activities for the rapid commercialization of new generation systems, are fueling this landscape.

The remarkable increase in demand in the UK market is largely attributable to the NHS digitization and regulatory pressure to address transfusion-related errors. Specifically, the growing risk factors of transfusion-borne infectious diseases are forcing the national authorities to take an active part in preserving the quality and safety of collected haematological components. This can be exemplified by the launch of a new warning system by the NHS Blood and Transplant in November 2024 to detect newly emerging viruses potentially reaching the UK due to climate change.

Germany is the largest landscape of the Europe blood collection monitor market, which is backed by its well-established industry of medical device automation. The nationwide urge to ensure optimal management is further accompanied by the growing public focus on streamlining workflows to align with the National Health Digitalization Strategy. Additionally, ongoing regulatory reforms via the German Institute of Medical Documentation and Information (DIMDI) help the sector facilitate new technology across the country's centralized healthcare system while contributing to the market competition.

Country-wise Availability of Cardiac Surgery Centers

|

Country |

Number of Hospitals with cardiac surgery (per million people) |

Year |

|

Austria |

0.77 |

2022 |

|

Belgium |

2.4 |

2022 |

|

Denmark |

0.6 |

2023 |

|

France |

1.0 |

2022 |

|

Greece |

2.9 |

2022 |

|

Italy |

1.6 |

2022 |

|

Netherlands |

0.8 |

2023 |

Source: ESC