Bivalirudin and Desmopressin Market Outlook:

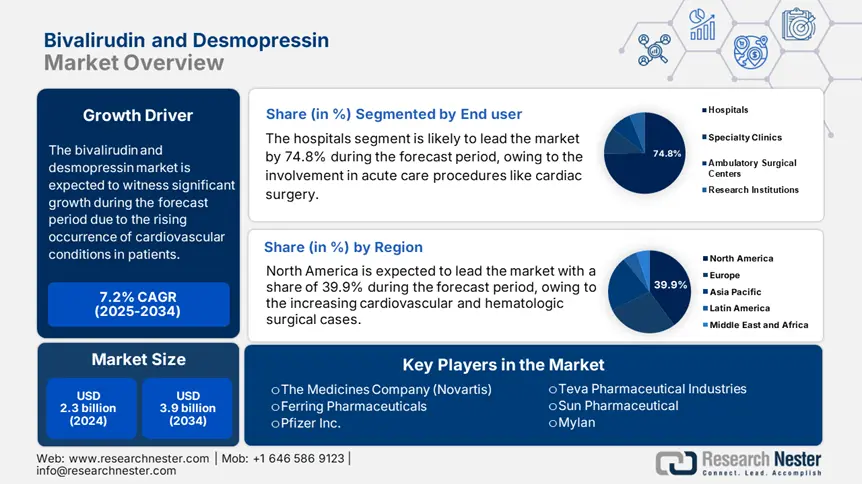

Bivalirudin and Desmopressin Market size was valued at USD 2.3 billion in 2024 and is projected to reach USD 3.9 billion by the end of 2034, rising at a CAGR of 7.2% during the forecast period, i.e., 2025-2034. In 2025, the industry size of bivalirudin and desmopressin is estimated at USD 2.2 billion.

The global patient pool requiring desmopressin and bivalirudin continues to rise and is fueled by the surging occurrence of cardiovascular conditions, chronic kidney disease, and bleeding disorders. In 2023, the U.S. recorded 1.6 million percutaneous coronary interventions (PCIs), and nearly 30.4% used bivalirudin as an anticoagulant based on its lower bleeding risks. Further, hemophilia A affects 209,010 people in 125 countries, according to the World Federation of Hemophilia, stating 75.4% of people necessitate factor-based or desmopressin therapies. On the supply chain side, both drugs have complex steps from active pharmaceutical ingredient production. This API is mainly concentrated in China, India, and the U.S., from formulation to financial packing to markets.

The U.S. imported $2.9 billion of pharmaceutical ingredients such as synthetic peptides and anticoagulants like desmopressin. Bivalirudin is a synthetic peptide depending on raw materials with high purity sourced from peptide synthesis suppliers and stringent sterile fill finish facilities. The producer price index rose to 6.7% for pharmaceutical preparation manufacturing in 2023. Whereas the consumer price index increased to 2.8% for prescription drugs. These values highlight the inflationary pressure on the hospital procurement budget. Further, the research, development, and deployment have experienced an increase in federal investments. These investments focus on drug optimization, reducing administration complexity, and improving emergency response integration.