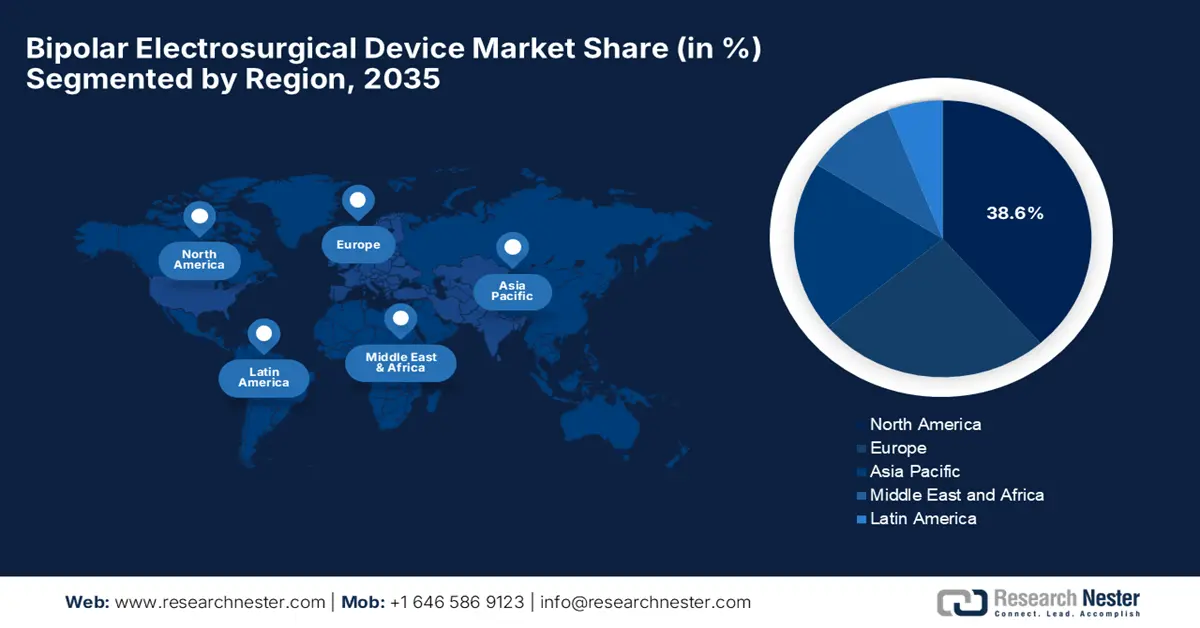

Bipolar Electrosurgical Device Market - Regional Analysis

North America Market Insights

North America is expected to capture the largest revenue share of 38.6% in the global market by the end of 2035. The primary fueling factors for this landscape include heightened demand for minimally invasive surgeries and a robust medical ecosystem. In this regard, Johnson & Johnson Medtech in March 2025 notified its launch of the DUALTO Energy System that can be utilized in surgical procedures. The company highlighted the products' simplified user experience and ease of use application, hence enabling a profitable business atmosphere in the region.

The U.S. is readily growing in the regional bipolar electrosurgical device market, mainly attributed to the rising chronic diseases that create sustained demand for surgical procedures. In this regard, Centers for Medicare & Medicaid Services data as of April 2025 revealed that ongoing post-operative visit tracking is refining payment for global surgical packages. Besides its collaboration with RAND, revealed discrepancies in expected and actual post-operational. Furthermore, CMS’s use of no-pay G-codes improves accuracy in reimbursement for device-dependent surgeries, hence benefiting both firms and consumers.

Canada’s market of bipolar electrosurgical devices is growing at a considerable rate on account of preceding advancements in surgical techniques and increasing adoption across outpatient centers. The country also benefits from continued innovations and profitable collaborations that enable wider clinical use. For instance, in February 2025, Aspen Surgical Products declared that Andau Medical will be the exclusive distributor of its surgical product portfolio across Canada. The report also stated that the partnership covers surgical markers, Symmetry instrumentation, Olsen electrosurgery devices, and laparoscopic tools as well.

Adoption Of Electrosurgical Devices in the U.S. 2021

|

Parameter |

Current (MED) |

Future (EES) |

Difference / Impact |

|

Annual Procedures |

10,000 |

10,000 |

N/A |

|

Procedures Involving Electrosurgery |

80% (8,000 procedures) |

80% (8,000 procedures) |

N/A |

|

Annual Cost |

Baseline |

$824,760 saved annually |

-$824,760 |

|

Cost Saving Per Procedure |

Baseline |

$101 saved per procedure |

-$101 |

|

Operating Room (OR) Time |

Baseline |

Reduced |

Significant reduction |

|

Hospital Stay Duration |

Baseline |

Reduced |

Significant reduction |

|

Disposable Electrode Usage |

Single-use disposables |

Reusable electrodes |

Reduced disposable usage |

Source: NIH

APAC Market Insights

Asia Pacific in the bipolar electrosurgical device market is expected to showcase the fastest growth in the tenure 2026 to 2035. This enhanced upliftment is efficiently propelled by increasing healthcare investments and a growing focus on minimally invasive surgical procedures. Besides, there has been an increased adoption of advanced surgical technologies, wherein the robust medical infrastructure and patient awareness also facilitate revenue in this field. Furthermore, the increasing collaborations between device manufacturers and regional healthcare providers enhance the product availability across the region’s vast geography.

China is augmenting its leadership in the regional market, owing to the presence of supportive government initiatives and strategic implementations by the manufacturers. For instance, in January 2022, MicroPort MedBot announced that it received NMPA approval for its Toumai Laparoscopic Surgical Robot, which marks the first four-arm system developed and commercialized in the country. The firm highlighted that the robot efficiently enhances precision in the minimally invasive procedures, hence suitable for market upliftment.

India in the bipolar electrosurgical device market is demonstrating notable growth due to the expansion of outpatient surgical centers and a huge emphasis on affordable yet high-quality care. In November 2022, Rajiv Gandhi Cancer Institute reported that it finished the preliminary clinical trials of SSI-Mantra, which is the country’s first-ever indigenously developed surgical robot. Besides, the robot demonstrated feasibility in complex procedures, advancing affordable robotic surgery, which marks a significant step toward self-reliant, cost-effective robotic surgery in the country.

Cancer Incidence and Mortality in the APAC Region 2022 (ASR: Age-Standardized Rates per 100,000)

|

Region |

Cancer Type |

Incidence (No.) |

Incidence (ASR) |

Mortality (No.) |

Mortality (ASR) |

|

Eastern Asia |

Cervix uteri |

167,528 |

13.4 |

62,094 |

4.3 |

|

Corpus uteri |

100,275 |

7.5 |

17,818 |

1.1 |

|

|

Vulva |

5,724 |

0.35 |

2,371 |

0.13 |

|

|

South-Eastern Asia |

Cervix uteri |

69,886 |

17.4 |

38,703 |

9.5 |

|

Corpus uteri |

26,601 |

6.6 |

7,936 |

1.9 |

|

|

Vulva |

2,239 |

0.54 |

813 |

0.19 |

|

|

South Central Asia |

Cervix uteri |

153,944 |

15.1 |

95,962 |

9.5 |

|

Corpus uteri |

27,172 |

2.7 |

10,143 |

1 |

|

|

Vulva |

4,086 |

0.4 |

1,997 |

0.2 |

Source: NIH August 2024

Europe Market Insights

Europe in the bipolar electrosurgical device market is poised for significant growth, which receives exceptional support from the regulatory frameworks that support both safety and innovation. In March 2025, Creo Medical notified the launch of its SpydrBlade Flex endoscopic device commercially in the UK and Europe, wherein St Mark’s Hospital in London as the first adopter. Also, the product is especially designed for precision in lower GI colorectal resections, thereby enhancing the minimally invasive endoscopy, hence benefiting overall market growth.

Germany is the leading player in the regional bipolar electrosurgical device market, facilitated by its technologically advanced healthcare system and high adoption rates. For instance, in October 2022, ZEISS Medical Technology stated that it received FDA 510(k) clearance for MTLawton, a new generation of disposable bipolar forceps designed to enhance electrosurgery. The product was developed in collaboration with neurosurgeon Dr. Michael T. Lawton. The instrument uses a copper-base alloy to reduce tissue adhesion and charring, hence supporting localized innovation.

France holds a strong position in the market, effectively fueled by increased focus on day-care surgeries and expansion of ambulatory surgical units. In November 2024, Halma announced that it acquired Lamidey Noury Medical for a total of €50 million manufacturer of electrosurgical instruments. The company further stated that this move aligns with rising demand for minimally invasive procedures in urology and gynecology. Therefore, this strengthens the country’s export potential for high-quality electrosurgical instruments through Halma’s global network.