Blood Collection Monitor Market Outlook:

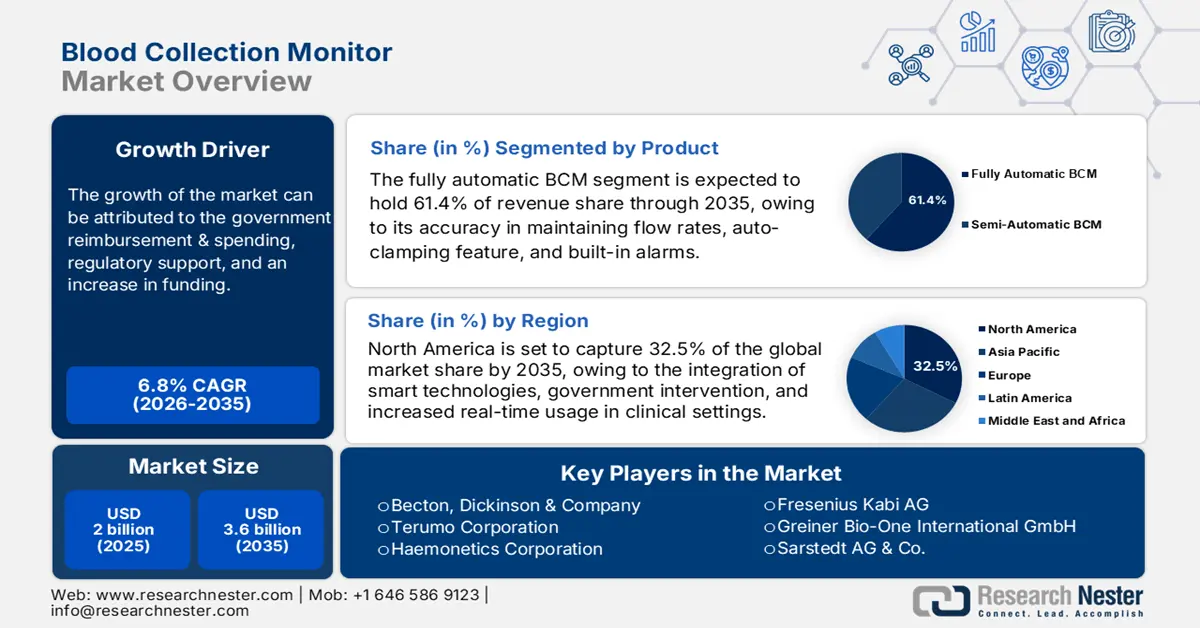

Blood Collection Monitor Market size was over USD 2 billion in 2025 and is estimated to reach USD 3.6 billion by the end of 2035, expanding at a CAGR of 6.8% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of blood collection monitor is estimated at USD 2.1 billion.

The amplifying burden of chronic ailments, such as cancer, kidney disorders, and cardiovascular diseases (CVDs), that require intensive surgeries for treatment, leads to a higher demand for blood transfusions. Testifying to the same, the Global Surgery 2030 report predicted approximately 30% of the worldwide disease burden to require surgical interventions. Thus, the dedicated healthcare authorities are now targeting a minimum of 5,000 procedures per 100,000 population, done in an operating room, to meet the growing needs during the same time period. Besides, more than 118.4 million blood donations were being collected every year worldwide till 2022, as per the American’s Blood Centers. This, coupled with the surge in blood safety and availability, further fuels the market.

The current dynamics of payers' pricing in the market are shaped by increasing cost-consciousness among healthcare providers. The amplifying pressure to demonstrate value-based outcomes from payers, including hospitals, government health systems, and private insurers, is demanding cost-effective solutions that offer both clinical efficiency and regulatory compliance. As a result, manufacturers are being pushed to offer competitive pricing models, such as bundled packages or value-based contracts, especially in large-scale tenders. Additionally, purchasing decisions are increasingly influenced by the total cost of ownership (TCO), which includes maintenance, durability, and integration capabilities.

Key Blood Collection Monitor Market Insights Summary:

Regional Highlights:

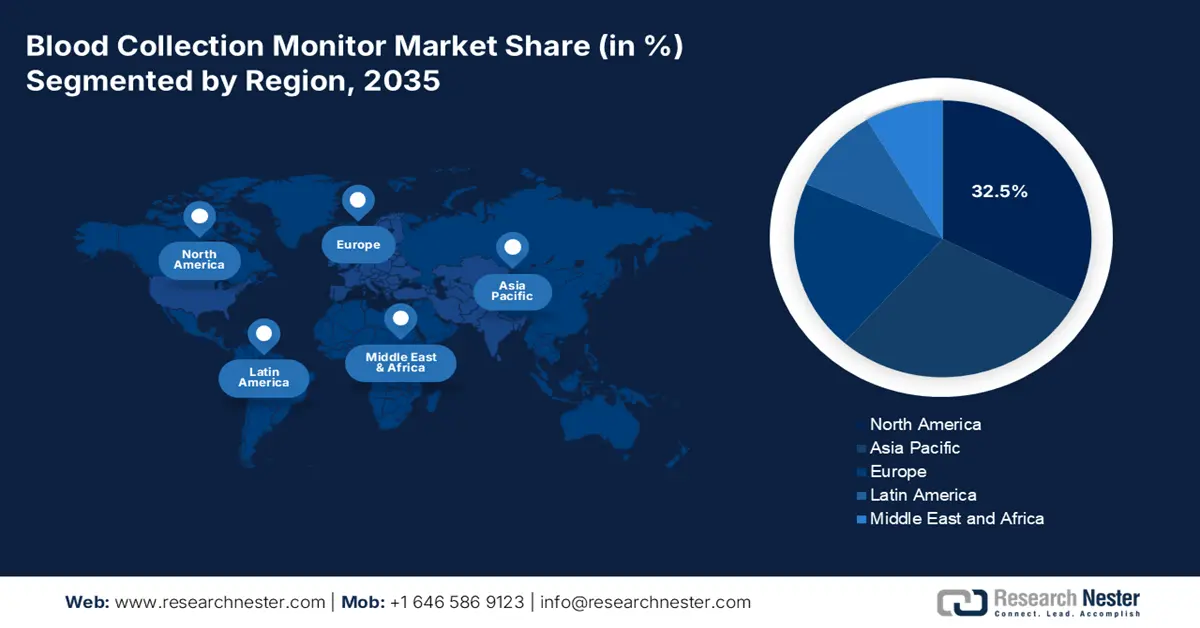

- North America is projected to secure a 32.5% share in the Blood Collection Monitor Market by 2035, owing to rapid smart-technology integration in healthcare infrastructure.

- Asia Pacific is anticipated to grow at the fastest pace through 2026–2035, supported by expanding elderly demographics and rising chronic disease burden requiring repeat blood diagnostics.

Segment Insights:

- The fully automatic BCM segment in the Blood Collection Monitor Market is estimated to attain a 61.4% share during 2026–2035, propelled by enhanced flow-rate accuracy and auto-clamping capabilities.

- Hospitals are projected to account for a 42.5% share by 2035, impelled by their higher proportion of global transfusions and strengthened infrastructure investments.

Key Growth Trends:

- Expansion in blood transfusion services

- Technological advancements and automation

Major Challenges:

- Controlled and restrictive pricing standards

Key Players: Fresenius SE & Co. KGaA, Haemonetics Corporation, Terumo BCT, Becton, Dickinson and Company (BD), Greiner Bio-One International GmbH, Macopharma, Grifols, S.A., Lmb Technologie GmbH, SARSTEDT AG & Co. KG, Barkey GmbH & Co. KG, Medicap GmbH, Kawasumi Laboratories, Inc., Nipro Medical Corporation, Delfi Medical Innovations Inc., SMS Technologies Pvt. Ltd., Angiplast Pvt. Ltd., Helmer Scientific, Bioelettronica, Braintree Scientific, Inc., Stago, Tasso, Inc., Fenwal, Inc. (part of Fresenius Kabi).

Global Blood Collection Monitor Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2 billion

- 2026 Market Size: USD 2.1 billion

- Projected Market Size: USD 3.6 billion by 2035

- Growth Forecasts: 6.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (32.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Mexico, Malaysia

Last updated on : 24 September, 2025

Blood Collection Monitor Market - Growth Drivers and Challenges

Growth Drivers

- Expansion in blood transfusion services: Developing countries are increasingly investing in infrastructural development to meet rising healthcare needs, where global health initiatives are pushing for voluntary and improved transfusion services. As a result of the growing demand to enhance the efficiency and consistency of these processes, the blood collection monitor sector is being upgraded to offer escalated quality and quantity. Moreover, the emergence of autotransfusion systems and the blood collection tubes industry is propelling growth in this sector.

- Technological advancements and automation: The blood collection monitor industry is evolving with ongoing innovations in technology and the design of products. Newer devices now offer advanced features, such as real-time data tracking, donor monitoring, and automatic mixing, which results in higher utilization of this equipment. Particularly, the rapid integration of Bluetooth, AI, and IoT allows seamless connectivity to hospital management systems. For instance, in March 2025, Vitestro unveiled its autonomous blood drawing device, Aletta, which is designed to deliver unparalleled precision and consistency with autonomous robotic functions.

- Tightening standards for blood safety: In addition to awareness campaigns and donor education initiatives, the blood collection monitor market is benefiting from stringent regulatory standards for safety and infectious disease transmission control. These include guidelines on donor safety, blood component quality, and collection accuracy necessitate the use of calibrated, automated blood collection monitors (BCM). Evidencing the push, in August 2025, the Ministry of Fisheries, Animal Husbandry & Dairying in India issued new standards of operating procedures (SOPs) for animal blood transfusion and blood banks, fostering new opportunities for the merchandise.

Global Demographic/Supply Overview in the Blood Donation Monitor Market

Global Blood Donation and Collection Data (2025)

|

Income Group |

Median Annual Donations per Centre |

Median Donations per 1000 People |

|

Low-income Countries |

1,300 |

31.5 |

|

Lower-middle-income Countries |

4,400 |

16.4 |

|

Upper-middle-income countries |

9,300 |

6.6 |

|

High-income Countries |

25,700 |

5.0 |

Source: WHO

Trends in the Patient Population/Demand Base of the Blood Donation Monitor Market

Country-wise Average Total Cardiac Surgical Volume (2023)

|

Country |

Surgery Types |

Volume (per 100,000 population per year) |

|

U.S. |

Coronary Artery Bypass Grafting (CABG) and Valve Surgery |

64.5 and 55.2 |

|

South Korea |

Coronary Artery Bypass Grafting (CABG) |

7.7 |

|

New Zealand |

Valve Surgery |

12.7 |

|

Singapore |

Congenital Heart Surgery |

1.2 |

|

UK |

Congenital Heart Surgery |

18.2 |

Source: NLM

Challenges

- Controlled and restrictive pricing standards: Public insurers frequently impose limited benchmarks for product pricing in the healthcare industry, specifically on medical devices, to combat affordability issues. This may limit the chances of generating greater revenue from the market due to such restricted dynamics for premium-priced tool manufacturers. However, to address the problem, suppliers are now partnering with national health agencies to establish better alignment with the elements of price ceilings that create new avenues for value-based reimbursement models.

Blood Collection Monitor Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.8% |

|

Base Year Market Size (2025) |

USD 2 billion |

|

Forecast Year Market Size (2035) |

USD 3.6 billion |

|

Regional Scope |

|

Blood Collection Monitor Market Segmentation:

Product Segment Analysis

The fully automatic BCM segment is predicted to capture the largest share at 61.4% in the blood collection monitor market over the assessed period. This subtype of BCM is increasingly becoming an undisputed part of the mainstream practices worldwide due to its accuracy in maintaining flow rates, auto-clamping feature, and built-in alarms. Besides, the increased procurement of automated systems also creates a substantial trend of obtaining efficiency-based benefits, establishing a strong consumer base for this product. This can be established through the study results from 2023, published by the NLM, where automated blood collection delivered an exceptional success rate of 94.3%.

End user Segment Analysis

Hospitals are estimated to dominate the field of application and volume of revenue generation in the blood collection monitor market with a 42.5% share by the end of 2035. The leadership of these facilities is primarily fueled by their significantly higher proportion of performed transfusions and donors. In this regard, the WHO reported that, in 2025, 55% of hospitals performing transfusions around the globe were operating under a system for reporting adverse events. In addition, ongoing investment in hospital infrastructure in middle-income countries is likely to spur BCM integration due to quality compliance and electronic health record integration capabilities.

Application Segment Analysis

Whole blood collection is expected to remain the leading sub-segment in the blood collection monitor market throughout the discussed timeline. This is largely attributed to its wide usage in a majority of medical systems across the globe as the primary source of transfusion components, such as red cells, plasma, and platelets. Particularly in emergency care, trauma cases, and surgeries, this method has become a necessity. Whole blood collection also forms the backbone of donation drives and mobile blood camps, particularly in low- and middle-income countries where apheresis infrastructure is limited, fueling continued dominance for the segment in this sector.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegment |

|

Product |

|

|

Mobility |

|

|

Technology |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Blood Collection Monitor Market - Regional Analysis

North America Market Insights

North America is estimated to acquire the highest share of 32.5% in the global blood collection monitor market during the analyzed tenure. The region’s proprietorship in this sector is attributed to the rapid integration of smart technologies in the healthcare infrastructure, which is further complemented by the strong presence of leading MedTech pioneers. Besides, strong federal investment from entities such as the CDC, CMS, and Health Canada empowers the cohorts of patients served by an adequate blood supply. Moreover, the high surgical volumes in developed countries further foster a substantial consumer base for the merchandise in North America.

According to a 2022 report from the ADRP Public Awareness Committee, more than 204.9 million individuals living across the U.S. were eligible to donate blood, where at least one transfusion is performed every 2 seconds. Besides, each RBC transfusion recipient in the country required an average of 2.6 units, which underscores the robust demand for blood donations nationwide. These figures display the presence of a lucrative landscape in the U.S. for conducting profitable business in the market.

Policy harmonization and blood safety infrastructure deconsolidation are the two major growth factors in the Canada market. Several national organizations in the country are proactively participating in the cohort of maintaining optimum blood safety and availability. In this regard, the Transfusion Error Surveillance System (TESS) was formed, which was monitoring 4 provinces and territories and 16% of blood transfusion activities in Canada till 2022. Such entities are heavily investing in reinforcements of advanced BCM systems in maximum clinical settings.

APAC Market Insights

Asia Pacific is poised to register the highest pace of growth in the global blood collection monitor market by the end of 2035. The growth is propelled by growing elderly demographics, increasing burden of chronic disease requiring repeat blood diagnostics, and rejuvenation of healthcare infrastructure. The region is led by China, which is the greatest both in terms of volume and expenditure on account of an enlarging healthcare industry. It is further followed by India and South Korea, who augments considerable opportunities for market expansion, with rising populations of elderly individuals and chronic diseases. Malaysia is much smaller but is experiencing rapid growth in line with regional trends.

China stands out as the epicenter of both production and consumer base for the APAC blood collection monitor market. The rising demand for safe and efficient donation and preservation practices for hematological components is the major propeller of this sector. The country's governing bodies are also promoting voluntary blood donation, which accelerates the adoption of advanced BCM technologies. To support this cohort, in 2025, the National Health Commission (NHC) partnered with China Railway Group to display promotional videos and posters on 260,000 screens across more than 3,000 railway stations and over 4,200 high-speed trains nationwide.

The enlarging network of urban hospitals and blood banks is fueling the India blood collection monitor industry. Besides, the shifting preference toward fully automatic and semi-automatic BCM under the country’s ambitious goal of achieving complete healthcare modernization is improving the sector’s compliance with regulatory standards. Additionally, the push from both public and private organizations for rising awareness around donor safety is further propelling the market forward. For instance, in November 2023, Abbott extended its worldwide donor recruitment campaign, BETHE1, by launching a youth awareness campaign in India.

Dynamics of Blood Supply, Benefiting the Market

|

Country |

Demand/Shortage/Trend of Blood Supply |

|

China |

Need 57.5 million units by 2036; potential shortage of 21.2 million units |

|

South Korea |

Need 5.1 million units by 2045; supply declines to 1.4 million units by 2050 |

|

Australia |

54.3% of the population is non-donors; increased risk of variant Creutzfeldt‐Jakob disease (vCJD) transmission |

Source: NLM and JKMS

Europe Market Insights

The Europe blood collection monitor market is estimated to garner a notable revenue over the timeline between 2026 and 2035. The region’s consistent performance in this sector is primarily accomplished through robust healthcare digitization, tightening of blood safety regulations, and centralized healthcare procurement programs. The adoption of automated BCMs in national healthcare systems is also escalated by the strong emphasis of domestic MedTech pioneers on innovation. Particularly, in Germany, France, and the UK, public-private partnership initiatives, accompanied by promotional activities for the rapid commercialization of new generation systems, are fueling this landscape.

The remarkable increase in demand in the UK market is largely attributable to the NHS digitization and regulatory pressure to address transfusion-related errors. Specifically, the growing risk factors of transfusion-borne infectious diseases are forcing the national authorities to take an active part in preserving the quality and safety of collected haematological components. This can be exemplified by the launch of a new warning system by the NHS Blood and Transplant in November 2024 to detect newly emerging viruses potentially reaching the UK due to climate change.

Germany is the largest landscape of the Europe blood collection monitor market, which is backed by its well-established industry of medical device automation. The nationwide urge to ensure optimal management is further accompanied by the growing public focus on streamlining workflows to align with the National Health Digitalization Strategy. Additionally, ongoing regulatory reforms via the German Institute of Medical Documentation and Information (DIMDI) help the sector facilitate new technology across the country's centralized healthcare system while contributing to the market competition.

Country-wise Availability of Cardiac Surgery Centers

|

Country |

Number of Hospitals with cardiac surgery (per million people) |

Year |

|

Austria |

0.77 |

2022 |

|

Belgium |

2.4 |

2022 |

|

Denmark |

0.6 |

2023 |

|

France |

1.0 |

2022 |

|

Greece |

2.9 |

2022 |

|

Italy |

1.6 |

2022 |

|

Netherlands |

0.8 |

2023 |

Source: ESC

Key Blood Collection Monitor Market Players:

- Fresenius SE & Co. KGaA

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Haemonetics Corporation

- Terumo BCT

- Becton, Dickinson and Company (BD)

- Greiner Bio-One International GmbH

- Macopharma

- Grifols, S.A.

- Lmb Technologie GmbH

- SARSTEDT AG & Co. KG

- Barkey GmbH & Co. KG

- Medicap GmbH

- Kawasumi Laboratories, Inc.

- Nipro Medical Corporation

- Delfi Medical Innovations Inc.

- SMS Technologies Pvt. Ltd.

- Angiplast Pvt. Ltd.

- Helmer Scientific

- Bioelettronica

- Braintree Scientific, Inc.

- Stago

- Tasso, Inc.

- Fenwal, Inc. (part of Fresenius Kabi)

The market is marked by significant global competition. There is an emerging focus on automation, patient safety, and decentralized diagnostics. Leading players in the market are established and use sophisticated systems and processes. Players in the APAC region are developing somewhat less expensive monitors by creating portable blood collection monitors for emerging markets. Companies, including developed and emerging market companies, are innovating, developing new regional penetration strategies, and exploring pricing and strategy to define a premium price.

Such key players are:

Recent Developments

- In February 2025, Tasso launched its next-generation technology for a dried blood spot (DBS) sample collection system, which combines its Tile-T20 dried whole blood cartridge and Tasso Mini device. It enables the precise, convenient collection of DBS samples for clinical trials and sports anti-doping testing.

- In November 2023, Becton, Dickinson and Company introduced a new needle-free blood draw technology, PIVO Pro, to establish its vision of a One-Stick Hospital Stay. The device is compatible with integrated catheters and features the Nexiva Closed IV Catheter System with NearPort IV Access.

- Report ID: 3992

- Published Date: Sep 24, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Blood Collection Monitor Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.