Blister Packaging Equipment Market Outlook:

Blister Packaging Equipment Market size was over USD 1.7 Billion in 2025 and is projected to reach USD 3.7 Billion by 2035, growing at around 8.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of blister packaging equipment is evaluated at USD 1.82 Billion.

The growth of the market can be attributed to the higher utilization of blister packaging in pharmaceuticals to pack medicines backed by the escalated consumption and distribution of medicines across the globe. Medicines comprises several chemical and other components that requires specialized packaging to preserve them for a prolonged time. If these medicines aren’t packed properly, the ability of them to treat diseases and disorders can be affected negatively. Blister packaging is considered to one of the most suitable types of packaging for medicines. As of 2021, it was estimated that approximately USD 1.5 trillion was spent on medicine across the globe.

Global blister packaging equipment market trends such as, the rising adoption of blister packaging and a noteworthy increase in disposable income are projected to influence the growth of the market positively over the forecast period. A report published by the World Bank stated that the adjusted net national income dropped to approximately USD 8,784 per capita in 2020. Additionally, higher demand for packed toys and others is further projected to hike the market growth over the forecast period. For instance, in 2021, toy sales across the globe were estimated to hit about USD 100 billion. Therefore, all these factors are expected to propel the growth of the market during the forecast period.

Key Blister Packaging Equipment Market Insights Summary:

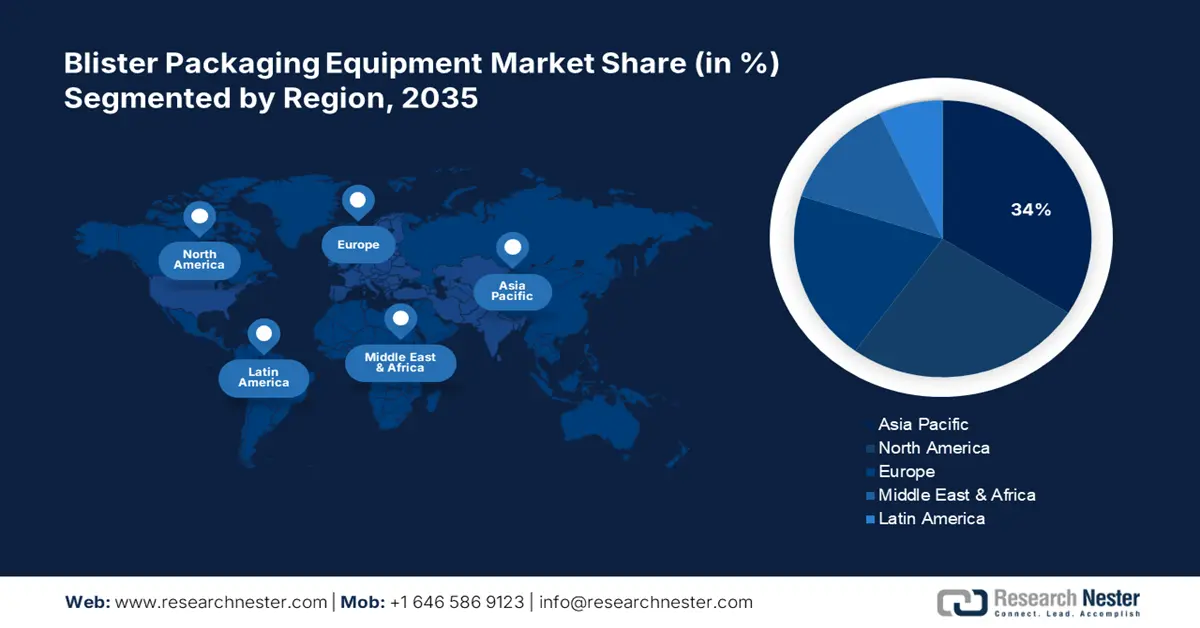

Regional Highlights:

- The Asia Pacific blister packaging equipment market is predicted to capture 34% share by 2035, driven by the boom in the regional population propelling demand for packaged food.

- The North America market will achieve substantial growth from 2026 to 2035, driven by rising demand for packaged and ready-to-eat meals and adoption of blister packs.

Segment Insights:

- The food & beverage segment in the blister packaging equipment market is expected to secure the largest share by 2035, driven by the increasing prevalence of packaged and ready-to-eat meals.

- The plastic segment in the blister packaging equipment market is expected to hold a significant share by 2035, driven by the widespread use of PVC to create robust and appealing blister packs.

Key Growth Trends:

- Growing Manufacturing Activities of Packed Pharmaceutical Goods

- Rising Inclination Toward Packed Food

Major Challenges:

- Escalating Concern for Material Waste of Blister Packaging

- Presence of Alternatives in the Market

Key Players: Tauriga Sciences, Inc., Tjoapack LLC, Amcor Limited, Display Pack Inc., The Dow Chemical Company, Tekni-Plex, Inc., WestRock Company, Honeywell International Inc., Sonoco Products Company, Marchesini Group S.p.A.

Global Blister Packaging Equipment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.7 Billion

- 2026 Market Size: USD 1.82 Billion

- Projected Market Size: USD 3.7 Billion by 2035

- Growth Forecasts: 8.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (34% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: Germany, United States, China, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Indonesia

Last updated on : 10 September, 2025

Blister Packaging Equipment Market Growth Drivers and Challenges:

Growth Drivers

- Growing Manufacturing Activities of Packed Pharmaceutical Goods - Based on the report provided by National Health Expenditure (NHE), the average spending on prescription drugs was stated to grow by 4.4% in 2018 around the world. Medicines are mostly sold out in blister packaging since it is the most required method for them to preserve all the health properties. Blister packaging is a process of heating a particular sheet to form a bubble or blister so that it can cover the entire body of the product. In pharmaceuticals, blister packaging is also referred to as unit dose packaging.

- Rising Inclination Toward Packed Food - As of 2021, the gross sales volume of packaged food was projected to reach about 35 thousand metric tons. Blister packaging is heavily used to pack food since it is durable and keeps the freshness of food for an extended time. It also reduces the additional cost of cartons which further decreases the packaging cost.

- Increasing Utilization in Baby Food Packaging - For instance, in 2022, the baby food segment in food industry across the globe was anticipated to generate total revenue of around USD 280 billion. There are countless options are available in the market when it comes to baby food such as, poultry, pureed meat, iron-fortified cereals, beans, and many more.

- Snack Packaging to Boost the Demand for Blister Packaging- In 2022, the revenue generated by the global snack food segment was projected to be about USD 500 billion. Furthermore, in the United States nearly 60% of the people states that they consume cookies every day while have snacks every day. Additionally, more than 2 billion pounds of potato chips are consumed by Americans every year, summing up to nearly 6 pounds per person.

- Spike in the Utilization of Blister Packaging Equipment in Production Line – for instance, a super-fast packaging line, Integra 520 and Integra 720 was launched by Marchesini Group S.p.A. in 2019 to meet the demand for blister packaging.

Challenges

- Escalating Concern for Material Waste of Blister Packaging - For instance, the waste pharmaceutical blister packages (WPBs) generate solid waste comprising aluminum and plastic. Owing to presence of WPBs, the recycling of aluminum becomes very difficult. Furthermore, the plastic layers of blister packaging also make the recycling procedure of blister packaging significantly complex. Hence, this factor is also expected to hamper the market growth over the forecast period.

- Presence of Alternatives in the Market

- Disrupted Supply-Chain on Account of COVID-19

Blister Packaging Equipment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.1% |

|

Base Year Market Size (2025) |

USD 1.7 Billion |

|

Forecast Year Market Size (2035) |

USD 3.7 Billion |

|

Regional Scope |

|

Blister Packaging Equipment Market Segmentation:

End-user Segment Analysis

The global blister packaging equipment market is segmented and analyzed for demand and supply by end-user into food & beverage, healthcare, cosmetics, pharmaceuticals, and others. Out of these segments, the food & beverage segment is estimated to gain the largest market share over the projected time frame. The growth of the segment can be attributed to the increasing prevalence of packaged and ready-to-eat meal. For instance, the volume growth of the ready-to-eat meals is forecasted to hit approximately 85,000 mkg by 2027. Now a day, packaged food is highly in demand owing to the growing economically active population. Additionally, escalating penetration of internet and smartphones also boosting the demand online food delivery where food packaging becomes vital to deliver the best quality food to the consumers. By 2026, there will be nearly 2,500 million users of online food delivery while currently approximately 72% of the global population prefer online food delivery system.

Material Segment Analysis

The global blister packaging equipment market is also segmented and analyzed for demand and supply by material into plastic, aluminum, and paper & paperboard. Amongst these three segments, the plastic segment is expected to garner a significant share. Blister packaging comprises PVC (polyvinyl chloride) plastic packaging. It is the most common packaging blister packaging material. Generally, PVC sheets with thickness of nearly 0.3mm are utilized to make blister packs. PVC sheets are used in blister packaging to make it robust, appealing, and durable which also makes blister packs hard to bend. For instance, the consumption volume of PVC (polyvinyl chloride) was stated to reach approximately 55,000 thousand tons across the globe. Hence, such factors are anticipated to propel the market growth over the forecast period.

Our in-depth analysis of the global market includes the following segments:

|

By Type |

|

|

By Equipment Type |

|

|

By Technology |

|

|

By Material |

|

|

By End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Blister Packaging Equipment Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is expected to account for largest revenue share of 34% by 2035. The market in this region is projected to grow mainly on the back of boom in the regional population that is propelling the demand for packaged food. For instance, in Asia Pacific, the total volume of packaged food production was estimated to reach around 1,000,000 by 2027. Furthermore, growing government initiatives in the region to develop healthcare infrastructure has also spurred the production of medicines.

North American Market Insights

The North American blister packaging equipment market is projected to witness substantial growth till 2035. The growth of the market can be attributed majorly to the rising demand for packaged and ready-to-eat meals and the rising adoption of blister packaging in plastic bottles. For instance, it was observed that around 35% of Americans consumed ready-to-eat meals in 2020. Hence, such factors are estimated to hike the growth of the market in the region over the forecast period. Furthermore, growing prevalence of chronic diseases in the region has boosted the higher consumption of medicines in the region. Therefore, such a higher consumption triggered the escalated production and distribution of the medicine across the region resulting in higher adoption of blister packs. For instance, in 2020, the total number of medicine doses consumes in USA was estimated to reach approximately 5 trillion.

Blister Packaging Equipment Market Players:

- Tauriga Sciences, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Tjoapack LLC

- Amcor Limited

- Display Pack Inc.

- The Dow Chemical Company

- Tekni-Plex, Inc.

- WestRock Company

- Honeywell International Inc.

- Sonoco Products Company

- Marchesini Group S.p.A.

Recent Developments

-

Tauriga Sciences Inc. to announce the completion of the final blister pack design for its product Tauri-gum. Tauri-gum is further available as an in-black flavor and also comes with cannabigerol. Tauriga Sciences Inc. is a diversified life science company. The company completed one of its vital initiatives to meet the significant national retail chains and demand from regional distributors.

-

Amcor Limited to acquire recognition for its AmSky, recyclable blister packaging system by the Association of Plastic Recyclers (APR). AmSky provides a sustainable packaging solution for pharmaceutical and nutraceutical companies. It has the potential to replace PE film recycle stream.

- Report ID: 4488

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Blister Packaging Equipment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.