Blood Clot Retrieval Devices Market Outlook:

Blood Clot Retrieval Devices Market size was valued at USD 1.87 billion in 2026 and is set to exceed USD 7.12 billion by 2035, expanding at over 14.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of blood clot retrieval devices is estimated at USD 2.11 billion.

The blood clot retrieval devices market is expanding at a very rapid pace owing to an increase in ischemic strokes globally, fueled primarily by population aging and the rising burden of cardiovascular disease. For instance, in October 2024, the World Health Organization revealed that people of 60 years of age and older outnumbered children under the age of 5 in 2020. Moreover, the percentage of people over 60 in the world will almost double, from 12% to 22%, between 2015 and 2050. In addition to this, according to the 2022 World Stroke Organization (WSO) fact report, there are around 7.6 million ischemic strokes every year, and also around 62% of all new strokes.

Enhanced awareness of the importance of early intervention in stroke management and diagnostic skill proficiency lead to earlier diagnosis and increased usage of blood clot retrieval devices. Furthermore, the trend towards minimally invasive devices is also robust because they reduce patient trauma and recovery time, thereby driving demand. For instance, in December 2024, Brandon Hospital introduced a blood clot removal method, thrombectomy system, approved by the FDA. The Cardiac Catheterization laboratory is the first facility to use this as it provides more accuracy and flexibility in the venous system.

Ongoing R&D activity on device design optimization and broadening applications to other vascular diseases such as pulmonary embolism and deep vein thrombosis are likely to sustain the path of the market growth. For instance, in March 2021, Inari Medical became a silver sponsor of the National Blood Clot Alliance's (NBCA) Corporate Roundtable, a new corporate partnership that supported the clotting disorders community and NBCA's mission. It worked to establish solid and long-lasting relationships with businesses that offer goods and services that aid in blood clot prevention, diagnosis, and treatment.

Key Blood Clot Retrieval Devices Market Insights Summary:

Regional Highlights:

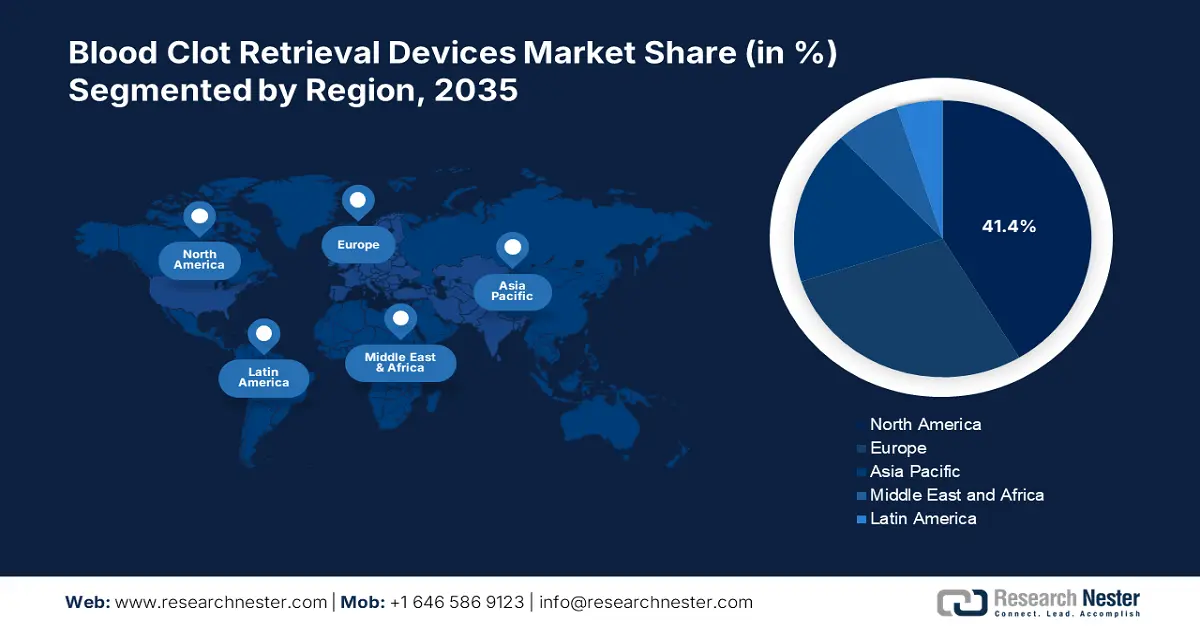

- North America commands the Blood Clot Retrieval Devices Market with a 41.4% share, supported by advanced healthcare infrastructure and widespread adoption of stroke treatment technology, fostering growth through 2026–2035.

- The blood clot retrieval devices market in Asia Pacific is a major growth hub by 2035, driven by the high stroke incidence and increasing access to thrombectomy procedures.

Segment Insights:

- The Ischemic Stroke segment is projected to hold 54.2% market share by 2035, driven by innovations like the CEREGLIDETM 92 Catheter System.

- Mechanical embolus removal devices segment are expected to gain a lucrative share by 2035, driven by technological advancements improving thrombectomy procedure efficiency.

Key Growth Trends:

- Enhanced diagnostics capabilities

- Improved reperfusion rates

Major Challenges:

- Risk of complications

- Logistical challenges

- Key Players: Argon Medical Devices, Inc., Cook Medical Inc., Control Medical Technology, Acandis GmbH, Phenox GmbH, and more.

Global Blood Clot Retrieval Devices Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.87 billion

- 2026 Market Size: USD 2.11 billion

- Projected Market Size: USD 7.12 billion by 2035

- Growth Forecasts: 14.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (41.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 12 August, 2025

Blood Clot Retrieval Devices Market Growth Drivers and Challenges:

Growth Drivers

- Enhanced diagnostics capabilities: The effective diagnostic performance is the pivotal growth driver in the blood clot retrieval devices market, spurred by advancements in neuroimaging technology. For instance, in February 2024, MRI software solutions provider Synthetic MR and Royal Philips announced the launch of Smart Quant Neuro 3D. It is a significant advancement in objective decision support for diagnosis and therapy assessment of brain disorders such as dementia, multiple sclerosis (MS), and traumatic brain injury (TBI). This increased effectiveness through visualization and successful clinical outcome, leading to more utilization of clot retrieval devices.

- Improved reperfusion rates: The crucial growth catalyst in the blood clot retrieval devices market ensures enhanced reperfusion rates in stroke treatments. With advancing medical techniques, the devices are achieving efficacy and improved capabilities in removing clots faster and efficiently, thus, propelling market growth. For instance, in June 2024, Penumbra, Inc. announced that its RED Reperfusion Catheters secured CE Mark (Conformité Européenne) and is now commercially available in Europe. It is a fully integrated mechanical aspiration thrombectomy system designed to restore blood flow in acute ischemic stroke (AIS) patients.

Challenges

- Risk of complications: The most potential risk in the blood clot retrieval devices market, is grounded largely on the inherent susceptibility of the neurovasculature to thrombectomy therapy. Moreover, the risk of manipulation of the retrieval device and catheter into small cerebral vessels results in the risk of vessel laceration or perforation. These intrinsic hazards require appropriate patient selection, prudent technique on the procedure, and constant technological evolution. Prejudice towards reduction of vessel injury and maximization of device utilization represent the main obstacle to widespread market application.

- Logistical challenges: The prime obstacle to the mass use of blood clot retrieval devices market is logistical hurdle, due to the time-sensitive nature of stroke therapy. The most critical part is timely patient transport to comprehensive stroke centers, especially in rural areas where there is no transport facility and a long distance to the comprehensive stroke centers, significantly reduces the window of opportunity for treatment. Poor infrastructure, including the deficiency of proper specialized ambulances, lack of 24/7 stroke units, and lack of proper trained personnel, strongly discourages timely patient access to these life-saving procedures, ultimately restraining the growth of the market.

Blood Clot Retrieval Devices Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

14.3% |

|

Base Year Market Size (2025) |

USD 1.87 billion |

|

Forecast Year Market Size (2035) |

USD 7.12 billion |

|

Regional Scope |

|

Blood Clot Retrieval Devices Market Segmentation:

Stroke (Ischemic Stroke, Hemorrhagic Stroke, Pulmonary Embolism, Deep Vein Thrombosis, Transient Ischemic Attack)

Ischemic stroke segment is predicted to capture around 54.2% blood clot retrieval devices market share by the end of 2036, countered by the ongoing specter of complications risks, mainly focused on the inherent friability of the cerebral vasculature in thrombectomy. The fine line between restoring blood supply and preventing vessel rupture or injury requires delicate technique and sophisticated device design. For instance, in February 2025, the CEREGLIDETM 92 Catheter System, a next-generation 092 catheter with the INNERGLIDETM 9 delivery aid, was introduced by Johnson & Johnson MedTech. When inserting devices for the revascularization of patients with acute ischemic stroke, the CEREGLIDETM 92 catheter system reduces flow in the M1 and enables doctors to have large distal access.

Device (Mechanical Embolus Removal Devices, Penumbra Blood Clot Retrieval Devices, Stent Retrievers, Aspiration Device, and Ultrasound Assisted Devices)

The mechanical embolus removal devices segment in the blood clot retrieval devices market is projected to attain a lucrative share during the stipulated timeframe due to rapid technological developments in performing thrombectomy procedures more easily and efficiently. For instance, in October 2022, Control Medical Technology LLC and Shanghai Easy-Flow Medical Technology Co. Ltd. announced the collaboration to market the Control Mechanical Thrombectomy platform in China. The purpose was to removeblood clots in the peripheral, coronary, and neurovasculature from thousands of procedures. In addition, the rate of product adoption will increase as thrombectomy devices continue to advance to provide maximum precision in minimally invasive procedures.

Our in-depth analysis of the global blood clot retrieval devices market includes the following segments:

|

Application |

|

|

End user |

|

|

Device |

|

|

Stroke |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Blood Clot Retrieval Devices Market Regional Analysis:

North America Market Statistics

By 2036, North America blood clot retrieval devices market is set to account for around 41.4% revenue share, due to its highly sophisticated healthcare infrastructure and the high acceptance level of novel medical technology. The most pertinent factor of growth is the high frequency of already present stroke centers and networked care systems. For instance, in February 2022, according to research presented at the American Stroke Association International Stroke Conference 2022, 91% of Americans can get life-saving care by ambulance in less than an hour from an acute stroke-ready hospital.

The U.S. blood clot retrieval devices market is growing exponentially owing to its well-developed health infrastructure, surging healthcare expenditures, and strong focus on technology development. For instance, in July 2024, as per the American Medical Association, in 2022, the U.S. health spending climbed 4.1% accounting for USD 4.5 trillion, or USD 13,493 per person. In addition, the country spent USD 4,464.4 billion on healthcare, which accounted for 17.3% of its GDP. This dynamic market enables ongoing growth and aggressive uptake of new thrombectomy technologies, making the U.S. a worldwide leader in this market.

The Canada blood clot retrieval devices market is likely to witness substantial growth during the forecast period, supported by the well-coordinated and publicly-funded healthcare system that guarantees universal access to sophisticated medical treatment. For instance, in July 2024, it was unveiled that, over 10 years, the Canada government has spent nearly USD 200 billion to enhance health care services for its citizens. Furthermore, to enhance nurses' working conditions, the local government released the Nursing Retention Toolkit in March 2024 with financial assistance of USD 47 million in federal funding.

Asia Pacific Market Analysis

The Asia Pacific blood clot retrieval devices market is predominantly driven by growth in stroke incidence. For instance, in April 2024, the National Library of Medicine revealed that in Asia, the prevalence of stroke is high for an estimated 4.7 billion people, which will result in the occurrence of 9.5 and 10.6 million strokes each year. This growth increases access to advanced stroke care, such as thrombectomy procedures, and hence, drives demand for clot removal devices, making the region a major growth hub.

The blood clot retrieval devices market in India is witnessing lucrative growth opportunities owing to the continued evolution of specialist stroke care units in urban agglomerations. For instance, in the year 2023, as per the data from the local government, the Pradhan Mantri Ayushman Bharat Health Infrastructure Mission (PM-ABHIM) consists of 12 Central Institutions, State Government Medical Colleges/DH, and Critical Care hospital blocks in every district with a population of at least 5 lakhs (USD 5,723.8). It covers 50, 75, and 100-bed Critical Care Units or Cardiac and Stroke Care Units (CSCU) in 602 districts throughout all States and Union Territories.

The blood clot retrieval devices market in China is experiencing fast-paced growth largely driven by the fostering partnerships between the government organizations and companies to improve healthcare access and build specialized stroke centers nationwide. For instance, in November 2021, an agreement was signed by UCSF Health and Chinese Hospital to work together on stroke and neurology services that cater to the needs of the Asian and China communities. This partnership was intended to create a primary stroke center at Chinese Hospital and enhance neurology and stroke care.

Key Blood Clot Retrieval Devices Market Players:

- Stryker Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Medtronic plc

- Johnson & Johnson

- Boston Scientific Corporation

- Penumbra, Inc.

- Edwards Lifesciences Corporation

- Argon Medical Devices, Inc.

- Cook Medical Inc.

- Control Medical Technology

- Acandis GmbH

- Phenox GmbH

- MicroVention, Inc.

- Inari Medical, Inc.

The competitive landscape in the blood clot retrieval devices market is controlled by a few large players due to their strong experience and extensive product portfolios. For instance, in June 2023, Sensome and Asahi Intecc announced about working together to develop the next generation Clotild Smart Guidewire. Asahi Intecc was responsible for manufacturing this innovative device used to treat acute ischemic stroke. Moreover, the established supply chains and strong brand recall assist these companies in taking a dominant position in the market, developing, and setting the competitive landscape.

Here's the list of some key players in blood clot retrieval devices market:

Recent Developments

- In February 2025, Vena Medical received breakthrough device designation for its microangioscope from the US FDA. It is a historic leap forward in the treatment of stroke and neurovascular disease.

- In April 2024, Penumbra announced the FDA's approval and the introduction of its next-generation computer-assisted vacuum thrombectomy system, (Lightning Flash 2.0). It is used to treat pulmonary emboli and remove venous thrombus.

- Report ID: 7294

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Blood Clot Retrieval Devices Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.